Below, we look at GAAP vs Ex-Items accounting as well as the math behind Wall Street profits and earnings in order to disclose the hype-driven headlines that have taken markets and investors well passed reality into dangerous waters.

Trust Facts, Not Opinions

In an era where “fake news” has become the new name for “news” in general, one can understandably worry as to who or what source to believe, be it left, right or center, conventional or non-conventional, on-line or off-line, bull or bear.

As I recently wrote, Kakutani’s book, The Death of Truth, raises the important distinction between opinion and “objective fact,” reminding us that in the fog of a 24/7 media circus (increasingly driven by sensational buzz and page clicks rather than honest fact-checking), one should read carefully between the lines.

Journalism, by every measure, has become less “investigative” and more “entertainment-based;” hack writers paid by “likes” rather than insight, pander more and more toward focus-groups rather than focused facts.

And when it comes to financial news, I’ve openly critiqued its staggering sell-side/bull bias.

But even I must check myself (as should you) against my own opinions. In short: when it comes to market analysis, you don’t need more rants, you need facts.

In this spirit, let me endeavor then to support my opinion that much of the current bullish news is in fact fake news. And to support this, let me rely on numbers rather than prose.

The Two Biggest Lies

The easiest way to bring this point home is to simply look at the most important metric for security pricing on all the major US exchanges: Profits and Earnings.

As even the most novice investor knows, profits and earnings determine whether a stock goes up or down. Stated more simply, when profits and earnings go up, stock prices go up; inversely, when profits and earnings go down, stock prices go down.

Fair enough.

In a record-breaking stock market that seems to only go up since the 08 Crisis, one would assume profits and earnings are doing the same thing, right? The main street media sure thinks so.

In fact, the financial media has been on a recent tear lauding (and promoting) the “booming” profits and earnings in the current nosebleed market that almost never dips or disappoints.

Well, let’s look at the math and see for ourselves whether “booming” is real, or, well…Fake?

The Al Capone Market

But before we do the math, let me remind you of that old little thing called honest balance sheet reporting (namely as required by Generally Accepted Accounting Principles, or GAAP, by the IRS) vs. the legalized fake balance sheet reporting (as allowed by Wall Street’s sell-side spin doctors), also known as Ex-Items accounting.

As I wrote in a prior (June 2017) piece entitled, It’s a Math Thing, Ex-Items accounting is literally a form of legalized fraud, that is, it’s…

“…a parallel little accounting universe (and an open secret in the hedge fund world) where CEO’s are allowed (a bit like Al Capone’s CPA) to carry two sets of books: one (GAAP) which they report to the SEC (nod to Sarbanes-Oxley) under penalty of prison, and another (non-GAAP, or Ex-Items), which they report to sell-side analysts and retail suckers (you and me).”

This is true. Really. I mean it. Unbelievable, yet true. And I’m guessing not 1 in 10,000 investors even knows this…

But in this accounting “new normal,” this “second book” basically allows “companies to skip past (i.e. ignore) over-head and report mostly cash-flow. That’s a bit like a lemonade stand that reports only lemonade sales but not the cost of lemons…”

Net result? Earnings, by the very nature of accounting tricks, are not honestly reported. Period.

Which is why an Associated Press report recently concluded (and your advisors probably over-looked), that 72% of the companies they reviewed had adjusted profits that were higher than net income. (From 2010 to 2014, the S&P as a whole showed adjusted profits that came in $583B higher than net income.)

Folks, pause to think about that for a second. Profits higher than net income??? Thank clever accounting to make 2 + 2 = 6…

The “Booming Profits” Lie

But let’s jump now to the current markets and see for ourselves what the facts rather than headlines have to say.

If you look at the pre-tax profits of corporate America for Q2 of 2018, the number comes to $2.2T.

Got it?

Ok, and if we look at the same data for Q2 of 2017, we see that the profit numbers were essentially the same. In fact, you can go all the way back to the pre-tax profits of Q2 2012, and guess what, profits back then were also around $2T.

In short, corporate profits are not “booming” at all. In fact, they are nearly flat, annualizing at a meager rate of 1.3%. (This doesn’t even keep pace with inflation…)

This, by the way, is not my opinion. It’s math.

However, if we look at after-tax profits, the growth rate for Q2 2018 is a much higher 6.8%.

Drum roll the “booming profits” headlines, right?

Nope.

If you think before (or even as) you read, then you’ll know these headlines are completely, well fake.

That is, we are not seeing companies (or their profits) growing at all. Instead, we are simply seeing a one-time IRS paper growth—the direct result of the infamous Trump tax cut, which brought corporate rates from 35% down to 21%.

And if you paid any attention to the details (rather than hype) of the recent tax cut, you’ll also know that it expires in 6 months…

Simply put: this is a 100% tax trick, not a profit surge. Full stop.

The “Booming Earnings” Lie

Turning from profits to earnings, let’s look once more at facts rather than headlines.

Currently, the Street is projecting Ex-Items earnings for year-end 2019 to be $177/share, at a “normal” PE multiple of 16X, which means they anticipate a 22% earnings growth in the next year…

But if you leave the fake world of Ex-Items accounting (see above) and enter the real world of GAAP earnings, here’s the real numbers: LTM GAAP earnings for June of 2018 came in at $122/share.

The pre-crisis peak earnings 11 years ago was $85/share, which means we’ve seen earnings grow by an annualized rate of 3.4%.

Again, this is fact, not opinion; this is math, not spin.

Now I ask you: Does 3.4% growth over an eleven-year cycle feel like a “boom” in earnings?

Reality Check

OK, so by pure math (as opposed to opinion), we can objectively conclude that since the last market peak in 07: 1) profits are empirically flat and 2) annualized earnings are paltry, not booming. Period.

The obvious next question is this: with earnings annualizing at 3.4% and actual profits mathematically flat-lining, how is it that US equity markets are at all-time highs?

The Debt Truth—The Skunk in the Media Woodpile

If you want to know why markets are ripping while such crazy “old-fashioned” indicators like profits and earnings are stalling, the answer is simple: cheap debt.

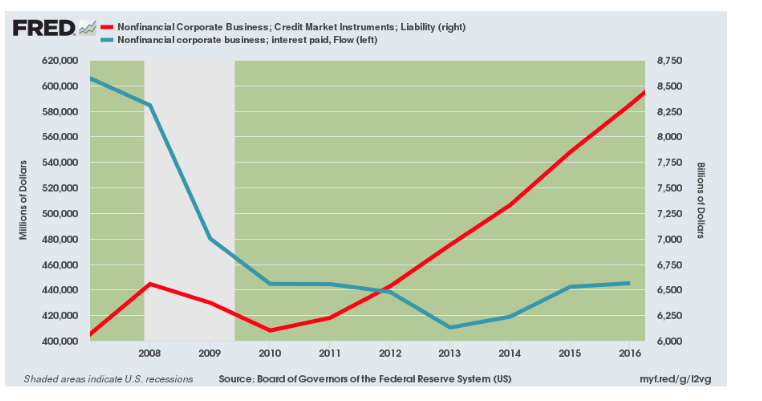

If you don’t believe me, let’s look at a colorful picture and do the math:

As you can see, the falling blue line represents the cost of borrowing. Needless to say, when bad or profitless companies see a chance to cheaply borrow their way out of a hole, they always do so.

This explains the rapidly rising red line, which represents corporate debt exposure. It’s skyrocketing.

As I’ve written ad naseum, we can thank the happy idiots at the Fed for creating this addictive debt monster and 100% fake “recovery.”

By cranking rates to the zero-bound in the wreckage of the Big-Bank-created fiasco of 2008, the Fed created a debt monster.

Why a monster? Equally simple: Debt is fun when rates go down; but debt is a killer when rates go up.

And guess what? Rates are heading up, not down.

This means all those companies (more than 80% of the entire market) that relied upon incurring (and perpetually rolling –over) $9T (!!) in low-rate debt to buy back stocks, pay dividends and fatten their EPS data, are eventually going to learn the meaning of “live by the sword, die by the sword.”

That is, the great re-fi mentality of rolling-over debt to party-on ends when rates rise. Companies will wake up to see their debt costs spiking and hence their already (and objectively) weak earnings tanking.

The party ends then.

The Big Question

If we just look at the math then, we see objectively that: 1) earnings are weak, 2) profits are flat, 3) corporate debt (at $9T) is at all-time highs, and 4) rates are rising, not falling.

We also see that none of these facts are being articulated in a simple, cogent or rational manner in the financial headlines or glossy bank brochures.

So, when will the debt damn burst? When will reality trump fiction and sell-side spin?

As soon as a critical volume of investors—either by wisdom or trigger event—face reality rather than spin, math rather than headlines…