Stocks Surge as Risks Rise

Following the release of Party-On or Hunker Down 5.0, the stock market has continued its powerful rebound and may be nearing a critical inflection point. Fueled by artificial intelligence enthusiasm and resilient consumer spending, major indices like the S&P 500 and Nasdaq have surged to record highs — up roughly 15–18% year-to-date.

Yet while the rally has been impressive, the market’s current posture leaves little room for error. Valuations are stretched, sentiment is exuberant, and even modest disappointments could shift momentum. Whether this moment marks a true turning point or merely a pause in the uptrend will hinge on corporate earnings and the durability of investor confidence in the weeks ahead.

Beneath the surface, though, signs of fragility are beginning to emerge. Elevated valuations, rising geopolitical tensions, and the looming impact of higher tariffs are weighing on sentiment. Goldman Sachs recently cautioned that October could bring heightened volatility, as earnings season and macro risks converge to test the market’s resolve.

Economic Undercurrents: Cracks Beneath the Rally

Broader economic indicators — including slowing job growth, persistent inflation amplified by tariffs, and compressed Treasury spreads — suggest that market optimism may be outpacing underlying fundamentals. In this environment, investors appear increasingly unforgiving of any missteps, whether in earnings delivery or forward-looking guidance.

While headline indexes continue to climb, the foundation beneath them looks increasingly fragile. Cooling labor markets, rising unemployment claims, and declining hiring rates point to softening consumer demand and a potential loss of economic momentum.

Despite strong earnings at the surface, growth remains narrowly concentrated in a few tech-driven sectors, while many companies report lackluster results. Market gains are increasingly powered by a handful of mega-cap stocks — notably Nvidia, Microsoft, and Meta — whose combined valuations now exceed 20% of the S&P 500’s total market capitalization. This concentration raises valid concerns about diversification and the durability of the rally.

Tech Under Pressure

Tech stocks especially are showing increasing vulnerability as elevated valuations collide with shifting macroeconomic conditions. After a powerful rally — fueled by AI enthusiasm and concentrated capital spending in mega-cap names like Nvidia, Microsoft, and Alphabet — the sector now faces mounting pressure from multiple fronts.

Recent market pullbacks reflect investor anxiety over fading hopes for aggressive Fed rate cuts, the government shutdown, and renewed U.S.-China trade tensions, particularly around tariffs on rare earths and critical tech materials. These headwinds have triggered volatility in the Nasdaq 100, underscoring how sensitive tech valuations remain to both policy shifts and earnings missteps.

As investors begin to de-risk portfolios and lock in profits, the sector’s leadership role may be tested — especially if AI-driven spending proves less durable than expected.

RRGs in Action: Mapping Market Rotation

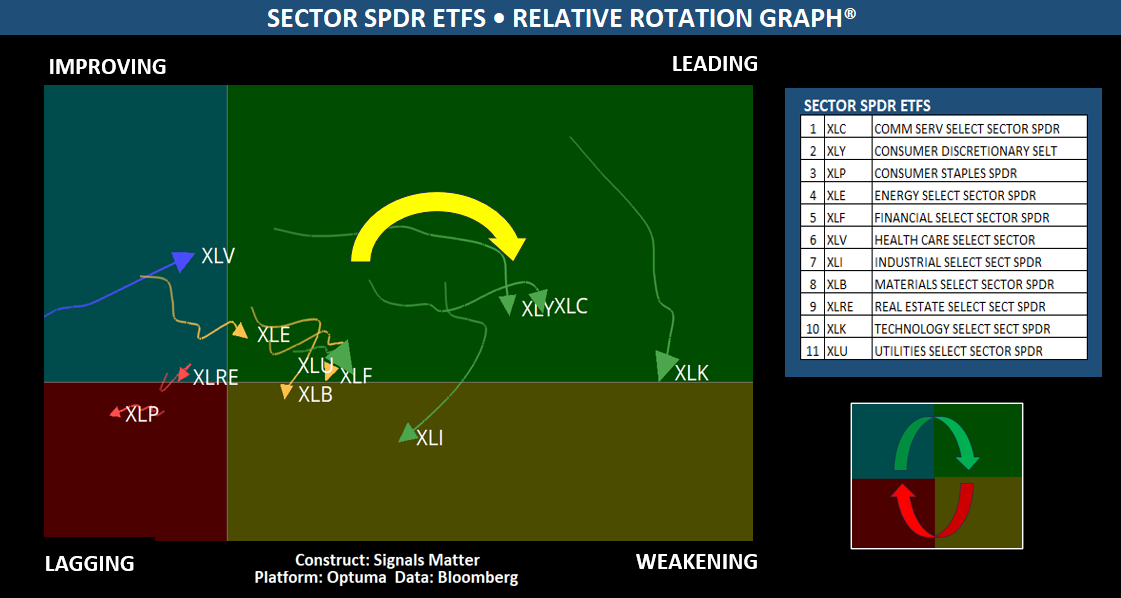

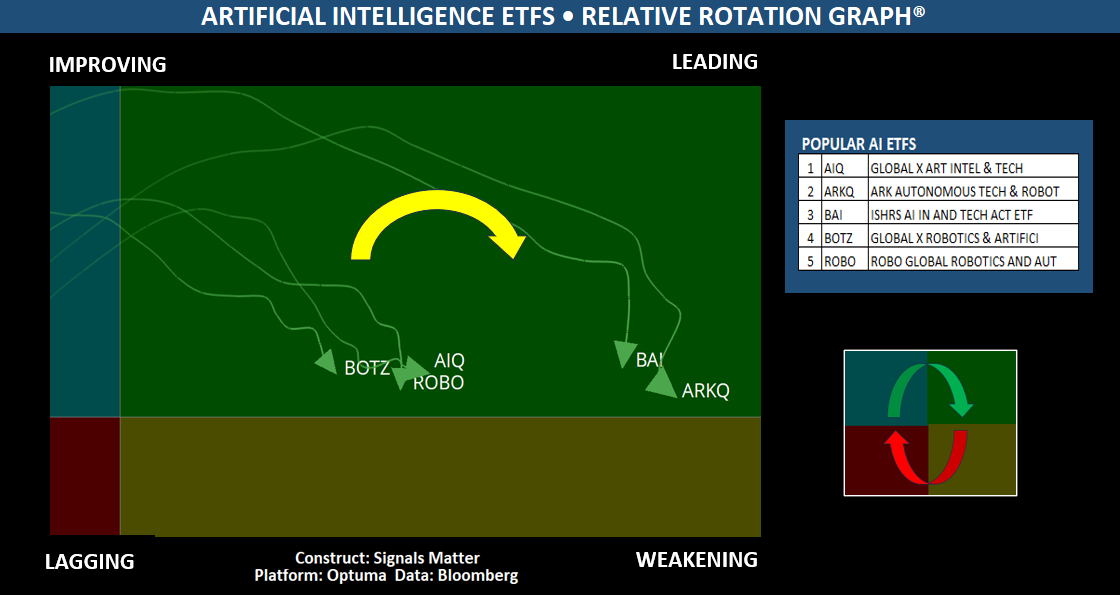

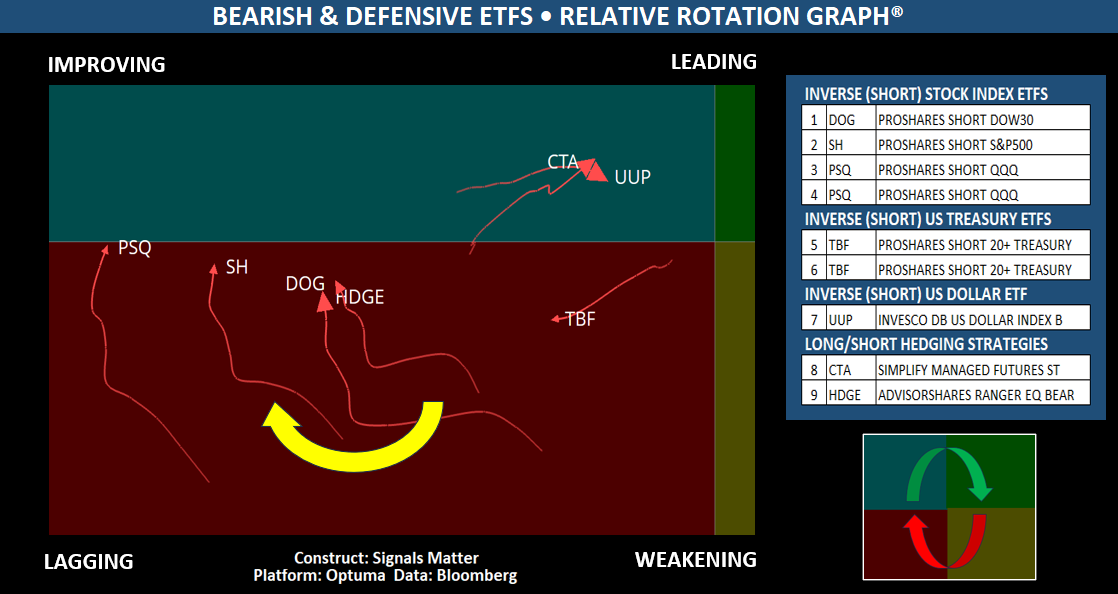

To visualize the current state of long (buy-side) versus short (sell-side) positioning in the markets, we frequently turn to Relative Rotation Graphs® (RRGs), developed by Julius de Kempenaer, Senior Technical Analyst at StockCharts.com. These powerful visual tools map the relative strength and momentum of multiple securities — from sectors and asset classes to individual stocks and ETFs — against a benchmark index.

RRGs plot assets across four quadrants: Leading, Weakening, Lagging, and Improving. This framework helps investors identify where capital is flowing, where leadership is emerging or fading, and how to tactically allocate exposure. At Signals Matter, RRGs help guide allocation decisions — especially in times like these, when market leadership is shifting and clarity is critical.

Sector SPDRs: Rotation into Weakness

Recent data suggests that U.S. Sector SPDR ETFs are beginning to show signs of fatigue as we move through October 2025. SPDR ETFs (Standard & Poor’s Depositary Receipts) are exchange-traded funds that track specific market indexes or sectors, providing diversified exposure to key areas of the U.S. stock market.

Most SPDRs have peaked and are now rotating out of the leading quadrant into weakening territory. While healthcare remains a bright spot — and a core holding in our portfolios — the majority are losing relative strength and exiting leadership. This shift reflects growing investor caution amid mixed earnings, elevated macro uncertainty, and a broader tilt toward defensive positioning.

Artificial Intelligence ETFs: Momentum Fades

AI-focused ETFs such as AIQ, ARKQ, BAI, BOTZ, and ROBR appear to be peaking as well after a strong year-to-date run, reflecting a broader shift in investor sentiment and sector momentum. These ETFs — concentrated in artificial intelligence, robotics, and autonomous technologies — delivered impressive gains earlier in the year but are now showing signs of consolidation and declining relative strength. Contributing factors include stretched valuations, profit-taking, and a rotation away from high-growth themes amid rising inflation and mounting macroeconomic uncertainty.

While the long-term case for AI remains compelling, current technical signals point to a potential pause — or even a pullback — as markets reassess risk and recalibrate toward more defensive or diversified positioning. Amid stretched valuations and shifting macro headwinds, investor enthusiasm may be cooling, at least temporarily, as capital rotates away from high-growth themes.

Bearish Bets on the Rise

Enter the bearish and defensive ETFs — tactical tools designed to profit from market declines or hedge against rising economic risks. Many of these hedges, particularly short-side ETFs, have been steadily rotating from the Weakening quadrant into Lagging territory, now showing early signs of potential improvement as equities begin to soften. This shift suggests that downside protection is gaining traction, with capital gradually rotating toward contrarian plays and volatility buffers.

Outright bearish bets are gaining traction, led by inverse equity ETFs such as DOG, SH, PSQ, and RWM — which short the Dow, S&P 500, Nasdaq-100, and Russell 2000, respectively. TBX and TBF offer inverse exposure to U.S. Treasury bonds, positioning against rising bond prices. UUP tracks the U.S. dollar and is often deployed as a hedge in volatile markets.

CTA, a managed futures ETF, seeks returns across commodities, currencies, and interest rates, while HDGE actively shorts individual stocks with deteriorating fundamentals. Together, these instruments reflect a growing appetite for downside protection and tactical diversification as market risks mount.

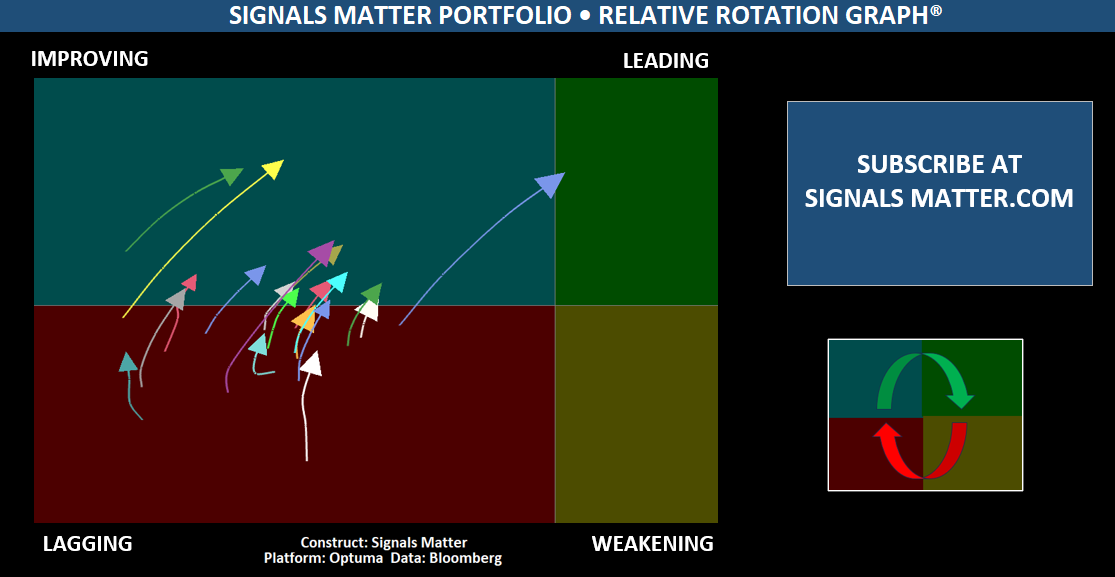

Why Active Portfolio Management Matters Now

Active portfolio management can outperform a traditional 60/40 passive portfolio — especially during periods of heightened volatility, macroeconomic disruption, or sector dislocation. Unlike passive strategies that remain tethered to benchmark allocations, active managers like Signals Matter can tactically reduce equity exposure, rotate into defensive sectors, shorten bond duration, or raise cash when risk signals emerge. Responsive positioning helps investors navigate uncertainty and protect capital when traditional models fall short.

Flexibility becomes critical when interest rates rise, inflation accelerates, or earnings disappoint — all conditions that can erode the performance of a static 60/40 mix. For insight into how to navigate these shifting markets, come see us at Signals Matter.

We actively manage portfolios with precision, rotating across sectors, asset classes, and hedging strategies to protect capital and pursue distinctive opportunities — especially when traditional models fall short. In times of uncertainty, agility and informed allocation make all the difference.

Signals Matter: Products & Access

Signals Matter delivers actively managed, all-weather portfolios designed to perform in both rising and falling markets. With a disciplined 50/50 allocation between individual stocks and diversified ETFs— that invest long and short—we blend growth potential with volatility control and downside protection, unconstrained by traditional benchmarks.

Signals Matter Market Reports are available free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox when you Sign Up Here. Our actively managed portfolios, recession matrices and more are available to subscribers who Join Here. For access to our hedge fund that trades our portfolios, or to discuss a private equity opportunities, we invite you to Explore Direct Invest and to Book a Meeting with us.