Holy Grail Investing | Make Money by Not Losing It

If you know which signals to follow, you'll be just fine.

We'll be frank. Investors are not getting honest, clear portfolio advice and thus are not adequately forewarned of the visible and the obvious when it comes to navigating markets.

Signals Matter Subscribers have a choice. They can learn by our methods and pull the trigger themselves, or they can just cut and paste our portfolio into their own. Both will save your savings.

How do we know what the signals are?

Study and practice. 50+ years at Morgan Stanley, the World Bank, Harvard, Yale, and 10 other institutions. Most individuals take a hit when the market crashes. Not us.

Every signal we share with our subscribers originates in-house. We even display the portfolios we create, along with real-time performance - in other words, total transparency.

Here's What You'll Get If You Sign Up Today ...

Our All-Weather Portfolio Service

Our Portfolio Service

Constructing portfolios that hold up in all-weather conditions is an artful science, built upon informed investing, market cycle discovery, meaningful diversification, competent risk abatement, adept technical analysis, and knowing which benchmark to use. Together, these foundational tools reliably generate and protect wealth.

The Predictable Nature of Market Cycles

Market cycles are predictable in nature, across every timeframe and every sector, so long as you have the right experience and the right tools. Market cycles are also actionable when it comes to making money, whether cycles are improving, leading, weakening, or lagging. They provide opportunity to profit, no matter what the direction.

Risk Abatement

True wealth preservation is not just about return. It’s about return adjusted for risk, or risk-adjusted return. Risk management is a core competency at SignalsMatter.com, built upon years of developing and applying risk-overlay technology for hedge funds we have managed and for institutional and family-office clients we have assisted.

Benchmarking

Benchmarking is foundational to sound investing and performance monitoring. If you’re using the wrong benchmark, like the S&P 500 Index, you’re already behind. The S&P 500 is a relative return benchmark and trust us, it’s not relevant to diversified investing. There’s a better approach, called absolute return benchmarking. We teach the difference.

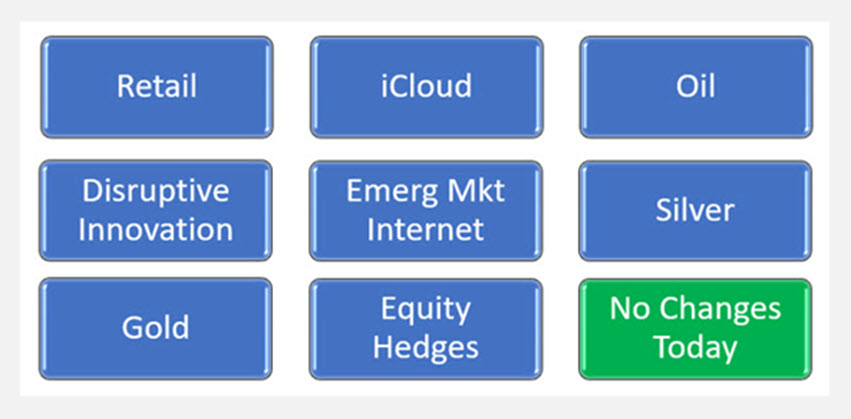

Website Daily Portfolio Recommendations

Portfolio suggestions are continually updated at SignalsMatter.com. Markets don’t stand still and neither do we. When markets change, Your Portfolio changes too, putting you on the right side of markets moves. Changes generally occur on Monday’s following exhaustive weekend analysis, shared with Subscribers. Active portfolio management catches markets moving from low volatility to high, or from long to short side investing.

Informed Investing

Well-informed investors are better investors. That’s why we go the extra mile to educate our Subscribers, to constantly share what we’re thinking. That’s why we post new insights, charts, and commentary each day that inform and protect, and why we update and display our macro thinking each and every week.

Meaningful Diversification

Meaningful diversification is not about growth vs. value, or high-cap vs. low. It’s about allocating smartly across less-correlated stocks, interest rates, bonds, real estate, currencies, commodities, precious metals, countries, sector-focused funds, and alternative asset classes, long and short. Meaningful diversification contains portfolio volatility.

Technical Analysis

SignalsMatter.com practices its own methodology when it comes to forecasting price direction and pace, honed from our hedge fund days. We constantly parse potential investments for coincident rotational opportunity, relative strength, trend, volatility expansion, low correlation, and positive investor money-flows, among other criteria.

Trust Us | Holy Grail Investing Works

The Holy Grail of Investing is making money without losing it in any market cycle. Holy Grail investing demands levels of diversification well-beyond stocks and bonds at all times, so that when one asset class zigs, the other zags. It works by containing volatility and hence downside risk, allowing profits to run unabated. We’ve been doing this for 50+ combined years. Trust us. Invest with confidence, no matter what lies ahead.

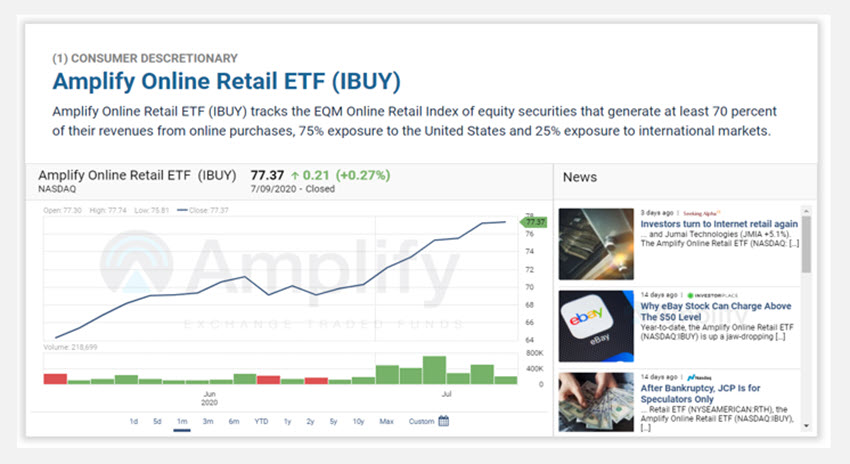

Website Portfolio Charts & Scrolling News

Portfolio Charts are updated in real time and provide Subscribers with performance-at-a-glance, constantly updated whenever your browser is refreshed. Tickers are graphed one-month back by default, although Subscribers are able to select their own timeframe. Scrolling news on each Portfolio Suggestion allows Subscribers to see what others are saying. Plus, Portfolio Suggestions are tabled with real time performance displayed, so you always know how your doing, at a glance.

Market Barometers

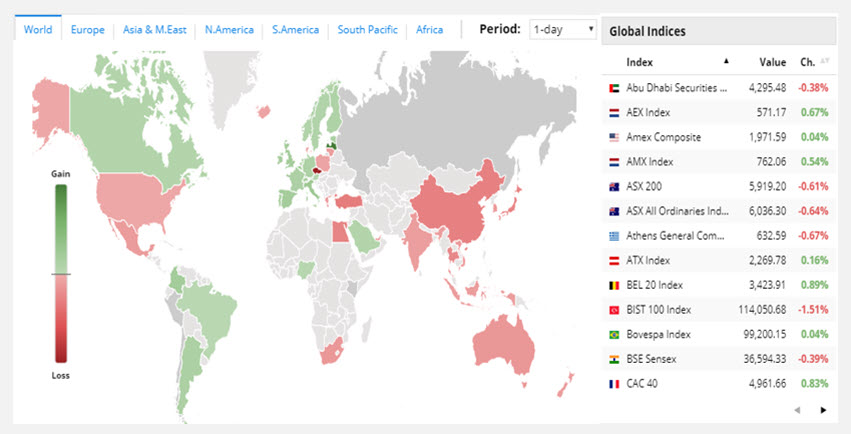

Global Heatmap

The Global Heat Map displays equity stocks performances, in whatever country and timeframe you choose. Countries displayed in red are losing money today. Those in green are making money. Grey is ambivalent. Dig deeper by clicking on any country. Then click to the right on any specific country-index you wish to chart and explore.

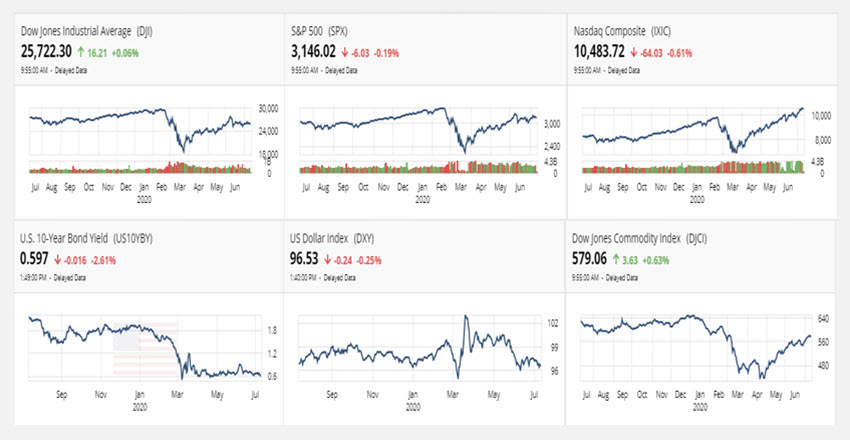

Market Watch

Market Watch displays current performance for U.S-based Stock, Bond, U.S. Dollar and Commodity Indexes. Be your own analyst. Click on any index for a full-screen chart. Then add nearly 30 overlays and indicators to analyze momentum, trend and more. And click on associated news feeds.

Storm Tracker

Storm Tracker

Storm Tracker is your 1-stop shop that tracks choppy waters ahead. It measures the probability of upcoming stormy weather by tracking literally hundreds of indicators, from GDP to global trends to up-to-date leading indicators to yield curves and our market timing indicator, Déjà Vu. Storm Tracker is updated weekly and informs on portfolio cash positioning.

Start Protecting Your Portfolio

Daily Insights

Brand new insights are posted each and every day. Examples on Small Cap Stocks & the Dow:

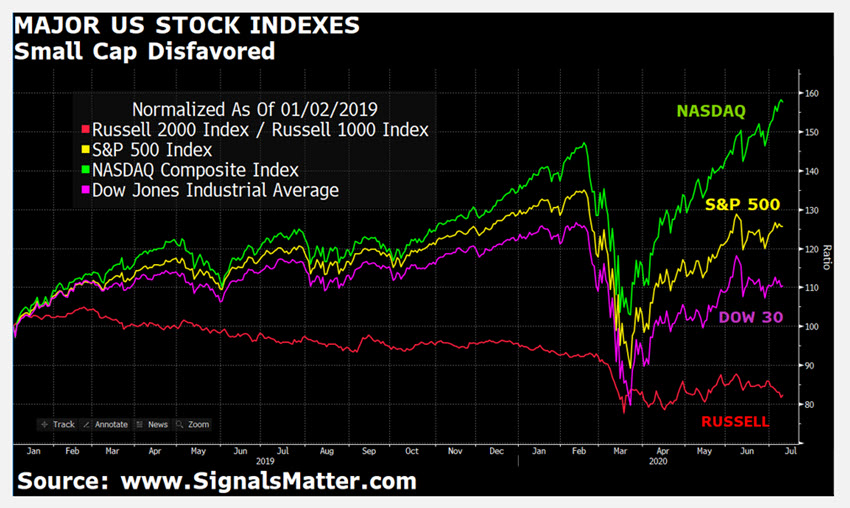

Small Cap is Lagging

Small-capitalization stocks have been losing momentum against the big boys for a long while. Looking back to the start of 2019, small cap just hasn’t provided the ride of the Nasdaq or S&P 500. When it comes to seeking protection against a market fall, we like to short from the bottom up to minimize the adverse consequence should markets continue to rise, something we do for you in our All-Weather Portfolio.

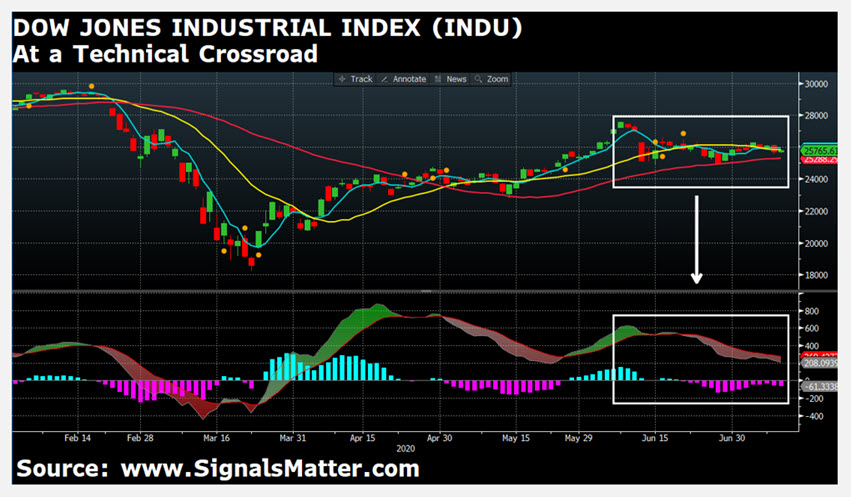

Dow Jones at a Crossroad

The Dow30 has been a laggard compared to the Nasdaq and the S&P 500 Index. Technical are suggesting we are at a crossroad, as sell signals materialize and oscillators peak. Look what happened last time, back in February of this year. We’re short the Dow at the moment, providing protect against our longs should or when markets decide to reverse course.

Investment Tools

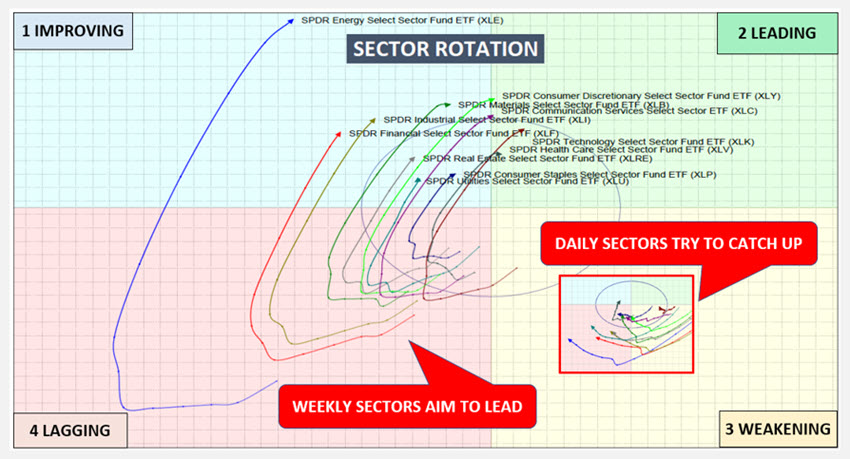

Sector Rotation

Sector Rotation is a useful tool when comes to looking ahead, rather than behind, for past performance is never an indicator of future returns. Sectors reliably rotate and provide Subscribers a heads up when stock sectors are over-bought (so they can sell) or over-sold so they can buy. Mapping both weekly and daily sector rotations together provides money-making clues, sector by sector.

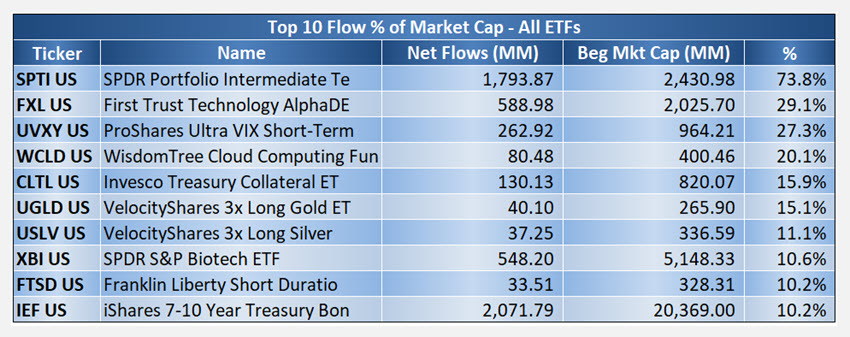

Money Flows

Money talks, in the form of funds flowing into or out of Exchange Traded Funds (ETFs), and when the money talks, it’s literally worth listening. We track flows for thousands of ETFs across general markets and individual sectors, so we know where the big boys are moving, providing Subscribers a distinctive edge when it comes to being on the right side of the markets. Flows matter. Take advantage.

And more...

Plus ... your very own Market School

Study Up on Markets. Learn How to Invest.

We created our very own market school as a safe, user-friendly, and constantly evolving online source of lessons that matter to our Subscribers, novice to expert. The Market School is a Subscriber-only tool that cuts through the noise, Wall Street talking heads, and sell-side pitches to bring Subscribers experience-based straight talk.

And there's more.

Much more...

Frequently Asked Questions

I'm shopping around. Why Signals Matter instead of a full portfolio service?

Fair enough. There are all kinds of investment sites on the web - from those offering “instant millions” in options or penny-stock trades to rather staid news aggregators or cookie cutter services that “design” 60/40 or 80/20 portfolios for a fee.

As for the “instant wealth” products, hopefully, you will realize that if something looks too good to be true, well, it is…Furthermore, just because online services with high price tags might convince you that they are special, we have seen far too many examples of these over-priced “exclusive market services” fail to deliver. In short, don’t be fooled by “Tiffany’s” pricing, as you’re likely just getting dime-store quality--and wasting hundreds, sometimes thousands of dollars in fees.

What’s the difference between a Portfolio Service and a Trading Service?

Signals Matter is an actively managed portfolio service which makes frequently updated recommendations as to which diversified assets should be held over an extended time period to produce absolute returns rather than returns benchmarked against the broader stock market indices. In bull markets, our approach manages risk and thus can (though by no means always) lag the broader markets. In bear or declining markets, our portfolio remains geared toward absolute returns and is thus designed to greatly outperform standard 60/40 or 80/20 stock/bond portfolios which fall greatly as the broader markets fall.

Overall, in both rising and falling markets, our portfolio is designed to produce steady returns with significantly less volatility—i.e. swings up or down. For us, slow and steady wins the race. Of course, when markets reach a recession, we anticipate a very good victory, and those subscribers who track our recessionary outlook and portfolio recommendations are far better positioned to make outsized returns while traditional investors are suffering outsized losses.

As a diversified portfolio, this means some asset allocations will be in the red (losing money), while others are in the green (making money), with the greens intended and designed to far outperform the reds. Any portfolio that is all “in the green” is not, by its very nature, “diversified,” and thus any subscriber to Signals Matter can and should expect to see certain positions lagging others. This is to be expected. Those who therefore ignore our cash suggestions and/or engage in self-selecting portions, rather than the entirety of our diversified recommendations, run a higher risk of concentrated gains or losses.

The best subscribers suited for Signals Matter are those who see the long play, not short-term moves, and we do not recommend measuring the success or failure of your portfolio by any given weekly or monthly performance period. Those who see portfolios as sources of quick returns, or who balk at every inevitable short-term loss, are advised to look elsewhere. Again, a winning portfolio is measured by time and cycles, not a given rise or fall in a particular allocation (or portfolio) during a snapshot in time.

Trading services, unlike a portfolio service, provide specific signals on a wider variety of specific securities for those looking to make immediate returns. Such services favor those who like to be actively trading on a daily or near daily basis. Many such services provide exaggerated examples of “wins” while neglecting to report on equally frequent losses. Furthermore, during extended bull markets, many securities just rise with the tide and are not the result of exceptional “stock picking.” We make no broad endorsement or criticism of such services, but do warn that if a trading service seems too good to be true, then it likely is.

Let’s be clear…Signals Matter is not a trading service. Yes, we make specific asset and security recommendations, and advise subscribers to follow all rather than a portion of those recommendations; nevertheless, we do not make daily trading recommendations nor offer trade signals (buy and sell) over wide swaths of “sexy” stocks and other securities for quick entry and exits. Rather, our vision is for steady returns in volatile markets and outsized returns in both recessionary markets and post-recessionary, rising markets. In our experience, that’s where the real wealth is made: realistically, patiently and intelligently.

What is the Storm Tracker?

For starters, it’s our best seller. With stocks and bonds at nosebleed levels and interest rates making U-turns upward, downward and all over the map, an increasing number of investors are camping onto the notion that nirvana cannot last forever. We agree. It cannot. And will not. When rising rates collide with the greatest debt bubble ever seen in the history of capital markets, it won’t be pretty…

Our many Blogs, Videos and Podcasts (under the “Market Reports” tab) point to a correction ahead, one postponed by Fed intervention for over a decade.

What we can do is prepare for change based upon constantly-monitored market signals so that you are always prepared and never caught swimming naked in a falling tide. Again, no one can perfectly time the first rain drops of a market storm, but we think we’re better than the rest at knowing when to reach for an umbrella.

This may sound “bearish,” and it is, but we are not afraid to be bullish when the signals tell us so. In 2019, for example, we turned bullish three times and bearish once, right on que with the market signals, thereby protecting investors when needed and making profits when opportunities and signals so indicated.

Mostly, think of our Storm Tracker as a market heat map that shows you where we are in the economic cycle and how far we are from the next “Uh-oh” moment, where most investors get crushed.

Valuable? You bet. For every percentage of red-storm-tracker-risk, we recommend an equal percentage allocation to cash so that you are: (a) not over-exposed to increasing risk and (b) have the necessary cash/dry powder available to buy at market bottoms rather than tops, where the real wealth is made in the markets.

And know this: Being defensive very early is much wiser than being a minute too late once markets free-fall. Very few understand this, especially as markets break new record highs each week and confidence in the Fed makes investors overly complacent, and overly at risk.

I’m a new Subscriber. Where should I go first?

Welcome aboard! Once you sign in as a Subscriber, the very best place to go is to your own Personalized Dashboard and the “What’s Happening Now” tab. In fact, we take you there automatically. Your subscriber landing page provides your first stop for headline content, each time you log in, providing ready reference to where the markets are today, our most recent Market Report and providing a link to ask us any questions you may have on your mind.

You’ll also see a global heat map of all the hot and cold market spots across the world as well as a U.S. Market Watch showing ticker performance across asset classes—almost like your own “mini-Blomberg” terminal.

Thereafter, you’ll see updated and timely charts as well as current trend data and much more. From there, you can click on the “What’s Ahead” tab end enjoy our Storm Tracker’s recession probability data in a simple visual format, yet one backed by the best combined indicators in the industry, which we share, confirm and update regularly.

Next, click on the “Your Portfolio” tab where we provide easy-to-follow recommendations showing you where and how to invest your money. We point you toward a handful of simple allocations to securities that we constantly parse from a deep, expansive and diversified pool of thousands of possibilities, each carefully selected depending upon where our market signals are pointing.