Wall Street Disaster

Below, we look at the notion of heroes and anti-heroes in a market overly awash with one too many of the following profiles: Woodrow Wilson, FDR, Richard Nixon, Alan Greenspan (et al), Leo Melamed, John Meriwether, Elon Musk, Fannie Mae and, of course: Larry Summers… We Also examine our modern Wall Street disaster in the making.

Philosophy

Infinite mystery surrounds. Countless untold stories pass us in airports, city streets or country barns.

Occasionally, by effort, chance or just coincidence, our lives can overlap with those who embody hints of greatness, even the heroic.

But what does it mean to “great” or “heroic” in a world that has often overused these terms? And by extension, what does it really mean to be “successful”?

These are personal matters, to be sure. My own definition of “success,” for example, has almost nothing to do with the economic attribution most commonly given to this elusive noun.

Aristotle, for his part, felt that success included aspects of the heroic, and by that he suggested that one was “successful” who made it a priority to serve something bigger than one’s self, to take heroic, even unpopular risks for the sake of a broader ideal rather than just private interest or vanity.

Let’s keep this definition handy, for it will be useful as we apply it to our modern era of what the Poet, Robert Bly, described as “a celebrity mad population of idiots…”

Success, in any culture or language, can mean many things to many people. Nevertheless, today the notion of success has too often been reduced to some ideal of material wealth and/or public recognition.

Aristotle, of course, would find this a poor definition of success. It’s fairly banal, or as Chamfort wrote, the majority chase after the false gods of fortune or renown like donkeys fighting for scraps of hay.

Between Wall Street and Los Angeles, I’ve frequently discovered that those who make attention or dollars a calling are often disenchanted with the results. In short, the trophy falls far short of an Aristotelian ideal…

But this is not a philosophical blog…

Instead, let me endeavor to place Aristotle’s classic notion of success within the modern context of our capital markets and seek, by contrast, to illustrate examples of the hero and anti-hero in the odd backdrop otherwise known as our “economy.”

But First, a Little History…

My grandfather was a pilot in the second great war. Never, not even once, did he speak of aerial combat. I do vaguely recall, however, as a boy, hearing him say that the worst part of those years was playing cards and smoking with friends one night, only to see their personal belongings packed away in footlocker by the next.

The life expectancy for US pilots at that period of 1943 was 18 weeks.

As for pilots, I knew others of that generation who flew (on both sides) in the Battle of Britain. They’ve long since passed away, but are worth a few sentences and contrasts here.

During the attempted German invasion of Great Britain in 1940, cadres of heroic men between the ages of 18-40 faced off against a far better trained, manned and equipped Luftwaffe to defend their fragile island from the unthinkable.

By the end of this great air battle, hundreds of RAF pilots had perished, but England remained free. As Winston Churchill famously remarked when referring to these truly heroic pilots:

“Never in the field of human conflict was so much owed by so many to so few.”

Recently, along the shores of Gallipoli, I saw similar words, and examples of extraordinary men rightfully honored on the shores of another great battle of another world war.

Today, sadly, a different class of individuals get the most attention—and not for the right reasons.

There are, of course, countless and noble exceptions, yet when I think generally of my own field of Wall Street dragon-slayers and our supportive DC lapdogs at the Fed, Hill or Whitehouse…, I feel less generous…

That is, when I consider the long, DC/Wall Street history of serving self-interest at the expense of candor, sacrifice or something larger than the self, the best line I can come up with largely boils down to this:

“Never in the field of human greed was so little owed by so many, to so few.”

And to make this point sink in, let’s re-enter the stage of capital markets and Capitol Hill for a study in the anti-hero…

Today’s Mis-Understanding of “Successful” – Markets and Politics

Long before Gordon Gecko or The House of Cards made it to the big screen or Netflix, the mythical stock markets and the political high ground of DC offered a wide range of settings and roles to achieve near instant acclaim and “success.”

What, after all, can usher faster respect today than to be a sitting President, Fed Governor, Cabinet member, hedge fund manager, Tech whiz kid or Wall Street elite?

Sitcoms, headlines and feature films glorify (directly or indirectly) such positions, even taking a perverse delight in the “bad-boy” courage of those who climb to the top in these iconic professions.

But as I noted in my long, four-part series on Market History, so many of these “heroes” are anything but, well: heroic.

Instead, we often see in both Wall Street and Washington the same philosophical (that is “human, all-too-human”) weaknesses of ego, self-interest and materialism trumping the values of truth, self-sacrifice and any concept of a greater good.

Wilson

Take Woodrow Wilson. Unlike Thomas Jefferson, who would have fought to the death to prevent a private central bank from taking over our economy, Wilson let a private bank raid our nation’s economic destiny in exchange for his own political self-interest.

Pressured by banking bullies, he surrendered to a powerful cartel rather than stand by his principals or his nation, describing the day he signed the Federal Reserve into law as the darkest day not only of his life, but in the history of this country.

Now what kind of hero would make such a sacrifice of principal? What kind of man would deny the best path for an entire country in order to please a handful of NY bankers and ensure his political future?

As Andrew Jackson described the very notion of such a private central bank as the “prostitution of our government for the advancement of the few at the expense of the many.”

Wilson, I feel, was precisely such a prostitute, but as we shall see, one among a long list of otherwise “successful” anti-heroes…

And if you think the Federal Reserve is anything but the cesspool that Jackson warned of, just read here, here or here… In short: see for yourself.

FDR

Long hailed as the President who brought the US out of the Great Depression, the truth of the matter is that FDR’s “New Deal” did not rescue America from the arrogant Crash of 1929…

Nor was it a local bank run that caused the markets to tank in 1929; rather it was the low-interest rate policy and debt orgy of the prior and roaring 20’s that caused markets to grow too hot—a theme repeated to this day in market bust, after market bust… from 1929 to 1987, 2000 to 2008 and very soon to the next—and greatest– crash to ever hit our country.

FDR, I’d argue, helped turn Washington into a Ponzi scheme — that is, a fake “producer” that solves losing old money by stealing or borrowing new money. Today, that means America solves old debt problems, by well…taking on more debt.

When you run a country or central bank rather than a Ponzi scheme, this is historically and legally achieved by: a) taking your currency off any collateralized controls (i.e. a gold standard) b) keeping interest rates low and c) printing money when you don’t have enough on hand (if Madoff had a printer, he certainly would have used it).

In 1933, FDR essentially took “the Madoff approach.” First, he confiscated gold in the US and then embraced the Thomas Amendment, which in the stroke of a pen devalued the gold content of the dollar and betrayed global market participants who relied on a currency standard.

By removing the dollar from the gold exchange, FDR, like other unwise actors to come, focused on manipulating the US currency rather than addressing US productivity—the veritable “P” in GDP.

Like so many politicians since, his was a shortsighted and self-serving decision with long-term consequences. FDR’s knee-jerk macro policies interfered with the hard but informative lesson of free markets, namely: deep recession always follows deep debt. There’s just no such thing as a free ride…

Policy makers, however, like to sell free-rides to get or stay elected. That’s not heroic—it’s ego, the placement of the self above the many.

Greater individuals, such as Eisenhower, through restraint, short-term discomfort (even unpopularity) and a long-term rebuilding of a dollar standard, national balance sheet, open trade, and industrial productivity, were far more heroic.

Nixon

But self-interest ala Wilson or FDR may have found one of its most infamous examples in Tricky Dick Nixon.

Free markets demand periods of heroic qualities, such as restraint and humility so that lessons can be learned from the hangovers of too much debt and diluted currencies.

Yet somehow in the drunken course of events since the days of Adam Smith, policy makers, Presidents, hedge fund managers, Fed chairs, Wall Street elites, and Main Street dreamers seem unwilling to exercise these two key components of heroic market courage.

And when it comes to lacking restraint and humility, Richard Nixon is an easy target.

In 1971, Nixon was staring down the barrel of an economy on the brink of bad news. The gold standard, revived by the restraint and humility of the Post World War II Bretton Woods Accord, meant the dollar was once again tied to a restraining asset upon which global markets and trade partners relied.

Nixon didn’t like this. Such short-term restraint may have been good for the long-term growth of America and global markets, but it could cost him his seat in the Oval Office.

Thus, Tricky Dick was in a pickle. Other nations trusted our gold-backed currency and were thus buying lots of gold-exchangeable dollars. Unfortunately, the US gold reserves were woefully low compared to the number of dollars in circulation.

In order to honestly and successfully rectify this imbalance, a heroic leader would have had to initiate a painful yet necessary recalibration of gold to the dollar, which would have meant short-term pain at home, and hence election-time risk for him.

But Nixon was no hero…

Given the choice between doing the right thing for his country or doing the wrong thing to keep him elected, he, alas, did what almost all elected officials do, namely: what was best for him.

In a move similar to FDR in the 30’s, he jettisoned the Bretton Woods gold exchange standard and thus once again welched on US dollar holders and currency-honest trade partners overseas.

With the currency untied to any standards, reigns or “chaperones,” Nixon was thus free to once again devalue the dollar and lower rates to encourage short-term economic activity (i.e. debt) to boost his pre-Watergate election chances.

He won by a landslide.

This “stimulus” mentality (repeated to this day by current policy makers—which is why Trump is so furious at Powell for not keeping the low rate debt orgy going) was tantamount to doping the economy for a quick fix (and political popularity) at the expense of inevitable inflation (remember the late 70’s?).

Nixon’s policies once again strengthened the template for a now trend-setting perversion of the role of central banking via a familiar pattern of: 1) removing the dollar from a gold standard, 2) lowering rates to encourage short-term speculation which 3) ends in unnaturally large market bubbles and corrections.

Look familiar?

Nixon’s 1971 decisions also set the stage for a global perversion of currency exchanges, which haunt markets to this day.

By removing gold from the global currency models, we now face the problem attendant to all floating currencies, namely the fact that free markets no longer set exchange rates, national policy makers do, and they do so selfishly—not heroically.

The US is a poster-child of such economic self-preservation, meaning it is able to export and monetize its deficits and inflation like an economic STD to the rest of the world (i.e. other nations are forced to import our inflated/devalued dollars) and thus spread and encourage reactive inflationary policies overseas.

US bubble policies (which keep anti-heroes popular, and thus in office) have therefore spawned global bubble policies.

Today, international “my-nation-first” currency markets are the scene of state sponsored manipulations where central banks (from the ECB, to the Bank of Japan and the Chinese star chamber) can buy their own sovereign debt pegged to thin air rather than an actual asset (i.e. gold) as part of ongoing global debt bubbles and trade battles to beggar-thy-neighbor via currency wars.

The Fed—A Building of Anti-Heroes

But let’s leave out easy targets like Presidents and look at even more dangerous folks like bankers…

The Greenspan Monster

Black Monday, October 19, 1987. In even that pre-CDS and CDO uber-leverage world, markets in the late 80’s once again reminded us that any significant degree of easy credit and leverage (by then computerized) leads to equal amounts of greed and then pain, which can come, seemingly, out of nowhere.

The spark which set off the crash of 87 was the ironic fear/rumor that the new Fed Sheriff in town (Alan Greenspan) might put an end to the Wall Street binge party by raising rates in a “Volker-like” scenario.

And so, in a single day, the stock index dropped 23%–double the 13% declines on the worst day of the 29 Crash.

But even more astounding than this Black Monday was the Lazarus-like resurrection of the market recovery on the Tuesday to follow. By 12:30 PM the next day, the market saw massive buy orders which, in a miraculous swoop, stopped the panic.

The Greenspan Fed was clearly no “Volker 2” and came to the rescue of wayward markets and over-levered and over-greedy Wall Street.

Rather than punish Wall Street for such behavior (i.e. over-leverage), Greenspan tossed his hitherto (and PhD confirmed) reputation for being tough on wayward markets (i.e. by not rewarding bad behavior with low rates) and literally got in bed with Wall Street.

Unlike Paul Volker or Bill Martin—true Fed “heroes,” Greenspan sold his soul (and economic views) to Wall Street, a precedent-setting move followed lock-step by Bernanke and Yellen…

That is, rather than allow painful corrections (i.e. natural market hangover) to teach investors a lesson about derivatives, leverage and other mines dotting the S&P futures pits (which dropped by 29% in a single day) and larger markets, the Fed comes in with buckets of cheap money and thus destroys any chance for the cleansing, tough-love of naturally correcting markets.

This, once again, created the moral hazard of letting Wall Street behave like the spoiled nephews of a rich uncle: spending with impunity until the next crisis, as there’s always Uncle Fed to bail you out—at least until that uncle is himself insolvent (which, ironically, and unknown to most, is where we are heading, Titanic-Like, today…)

Modern Wall Street—Almost Nothing but Anti-Heroes

Self-seeking, career-preserving policy makers who create environments where the dollar is unrestrained, credit is easy and regulation is lax (or favors “creativity”) stay popular and keep their jobs.

They also set a stage where clever market players are free to scheme their ways into ever-increasing bubbles.

The Exchange Pits and the Derivatives Cancer

This creates a cancer to form in every asset class, including within the once humble mercantile exchange.

It was in this former cob-web-modest Chicago-based exchange where the wrongly acclaimed ant-hero, Leo Melamed, applied the notion of using futures contracts (originally and modestly created to help farmers and suppliers adjust for price volatility) to global currencies, a greedy idea which could only have been spawned in the unfettered currency environment created by Nixon’s folly in 71.

Shortly thereafter, Melamed, having conferred with well-paid “advisors” like Greenspan and other easy-money, self-interested minds (including Milton Friedman), got the green light to open currencies to an entirely new level of speculative alchemy.

Four decades later, the volume of currency (and risk) traded in 1 hour today on the commodities exchange exceeds the annual volume of funds traded on the original MERC.

Now, like all post-71 markets, the exchange pits have morphed into a casino with an astonishing 50,000X growth based on derivatives, leverage and hi-tech software trades that set up 100:1 ratios of hedging volume to the underlying activity rate.

These “modern derivatives” are nothing more than levered and cancerous hot potatoes whose degree of risk and tranched confusion are so far from the plow of any actual value that when a liquidity crisis comes again, this very tall house of cards will fall like the others.

In short, this is not our grandfather’s MERC…

By introducing derivatives, traders (aided later by other falsely acclaimed “geniuses” like Larry Summers) learned to use 20:1 leverage on T-Bill Futures, which soon went to wheat futures.

Because the Fed’s open market desk was transparently taking the volatility out of the Treasury trade, this was easy money at easy leverage for exchange traders. Yet like all easy money schemes, the party stops at some point, as it did in 87.

In a single day, free market forces stepped in and crushed these guys, as they deserved.

The Fed’s reaction? Simple, bail out the bad guys. Not very, well…Heroic.

Greenspan, rather than assume responsibility or learn lessons from “derivatives” speculation and the leveraged time bombs it unleashed upon the Chicago Merc and the S&P futures between 1971 and 1987, simply blamed the crash on “animal spirits.”

In doing so, the central bank conveniently overlooked the fact that “animal spirits” are not a cause of market DUI’s, but a result of his FED moonshine (i.e. low rates) supplied by deliberate and transparent policies of easy money aimed at boosting Wall Street, not Main Street.

Enter the Hedge Fund Anti-Hero: Long Term Capital Management

In yet another example of the non-heroic, we see the 1998 collapse of LTCM—aka Long Term Capital Management—a hedge fund leveraging over $125B (yes, $125B) at the height of its drunken splendor.

This Greenwich, CT-based creation of the not-so-heroic John Meriwether ,with a staff of the best and brightest Wall Street algorithm writers and Nobel Laureate advisors stands out as telling reminder of three repeated observations regarding Wall Street: 1) the smart guys really aren’t that smart, 2) wherever there is exaggerated leverage, a day of reckoning awaits, and 3) the Fed once again comes to the aid of Wall Street when its misbehaving “elites” gets caught in yet another market DUI—that is trading under the influence of easy credit and hence easy leverage.

In 1998, when the Russian default sent the S&P down 12%, this was an acceptable pullback rather than grounds for a “Fed-to-the-rescue” panic.

LTCM, whose risk models had no formula for the complexity of black-swans (i.e. “$#!T Happens”), got caught with its hands in the leverage cookie jar and deservedly lost all its fingers. The fund tanked under the weight of its own vain stupidity.

Nevertheless, the Fed, fearing that the loss of one bad mega-hedge fund was too much for natural markets to handle, intervened and did what its spoiled nephews on Wall Street had grown to expect: they cut the Fed Funds rate and bailed out Wall Street.

Of course, the pattern (and lesson) after LTCM was not headed, it simply continued…

Enter the Dot.Com Anti-Heroes…

Just as the smoke was rising from the Connecticut rubble of LTCM, another classic asset bubble misconstrued as free-market prosperity was playing itself out in the form of a dot.com hysteria.

I remember it well, as I started my first fund during this crazy period of excess and over-valuation. Even at age 28, my grossly over-paid common sense knew the dot.com NASDAQ was a bubble not a market…

The Fed, as always, misrepresented these rising stock prices as proof of a rising economy, when in fact, the dot.com mania was just a protracted spring break of traders gone wild that ended with a memorable hangover and market nosedive.

Even I knew that a NASDAQ trading at 100X earnings at its March 2000 peak was warning enough that the party was nearing an end.

And it was. By April of 2000, a tech bubble inflated by the easy money which flows from DC policies serving Wall Street salaries via grotesque private credit expansion did what bubbles do best: it popped.

In retrospect, the dot.com implosion seems obvious. But even at the time it was happening, that market (precisely like today’s) felt, well: unreal. Consider Dell Inc. It started at $0.05 per share and grew to $54.00/share (a 1,100X multiple) only to slide back to 10.00/share.

Does that smack of efficient market pricing? (There are numerous examples of other roller-coaster mis-pricings of that era, from Cisco, Juniper, Nortel, Yahoo and Lucent to Global Crossing and Commerce One.)

I’ve written elsewhere how those days and stocks remind me a helluva lot about today’s TESLA, AMZN, Netflix, Facebook and other Tech Stock comedies…

(Btw: when it comes to modern anti-heroes, Elon Musk deserves his own blog…)

The pattern is fairly clear. Easy Fed leverage (low-rate credit policies) and peak valuations are harbingers of bubble creation and bubble implosion.

The dot.com champagne party of the 1990’s, like its predecessor in the dapper 1920’s, ended in ruins, with the S&P down 45% and the wild-child NASDAQ off 80% by 2003.

Today’s tech, stock and bond bubble, by the way, will be no different in its eventual fall from grace…

As for the FED and its Wall Street minions, have they learned anything about restraint, humility, or long-term solutions through the honesty of short-term sacrifice and even the personal and professional risk of pointing out dangers rather than cow-towing to a salary or “successful” position?

Nope. No heroes there…

Instead, in the rubble of the dot.com bubble, the market-enamored policy makers at the Fed began the greatest rate reduction yet seen, resulting in a wide-open spigot for more easy credit, leverage and hence debt-induced market deformations.

That is, they solved one bubble crisis by creating a new bubble.

In the wake of the dot.com collapse of 2001, the subsequent sub-prime storm of 08 was not the only consequence of the Greenspan rate reduction and the “hot money” that followed.

A wide and embarrassing swath of wasteful M&A, stock-by-backs and LBO deals took place (just like we are seeing now, along with the PE strip mining of the retail sector).

This new “hot money” was expressed in: 1) aggressive stock buy-backs (i.e. Cisco, Exxon, Microsoft, Hewlett Packard), 2) M&A mania (Time/AOL, JDS Uniphase/SDL, or the numerous companies WorldCom devoured), and 3) grossly mispriced LBO’s (Clear Channel, Alltel, Hilton Hotels).

Look familiar?

Highlights of this low point in “American deal making” include GE’s dive from $50 to $10 share prices. Net result? Did GE’s Mr. Jeffrey Immelt take his lumps courageously? Did the company learn the necessary lessons of reckless speculation in the fall from its 40X valuation peaks?

No. Instead, GE’s CEO took a bailout… But hey, he’s still a great “success,” no?

Additional examples of executive profiles without courage were plentiful in that pre-08 era of reckless borrowing and spending. The boards and CEO’s of countless unprofitable LBO’s shared over $300B in a carried interest jackpot while their publically traded balance sheets stayed permanently red.

This was also an intoxicated and unproductive era that ended (2008) in staggering write-downs on massively overvalued operations that, like Tesla, were not close to profitable (but for their executive salaries).

More Real Estate “Hero’s.”

No history of irrational bubbles or over-paid “anti-heroes” would be complete without a salute to the real estate markets of 2004-2006.

And the first name that comes to most minds is Fannie Mae, a GSE (“Government Sponsored Entity”) who, along with its cousins Freddie and Ginnie, grew astronomically in the 40 years following their accidental births in FDR’s New Deal era.

Indeed, the notorious exuberance and balance sheet ballooning of these operations is now the stuff of legend as a towering example of easy DC money prompting bad, very anti-heroic behavior—and, as always, with national consequences.

Heading toward the crash in 08, these “governmental entities” had completely lost their way and were acting like hedge funds with mortgage pools levered at 200:1.

In an era of egregious underwriting standards and fast money, these alleged real estate caretakers became dispensers of poison, indirectly setting the stage for increasingly bad practices, including the growth of predatory, boiler room mortgage brokers selling non–recourse loans to unqualified buyers whose paper was then consolidated, packaged, tranched and syndicated to the world as AAA securities.

Of course these packaged assets were just “pigs in lipstick” whose facade of value pushed the Case-Shiller Index up 60% by 2001, and then to a staggering 195% by the housing markets’ 2006 peak.

Such unprecedented “growth” should have been an obvious sign of trouble, as it had nothing to do with intrinsic value but everything to do with easy credit.

Unfortunately, the real estate market then, like today’s real estate market, were too shortsighted to take their eyes off the immediate prize/profits and consider the longer-term risks ahead for the nation.

In this bonfire of greed and self-interest, the stock and option values of Freddie and Fannie skyrocketed. Like dot.com executives, these horrific GSE managers focused less on national interests and more on the need to keep earnings growing to justify market prices and annual bonuses.

This meant they had to continually dig deeper into the pigpen of poor credit borrowers to churn and generate more toxic yet tradable loans, 80% of which were to be re-syndicated into the growing real estate and sub-prime Wall Street disaster bubble. (The Chinese, by the way, bought over $1T of this GSE toilet paper).

Needless to say, the GSE’s, like most of the LBO, PE and M&A deals of the same era (above), were not real businesses contributing any actual value to the US economy. (As their stock prices roared, US GDP by 2006 was at its worst since the 1930’s).

In short, anti-heroes were swarming all over DC and spreading their cancerous consequences across the nation.

The net result of this Fed-created, low-rate, easy-money, rogue financing (from bank “wirehouse lines”) was, alas, a massive housing bubble, followed by an equally massive “pop” and economic collapse.

Stated otherwise, a small cadre of greedy GSE executives helped bring an entire nation into a recession.

As for 2008, all of us remember it well. By the year’s close, $5 trillion of stock value had disappeared…

By 2008, the Fed supported markets had also invented even more complex and pernicious tools of leverage and speculation –namely an unregulated derivatives market, which gives entirely new meaning to the expression “form over substance” as veritable leverage monsters which Warren Buffet aptly described as “weapons of mass destruction.”

Today, the notional value of these derivative instruments exceeds 9X global GDP. That number alone is simply astounding. Staggering. It is the off-balance-sheet Ebola market virus no one wishes to discuss or consider. The implications of such leverage cannot be stressed enough, and yet 9 out of 10 market professionals aren’t even aware of the statistic or able to explain what it means.

Larry Summers

But if there’s one supreme anti-hero who takes the first prize for self-interest over national interest, it would have to by my former University President, Larry Summers, the veritable dispenser of the derivatives cancer…

It bothers me, for example, that the same personalities who got us into the 08 mess are the ones the markets are looking to for leadership today. Even Larry Summers is seen as a kind of Oracle, despite having sold his soul to a market devil long ago.

Yet the world of pundits and market cheerleaders continue to headline bow-tied economists and men with academic credentials to make the world seem normal. As a result, well—positioned frauds like Larry Summers still get a lot of applause-and the moniker of “success”.

Yet praising Larry Summers as a “success” would be as odd to me as praising Lance Armstrong for his contributions to drug-free cycling. The ironies just abound.

Larry Summers. He was the president of Harvard. He worked for Clinton; served as a Treasury Secretary. He makes lots of opinionated (and well paid) speaking appearances.

The banks love him. He has been a handsomely rewarded consultant for Citigroup, did equal “work” $$ for the Nasdaq, D.E. Shaw, Andreessen Horowitz and Alliance Partners. I’ve sat with him at more than one paid-for event.

But let’s not let credentials get in the way of facts. As La Rouchefoucauld noted centuries ago, the highest offices are not always—or even often–held by the highest minds.

Opinions of course differ, but it’s hard not to list Larry Summers among the key architects behind the 2008 financial debacle. Where Larry Summers Went Wrong.

Most veterans of recent market cycles pre and post 08, concede that OTC derivatives were the heart of the 2008 darkness.

These tranches of questionable (and largely misunderstood) asset backed collateral were passed about the prop desks from Goldman to Bear Stearns to Joe-trader like hot potatoes until eventually we discovered this wasn’t manna, but manure; thereafter: everyone’s hands were collectively burned…

The sordid history of CDO-driven pain is admittedly easy to critique in the 20/20 clarity of hindsight. Michael Lewis and many others have made the WMD of 08 seem so obvious.

In fairness to poor Mr. Summers, perhaps he meant well, perhaps there really was no way to know the dangers of those elusive derivatives and the collateral beneath (often very, very far beneath) their layers of levered tranches. And perhaps there is no way to know what lies ahead of us today.

But then again, perhaps Mr. Summers was just unable to see what other smarter people did see, though Larry, it has been argued, can’t imagine anyone smarter than him.

In fact, at Harvard (where Summers ignored repeated warnings by its expert endowment staff and thus lost the university $2 Billion in funds, half of which were toxic interest rate swaps he helped mid-wife in the 90’s), Summers created another scandal as its President when observing that women students weren’t as mathematically gifted as male students.

Ironically, however, one woman in particular—Brooksley Born, then head of the CFTC–was a bit smarter than ol’ Larry when it came to the math of derivatives.

More importantly, she had a ton of common sense, and to her, those derivatives sure looked pornographic… She wanted to clean up the market smut.

But in 1998, then Deputy Treasury Secretary Larry Summers (such a “successful” title) telephoned her desk and openly bullied her: “I have 13 bankers in my office,” he shouted, “who tell me you’re going to cause the worst financial crisis since World War II” if she continued moving forward in bringing much needed transparency and reporting requirements to the OTC market.

Larry then went on to attack Born publicly, condescendingly assuring Congress that her concerns about the potential unwieldiness of these instruments were essentially silly, as “the parties to these kind of contracts are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counter-party insolvencies.”

In other words, the “heroic” and extremely well-paid elites knew what they were doing—common sense be damned.

But fast-forward less than a decade later (and an OTC derivatives market which Summers helped take from $95 Trillion to $670 Trillion), and we all learned how those “eminently capable” and “largely sophisticate financial institutions” (Bear, Lehman, Goldman, AIG et al…) did in fact create the worst financial crisis since World War II.

It’s just too bad our equally “successful” and elite Congress listened to the elite Summers rather than a far more heroic Born, even if her mathematical mind, according to Summer’s understanding of gender, wasn’t as strong as her male bully at the Treasury…

In addition to helping de-regulate the most toxic instruments to hit Wall Street since its inception, Larry Summers was a critical figure to the WTO agreement.

This agreement, negotiated behind closed doors, effectively lead to the repeal of Glass-Steagall, the 1933 law which tried to keep commercial banks from becoming hedge funds—the very banks whose derivatives desks blew the markets to shreds in 08 before TARP (i.e. you and me) bailed those anti-heroes out.

Yet prior to the implosion he helped create, Mr. Summers described this agreement as “historic legislation [which] will better enable American companies to compete in the new economy.” Thanks for that new economy Mr. Summers.

In fact, so little that Larry Summers has touched and/or pontificated upon has done any good at all (including the 2000 Commodities Modernization Act which created the “Enron loophole” for his friend, and criminal, Ken Lay), that it makes me wince whenever our gushing press seeks his guidance for the “new economy.”

And you? Do you still think Summers and his ilk are “heroic”? Successful?

It’s worth remembering that neither Greenspan in 01 or Bernanke in 08 ever saw the market crashes coming. Of course, neither did any of the “heroes” running the private banks or the US Treasury. So much for “successful” posts.

As for me, I’m still looking for one of those “heroes” to talk straight—and more importantly, take a little responsibility rather than just another high-paying book advance.

Back to Philosophy

A man, we all know, is many things. Most would agree that we are philosophically, economically, morally and historically designed to screw up—over and over again.

Mistakes—and the lessons derived from them–are how we mature, develop and improve in all walks of life, personal to professional, political to paternal. In short: we all screw up. We are wonderfully, perfectly fallible.

What is less forgivable is not a lack of perfection, but rather a lack of accountability, even humility. A lack of courage, in short, to do what is right for a greater number than just one’s self.

Obviously, we can’t all be the young RAF pilots or Australian volunteers I alluded to at the very beginning of this long piece. But being a hero or a success does not require such dramatic backdrops as The Battle of Britain or Gallipoli.

Sometimes, just being honest and self-sacrificing is enough. The anti-heroes touched upon above and the countless other Wall Street disaster “supermen” (whose executive to worker salary ratios are at 333:1) do not represent anything close to serving a cause greater than their income or position.

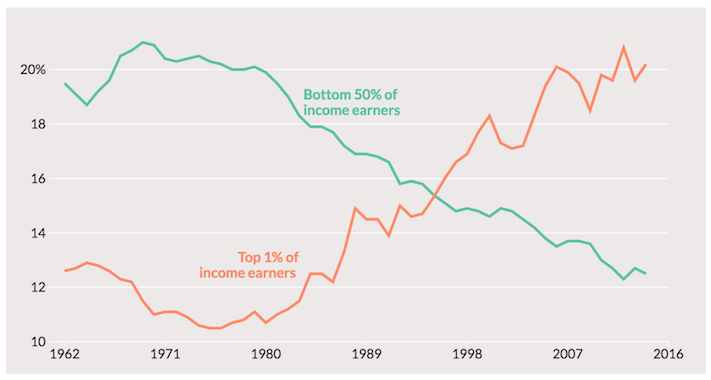

Anti-heroes like these are the reason a select few are succeeding while the great majority are suffering. In sum, these anti-heroes help explain graphs like this:

We Need More Candor—Less Anti-Heroes

We stand today at the edge of a market cliff built upon unprecedented levels of post-08 debt and money supply expansion. The current deficit stands at $21 Trillion (more than doubling its 2008 levels); money supply was up 500% (representing more money creation in the last decade than in the previous century combined).

This “binge,” of course, has been seen before, only now it’s just much bigger. It has also falsely presented to the masses as an economic “recovery.” Nope. It’s just a securities bubble. Don’t believe me? Ask our dying Middle Class.

Such data demonstrates that nothing has changed (or was learned from) in nearly a century of market manipulations save for the scope and type of the bubbles created, and hence the scope and type of corrections to follow.

Today we are the inheritors of the sins of such anti-heroes. As such, we owe it to ourselves and our nation to look beyond their false “success” and dig dipper into facts and common sense.

If easy money leads to market bubbles, bad investing and market crashes, then we all can see what’s coming.

Since 2008, money has never been easier, investing has never been “badder” and bubbles have never been bigger.

Every blog penned in our media section is dedicated to making these truths more obvious.

Get and stay informed.

And as always, be careful out there.