Bulls or bears? One can actually be the latter yet invest like the former.

16 shares

I’ve given you plenty of evidence already of the fundamentally broken, distorted and dishonest nature of the U.S. markets as well as the media spin and Fed “tricks” that support them.

But at Signals Matter, we also know these tricks and distortions can send otherwise broken markets higher before they eventually tank.

Meaning profit opportunities for you.

If the Fed, for example, is crazy enough to keep low-rate debt bubbles and stock markets going, as per the “Powell-Pivot” in March, we may scratch our heads, but we don’t fight the Fed’s decision.

Instead, we capitalize on the opportunity and trade the “crazy” until our signals tell us otherwise.

That’s how, bulls or bears, we can trade like bulls despite thinking like bears.

This fidelity to signals and profits applies not only to the otherwise insanely over-valued stock and bond markets, but to commodities as well.

At Signals Matter, we invest based upon on what’s happening today, not what others are arguing about tomorrow, bulls or bears.

Take the following example from the infamously capricious oil market.

Beat the Oil Optimists to the Punch

On January 4, 2019, the signals we’re tracking clearly said to buy the energy complex.

Bullish bets were increasing as production cuts by OPEC and other top exporters were impacting.

Plus, we expected computer-driven short covering by those still short in what was quickly becoming a net-long market, providing an opportunist entry across drillers, producers, and service providers.

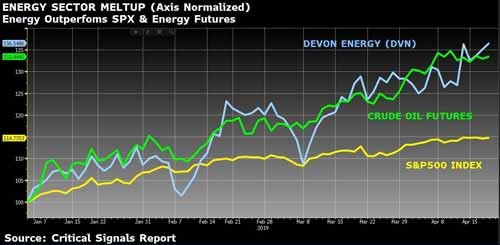

Here’s how the trade worked out in the 109 days from January 4 through April 18 …

For the Energy Select Sector SPDR ETF (XLE), it went up 15% and up 48% annualized.

Then for five highlighted stocks: APA, DVN, NOV, NBL, FTI, they were on an average up 26% and up 87% annualized.

Now for those over three months, here was the best trade. For Devon Energy (DVN), it went up 41% and up 137% annualized.

Then finally, if you take a look at the call option for DVN April 18 $31, it was up 373% and overall up 1,310% annualized.

Any way you slice it, energy typifies the “melt up” trade.

Heck, the stocks did just as well as the futures with a whole lot less risk.

And the options being up 1,310% annualized is unbelievable thanks to the signals showing to buy at $0.56 and sold at $2.65

That is a powerful melt up.

And regardless of being labeled bulls or bears, we anticipate much more of this “melting up” in the stock markets as well, despite their inevitable collapse thereafter.

Like the stern of the Titanic rising high above the water before sinking to the bottom of the Atlantic, markets rise dramatically before tanking.

At Signals Matter, we help you on the way up and get you safe before the markets sink, and then make you a fortune on the way down.

Stay tuned for more on how Signals Matter makes money in all market conditions.

In the interim, be careful out there.

Comments

2 responses to “Think Like a Bear, Trade Like a Bull”

- Ric Wilsonsays:

May 1, 2019 at 10:48 PM

Thank you for straight forward no bs information. I agree with your forecast for a big jump up and then a devastating drop just in time for gold/silver miners. Looking forward to the ride.

- Bruce Cohoonsays:

May 1, 2019 at 11:07 PM

I think your analysis is timely and

“spot-on”. I can only hope you get out before the inevitable