U.S. exporters face a bumpy 2020.

23 shares

Welcome back to What’s Happening Now, our last report for an eventful year in which equity markets reached for the stars in an undeniably strong year-end rally which we openly foresaw in Q2 and officially called in early October.

Investors are closing out 2019 $6 trillion richer, with the S&P 500 Index up 29% and the Nasdaq up a whopping 36% heading into the last two trading days of the year-a classic melt-up driven by low rates, bailouts and money printing—i.e. THE FED.

No shocker there–debt and bailouts are the Fed’s new “growth industry.”

So, out with 2019 and in with 2020.

The bustle of a New Year is often refreshing. That sense of a fresh-start at midnight this Tuesday can seem cleansing as we leave a Fed-driven party behind us while reaching for champagne with friends and family.

It’s striking to us though, as we close 2019 and page through the Main Street Media, that another recession seems almost unimaginable – priced out for some given the year-end rally, or ruled out by others as just unthinkable.

Stated otherwise: All is well… Party-on this New Year’s Eve… for hope breeds eternal, no?

Having Hope vs. Having a Plan

But does hope really breed eternal?

Well, hope does breed inspiration. Inspiration breeds New Year’s Resolutions of new personal achievements ahead, new ambitions, new confidences, relations and higher expectations for a better 2020.

As for the markets, hope allows us to equally wish for better days with less dirty politics, less insane stimulus, less global confrontations and more market highs for years to come.

In short, for many investors, there is a sense that our Rich Uncle Fed will take care of us in 2020, yet again, as it has done year after year after year…

Alas: No more recession talk-it’s no fun at a party.

We don’t wish to spoil Tuesday evening’s celebration, so party-on with the special someone(s) in your life, but as for the Fed party we’ve been enjoying since 2009, please know that when it comes to your money, hope has never been, and never will be, an investment plan.

Sure, we can hope the next recession is off the radar screen for 2020 – that’s been the Fed’s investment plan for years, and we’ve said many times that the Fed is a powerful force for delaying reality in the current Twilight Zone of debt without tears.

But the Fed has by no means outlawed recessions, it is simply a master at postponing them (year after year after year…), and hence making them worse down the road.

Meanwhile, its record for forecasting recessions is 0 for 9.

But forecasting is for crystal balls, tarot readers and prompt reading media bubble heads, not risk-smart investors. As stated recently, we are way past the bull vs. Bear hoopla and all about risk management and long-term profits.

The Media…

But speaking of bubble heads…

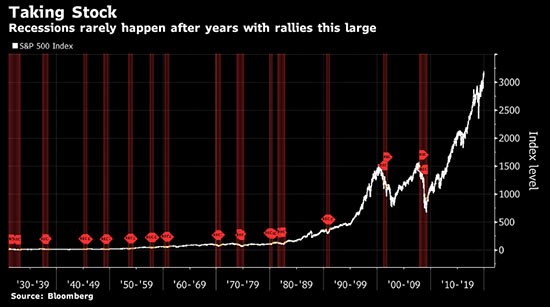

Bloomberg’s PR department recently observed that “Recessions rarely happen after years with rallies this large.”

That’s a pleasant thought.

Unfortunately, it’s also factually and empirically not true.

We’d remind such journalists to look back to the dot.com crash in 2000 or the mortgage-crisis crash in 2008 and re-phrase their headlines to: “Recessions consistently happen after years with rallies this large.”

The falling white lines below following the prior two market bubbles make this undeniable. It’s in the rearview mirror…

Despite such stubborn facts, the media spin-sellers also declare that the world is richer after 2019 and will just keep getting richer and richer, right?

Well, again… the true answer is actually no.

The world is not richer at all, it just has infinitely more debt than at any other time in history, and debt is not the same as wealth, as 90% of Americans who juggle more than three credit cards can attest.

Furthermore, debt bubbles masquerading as “wealth peaks” get proportional in their levels of both delusion and risk. Stated otherwise: The higher the rise, the harder the fall.

Take another look at that graph above. We ask you as we enter 2020: Does this most recent bubble look like a peak to you?

If so, do you think it’s wise to assume the S&P Index is going to keep rising at this pace?

Not likely. And here’s why.

This is a stimulated and rigged rally without substance. Economies around the world are not doing well or “getting rich.” In fact, most nations are growing poorer as the “Twilight Zone” stock cliff gets higher.

When markets correct on euphoria, markets often get marked down by 50%, as they did in 2008. Look again at that chart…a 50% selloff from these nosebleed heights would devastate, well, just about everything.

The real question coming into 2020 is thus not how to continue to bubble-up, but rather how to manage the fat-pitch profits as well as the risks of a potential melt-down at worst or, at best, how to deflate this balloon before it pops, we pop, or China pops.

After all, we two gorillas, China and the U.S., are the biggest gorillas in the room heading into 2020.

Gorillas in the Mist of Trouble

Have a look at these two chilling charts put out by the Financial Times as this new decade roars in.

If you thought the current U.S. trade war with China is at the core of China’s emergence as THE dominant global exporter, think again. This has been going on for a very long time.

Backtracking two decades to the year 2000, the U.S. (in blue) once dominated global trade with U.S. exporters as the world’s most powerful exporters…

Now, fast forward two decades to 2019 (below). China (in red) is killing it – displacing the U.S. exporters by becoming itself the world’s most dominant exporter.

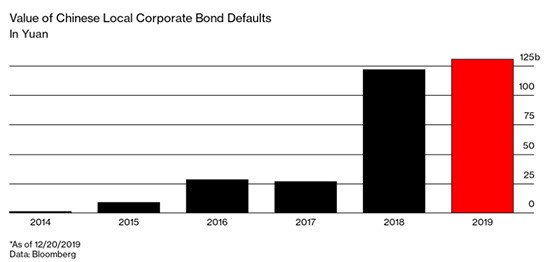

Good for China? Maybe. But for all of China’s dominance on the export front, this China is rotting from within as local bond defaults soar (chart below).

Whatever one thinks of China (and we are hardly big fans ourselves…), we must nevertheless concede that it’s not so good for the global or US economy when the world’s leading gorilla is in trouble or on the verge of a “Minsky Moment” that could rattle the globe (a notion coined by economist Hyman Minsky when excessive debt builds toward excessive defaults).

As for the U.S., we’ve made no secret about the unprecedented levels of toxic debt it carries or the deadly Minsky Moment it too faces.

So, here’s the bottom line for both these gorillas as we turn the page on 2019: All in, global growth just ain’t what it used to be and neither the U.S. nor China is an exception. U.S. exporters are just some of the many who will be suffering in 2020.

And it takes growth, not more debt, to repay debt – pure and simple. Common Sense.

Unfortunately, neither the Fed, the Peoples Bank of China nor the cheerleaders in the Main Stream Financial Media seem to be publicly concerned about growth or common sense.

Party On

So, party-on this New Year’s Eve… that’s our plan. Dream and hope ahead for those you love, the lifestyle you enjoy and the goals you have set for yourselves; there’s certainly nothing wrong with that! U.S. exporters, however, will have far less to celebrate.

But when it comes to your money, the way you invest or the portfolio you are preparing in a global market devoid of common sense, you’ll need far more than hope to get ahead-you’ll need a plan.

Fortunately, we built signals matter to give you that plan. Our portfolio plan appreciates making money, but does so with an eye toward respecting common sense, market signals, history and managing risk, qualities our subscribers both share and expect.

And of course: Have a Happy New Year!

Comments

8 responses to “Party on New Year’s Eve?”

- Terry says:

Have read Harry Dents piece to get money for his subscription site. He say get out of gold and buy up dollars. Others are saying get out of cash and buy gold. Seems they are just trying to sell you their investment letters.

- Concepcion Ramirez pacheco says:

Hola buenas tardes yo consecución les doy las gracias por su atención y al mismo tiempo estoy con uds.y si bien esta espero que me den un lugar para marzo gracias y saludos

- Concepcion Ramirez pacheco says:

Felicidades a todos y todas las personas que forman esta gran comunidad y esperó trabajar con este gran equipo ojalá me puedan ayudar a escalar posiciones más altas.saludos

- Larrysays:

Anxiously awaiting!

- Karlsays:

So you think the crash will wait until March 1, at least? Good. I should be ready by then. Dad always said to beware the Ides of March. Grin!

- Edouard d’Orangesays:

Happy New Year, Matt & Tom.

- hugo kowalewski-Ferreirasays:

thanking you in advance for your attention

hugo