Below we look at rising debt levels, the currency risk that follows central bank debt “solutions” and why gold still matters.

As March rolls in, the ever increasing disconnect between Wall Street and Main Street continues, as I touched upon in this recent video from New York.

Market noise, and thus market questions, are seemingly never-ending: What to buy? What to sell? What to hold? What will the Fed do? Where are markets headed? When will the next recession hit and why?

In short: What should one do?

In this increasingly volatile market (think late 2018), nervous investors still look to consensus-thinking (safe?) advisors and prompt-readers in search of quick answers and instant, calming solutions, most of which are the same. “Markets rise and fall,” the experts say as a chorus, “just be diversified [stocks and bonds] and carry on. The economy is strong, employment is high, inflation is low and the markets will stay the steady course over time.”

This may feel and sound comforting, but the data (i.e. objective facts) as to the economy, employment, inflation and stock and bond “strength” suggests otherwise. As I indicated in a video shot in the fall, such traditional portfolio thinking is dangerous.

As for market timers and market predictors, they too are everywhere, and always have been and always will be. Some are bulls, some are bears. So again: Where can one go for simple, blunt guidance?

The answer, in fact, is right in front of us, which is to say, right behind us. So, if you really want to know where the markets and your portfolio are headed, history, rather than tarot cards and/or market timers, has an answer.

And if you cut through all the noise, yield curves, derivatives math, political headlines, fancy market jargon, expert-testimony, and Fed-speak, this history is actually quite simple.

In fact, the entire history of economic cycles and busts, from 33AD Athens or 18th century France or the Great Depression of 1929 to the Great Recession of 2008 simply boils down to this: Every market crisis is preceded by a debt crisis and “solved” by a currency devaluation.

Everyone. Every time. Period.

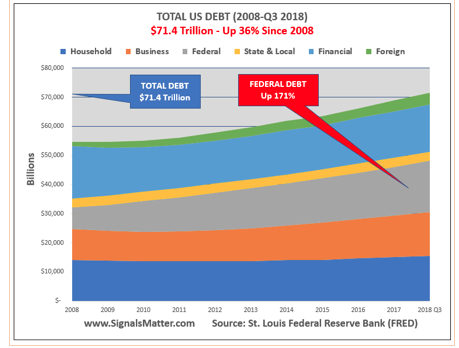

And guess what? With debt levels at $244T globally and $71T here in the US, the world in general, and the US in particular, has never been in more debt nor faced a larger debt crisis. Think about those numbers. In essence, they are the two most predictive numbers required for understanding where we are today and where we are headed tomorrow.

Since the post-08 Fed opened the easy money (low rate) credit spigots, credit expansion across all sectors, private and public, has never been faster, fatter or more dangerous.

And as centuries of market history confirm, the bigger the credit expansion, the bigger the collapse to come:

“Every collapse of a credit expansion is a bankruptcy, and the magnitude of the bankruptcy will be proportionate to the magnitude of the debt debauch.” – Freeman Tilden, 1936

As for such “debaucherous” debt bubbles, they “pop” when the cost of carrying that debaucherously high debt gets too painful. And because this pain level rises in tandem with rising interest rates, everything thus hinges upon rising rates.

And once those rates get too high, asset bubbles (like the those in our current stock and bond markets) “pop” as loan/credit defaults cascade en mass. We saw this in the sub-prime debt market of 2008, and will see it again in the corporate debt market of today, of which greater than 60% of its “bonds” are classified as junk, high-yield and levered loans…

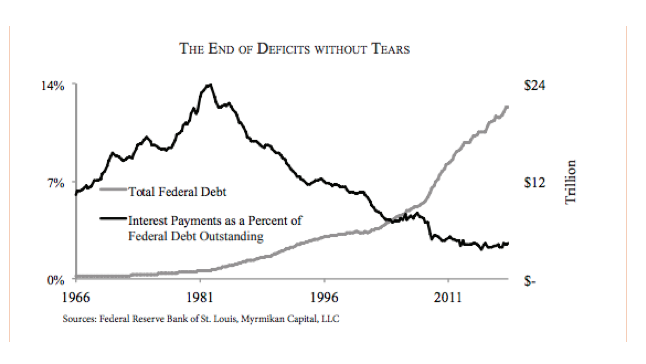

You see, the US is in debt like never before, yet because rates are still low, we, as a country, have been able to get away with deficits (i.e. a credit-card “recovery”) with no ill effect for decades. Such debt-driven peace of mind has convinced many that the U.S. can run forever with what Jacques Rueff described as “deficits without tears.”

And as the following graph clearly shows, we can run massive deficits (grey line) without “tears” simply because rates (black line) have been artificially crammed to the floor since the mid 1980s in general and 2008 in particular.

Stated otherwise: Falling interest rates (artificially supported by the Fed) have made debt relatively easier to carry—at least for a while…

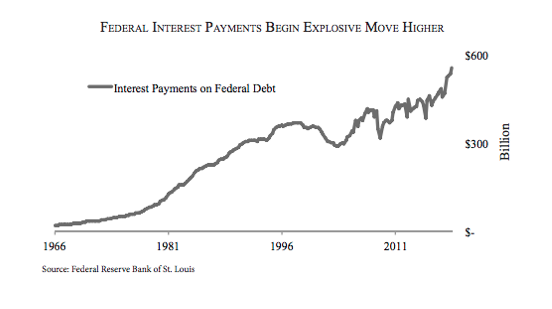

But here’s the rub folks: rates are rising due to market pressure (rather than Fed “control”), and the cost of that debt (i.e. the “interest expense”) is edging higher:

This means everyone from Joe six-pack to the US government is about to face increased (i.e. tearful) debt expenses. And as for Uncle Sam, whose debt bills are increasing at an annual rate of $1.2T, who or what will come to his rescue? How is this rising debt expense ever going to be paid?

Will it come from tax revenues in an era of poorly timed tax cuts? Can we expect bailouts from a broke EU, a broke (and belligerent) China or an even more broke Japan?

The short answer is this: Not a snowball’s chance in Heck…

Instead, most of us by now already know what will happen. History, in fact, confirms it. The answer is quite simple: The US will devalue its currency to solve its debt problem, which means the Fed will eventually and once again start printing money out of thin air under the euphemism of “Quantitative Easing”—i.e. “faking it.”

How can we so sure? Because as history confirms, the US in general, and the Fed in particular, literally has no choice.

If they don’t print more magical money, there will be no new “credit-card” money to continue supporting an already artificially supported bond market. This means bond prices will fall and thus bond yields (and hence interest rates) will naturally and mathematically rise.

This subsequent rise in interest rates (and hence interest expenses on debt) at both the government and corporate level, will be fatal, creating a market catastrophe in an already catastrophically over-valued (and debt-driven) US securities markets.

After all, rising rates create tipping points in which debt-laden companies need to dip into their earnings (already distorted by debt-driven stock buy-backs and ex-items accounting scams) to pay their rising debt costs.

This hit on earnings, of course, results in falling stock prices. We’ve seen the first early symptoms of this in real time. From June to December, 2018, the FAANG’s (Facebook, Apple, Amazon, Netflix and Alphabet’s Google) have dropped a whopping 32% in 7 short months.

And as for our completely broken (and overlooked) bond market, it is even more of a distorted danger zone for otherwise unknowing investors. The most obvious symptom of this distorted credit bubble is the so-called “high-yield” bond market, which is in fact, a low-yield mine field.

High yield issuers, for example, recently saw their first bond issuance after one of the longest dry spells (40+ days) since 1995. For these junky companies who perpetually need more borrowed money (by issuing bonds) to pay back their maturing, and perpetually “rolling” debts, they face a tearful problem. Namely, the new interest rate they have to pay is 6.5% today to cover yesterday’s debts pegged at 4.125%.

In other words, the perpetual US debt-rollover orgy is slowly coming to an end. The tears, in short, are only just beginning. As interest rates continue to rise in the face of a cornered Fed and growing Treasury Bond supply (over $1T worth of “IOU’s” per year) just to pay for our public debt roll-over, these tears will turn into sobbing fits.

That is, at some point soon (one we are tracking carefully), the bubble in US stocks and bonds will do what all bubbles throughout history have always done, namely: “pop.”

And at that moment, unless the Fed starts printing more money, and I mean fast and furiously, Fed-supported bond prices will tumble further, rates will rise further, and the next market crash will make 08 seem benign in comparison.

Why? Because today’s debt crisis (which includes everything from real estate, corporate bonds, student debt, government deficits and car loans) is far worse than just the sub-prime mortgage crisis of 2008.

So, there we have it folks. Our debt-soaked, artificially supported securities market is facing an inevitable and interest-rate-driven “uh-oh” moment. Sadly, the only tool the Fed has left in its tool box to slow this debt slide is the unconstitutional (but Wall-Street-loving) power to print money.

But is this really a solution? Is it good news? Comforting news? Calming news?

In fact, the Fed (and thus you and I) is now stuck between a rock and hard place—a dilemma of their own creation. They either suddenly allow natural supply and demand forces (i.e. market-driven rising rates) to crush our completely Fed-distorted and debt-driven bond and stock bubble, or they again print money to the tune of trillions and unleash a profound devaluation of the US dollar.

Folks, that means they get to choose between a natural market catastrophe or the catastrophic inflation of currency deflation via un-natural Fed money printing.

Given that the Fed since Alan Greenspan serves a Wall Street master rather than natural market cycles, it’s not hard to guess what the Fed will eventually do—i.e. print dollars and thin an already weakening US currency.

And guess what the best hedge against thinning currencies throughout history and the world has always been? Well, the long and short answer is silver and gold.

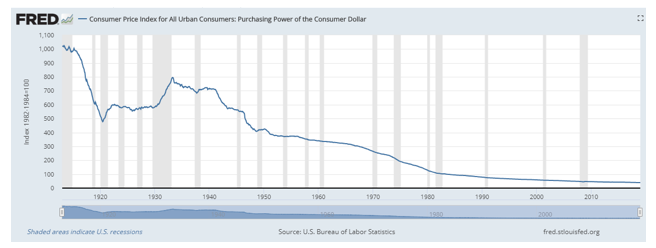

Historical devaluation of the US Dollar’s purchasing power as a result of debt-inspired currency devaluation is not an opinion, but a fact, as the below graph of the Dollar’s declining purchasing power confirms:

Meanwhile, the purchasing power of gold (measured in US dollars) has a far better historical, as well as graphical…track record.

One does not need to be a “gold bug” or precious metals peddler to see this. I’m certainly not of that stripe. Gold and silver are volatile movers (as are the GLD and PHYS vehicles) and can continue to rise and fall in the coming months and seasons as headlines replace truth and sales-spin ignores common sense.

Nevertheless, for those of us who invest for the long-term and with a respect for history, owning a smart allocation of such metals (the Swiss, for example, typically hold at least a 10% allocation to gold as “insurance”) makes far more sense than anything we’ve seen coming out of DC or Wall Street since 2008…

Be careful out there.