Below, we look at the main stream financial media, its bias toward spreading calm rather than reality, and the most recent example of mis-information regarding the banking risks as shown in Bloomberg’s most recent piece by Yalman Oranan.

Fake News or Just Self-Serving Propaganda?

My ongoing amazement with Financial Media spin continues to find shameless evidentiary support from the usual suspects, from the WSJ to the daily blog fest that rains “don’t worry” upon the retail investor class on a daily basis…

By now, you know the “good news” memes that keep this market wave rolling toward the rocks—the ”exploding earnings,” or “continued synchronized global growth,” and of course “high consumer confidence,” etc. etc.

Given that markets are empirically crazy and at ever-increasing stages of risk by every traditional metric, from the CAPE indicator to fake accounting and cleverly twisted (i.e. dishonest) earnings and profit reports, one can see why there’s so much need to keep retail investors happily…. well: duped.

Good News is Good for Business

After all, the entire financial industry of wealth managers and bankers, RIA shops (from Ed Jones to Goldman Sachs) and their bubble-head salesmen rely on one thing: keeping clients fully—to nearly fully-invested at all times.

Remember, the “experts” and advisers get paid by assets under management, not straight talk. Mutual fund reps and ETF peddlers also need money to keep coming in, not going out to safety.

In short: Bad news doesn’t sell. Good news does.

In such a self-interested, rather than fiduciary backdrop, can you ever imagine a scenario where bank presidents and PWM managers create a massive media campaign warning investors to leave these dangerous markets?

That would be akin to the stores on Madison Avenue posting signs on their grossly over-priced doors saying “Go Away! You’re getting Robbed Here!”

A Typical Market Puff Piece

But rather than just rant, which I tend to do in my opening paragraphs, let’s just take a look at a real example and do the math rather than the shouting…

Bloomberg Looks at Banking Risk

Here, let’s consider the venerate Bloomberg Media, in this case a recent article posted on the 10-year anniversary of the Lehman collapse by Yalman Onaran.

In this mixed example of “be calm, carry on,” Onaran presents all kinds of math-based data and charts to suggest the US banking sector today is much safer than it was when monsters like Lehman and Bear Sterns walked the prehistoric canals of Wall Street circa 2008.

What’s fascinating about this exemplar article, however, is that the very evidence and data Onaran employs to make his case, if looked at even for more than a second, actually defeats his case.

As I see it, it’s a remarkably (and unintentionally) odd piece of misinformation…

So let’s dig into the data, shall we?

Safer Banks: Capital Requirements

Onaran begins by relieving all of us with the comfort that banks, “on many counts,” are safer than before the last crisis.

Really?

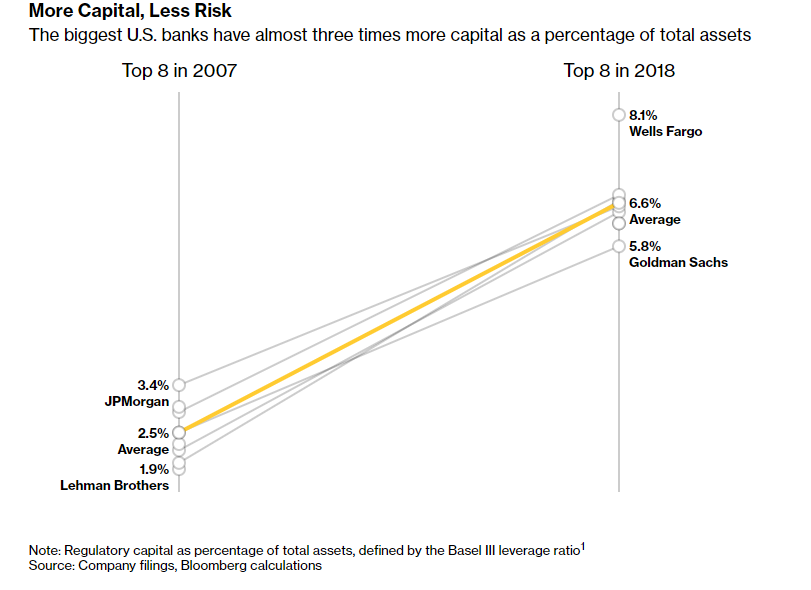

Well, for one thing, Onaran consoles us with the “fact” that there has been “a sharp increase” in the capital requirements imposed on banks to make sure they have enough money to “buffer” them from another 08-moment.

In the past, for example, many banks had only $2.00 for every $100 of “assets” in their “cushion accounts,” and thus when bank assets were wiped out in market downturns, banks were caught swimming naked at low tide.

But don’t worry… As Onaran tells us, today, banks have $7.00 in their “buffer accounts” for every $100 they roll the dice with in the market casino. He even provides a nice little graph to make you feel even safer…

Folks, does that feel, look or seem like a “cushion” to you? Moving from a 2% to a 7% “cushion”—as any banker who lived through 08 knows all too well–is like putting silly putty on knife wound…

But just to make you feel even safer, Onaran quotes Danile Tarullo, who recently oversaw financial regulation at The Federal Reserve. As Tarullo blabbers:

“The resiliency of the biggest banks is pretty high right now,” said Daniel Tarullo. “It would be good for them to have a bit more capital and be even more resilient, but what we’ve got right now, if preserved, is pretty good.”

Needless to say, given that The Federal Reserve is the ticking time bomb behind this market bubble, and given the further fact that this bastion of yes-saying “economists” with zero trading experience has the worst forecasting record in the history of 20th century market crashes, citing Tarullo as a valid/objective source of market stability is akin to quoting Dr. Seuss for cancer advice…

Safer Banks: Constraining Bank Growth

Onaran’s next observation is that those brave bank regulators have done a terrific job of constraining bank growth, because after all, it was those banks that killed the markets in 08—and who were justly rewarded for their sins with trillions in tax-payer bailouts and re-cord breaking bonuses…

Onaran’s evidence for this much needed bank growth regulation? Well, his exact words: “banks are smaller than they were in 2007.” Such profundity. Such wise reporting. Such comfort.

But look deeper, for that’s like saying Jeffrey Dahmer was safer in 1991 than he was in 1980 because his kill ratio was lower by one decapitation in 91…

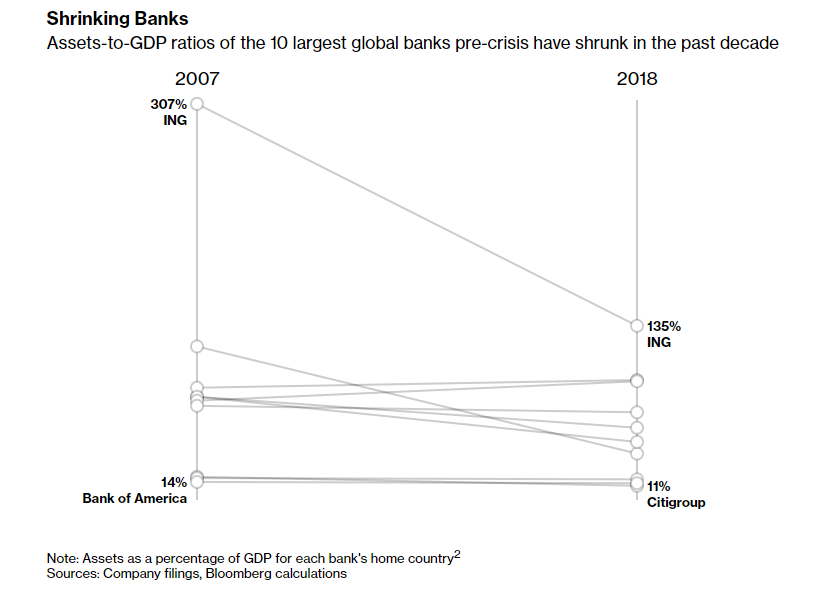

In a remarkable piece of blatant trickery and whistling past the graveyard ofreality, Onaran claims “banks are shrinking” by reporting that the ratio of Bank Assets-to-GDP in places like Bank of America and Citigroup have “shrank” from their 2007 percentages of 14% to 11% today.

A 14% to 11% “shrinkage” in 11 years?

Can anyone call that a “safe change”? Onaran: Are you serious?

But not to worry, Onaran gives us a pretty graph (with more exaggerated slope lines) to make his “report” look very calming…

Note also how Onaran uses an outlier “bad-bank” example like ING whose 07 ratio of 307% “shrank” to 135% by today’s measure.

Again, all of you have the same common sense as me. This “calming data” from Bloomberg is like a frat-boy saying “I’m doing much better today: only 12 beers for lunch as opposed to my typical 20.”

Note as well the other little “trick” Onaran uses… These “shrinking” ratios of assets to GDP ignore the fact that actual GDP today is lower than it was in 07, which further distorts his already weak puff piece as to US banks.

The simple fact is this: nothing fundamental has changed in these banks since 08. They are as bloated and dangerous as ever. Period.

Safer Banks: More Stable Funding

Once again, Onaran puts his own graphical feet in his mouth—and very deep it seems to me.

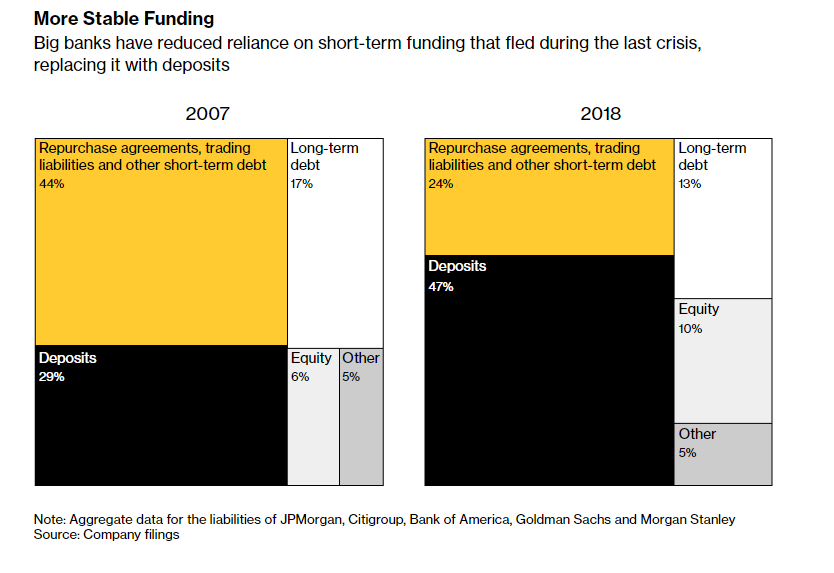

Here, he makes another calming but entirely shallow claim that banks are safer because they’ve reduced their reliance on short-term funding (i.e. trading leverage that leads to market crashes).

To make his misleading point, he provides data that the big banks, as a group, have reduced their short-term debts (re-purchase agreements) from 44% in 2007 to 24% today; deposits moreover are up from 29% to 47% and the equity on their balance sheets has “skyrocketed” from 6% to 10%.

And once again, he calms our fears with another graph:

Folks, when markets correct, as markets always do, these “more stable” funding “improvements” are paper tigers.

My colleague and I come from these banks, and nothing about these “improved” numbers would make an ounce of difference in surviving a market crisis.

Context Matters

In addition, Onaran fails to place any of this “improving” bank data into the current macro context.

Unlike 08, for example, our national, corporate, and private debt levels are massively higher today than on the eve of the last crisis. Stated simply: the debt powder keg today is infinitely more dangerous than in was on the eve of even the 08 disaster.

When bank assets fall in the next correction, the speed, depth and power of the flood of losses will run straight past these minor “funding improvements” like a hurricane surge over sand-bags.

Evidence Matters

By point of fact, rather than opinion: banks are not fundamentally safer today than they were in pre-crisis 07.

In fact, the very evidence Onaran uses to prove this is, in and of itself, equal proof that he is wrong—and mathematically so.

When studying law, I would have dreamt of a witness to cross examine like Onaran. There’s nothing easier for a conviction than to use a witness’s own facts against him…

What’s even more disturbing are some of the other facts which this Bloomberg piece overlooks—a tactic which those with (or without) a law degree call “lies of omission.”

The Rest of the Banks/World Matters

In this measured “puff piece” on US banks, Onaran forgets that banking, like markets, are international in their scope and danger.

Just like European banks and economies suffer when, say, a “Lehman moment” occurs in the States, US investors suffer when foreign banks go astray. In short, any banking article needs to think beyond just the so-called “safer” US banks…

Onaran, for example, left out any discussion of the ultimate banking bad-boy, Deutsche Bank, which even the IMF warned is so levered, mis-managed and corrupt that it serves as “the single greatest risk to the global financial system…”

Size Matters

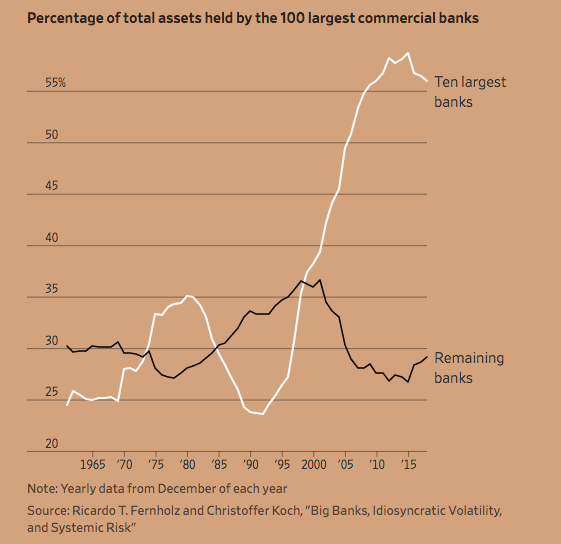

Equally absent from this Bloomberg banking “puff piece” is any discussion of the profligate nature of the Big Banks, the sins of their past, and the manner by which they were rewarded rather than sanctioned for taking the US into the 08 crisis, which was “solved” only by creating an even larger, debt-based bubble, and hence an even greater crisis to come.

Today, the biggest banks are still as big as they were in 08. The risk of bank concentration 10 years ago has not gone away. In fact, and as the below graph makes visibly evident, consolidation and bank size/concentration continues to increase.

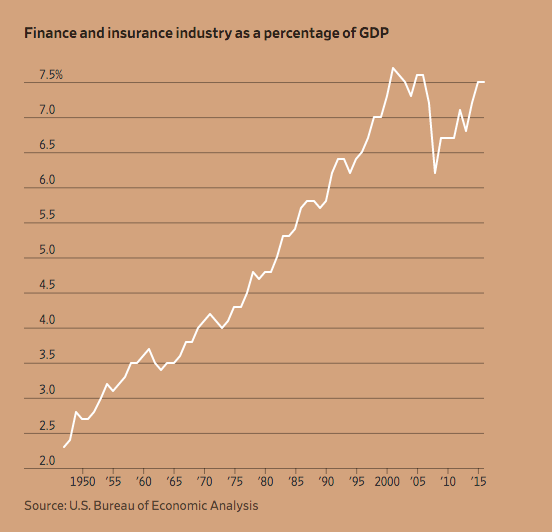

Furthermore, the power—as well as danger—of letting the maniacs run the asylum –continues today at the same dangerous pace that led the US into the pits of the 08 crisis. The financial sector is once again becoming one of the largest components of our economy:

Such power and size among banks will lead directly to increased/future risks for borrowers and consumers (i.e. Main Street) in the next crisis.

Accountability Matters

Perhaps the most appalling and overlooked point about banking today is the fact that the very foxes who slaughtered the economic henhouse in 08 are now guarding it.

In essence, the bankers are regulating themselves, and learning nothing from their 08 sins.

As Phil Angelides, chair of the official US governmental inquiry into the 08-financial crisis cryptically put it: “This is not an industry that has examined itself and remade itself in the wake of the crisis.”

Truer words were never spoken.

Don’t believe me?

Just consider the list of the following bank regulators who came in post-08 to “clean-up” the banking mess:

Brett Redfeam, Joseph Otting, Steve Mnuchin, Shahira Knight, Dina Powell, Robert Khuzami and Randal Qaurles.

Guess what they all have in common? Resumes and pay stubs from The Carlyle Group, Deutsche Bank, Goldman Sachs, Fidelity Investments, CIT Bank, US Bancorp and JP Morgan…

All of us, when reading “market reports” like this latest Bloomberg piece, need to think about facts, context and bias, including my own.

Good folks and investors deserve better than more spin—for in the end, it’s the little guys and their 401K’s (and not Fed Governors or Bank Presidents) who get hit the hardest when markets crash due to banks driving under the influence…