Here, we look again at the facts and forces behind a trade war reality not otherwise seen in the main stream financial media.

15 shares

In our last report, we discussed distractions, headlines, and tariffs, all of which are further, combined evidence that markets are rigged to fail, as we’ll detail in a special report to come.

Today, we’re going to capitalize on why you shouldn’t listen to those optimists (red or blue) in D.C. that tell you not to worry about tariffs, and what exactly you can expect from an escalating trade war and trade war reality.

We’ll also talk about what all of this means to investors- and thus why it matters to you.

So, let’s dive in…

Game-Changers Don’t Mean Good Changes

Today, most folks are just trying to get by – and increasingly unable to do so. Perhaps sticking it to China and other problematic trade nations might feel like a way to finally help us at home. But this, sadly, is not part of trade war reality.

Again: I get the frustrations. China cheats. Big time. And drugs coming through the Mexican border are indeed killing Americans at horrific rates. But as for true “free trade,” we’ve never really had it, period. All countries cheat and lie, some more than others. We all know this too.

The real questions are: How do we deal with this current trade war reality? Are tariffs the answer today, right now? What are the consequences, seen and unforeseen?

According to the Nobel-Prize winner, John Nash, who was smarter than anyone in D.C., as the rules of an even imperfect game (like replacing free trade with tariffs) fall apart, all kinds of known and unknown problems arise. Nash, in short, would have understood trade war reality.

But Washington Tells Us Not to Worry?

The optimists in D.C. tell you not to worry. Sure, they admit prices will go up in a tariff war, but assure us that these price-hikes will be spread across so many products that no one will really notice. Price inflation, they insist, will be minimal. Is that trade war reality?

But others are not so optimistic. I, for one, already know how dishonest our own “home team” Fed is when it comes to cheating about inflation…

Today, for example, we live in a Walmart nation.

As tariffs continue to rise, prices there (and in other stores) will rise as well, because greater than 90% of the “U.S. products” sold in those industrialized shopping centers are, well… made in China. Whose fault is that?

Hint: as the American CEO’s at Apple, Nike et al…

But tariffs do more than create sticker shock at Walmart. Remember, real economies run on business growth, not on the debt-driven stock market growth which fuels our rigged economy.

Businesses, in turn, run on supply chains. If one part of that “chain” gets too expensive in a trade war, the chain pops and the economic bicycle stalls… In other words, as the game changes, many of the players get hurt. Supply chains are already breaking down now–that’s just trade war reality.

Thus, if it feels patriotic to engage in “America first” rhetoric (or tariffs), I fully understand the urge to think this way. Unfortunately, however, if you dig a little deeper into the math, such policies only make things worse for Americans in the long run…

Farmers, who are already getting crushed by tariffs, know this all too well. But that’s just the beginning.

As to the ag-related stocks we mentioned on Tuesday, namely John Deer (DE), Caterpillar (CAT), and Archer Daniels Midland (ADM), take a peek below… they got hammered in 2008. Different this time?

Nope… already looking toppy, especially ADM. Just more trade war reality.

If a trade war continues, shorting, rather than buying, these tops is the trade to look out for.

As metal prices rise, many companies have to turn down orders they simply can’t afford. The domino effect on our already meek U.S. manufacturing and industrial production numbers then goes down – not up. More trade war reality.

We are already seeing this today:

In such changing playing fields, iconic American companies (like Harley Davidson) thus jump to places like Thailand to save on operational margins and labor costs. More U.S. jobs are thus lost… Again, things break down, rather than rise up despite the “feel good” tariff headlines. Again, just more trade war reality.

The “All-American” Harley may anger you as acting “un-American,” but hey, that’s “Realpolitik” in a nutshell, and countless other “All-American” companies have been doing this for years. Again, whose fault is that?

And now, as tariff wars further change the field of play, players of all nations begin to do increasingly scary things, causing mutually destructive breakdowns in the playing field of supply chains.

What Can We Expect from a Trade War?

So, what’s next? Will NAFTA effectively die? Will China and the U.S. keep fighting, or make a headline-filling (and thus market rising) “peace” soon?

As an investor, it’s difficult to know, because geopolitics (from tariffs to exploding oil tankers) are very hard to predict in a free trade game that is no longer familiar, nor free. In short, bad things are happening. That’s just more trade war reality.

The ever-cheating China, for example, is now increasing its exports to other nations faster than the U.S. is finding new trade partners. More trade war reality. Within a few years, Xi might be able to offset China’s losses. And unlike Trump, Xi doesn’t need to worry about an election campaign; in China, he’s “Emperor for life”…

Now that’s cheating!

So, in this new game of unilateral trade deals, a tariff war makes us incredibly vulnerable. Again: no one really wins. Trade war reality.

The U.S. today is already economically weak and politically divided, as the headlines remind us, rightly or wrongly, every day. But the real and most current fear isn’t about what the media tells you – it’s about money.

Sadly, the majority of Americans have less of it today than they did yesterday.

I’ve already discussed the seven million Americans defaulting on car loans and the 480 million in credit cards being juggled by average, under-employed Americans just to buy groceries while over $4 T in student loans, credit cards, and car payments will inevitably go unpaid…

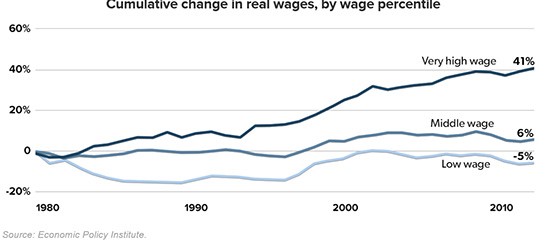

Despite the rising 1% class, most Americans are simply, factually and undeniably getting poorer by the day.

The U.S. is currently experiencing almost 40 years of declining real wages, as such households and companies are going into record debt, and that is THE REAL ISSUE that the headlines are largely ignoring:

Massive Stress Leads to Massive Desperation, which Leads to Massively Bad Decisions

Debt, of course, leads to stress, and stress leads to scapegoats and distractions, two things upon which the media loves to focus. But the real focus needs to be on our debt. It’s just that simple, and nor can this issue be printed away or rate-cut away forever.

But far more tragically, this self-created financial stress has led to a doubling of the drug-related (i.e. depression-related) death rate for the bottom 60% of the U.S. population since 2000. That’s simply staggering, and frankly says more about the real state of our union than any financial graph or waving flag, be it American, European, or Asian…

So, what can the U.S. do in the backdrop of such bottom-up, homemade stress in the real America – the same America certain politicians dismissively refer to as the Walmart Nation, whose prices will rise as lower-class wages keep falling?

Will a trade war really be of any genuine help to the crumbling reality of Main Street Americans?

Such ignored stress/reality, driven directly by historically unprecedented debt levels handed to us by our own dangerous Fed experimentation (which helped the bankers who got us into the 2008 recession), is a ticking timebomb, or as we often say, an approaching “storm.”

Fantasy Options

Given that the U.S. is already broke and in debt, what are the options out of D.C.?

Will our leaders admit that we are broke and debt-addicted by a drug pusher at the Fed? Raise taxes? Good luck on election day with that…

Print more and more money? Some, including the lunatics behind modern monetary theory (MMT) are calling for just that.

Or what if the tide from Main Street populism forces a massive debt-restructuring – a big, happy debt “reset” where all or most debts are simply forgiven in what is akin to a collective, national “Bankruptcy Plan”?

Such extremes might sound like good news to many, and have been increasingly called for, even from folks at the London School of Economics to members of our increasingly desperate Congress.

Who will pay for all this magically “forgiven” debt? Do the “experts” favoring such a “solution” honestly feel it can be achieved safely?

And what about the institutions, banks, pension funds, and other market players that currently hold all this bad debt in securitized or balance sheet form? If that debt magically vanishes, do you think markets, and your portfolios will go up or down?

The U.S., in fact, has experimented with such (smaller scale) debt “resets” in the 1930s and 1970s. It wasn’t pretty for markets or savers.

If a new debt “reset” actually occurs, crypto, gold, and other key assets will skyrocket. Markets will bottom. Either way, we’ll be tracking this possible, desperate scenario as well. Again, we’re not psychics, we’re market watchers.

Which means we have to be prepared for almost anything in our current fantasy-supported, nightmare market scenario.

RIGGED TO FAIL

But the real point I’m making today is this: The very fact that we, as a debt-soaked nation, have gotten to such desperate levels that we have been reduced to the old reliable scapegoat game disguised as a tariff war, which is further disguised as nationalism, which, in turn, is further disguised as patriotism, is actually a bad sign of the times.

But what’s an even scarier sign is that we are stooping to such absurd options like MMT or a debt “reset.” Such desperate fantasies (disguised as policies or even solutions) just prove how fundamentally broken our so-called “capitalism” has become.

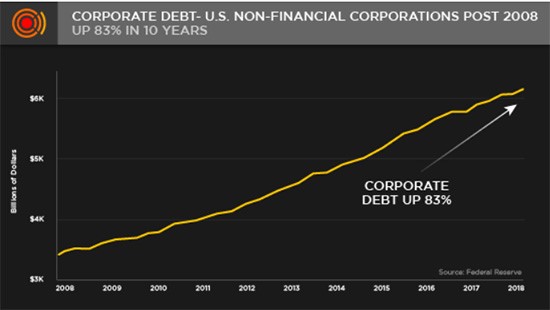

For over 11 years now, our markets and economy have been rigged by a Fed “stimulus” system of debt can-kicking which has avoided short-term pain only by making the longer-term pain ahead infinitely worse.

Thus, we’ll likely see rates come down more, even to negative territory, before someone or some event finally sends these markets over the very debt cliff that most of our leaders have pretended doesn’t exist or blamed others for creating. The blame lies within our own central bank (i.e. “centralized”) system.

But for those on the inside who’ve already pocketed a fortune or a seat in Congress, do you think they really understand such realities – or worse, even care?

Rather than take responsibility for destroying our country from the inside, bankers on Wall Street and headlines out of D.C. will just blame everyone else – including those easily detestable “players” in China and elsewhere.

If D.C. and Wall Street had bravely allowed natural supply and demand forces (rather than Fed forces) to drive markets naturally, 2008 would have given us the chance to punish overly indebted banks, investors and funds with a well-deserved financial spanking (rather than bailout).

Instead, we simply printed money (by 5X) and doubled debts (by >2X) to postpone reality in favor of the headline-supported fantasy that debt no longer matters and that bad actors off Wall Street deserve bonuses and media spotlights rather than pink slips or iron bars.

Real capitalism – the kind I admire – rewards the wise and informed while punishing the stupid and greedy.

But since 2008, the stupid and greedy coming out of the Fed, D.C., and Wall Street have been unfairly rewarded by low rates and printed money – turning (distorting) our entire “free market” system into a totally rigged game – and one that is rigged to fail for many reasons.20

In the meantime, however, our Storm Tracker was designed to watch, announce, and react to this rigged game and thus keep YOU ahead of the storm surge.

Stick with us, the facts and our blunt speak so that common sense rather than fantasy (or headlines) keeps you safely apart from the herd. Our reports will keep you in the green rather than lost in the noise–even when it comes to trade war reality.

Comments

6 responses to “Part II on Distractions, Headlines, Tariffs and Rigged Markets”

- andrew hubert willmannsays:

June 21, 2019

brilliant analysis-txks,Andrew H.Willmann

- C Lindsaysays:

June 21, 2019

Good reading. The greedy and stupid have plenty of followers that aren’t informed. They both don’t really care one way or the other. Around and around we go where it’ll stop nobody really does know. “Vote for me I’ll keep you Free” is the slogan the uninformed live by not facts! Will admit it’s a sad state.

- Edward Macksays:

June 21, 2019

And yet, no one, I mean no one, is listening to your warnings. The markets gain every day. The recession reckoning tool is only at 9%. Some time, Matt, ya gotta face reality. The Federal Reserve can keep this game going a lot longer than you believe. The “don’t fight the Fed” maxim is turning out to be all too true. I just wish that I would have ignored the naysayers and stayed in equities instead of pathetic sub 2 % cash vehicles.

- peter dochertysays:

June 22, 2019

A really interesting article,I agree with Edward Mack, the feds are being so accommodating it beggars belief, I’ve been listening to the fearmongers since 2009 , I got out early in 2006 but have missed out on this rally , staying in cash ,earning in most cases less than 1% a year. Its so confusing now. At the moment it seems cash accounts are risky with talk of negative interest rates and bail ins .The optimists and some cynics are even predicting the best gains of this rally are yet to come.

- Franksays:

June 22, 2019

Every one thinks the fed controls interest rates. They don’t. They just follow what is going on with interest rates. Just look at a chart of fed rates and interest rates. Furthermore, the fed, Washington and Wall Street lie about inflation. Inflation is not 2%. I don’t know exactly what it is but say 4 or 5%. If that was the case then interest rates would have to be at least 5 or 6% but the Deep State wouldn’t allow that. This last time for the first time I’ve ever seen it, according to the “inflation experts” in Washington they included “used car prices” in the inflation rate. In the past when did that ever happen? Can’t trust Washington, Wall Street, and especially the fed.

- jack kimura says:

June 24, 2019

Is there a way to protect one self in this volatile market and still take advantage of the so call Melt Up?