Below, we look at bonds…

The Traditional 60/40 Portfolio

The traditional 60/40 stock/bond portfolio has been getting a lot of press heading into year end, as in Bloomberg’s chart below.

But the headline, “A 60-40 portfolio has performed almost as well as an all-stock portfolio,” is deceiving.

Bloomberg plotted stocks against a 60/40 blend of stocks and bonds, therefore stocks against mostly stocks.

That’s a whole lot less helpful than dissecting stocks against bonds for 2020 YTD, so let’s separate the two to see what’s really going on this year-to-date.

Pure Stocks vs. Pure Bonds

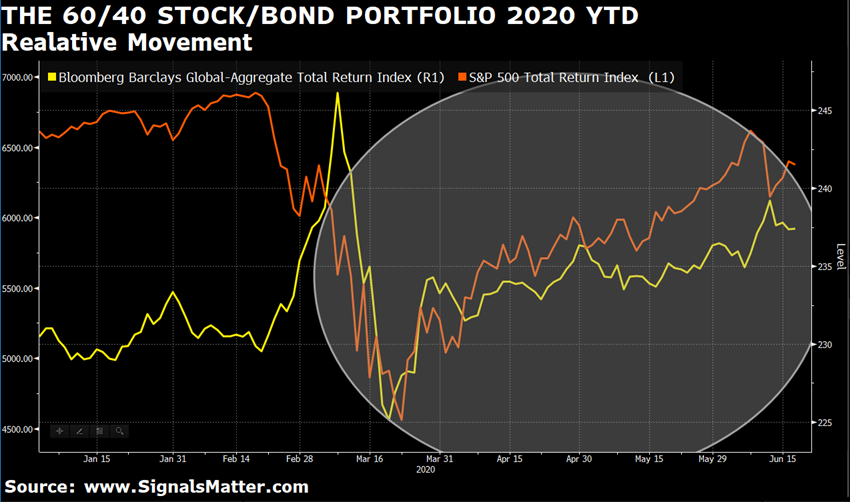

Below we plot pure stocks against pure bonds, the two-components of the 60/40 Portfolio.

We used the Bloomberg Global-Aggregate Index as a standard proxy for bonds and the S&P 500 Total Return Index for stocks.

That big grey circle tells the tale. It circles the periods during which bonds and stocks moved together.

Ah ha!

Note that bonds DID tumble along with stocks once the stock downturn accelerated in earnest, and the fire sale accelerated.

That’s troublesome and certainly not protective. What’s more, the two asset classes remained correlated for the entire period thereafter.

Normalizing Charts

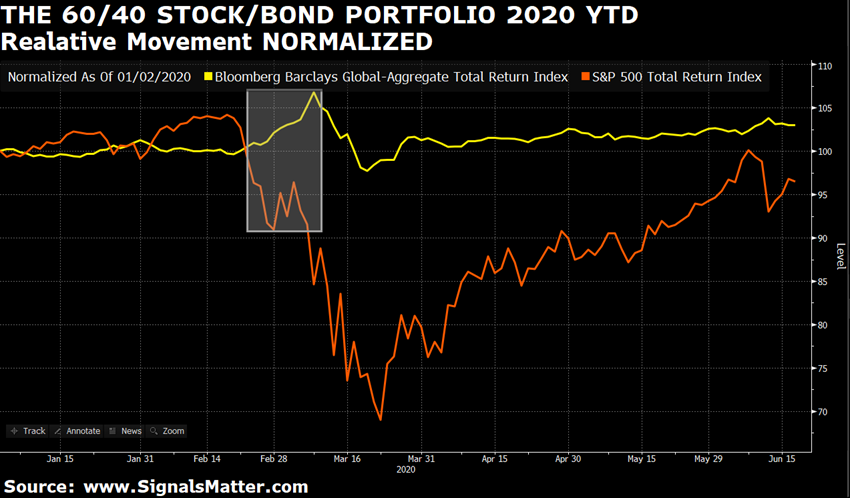

Let’s “normalize” this second chart to give us a better view.

Normalizing charts is a handy tool. Normalization adjusts the values measured on different scales to a notionally common scale for comparison purposes.

Our third chart below normalizes the chart above, a fairer approach, because bond prices just don’t move that much compared to stock prices with interest rates this low (e.g., they don’t provide the relief sought as counterweight to falling stocks).

That grey rectangle in the chart highlights the period in which bonds and stocks were uncorrelated—i.e. didn’t travel in the same direction. In short, one “zigs” while the other “zags,” which is what is intended in stock and bond portfolios.

But once you cut through the fog, the truth is pretty shabby, really, for that sought-after non-correlation didn’t last all that long, once that “Uh-Oh moment” occurred.

Note how bonds fell precipitously with stocks halfway through the downturn, recovered some, and then just flatlined thereafter.

So much for “diversified protection” when it counts.

How helpful is that for so-called “risk management” and bonds as a “safe haven,” as traditional advisors so often promise?

So, what’s really going on?

Interest Rates

The issue here is interest rates. Interest rates are so low, hovering near zero, that a few basis points on interest rates don’t move bonds much or account for much when it comes to providing hedge protection.

Even if you’re a 60/40 advocate, we know that past performance is no indicator of future results, especially in the current environment of artificially-repressed interest rates set near zero (and held there for far too long).

Looking Ahead

Looking ahead, expect change.

Those bonds in the 60/40 stock/bond portfolio did not help much last March and can be expected to help less going forward, as faith in bonds wanes with interest rates rising.

Such 60/40 portfolios are, in fact, a potential timebomb, ready to blow when we get through this pandemic, with an inflation-friendly Fed at the helm.

Inflation permissions higher interest rates. Higher interest rates take bonds down, and stocks too, as we exhaustively describe in our FREE Investment Primer.

Now would be a very good time to download and parse through our recently updated Investment Primer for 2020.

No More Bonds?

Peaking ahead into 2021, bonds are out.

What to do?

There is so much to do! So many other securities to invest in when the time is right, which we share with our Subscribers each and every day as Portfolio Suggestions with a constantly-rotating, educational portfolio.

Interesting?

Here are 3-easy steps.

- First, take a careful look at what we do for our subscribers at Signals Matter.

- Second, see what our Subscribers are saying about us by reviewing these Testimonials—there are literally hundreds. Testimonials are the most credible source of information you could have when considering a subscription to www.SignalsMatter.com, bar none. It’s not what we say that matters. What matters is whether what we say matters to our subscribers.

- Still interested? Then try us out for a month by getting started here, and if you like what you see, with a single click you can upgrade to an Annual Subscription and save 15%. Or, bail, if you chose not to receive a constant flow of daily Portfolio Suggestions intended to keep you safe and profit in any market environment.

We hope we see you on the other side!

In the meantime, be well, stay safe and stay diversified!

Sincerely,

Matt & Tom