7 shares China’s real growth story ain’t all it’s cracked up to be.

The media cheerleaders are back at it again, this time giving us more good news out of China.

Such Chinese “good news” sends investor fears, and hence the VIX, to the floor:

Although China’s real growth in 2018 was the slowest since 1990, the gist of this recent media “rah-rah” stems primarily from China’s Q1 “rising growth,” driven entirely by its central bank’s recent decision to ease banking reserve requirements, which it has done by allowing more debt “stimulus.”

Folks, debt-based “growth” in an already debt-soaked China is not good news, it’s merely a postponed hangover and thus postponed bad news.

But given the financial media’s 24/7 misunderstanding of context, such longer-term perspectives are effectively non-existent today.

I’ve written elsewhere of the correlation between bad economic reality and false media hope in our daily headlines.

In the sad “new normal” of a world awash in $250 trillion of global debt created and maintained by a desperate cadre of “supportive” central banks, a key tool for keeping investor faith alive in the backdrop of this ticking, debt time-bomb is a perverse string cite of fictions masquerading as data and financial “news.”

The recent “growth story” about China is no exception to this sad trend.

Hard Facts Make for Better Investing

At Signals Matter, we promise facts, hard facts, not warm and fuzzies.

This is not because we have a bearish axe to grind.

It’s simply because smart investing and risk management require math-based truths rather than sell-side spin.

As such, I’ve given plenty of equally hard evidence of the dishonesty that pours down upon investors on everything from inflation to employment.

Well, as for China’s real growth, it’s once again time to sift through the market noise and take another hard look at reality, not fiction.

First and foremost, the Paper Tiger that is China represents one of history’s most dishonest sources of economic truth.

It is an absolutely freakish mix of so-called “capitalism” and Mao-like centralized control from a president who has legally made himself “leader for life.”

This Paper Tiger only looks like capitalism because beneath its “market economy” hood lies a red engine driven entirely by state-owned-enterprises on rigged stock exchanges which feed off government/communist subsidies that have monopolized both its economy and society.

The “new” China is still all “red” and as transparent with “facts” as a Lance Armstrong was with steroids.

Like the U.S. and the EU, China’s central bank has gone out of control in “supporting” its markets with printed money and easy-debt.

Today, its actual, rather than reported, debt-to-GDP ratio lies somewhere between 260% and 300%, of which at least 150% is corporate debt.

Central to this debt-driven fantasy is China’s horrific housing market. And just in case you’ve forgotten what a bloated housing market can do to an otherwise “powerful” nation, just think back to the U.S. sub-prime crisis of 2008…

As for China in 2019, it sits upon a much larger housing bubble.

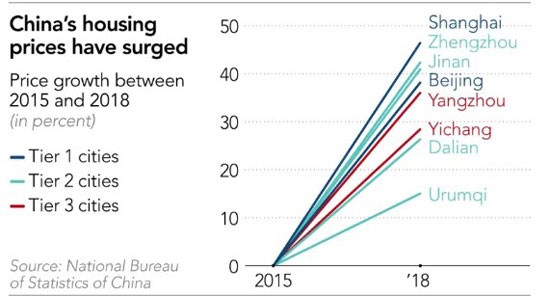

Like the U.S. circa 2006, the big elephant in the Chinese living room is its gigantic housing boom from Jinan to Chenggong.

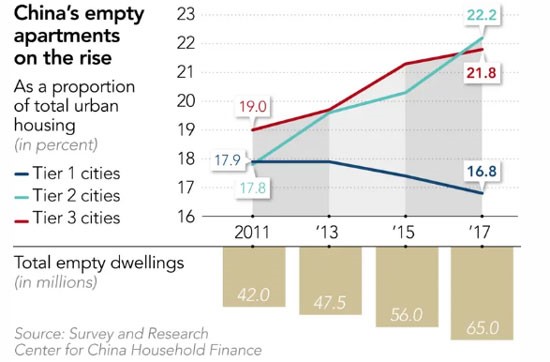

Folks, this bubble includes as many as 65 million empty apartments across the country.

Given that roughly 80% of Chinese wealth stems from some form of real estate, this weakening, $67 trillion real estate market, is the elephant in the room, and getting harder to ignore-even from our bubble-head financial spin-artists.

In fact, the real estate market bubble in China has a value that is twice the size of the combined G-7 economies.

A slowdown in Chinese real estate would thus be fatal to Chinese growth, and given that Chinese GDP comprises 40% of global GDP, such a slowdown will impact the world, not just the Paper Tiger.

Over the last decade, the Chinese, like pre-08 Americans, have been playing with housing fire using risky leverage and shady debt schemes.

In fact, 30% of China’s junk-bond market is comprised of real estate developers heading toward a financial graveyard.

In plain-speak, the current Chinese housing market, much like the pre-U.S. housing crash, represents a perfect set-up for another “Minsky Moment.”

That is, there could be a spontaneous collapse in price following a prolonged period of “growth” and surging price moves, as we’ve seen in China.

You Need to Know the Source of China’s Real “Growth”

China’s recent Central Bank move in early January to prolong this “growth” by lowering the cash reserve requirements of its banks by 100 basis points is merely adding more dynamite under its debt-soaked real estate bubble.

Of course, the financial media, posing as financial “experts,” have heralded this move, which freed up an additional 800 billion yuan for new lending.

Like just about everyone else, however, these journalists have forgotten that in China, as in the U.S., one does not solve debt problems with more debt.

Of course, in the short-term, this new “stimulus,” like a Lance Armstrong steroid boost, can buy a little fun and market “good news.”

But the headwinds of reality will get the last laugh.

China’s real growth faces a mutually destructive trade war with the U.S., an aging population, and a grotesquely unsustainable debt to GDP ratio.

At current debt levels, nearly 70% of the new “lending” created by these lauded “lower reserve requirements” will simply be used to repay interest on prior debts, leaving only 30% left over for so-called “new growth.”

In short, and just like in the U.S., this China bubble is sustained by debt roll-overs, not genuine economic vigor.

And just like in the U.S., this totally artificial “recovery” (i.e. reality-can-kicking) is driven by central bank fiat, not bottom-up health.

Assuming we can even trust the GDP news out of China, its otherwise dubious data is slowing, not growing:

Alas, and as usual, don’t be fooled by headlines regarding China’s real growth that gloss over much deeper, systemic risks.

Like the U.S., China is using debt and central banks to buy time, not solutions.

At some point, however, both of these “global giants” will collapse under the weight of their own gigantic debt.

Stay tuned for my next special report wherein I will release the near-term bullish cases for U.S. markets coming from these global debt conditions.

In the interim, and as always, keep your eyes on the data, the facts and the market signals, not the puff-piece headlines.

And as always, be careful out there.

Comments

4 responses to “China’s REAL “Growth” Story sends Ominous Message…”

- Surindr Supasavasdebhandusays:

May 7, 2019 at 4:44 AM

what is the value in china today is

“don’t be poor.”

if the government and the society can work together to

erase all the poverty in rural area, it is the real value, both

hard and soft economy.

houseing and real estate is not a big deal in china, because there are

so many people, and many of them need a house or an apartment.

if they can afford, they will buy and live in.

when housing price is in the world of speculation, becuase it is a limited resource in the world, it is going higher and higher from time to time, to match so much paper money printed every year.

it is the same as so much money kept in the billionaries without spending.

we can stop many things, but we cannot stop “dont be poor,” because all people want to work to have a better living.

with best regards

- Standard Oyster Companyy says:

May 9, 2019 at 11:42 PM

Hi there, I found your web site by way of Google while looking for

a similar topic, your site came up, it appears to be like great.

I have bookmarked it in my google bookmarks.

Hi there, simply was aware of your blog via Google, and located that it’s really informative.

I’m going to be careful for brussels. I’ll appreciate

when you continue this in future. A lot of other people shall be benefited from your

writing. Cheers!

- Breda says:

May 29, 2019 at 8:08 AM

Hey there! This is my 1st comment here so I just wanted to give a quick shout

out and tell you I truly enjoy reading your blog posts.

Can you suggest any other blogs/websites/forums that deal with the same topics?

Appreciate it!

- Boot Philds says:

July 24, 2019 at 12:24 PM

Thanks-a-mundo for the blog. Really looking forward to read more. Awesome.