Low interest rates in the bond market have a direct impact on the stock market. Below, we show you how and why, using Netflix as a classic example.

18 shares

The relationship between low interest rates and inflated stock prices is dangerous, and that danger is likely impacting your money.

As market veterans who’ve seen this movie before, we’d like to make this point about low interest rates stick with another source of entertaining fiction – Netflix.

The company’s taken on a frankly disturbing amount of debt, something that even a market darling FAANG stock isn’t safe from.

Here’s why you should keep an eye on this debt drama…one driven entirely by the “good times” which low interest rates create just ahead of really, really bad times.

First, the Bond and Low Interest Rates Backdrop

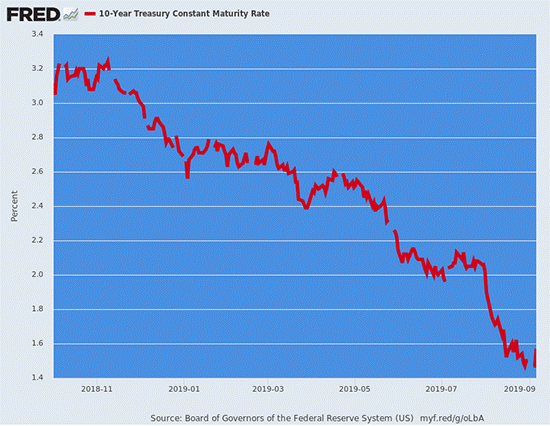

The pulse of the bond market (and hence the current stock market bubble) rests on low interest rates and borrowing costs, driven by those compressed yields on the 10-year U.S. Treasury.

As you know by now, yields on that benchmark Treasury Bond recently hit the basement of history:

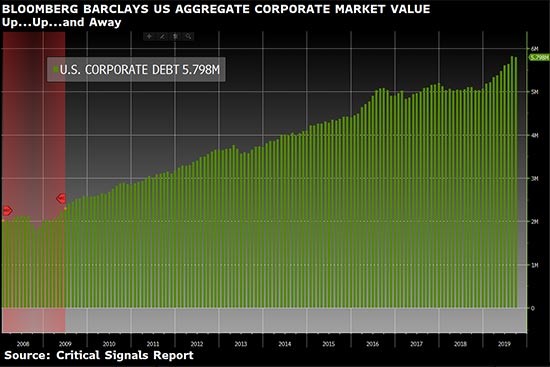

When the cost of borrowing hits a bargain basement like this, companies naturally borrow to take advantage of low interest rates.

In fact, they borrow and borrow and borrow more, almost tripling the levels of corporate debt seen since the eve of the Great Financial Crisis of 2008.

Is such borrowing at low interest rates bad thing?

It depends.

If that borrowed corporate money is used for new capacity outlays (CapEx) and overall corporate building from within, it can actually be a good thing, especially if a company has the revenue to pay back the well-used debt in an orderly way.

If, however, fathead executives use that borrowed money (driven by low interest rates) to buy back their own shares and hence fatten their share-price-measured salaries, that’s not only bad, but it’s also sickening.

A true horror film.

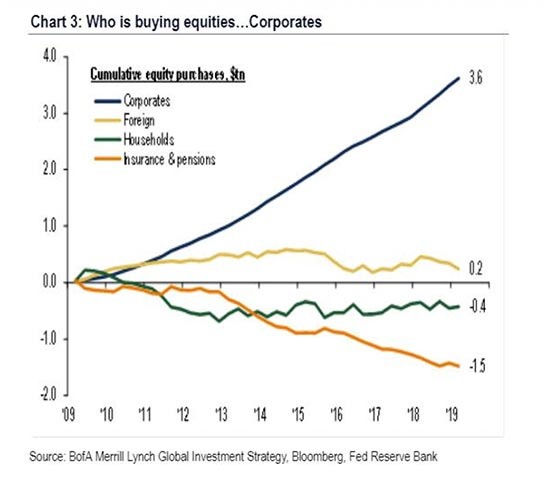

With that said, guess where the borrowing has gone in corporate America. You guessed it – corporate stock buybacks.

And I’m talking about massive, historically unprecedented levels.

In effect, the primary buyer of U.S. corporate stocks has been the corporations themselves, not retail investors or other institutions – i.e. natural demand.

This, by the way, is just further proof of a market totally rigged to fail on the back of artificially low interest rates.

In fact, between 2017 and 2019, over 20% of the market cap for the U.S. stock market has been driven by companies drinking their own Kool-Aid – i.e. buying their own stock.

What’s even scarier is that while S&P companies have been going into debt to pay their executives with stock buybacks that distort/inflate their EPS (earnings per share) data, the major institutional buyers have been selling those same stocks to the tune of 7% of the market cap of our equity markets.

Meanwhile, bond buyers (suckers) are slurping up the low-yielding IOUs of these self-serving companies for almost no yield in the foreground of a Fed that has all but murdered natural yield in the broader markets. Just look at the yields on the 10-year U.S. Treasury above. Talk about low interest rates…

But it gets worse.

For in addition to drinking their own Kool-Aid to stay alive, the vast majority of these buyback-driven companies are otherwise broke and surviving exclusively off low interest rates and cheap debt. They are like the zombies we’ve seen streaming on hit shows like “The Walking Dead.”

As of today, nearly 75% of the $3.2 trillion gain in market cap is driven by BBB rated securities – i.e. the D- students (and zombies) of the bond market, which means a lot of these corporate bonds will be downgraded to junk status when the inevitable recession becomes official and the debt cycle driven by low interest rates ends.

Stated otherwise, corporate bonds today are what subprime mortgages were in the melt-up to the 2008 disaster: ticking time bombs.

What About Your Favorites?

Some of you may be thinking that your favorite stocks are safe, well-capitalized, and debt savvy. Perhaps you’re thinking those infamous big tech FAANG stocks are the A+ students?

Think again. Here’s a peek behind the curtain of one stock in particular to make this sad reality of low interest rates sink in…

Specifically, I’m talking about Netflix, otherwise known by many of us math geeks as “Debtflix.”

Netflix, of course, streams some pretty cool content. I’m a subscriber, but I’m not a stockholder, despite its rising price. And here’s why.

The hard fact is that Netflix subscribers like me are not triggering enough revenue for the company at the levels necessary to cover marketing and other expenses essential to making the company even remotely close to profitable.

To cover this widening gap, Netflix is taking on debt. Lots and lots of it, driven by the seduction of low interest rates.

In terms of free cash flow (FCF), Netflix is burning through cash at record speed. Other bad boys in the FCF burn race to the bottom include Uber, Snapchat, Lyft, and Tesla. Together, they’ve posted an astounding $24 billion in negative cash flows since their respective launches. Such crappy news, however, won’t keep their stock prices from rising in a world gone mad.

But Netflix is outpacing even these class clowns, posting negative cash flows of $1.7 billion in 2016, $4.8 billion in both 2017 and 2018, and another $1.2 billion for the first half of 2019.

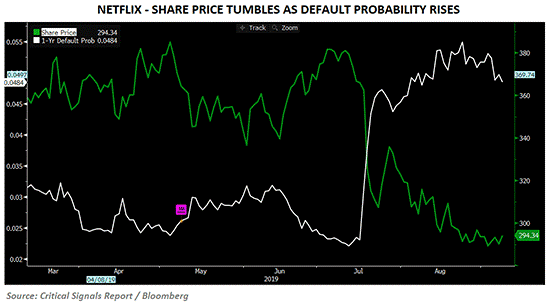

And at the same time that Netflix has been burning through cash, it has been stacking up a mountain of debt at low interest rates to cover the shortfalls. And guess who’s been watching those default risks rising… Netflix stockholders, of course.

Since 2016, Netflix has added $8 billion in debt, once again outpacing the broken balance sheets of Uber, Tesla, and its other broken peers above. Total debt for “Debtflix” now stands at nearly $13 billion, widening the gap even more. This kind of crazy is driven exclusively by low interest rates, which in turn, are driven exclusively by Fed rate suppression.

And that is where Netflix stands today – a classic metaphor of a “safe name” losing money, taking on debt, and yet promising some magical bright new day of rising revenues despite strong evidence to the contrary and a recession around the corner.

But hey, why worry? With the Fed slamming rates to the floor, can’t companies like Netflix just borrow forever at low interest rates to keep stock prices elevated on IOUs, revenue promises, and low interest rate debt that never goes higher?

If you believe that, then go long Netflix. We actually think the stock (and market) will rally by year end, as the Fed will undoubtedly be printing more money this fall—they’ll have no choice.

If, however, you understand that low interest rates compressed to historical lows can and will eventually spring forward into balance sheet-killing rising rates, I’d suggest you hedge even these fat pitches with a healthy cash allocation—because managing risk is the better way to make money longer term.

At the current and compressed low interest rates, S&P companies spend about $20 per share to service their debt. But if currently low interest rates climb by just 2% (and they eventually will), the cost per share to service that same debt climbs to over $50 per share, which means companies will need to dip into their fake earnings just to cover interest expenses on their debt.

Needless to say, that’s when earnings fall like rocks and hence stock prices, too. And that, by the way, is when I’ll be telling you to short names like Netflix, not buy them, because over-indebted stocks like these always fall much faster than they rise.

In the meantime, stay informed, stay patient, stay safe…

Sincerely,

Matt Piepenburg

Comments

5 responses to “What Low Rates Do to Your Favorite Stocks”

- larry russellsays:

So what woudl you do?

Go to cash?

Buy value stocks?

sell your winners or your losers?

- Eric Bingensays:

Fascinating article Matt. What an eye-opener. Thank you.

- Yvonne Mongeonesays:

Thank you for this..can. You tell me what a Trump win will do to the economy.

- B. WARRENsays:

NO SYSTEM BASED ON DEBT HAS EVER LASTED AND WHAT WE NOW HAVE WILL BE NO DIFFERENT. I THOUGHT IT WAS ALL OVER IN 2007 OR 2008, I AM SURPRISED THEY WERE ABLE TO GET IT GOING AGAIN.

HOW MUCH LONGER WILL THEY BE ABLE TO KICK THE CAN DOWN THE ROAD? I WISH I KNEW. WHEN THE BOND MARKET FINALLY FREEZES IT WILL BE OVER. EVEN THE BIG CORPORATIONS HAVE NO MONEY TO OPERATE WITH. THEY GO INTO THE BOND MARKET TO BORROW THE MONEY TO OPERATE EACH MONTH. WHEN THEY CANT THEY WILL HAVE TO CLOSE THE DOORS. ITS ALL BASED ON DEBT AND CREDIT. CAN ANYONE SERIOUSLY THINK THERE WILL BE A HAPPY ENDING TO ALL THIS?

- Mindysays:

We have heard your message (loud and clear) and have reduced our stock holdings substantially. It was hard to pull the trigger, but glad that we have taken our profits off the table rather than wondering why (like a deer in headlights) we didn’t.

Much appreciated,