Below, we look at the three broken legs keeping our broken market stool wobbling rather than falling. Hint: One of them is stock buybacks…

40 shares

We’re enjoying your comments and questions – especially one that essentially reads, “What’s holding these markets up with all the bad news out there?”

That’s the magic question. Here’s our answer:

There are basically three forces keeping this broken market standing, namely 1) corporate stock buybacks, 2) the proliferation of passive index funds, and (of course) the 3) Federal Reserve.

And as both math and history confirm, they are each highly dangerous and, together, they are treacherous.

Let’s discuss…

Market Performance, Huh?

First, let’s be clear on exactly “what’s up.”

In Monday’s article, we reminded readers that despite all the bullish “surges” which bobblehead financial journalists and sell-side Wall Streeter’s headline on a near-daily basis, actual returns over the last two years of increased risk have been flat to minimal:

In short, from January 2018 to the last high of 2019, almost nothing has changed or been gained net/net, when all is said in done.

Again, this is not opinion but math. That total of 5.2% up was accompanied by a 20% downturn in the last quarter of 2018 – not what we call “fun.” Nevertheless, expect the Fed to juice these markets for a nice year-end self-congratulation of pure steroids.

Stock Buybacks – An Invalid Market Force

Here’s some more math.

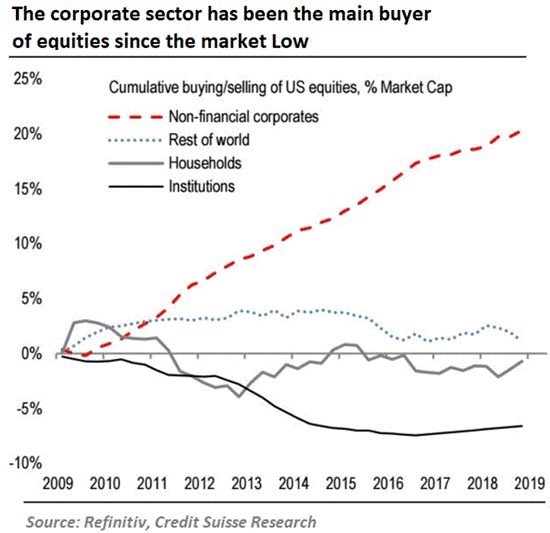

Since the alleged “recovery” in the U.S. equity markets began in 2009, corporations themselves purchased over 20% of the U.S. market cap at the very same time that the “smart money” institutional investors sold over 7% of that same corporate sector.

Stated otherwise, the wind beneath the U.S. stock market has come from the very companies that comprise that market. See for yourself:

This means that even the paltry gains witnessed by our markets in the last two years would be far, far lower today if it weren’t for these stock buybacks. In short, markets would otherwise be falling to record levels.

The math behind these stock buybacks is revealing in many important ways.

First, it just feels wrong.

After all, if I were to legally announce that I were a “best-selling author” based upon book sales, that would be impressive on its face.

But if I were to later admit that my rich uncle bought all those books and now warehouses them in his garage, my “best-selling” status would feel a bit tainted.

Well, it’s no different when considering the status of our “surging market highs,” for they are “high” only because publicly traded corporations like Cisco, Lowes, General Electric, and Apple have been “high” on their own Kool-Aid – i.e. “buying their own books.” That’s the power of stock buybacks.

Secondly, such stock buybacks create equally tainted data points, most notably when the media brags about “impressive” earnings per share (EPS) data.

Here’s the rub: That EPS data is totally rigged.

When companies buy back their own stocks, the available number of shares aftet the stock buybacks is greatly reduced, and hence the earnings per those reduced shares make the data seem better than it actually is.

That is, we have the same earnings divided by a smaller number of shares, and hence a higher (yet fudged) ratio of earnings per share.

Putting numerical lipstick on a corporate pig by using stock buybacks is artificial. But there’s more…

Taking this a step further, think about this. Executives are often compensated by EPS stats, which we now know are inflated EPS stats. Which means they are enriching themselves even as their corporate performance sags.

Ah… what a “recovery,” eh?

There is also a matter of simple legality here, something former law graduates like myself cannot ignore or easily accept.

It’s worth noting as well that such stock buyback scams were a leading “proximate” and “direct” cause of the great market crash of 1929, and thus subsequently outlawed by no other than the former bootlegger and market-rigger-turned-SEC-Chairman, Joseph Kennedy.

After all, it takes a fox to catch a fox.

Unfortunately, and thanks in part to the unfettered, deregulatory “insights” of Milton Friedman and the Chicago School, such pesky legalities were later dismissed, and the stock buyback scam that crushed us in 1929 was reinstated.

So here we are again, heirs to a bad plan reborn in bad times.

Index Funds – Another Bad Plan

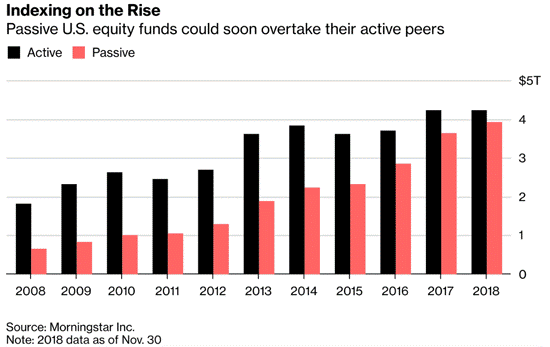

Bad plans don’t just develop because they occurred in the past. They are reborn, generation after generation. A completely new generation of equally bad plans has indeed emerged, including the modern index fund into which the majority of retail investors have been herded like cattle by their traditional (highly dangerous) wealth advisors.

By index fund, we refer to a simple mutual fund (MF) or an exchange-traded fund (ETF) that follows preset rules that track a specified basket of underlying investments. The most popular index funds track the major indexes, like the S&P 500 Index or the Dow Jones Industrial Average.

By parallel, the recent flood of funds into index funds mirrors the pre-’08 rush to buy into the subprime Collateralized Debt Obligation (CDO) bubble that brought our markets to their knees.

Now, as then, this massive inflow is poised for a reversal – i.e. an equally massive outflow. Of course, the longer this bubble persists in the interim, the uglier it will be when it reverses.

That’s because as in 2008, no one is taking the time to look beneath the hood of these indexed securities at the underlying balance sheets that comprise the basket of assets they hold.

Prices in these indexes are based on volume, not valuation. They rise with the market tide, not on individualized volume, earnings, profits, or losses.

The Russell 2000 index is a perfect (and mathematical) example of this distortion. The majority of the stocks beneath its hood trade at low volume and are valued at less than $5 million each, and almost half of those names trade at less than $1 million on any given day.

But when packaged together under a nice index ticker, these same stocks peddled by Wall Street and consensus-thinking wealth “advisors” trade at hundreds of billions of dollars.

The S&P is little better. Its index is comprised of the world’s largest stocks and trades at levels that reach trillions of dollars, but over half the names in that index trade daily at less than $150 million on their own.

In short, index funds are “like a box of chocolates,” most of which are crap, but trade at grotesquely overvalued prices merely because a few “good flavors” in that chocolate box are tasty enough to seduce investors to buy the whole box.

But as Forrest Gump further reminds, “stupid is as stupid does.”

Smart investors, however, see right through these risks and don’t buy in bulk via indexes, but handpick their chocolates carefully, typically looking for the few true value names in the small-cap growth space (mainly good technology stocks) which offer the most bang for the individual buck.

But even such sniper-shooting for genuine value has risks today, as even the good names (with good balance sheets) can and will go down when the market tide goes out.

Ironically, it will be the sudden outflows from the big index funds (and the many bad chocolates they hold) which will punish the few good chocolates trading outside the indexes.

All of this is my way of saying that risks continue to outweigh reward in these increasingly overvalued and distorted markets – made all the more so by such dangers as seen in stock buyback scams and index overvaluations.

Today, any number of foreseen and unforeseen events (drone strikes to repo market “glitches”) can make rising tides suddenly turn into falling tides driven by massive flows out of the above-described index vehicles, or rising tides in interest rates which end the current buyback scam.

Today, I therefore see a market stool held together by three shaky legs: 1) stock buybacks, 2) overvalued/crowded index funds, and, of course, 3) totally rigged Fed support.

Which leg will break first? When will it happen?

Does it matter? Well, yes and no. At this point, it’s smart enough to simply avoid sitting on a broken stool.

Simple math and common sense speak for themselves, and you have plenty of both to make the right decisions now.

Sincerely,

Matt Piepenburg

Comments

21 responses to “Three Legs of a Broken Market Stool”

- Terry says:

What do you think of some of these so called gurus saying that the government will confiscate or change the value of ur currency?

- Peter Martenssays:

Concerning corps buying back it’s own stock, do they then cancel those shares? If so, as is my understanding, the following P/E ratios as reported would appear to be valid. I do follow generally the balance of your assessments.

Thank you

- Jack Rydersays:

So should the average investor bail out of stocks and into CDs?

How about preferred stock or corporate bonds rated at Aa- or better?

- CHARLES BATEMANsays:

what does the retiree who has already exhausted most his savings & investment do to avoid calamity & starvation ?

- luc morinsays:

Great article. It summarise well the risk in the market.

- Lutfar Rahmansays:

shall we buy some SPY December Puts ?

- Louisesays:

Cash will be King when it occurs.

- Johnsays:

Why aren’t people rushing in to buy assets with yields in such a low interest environment ?Why aren’t the banks falling over each other to lend money?Why aren’t a flood of liquidity causing assets prices to blow off?

- roland h.says:

excellent, perfect examples from the past – many hanks

- martinsays:

While falling rates continue to juice a fragile and toppy market, tempting investors to chase yield; and approaching zero to negative rates advance on the alleged power house of the world economy, , I look to MSCI and wonder, is constant economic growth the future; maybe social capital is a more productive measure of the possibilities to truly harness the fullness of human(e) potential. Quizzically yours, martin. limits to growth, like a virus, Volume =4/3 pie r cubed Area is pie r squared. Think about that. What is the surface area, From memory it is 4 pie r. LIMITS

- Nicholas McMahon Turner says:

I use a 3 leg stool to sit on when milking my cow. Looks as if I will no longer be able to milk in the near future. My poor cow will suffer badly.

- Mark Hammondsays:

Great article!

- Edsays:

Great, long on thoughts, but what do you recommend?

- Franksays:

Couldn’t agree more. I have monthly indicators that topped in January of 2018 and are still headed down. I do not understand what is holding this market up, except as you explained above. Still, the end will not be pretty in a few years.

Thanks for great insight that 99% of “investors” don’t understand.

- Zarlingsays:

You always concentrate on the negatives; certainly there are positives out there and ones that could happen ! For one Trump and Trade & the Another the FED is too powerful to go against … history has proven that.

- Bobsays:

As I could not have said it better,, just standing by looking for shorts,, that are attractive,,

- Leon Bersays:

I was curious about why you do not recommend silver & gold miners since a market crash would likely send these investments much higher. I am already invested in high quality established gold-silver mining companies which already is showing a 3 to as high as 10 to 1 increase in value as gold-silver moves up.

- Edouard D’Orangesays:

Understand your broken market stool argument, but I don’t see any of the three legs of the shaky stool breaking at the moment. Buybacks continue with little abatement; index funds keep gaining with 401k’s and investors placing money that can only earn more there than in 1% or so savings accounts; and the Federal Reserve is sure gonna keep supporting and rigging markets, money and interest rates. Hopefully, I can get out before some black swan or other event happens to drop markets

- jack kimura says:

Under these circumstances, would you suggest going in to all cash and gold?

- Jay Kleesays:

You probably aren’t allowed to touch this even if you believe it’s true, but I believe the Working Group on Financial Markets (est. 1988) buys up stock futures on a daily basis, especially when bad news come out. If you compare the real time S&P 500 price action to the ES futures market, the ES is almost always a few points higher, especially when stocks are selling off.

I was thinking stock buybacks were outlawed until sometime in the 1980s?

- Ankur Anand says:

Excellent articulation with clear view. Thanks for the best work. I really learned a lot of things after reading the post. Please let me know for the upcoming posts.