Our Portfolio Service

Portfolio Objectives

Key Principals

Over the past six months, our daily lives have been dramatically impacted by a global pandemic, changing how we view and value the world around us and how we interact with it. Investors find themselves facing a level of uncertainty never experienced before. Risks of a different sort are popping up each day, making unease part of our everyday life, from family to financial stability. Global stock markets have experienced unparalleled volatility, with historic drawdowns followed by historical recoveries.

This type of volatility can be disastrous for the average investor, as most do not know their risk tolerance until it is too late. Even if they did, they don’t know how to contain risk when it comes to portfolio investing. Panicked investors sold at the bottom last March, losing much of their hard-earned wealth along the way for they missed the recovery. Experiences like these can often time scar investors permanently, scaring them away forever.

We’re here to help. Based upon decades of investing experience advising the top 1%, we’re here to give back, to design portfolio suggestions with Main Street in mind that will protect during periods of abject, unexpected, and unparalleled market volatility. We call our portfolio an all-weather portfolio because it protects investors in all weather conditions, namely in up, down, and sideways markets, by sheltering portfolio performance from the unexpected. We also call it “Holy Grail” investing. Here are the key principles to Holy Grail investing:

Key Principles of Holy Grail Investing

- Win by not losing.

Let your profits run and cut your losses short. - Optimize expected return.

Put the probability of gain on your side. - Build wealth reliably.

No matter what the market conditions.

Better Portfolios Are Diversified Portfolios

Portfolio Diversification

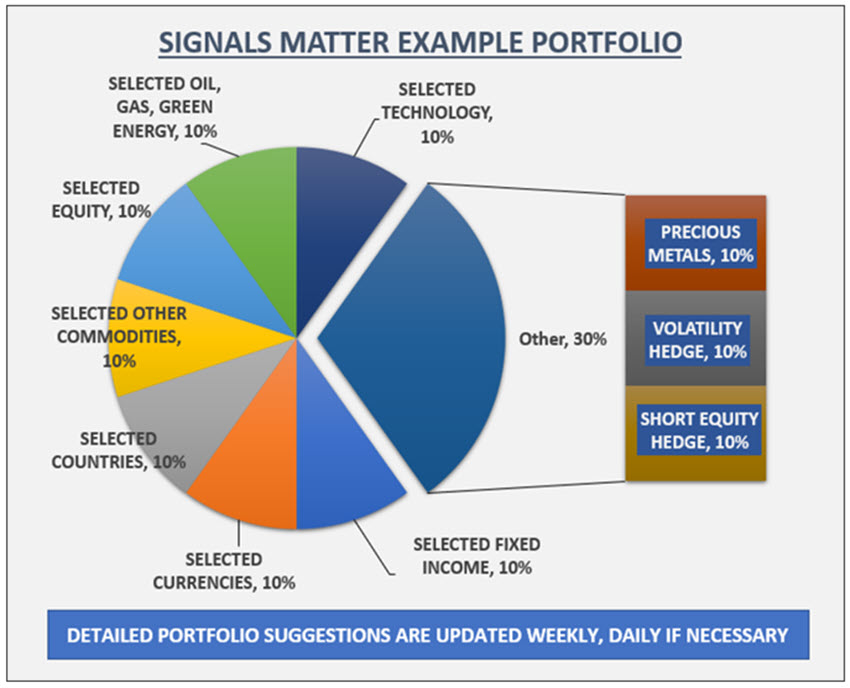

Better performing portfolios are diversified portfolios, a notion that goes well-beyond the common understanding of most investors. Meaningful diversification is not about growth vs. value, or high-cap vs. low. It’s about allocating smartly across less-correlated stocks, interest rates, bonds, real estate, currencies, commodities, precious metals, countries, sector-focused funds, and alternative asset classes, long and short.

That’s a mouthful, but that’s what it takes. Meaningful diversification is not just essential, it’s consequential when it comes to containing portfolio-level volatility. Meaningful diversification leads to less risk and far higher risk-adjusted returns. Here are the key principals of portfolio diversification:

Key Principles of Portfolio Diversification

- Diversified holdings demand uncorrelated investing.

Meaningful diversification contains portfolio volatility. - Containing portfolio volatility lowers risk.

Lowering risk leads to higher risk-adjusted returns. - Higher risk-adjusted returns drive profitability.

And keep you safe in all weather conditions.

Better Portfolios Are Informed Portfolios

Informed Investing

Better performing portfolio are informed portfolios. That’s because well-informed investors are better investors. And that’s why we go the extra mile to educate our Subscribers, and constantly share what we’re thinking. That’s why we post new daily insights, charts, and commentary each day that inform and protect, and why we update and display our macro thinking, market cycles, and investor flows each and every week.

Market cycles and rotations are predictable in nature, across every timeframe and every sector, so long as you have the right experience and the right tools. Market cycles are actionable when it comes to making money, whether improving, leading, weakening, or lagging; and they provide opportunity to profit, no matter what the direction. ETF investor flows are equally informative when it comes to knowing what the smart investors are doing, in advance. Informed investing makes a difference. Here are the key principles:

Key Principles of Informed Investing

- Understand the markets and the macro.

Big picture investing provides a meaningful tailwind. - Put market cycles on your side.

Informed portfolios track sector rotations. - Put market flows on your side.

Informed portfolios track investor flows.

Better Portfolios Yield Better Performance

Where's the Proof?

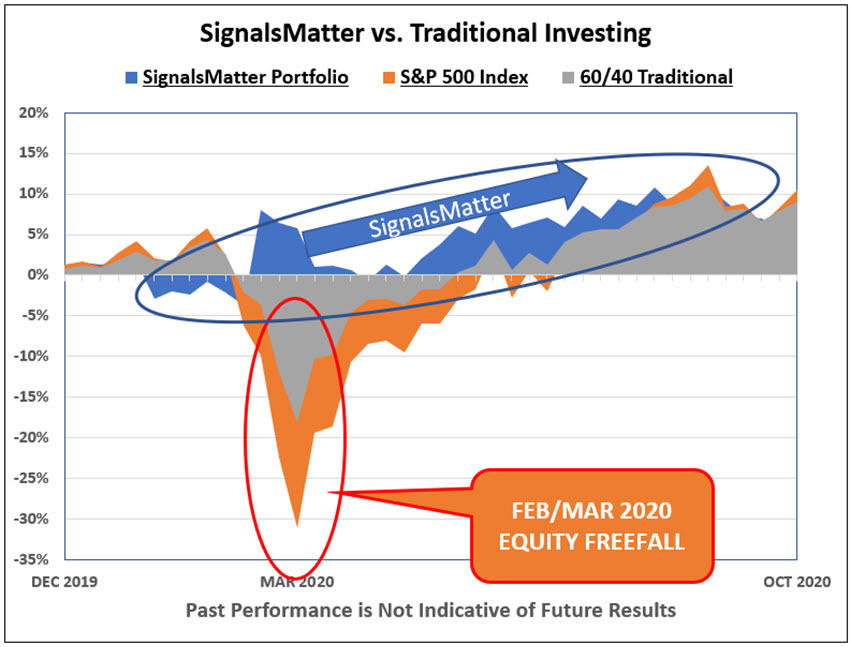

Constructing portfolios that hold up in all-weather conditions is more than a science. It’s an artful science, built upon informed investing, market cycle discovery, meaningful diversification, adept technical analysis, deep competency in risk containment, and knowing which benchmark to use. Together, our foundational tools are geared to reliably generate and protect your wealth. Here's the proof:

The Proof Is In The Pudding

- Our Portfolios Are Diversified.

We invest long & short, in asset classes far beyond stocks and bonds. - Our Portfolios Are Informed.

By our market-leading blogs, Market Reports and indicators. - Our Portfolios Perform Better.

In both bull and bear markets.

Refreshed Daily on Your Dashboard

Daily Portfolio Recommendations

Portfolio suggestions are continually updated on SignalsMatter.com. Markets don’t stand still and neither do we. When markets change, Your Portfolio changes too, putting you on the right side of markets moves. Changes are generally implemented on Mondays, following deep and thoughtful weekend analysis, all shared with Subscribers. Here's an example portfolio:

Real-Time Performance Reporting

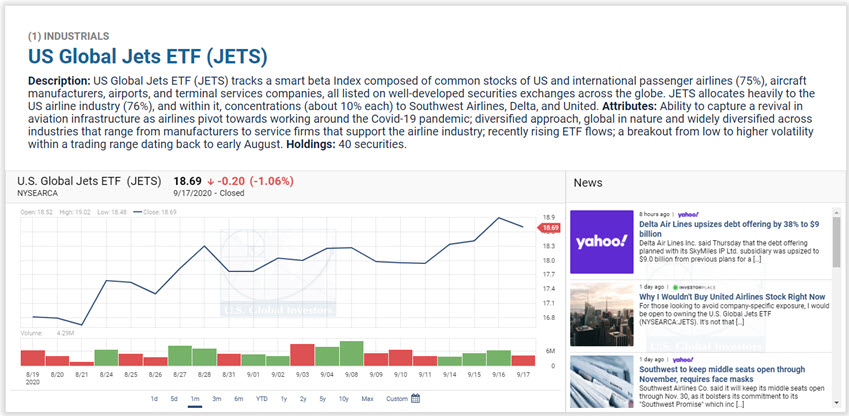

Portfolio Charts and Scrolling News

Portfolio Charts for each Portfolio Suggestion are updated in real time, each time your browser is refreshed. Each Suggestion is individually described, along with investment attributes and holdings. Tickers are graphed one-month back by default, although Subscribers are able to select their own timeframe. Scrolling news on each Portfolio Suggestion allows Subscribers to see what others are saying. Plus, Portfolio Suggestions are aggregated and tabled with real-time performance displayed, so you always know how they're doing, at a glance.