Pension funds are approaching a perfect storm. Below, we explain why.

33 shares

There’s no way to beat around the bush with this: Pension funds across the country are massively underfunded, massively allocated to risky stocks, and massive in size.

This trio of facts represents a ticking time bomb of demographic and market risk set to explode in the very near future.

In the past, we’ve warned about a perfect storm approaching our markets, economy, and money. This impacts a similar storm about to hit pension funds.

As a quick refresher, we’ve looked at historically (record) high and mathematically-confirmed overvaluations in our stock and bond markets, all now converging before a barometric, low-pressure front of investors with topping exposure levels in a topping market highs that is about to collide with the largest debt bubble in recorded history, set to blow apart the moment the Fed loses control of interest rates.

In short – a truly perfect storm.

And its wind speed is about to get worse. Much worse. Pension funds will be the first to drown.

That is, there’s another massive weather front gaining speed: the fatally flawed U.S. pension funds system. In fact, pension funds may very well be the singular gust of wind that ultimately sends our markets to the basement of history.

And rather than just wring our hands about the obvious dangers of stocks, bonds, yields, and Fed rate moves in a now undeniably rigged to fail market, we need to look at the most at-risk demographic and market triggers for our slowly tanking markets and economy. This means we need to look at pension funds.

When this huge class of investors sees their dangerously overweight stock holdings in pension funds tanking, our economy will face its darkest days and years. The evidence of this is now overwhelming. Let’s look at how this set-up plays out and how we got here.

The Baby Boomers

At the close of World War II, a new generation was born that comprised the largest population surge in our history: baby boomers.

Like most kids, this generation didn’t want to be like their parents – a generation marred by two world wars and thus a genuine instinct to expect the worse and do nothing more than save, save, and save.

Instead, baby boomers learned how to spend, spend, and spend. Sure, they worked hard, too, but the key components of their generational story were work, spend, and consume.

What made them so optimistic and carefree – and potentially reckless? The answer is simple…

Wall Street Led Them Astray

That is, the Wall Street that grew up with the baby boomers said there was no need to save and worry anymore. “Just let our expertise and the ever-rising stock market make you safe.”

This was a great idea for the advisors, fund managers, and bankers who could cash in on the fees and the constant stream of dollars pouring into Wall Street from the paychecks of Main Street’s largest investment class – the doomed baby boomers and their growing pension funds.

Of course, the pension funds and trustees to which this generation trusted their money drank the same Kool Aid from the Wall Street crowd.

Nearly every penny that went into these retirement pension funds (as well as 401(k)s and IRAs “advised” by so-called “retirement planners”) went directly into stocks/equities or other equity-related risk vehicles, i.e. private equity, venture capital, and hedge fund strategies hired out by the notoriously not-so-savvy pension fund advisors.

This was an absolute boon for Wall Street salesmen (who saw the poorly experienced managers of these pension funds as easy “suckers”), and these fattening pension funds helped push markets to all-time highs in the 1980s and 1990s.

But Wall Street didn’t stop there; it added an extra twist in the 1980s, namely easy credit – otherwise known as debt. Baby boomers thus went crazy for stocks and even crazier for debt.

Pension funds effectively became casinos for speculation while many baby boomers went into debt rather than saving.

Big Promises, Little Returns

But hey, why worry? The stock market only goes up, right? The pension funds had their backs, right?

Well, by 2000, and then again in 2008, the foregoing system of “speculate and borrow” blew apart. Pension funds lost massive amounts of money in these epic market crashes, which meant the baby boomers looking to retire were in a pickle.

Despite the raging bull ride since 2009, the losses of 2000 and 2008 were enough to gut most U.S. pension funds and prevent them from meeting target returns. Remember, the key to success is to avoid losses, not chase tops.

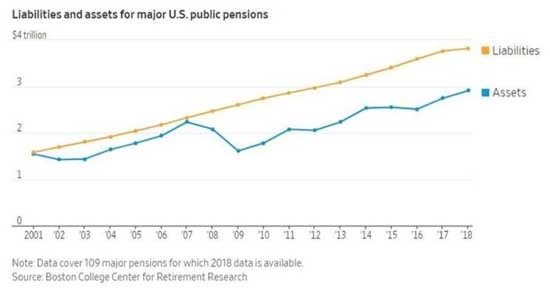

Unfortunately, the pension funds didn’t avoid those two seminal market crashes. As a result, today their collective assets don’t come even close to matching their collective liabilities, which means they can’t pay what’s owed:

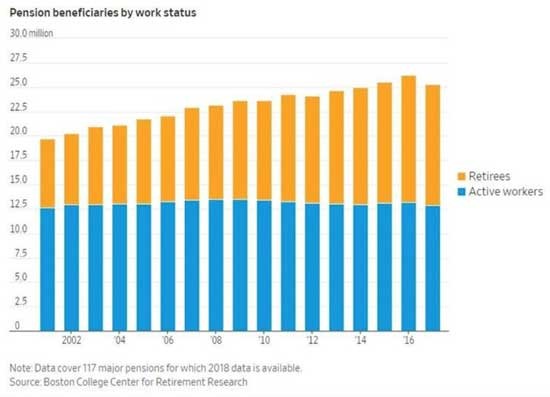

And now, as of 2019, the average age of a baby boomer is 64 years, and the average retirement age is 64, which means many baby boomers want to retire.

In other words, retirees are beginning to ask the pension funds for their promised money…

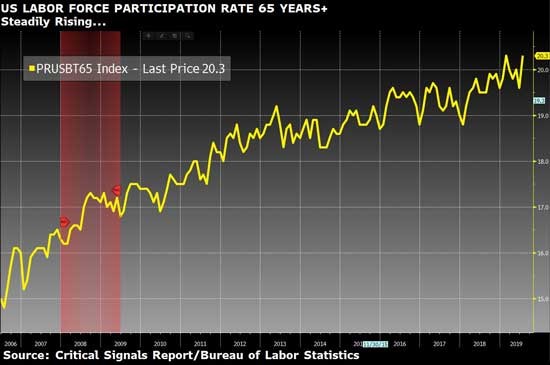

But here’s the rub: Most of them can’t afford to retire because retirees, like pension funds, are not flush with the monies Wall Street promised. This explains why the labor force participation rate for those over 65 is now skyrocketing past 20%. In other words: Many folks can’t afford to retire.

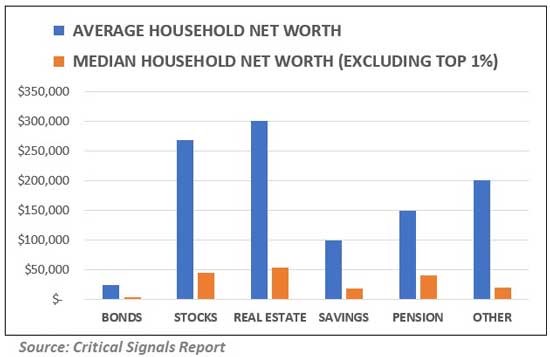

But how can this be? After all, D.C. and its statisticians (as well as Wall Street and their media minions) keep telling us that the average household net worth in the U.S. is off the charts solid, with the average 65-year old owning $24K in bonds, $269K in stocks, $300K in real estate, $100K in savings, $150K in pension funds, and another $200K in “other assets.”

But if you are past the age of 65, you might be thinking that such numbers may not resemble your own personal experience.

Trust us: You’re not alone.

The above statistics use an “average” rather than “median” metric, which means it includes the top 1% of U.S. wealth, which massively skews the data.

If, however, one stripped out the absurdly skewed wealth of just the top 1% of Americans, then the median household net worth data comes much closer to earth, namely the median retiree wealth is composed of $4K in bonds, $45K in stocks, $54K in real estate, savings of $18K, pension assets of $40K, and other assets of around $20K.

Quite a difference, no?

But by now, you see how D.C. statisticians effectively lie to make reality seem better than it is…

Of course, many folks have far less than even this “median” data. In any event, and given the increased life expectancies of modern times, most baby boomers simply can’t afford to stop working or worrying.

Solution for Crazy? More Crazy…

So, what have baby boomers done to make up for the losses rather than windfalls that Wall Street and their pension funds had promised?

Well, the data is in, and the answer is as obvious as it is both predictable and insane – Wall Street has ’em “suckered” again: Everyone, including the under-funded pension funds, is going hog-wild into the highest risk securities, namely more equities and equity like vehicles.

Next week, we’ll explain why the above facts and recommendations from Wall Street are the perfect setup for a disastrous market-trigger event that invlovs pension funds.

More importantly, we’ll show you how to prepare for what’s ahead…

In the meantime, stay tuned for our next report We’re going to share with you the one reliable indicator that will inform whether we are already in a recession or when we shall enter.

To be forewarned is to be forearmed, a claim that dates back to the 16th century and has stood the test of time.

And with us, you’ll be armed and ready.

Catch you then.

Sincerely,

Matt Piepenburg

Comments

17 responses to “This “Perfect Storm” is Getting Closer”

- James Brimacombsays:

Hello //Matt

Just passed a 90 year cycle on the Dow Jones Industrial top on September 3. Any ideas on the timing of what is coming? Thank You

- Marksays:

Thanks again!

- Stephen Hamiltonsays:

Great knowledge but very scary

- PAUL LAMOUREUXsays:

…THANK YOU, MATT…REFERRING BACK TO YOUR 3RD COMMENT FROM THE LAST…

- paulsays:

You have to start saving from a very early age and never stop . Also put aside gold to protect you from devalueuation of the currency .

- Rob Hendersonsays:

Ask the pension actuaries what is planned.

Those in power will alter the terms from defined contribution plans to loose defined benefit plans and let the members carry the loss. Or worse still, the trustees have powers to ‘gate’ or ‘freeze’ all pension schemes for the protection of all members. What will be will be for the protection and stability of the system and in the public interest. The old adage will come againt to be appreciated – “never let others manage your money”.

- Nick Davissays:

Good evening Matt

I’m 72 born 1/47 in Wenatchee,Wa

I’m confused and concerned about the near future… don’t get me wrong, there is a lot people my age that have a lot money

I’m more worried about my daughters 46 and 50. One is invested heavy in the stock markets…and the other one took out a large loan to upgrade her wine and coffee shop

a can you help

My 7 granddaughters call me Happy

- Andrewsays:

The main question is WHEN !?

- Larry Silbaugh says:

Let me add another ton of dynamite to this scary cargo, Matt. As I understand it our esteemed political leaders in BOTH PARTIES have also directly added their expertise to this mess by mandating all social security funds be invested in only government bonds – treasuries. Well, if the math gods are correct in estimating that most retirement funds need an honest annual return of about 8% to successfully meet future obligations, how much sense does that make when treasury rates are far below this 8% target. So it seems that EVERY retirement fund in the country is a rapidly ticking time bomb.

- White says:

Enjoying this newsletter and staying abreast of economic conditions, helping me to be prepared, rather than “reacting to”….after the fact.

- Eva Morrissays:

Thank you. I look forward to Monday.

- Larry Ettingersays:

very interesting and informative…I am waiting for your solution to this dilemma to see if your info is worth reading further

- R.says:

Excellent, terse summary of the situation. Keep up the good work.

- David Hanansays:

Thanks for your insights. Been reading about them for years. Am a tail end baby boomer and am a MoneyMap subscribing using options to make up for retirement income I forced to part with. I also teach stats and would love to use the above data to reinforce teaching of the difference between the mean and median (normal and non-normal data). Can you share your data or where I can pick it up? Thanks in advance.

- Mindysays:

Thank you Matt,

for keeping us informed.

The graphs you presented on retiree pensions, labor force and net worth are surprising, but (at the same time) understandable and sad.

I am the first to admit that I don’t know (or even pretend to know) a lot about Bonds. With that in mind, when you warn of the Bond Market crashing, would you say that, that is across the board or just certain types or classes (for lack of a better term) of bonds?

Most appreciated,

- Timsays:

This is the best mail that I have read from the website critical signals! I wish more people would open their eyes and listen because you are correct it will be too late.

- Dianesays:

Thanks.