Signals Matters News Letter: The Signals THAT Matter

Party on or hunker down? That is the question du jour.

Our insights and analysis on economic indicators and market conditions suggest that, despite all of the euphoria over rising stocks, recession indicators are rising, now that interest rates have made the turn, and rate cuts are hardly a glowing indicator of a strong economy.

But then again, markets are so disconnected from the real economy that one has to temper the sobering news on the streets with the intoxication in the markets—not an easy task…

As for WHAT’S HAPPENING NOW…

Now Comes the Hard Part

Now that the Fed has begun lowering interest rates, the clock is ticking on whether a recession may ensure–the hard part.

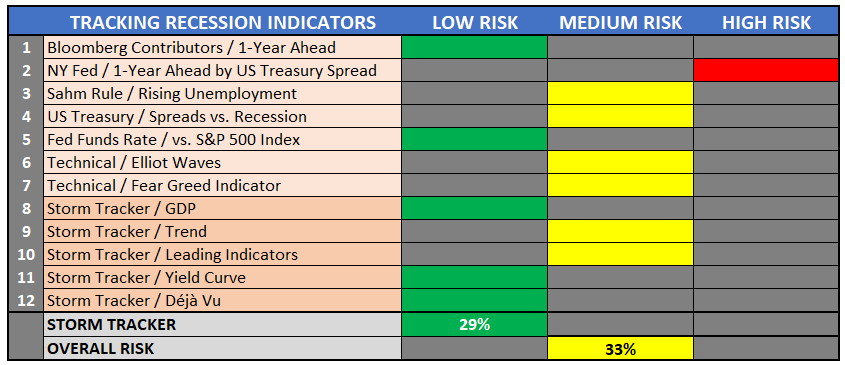

Tracking Recession Indicators

There are a myriad of recession indicators out there. Here’s what we’re tracking, top-down, in two groupings. First, we track quantitative inputs, including

- Bloomberg Contributor consensuses,

- NY Fed projections,

- Rising unemployment figures,

- US Treasury interest rate spreads,

- Fed Funds rates,

- Elliot Waves, and

- Fear/Greed indicators.

Second, we track macro indicators in a tool we call Storm Tracker that include:

- GDP growth (10 data points),

- Yield Curves (10 data points),

- Trends across financial conditions and global equities, bonds, currencies, and commodities (120 data points),

- Leading Indicators (29 data points), and

- US Treasury spreads vs stocks (3 data points).

To make it simple for Signals Matter Subscribers, each week, we graph all of the above in excruciating detail for the analysts who follow us, along with this very simple summary for those who just want the bottom line, which is this.

Storm Tracker projects a 29% chance of a recession in the coming 12 months, which rises to a 33% chance when additional technical indicators are added.

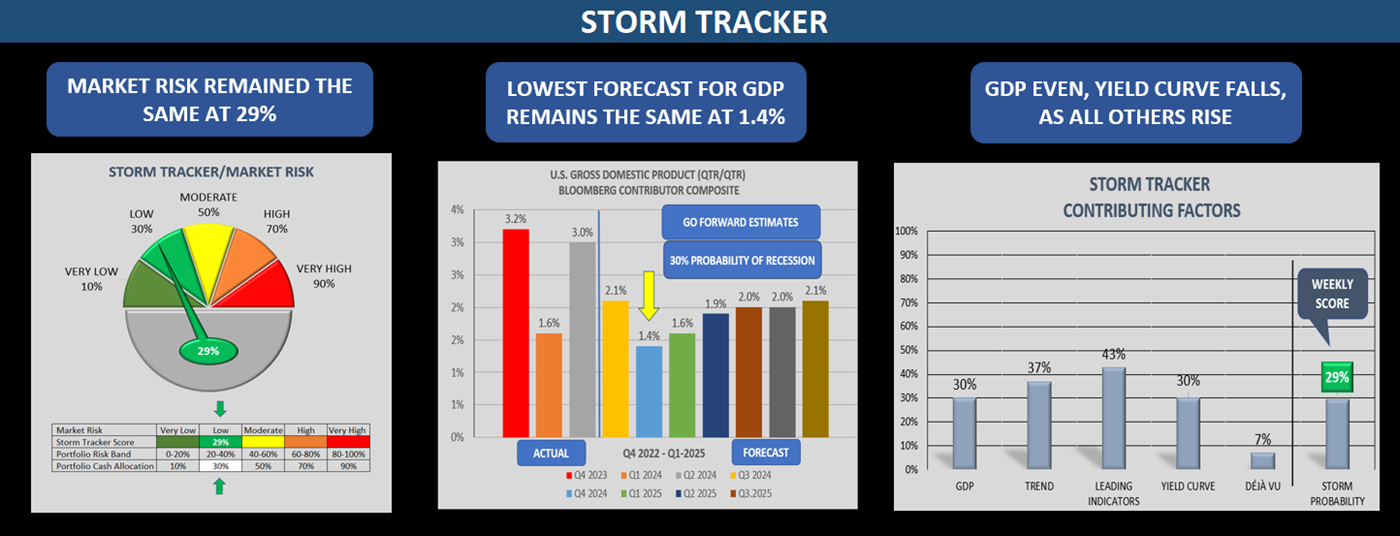

Storm Tracker

Summarizing for the current week, Storm Tracker is signaling a 29% probability of recession in the coming 12 months; a decline in GDP growth to 1.4% in Q4 2024; and contributing factors that include GDP, Trends, Leading Indicators, Yield Curves, and a proprietary signal we call Déjà Vu. Compared with the week prior, adverse Trends rose 12% last week and adverse Leading Indicators rose 19%, offset by yield curves improved by 25%.

Next Steps

If you’re concerned about a coming recession, this stuff matters, folks. While it’s fine and dandy to track and understand recession probabilities, what to do about them is the harder part.

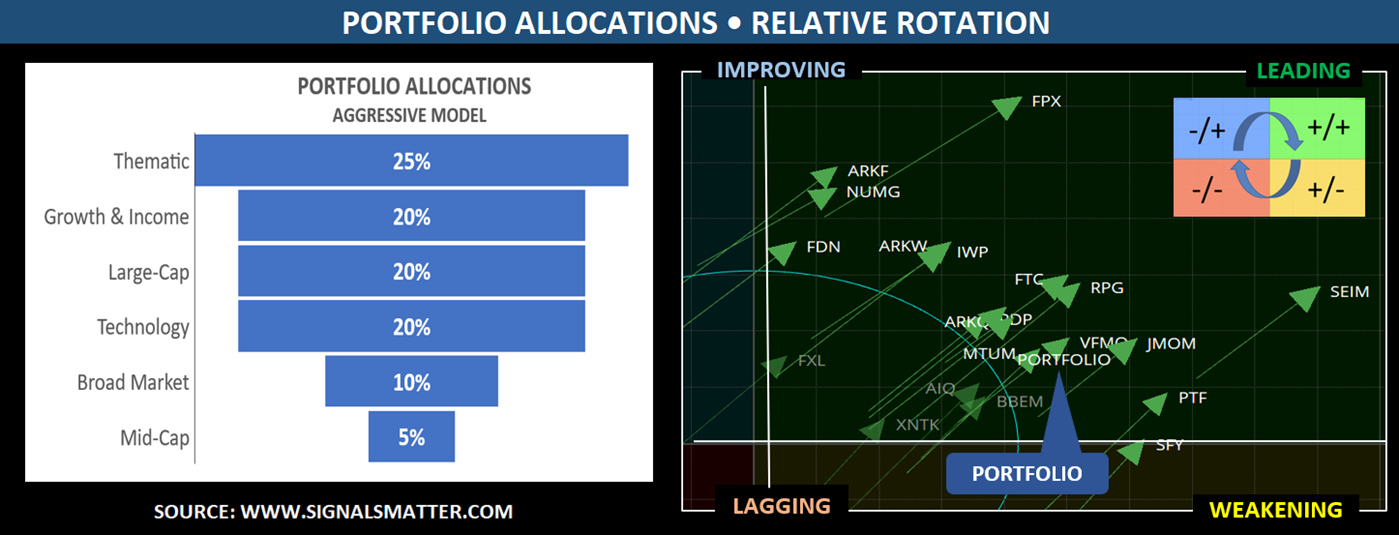

At Signals Matter, we publish five Portfolios that range from Conservative to Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. Each Portfolio allocates to 25 carefully selected Exchange Trades Funds (ETFs) in proportions that vary with Storm Tracker risk.

As risks rise, allocations increasingly favor ETFs of short-maturity treasuries. As risks fall, it’s party-on with up to 100% of allocations to equity sector ETFs.

As we pen this note, Model Portfolios are mainly allocated to equity ETFs across leading sectors. As recession probabilities rise and stock ETFs begin to weaken, there are always ETFs that are improving, be they allocated to energy, commodities, county ETFs, emerging markets, financial services, tech, volatility, and even ETFs that outright short the markets so as to gain when stocks fall.

The idea is making money in any investing environment, recessionary or not.

Bottom Line

The takeaway from all these charts and narratives is that, according to our tea leaves, there is a trackable 29%-33% risk of a recession occurring within the next 12 months. Having said, recession bells generally toll only one to three months in advance, and DC won’t officially announce a recession until it has already happened.

Our Subscribers keep an eye out each week for refreshed signals and when it may be time to hunker down. In the meantime, it’s party on!

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.