Geopolitics, and geopolitical risk, are a separate category of market risk which we address below.

31shares

This week, as I pack my bags for Europe, I found myself on the phone with a DC think-tank to discuss the future—not just for the next year, but for the next decade.

Folks, it was not an altogether uplifting discussion…

My aim here is not to spout personal opinions, take a political stance or convince anyone to run for the hills or pop more champagne.

Like Switzerland, I’ll aim to stay as neutral as possible (except when talking about markets) and simply report what was discussed with regard to geopolitical risk—hitting the broad themes and thus allowing each of you to draw your own conclusions.

Thereafter, you can decide if we are staring down the barrel of either 1) more central-bank-driven bliss ahead or 2) pitch forks, gun smoke and angry mobs.

Maybe it will be something in between?

Anyway, here’s what was discussed as to geopolitical risk…

The US: The Uber Rich Are Uber Nervous

2019 saw a lot of billionaires (Cooperman, Blankfein, Dalio, Dimon, Gates, Bloombrg et al) online or on TV defending themselves from a growing antipathy bubbling up from Main Street in general and the Generation Z and Millennial class in particular.

America’s increasingly angry youth seem to be catching on to a notion that their generation will be paying for the debt sins of their parents, and the numbers seem to confirm that they will not have the same income, housing or employment opportunities as their moms and dads.

More and more are living at home after college and staring into the abyss of student loans they can never repay and jobs that, despite the reported employment highs, are less and less meaningful or lucrative than one might think, even those working for Facebook can’t exactly call it a “calling,” but more of a soul-crushing surrender.

So why are younger Americans reaching record levels of anxiety, prescriptive solutions and addiction to social media, tweet-length communication and growing levels of both personal isolation and social frustration–all of which contribute to geoplolitical risk?

Some argue it’s because they were born into an almost Huxley-like nightmare driven by technological highs that snuff out soul-fulfilling instincts.

I’m thinking of Huxley’s literary “soma drug” which much like today’s social media, has everyone drugged and algorithmically glued (nudged) to a common screen as if Artificial Intelligence is better than natural experiences to lift us individually higher.

Whatever your take on this, the data at least raises the question that perhaps genuine cell phone addiction, radio frequency radiation and sound bite attention spans are hurting rather than uplifting this tech-mesmerized generation.

Time will tell if such tensions, debt frustration and personal angst will reach a tipping point level of geoplolitical risk.

But according to the think-tankers, the real unrest from this new generation comes from them catching on to the notion that our generation (i.e. my circle of Ivy League bankers, hedge fund types and private equity gurus in neckties) have stolen their future and their wealth.

(Then again, younger (and grossly overpaid) executives like Elon Musk and Adam Neumann or intel gatherers like Mark Zuckerberg wear hoodies not neckties… so perhaps it’s not all a generational thing.)

Nevertheless, it seems clear that many 30-somethings angrily believe that a post-2008 DC bailed out the bankers and dismantled the rule of law for a 1% class that has coopted Congress to their exclusive advantage (remember: There are five financial lobbyists for every member of Congress…)

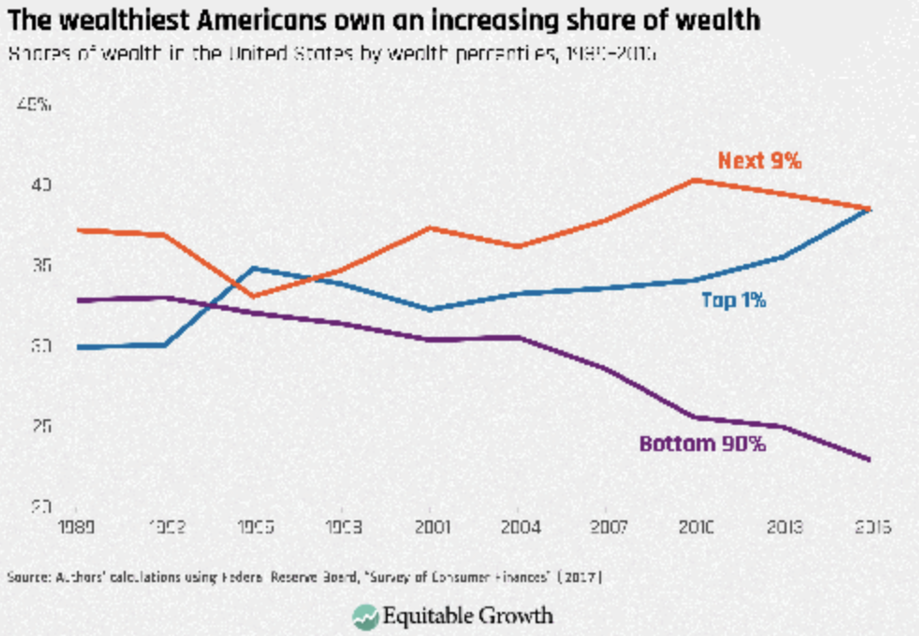

In this backdrop of geopolitical risk and generational frustration, even billionaire Ray Dalio sees the writing on the wall, namely a growing polarization of extreme left and extreme right politics and social division, a polarization that always rises its ugly and historical head whenever wealth disparity reaches unacceptable highs like this:

U.S. Politics…Trump and Four More Years?

As for U.S. politics and geopolitical risk, I will take no sides at all, but, again, simply pass on to you what was shared with me.

The consensus out of DC’s “realist camp” of think-tankers is that a Trump re-election in 2020 seems likely, at least once one leaves the bubbles of urban settings like DC, NYC or L.A. where it’s dangerous to even wear a red MAGA hat.

Whatever your political views, there’s no denying the political tensions in the “dis-United States” where the cultural creatives at NETFLIX have tried to air shows that involve “social justice warriors” hunting down right-wingers for sport.

That’s hardly a healthy message for American streaming…or American unity.

But even life-long Democrats on my three-hour discussion confessed that Trump has a strong chance of winning for no other reason than that the Democrats can’t come up with a winning campaign idea, having apparently learned no lessons from Hillary’s defeat, which the Left somehow refuses to accept.

Furthermore, the frustration and mood in the swing states (not very Biden or Warren friendly) suggest an easy victory for Trump, provided he can post-pone a recession in 2020.

This is a critical precondition for the President, which is why many believe that the Fed will be firing on all cylinders to stimulate the stock market in 2020 on the heels of White House pressure and increasingly biting tweets.

The Fed and the US Markets…

Toward that end, and in order to keep the repo markets from imploding again, we can expect the Fed to print more money and perhaps even take rates below zero, despite Powell’s infamous double talk and promise to end repo support in March of this year.

Don’t hold your breath. The need for more printed dollars poses further geopolitical risk to global currencies.

The harsh reality today, and one for which I do feel qualified to give my own blunt opinion, is that the Fed has no choice but to save the repo market by dumping more money into it in 2020.

If repo rates ever hit 10% and stayed there, it would be an immediate “game over” moment for the US. Full stop.

Thus, expect more printing and rate reductions in 2020, which (and but for the dollar illiquidity in the Euro Dollar market) would be a bad sign for the U.S. Dollar and a tailwind for gold.

And while we’re on the topic of markets and geopolitical risk, the financial experts in our little discussion foresee more tech unicorns losing their horns in the coming decade.

Here, again, I’ll openly agree.

As we already saw in 2019, embarrassing disasters like WeWork are more the rule than the exception, and although WeWork was no Enron, the reckless tech enthusiasm seen from lenders like Soft Bank is starting to see the light of reality.

In short, expect less exuberant lending and magical IPO’s from Silicon Valley.

And as I’ve written elsewhere, broken balance sheets like Tesla may be rising toward crazy highs but could one day be the goat rather than hero metaphor of the tech sector’s eventual fall from grace.

The Rest of the World—Oil Looking for a Match?

The conversation in DC on geopolitical risk turned from the US to abroad, where uprisings from Venezuela, Chile, Peru, Lebanon, and Israel to Indonesia, Iraq and Hong Kong made record breaking headlines in 2019.

Gary Young of The Guardian described this extraordinary global unrest as “streets of oil” waiting for something to ignite it. He predicts that the coming decade will be far more “combustible” in terms of geopolitical risk than the last.

Why such pessimism?

Well, globally there is a growing sense that no one has punished the banking and political bad guys for putting the world over $240 trillion in debt, tripling in just over a decade.

Meanwhile, supply lines in everything from oil to microchips have been severed by the China trade war and growing tensions in the Middle East, which seem to never end and whose origins are becoming increasingly more suspect than what is otherwise reported on the Main Stream Media.

Whatever one’s views on such matters, these disruptions lead to price hikes which the bottom 90% of the world feel more intensely than the top 10%. That’s geopolitical risk in the making.

In France and Germany, two countries I frequent, the social tensions are now open and obvious, clear signs of growing geopolitical risk.

More and more foreigners (from the EU to Latin America) are blaming the US for imposing its grossly inflated dollar on them in the form of usurious loans that require dollar-denominated repayments, which become more painful to repay as the dollar rises on a rigged system in which the U.S. greenback has a hegemony over international bank settlements, to say nothing of its monopolistic “Petro dollar.”

Again, and without taking sides, I’ll simply report the discussed mood overseas, and its one in which many foreigners perceive the US as bailing out banksters, entering false wars, increasing the wealth gap and imposing its currency schemes on them to benefit the banks, not the people.

Such tensions and perceptions add to the geopolitical risk tensions.

“The people,” meanwhile think the only bank looking out for them is the IMF, and all that the IMF offers them is more austerity.

This may not be an entirely fair anger (the Greeks, Italians and Spaniards, for example, may have themselves to blame as much as any central bank), but it’s anger and geopolitical risk nevertheless.

And national anger is never a good thing, whether you agree with its origins or not.

With this rising anger and geopolitical risk, one fueled by unpayable debt burdens at historically unprecedented levels around the planet, increasingly blunt speakers like Ray Dalio worry that certain countries will stop buying US Treasuries, which would cause interest rates to rise.

And as I’ve repeatedly said, rising interest rates (whether or not driven by geopolitical risk) would crush the current melt-up here in the U.S.

A De-Dollarized Future?

Some think-tankers argue that more and more countries—including Russia, China, Iran and even fiscally conservative Germany, are seeking ways to get off the U.S. Dollar and begin to settle their payments in non-dollar electronic currencies and issue their own debt outside of our SWIFT system of controls.

If this were to ever occur, the U.S. side (which includes dollar-friendly allies like Japan, Israel and Saudi Arabia) would struggle as the US slowly loses control of its global dollar hegemony in the coming decade. That’s geopolitical risk directly impacting U.S. markets.

This would mean more confrontations and zenophobia with China and other non-dollar-friendly nations, the number of which is rising, and with it, geopolitical risk..

In case you think such fears are the exaggerations of stuff-shirted “think-tankers,” keep in mind that even Michael Carney, the Governor of the Bank of England, announced in 2019 that “the dollar’s days are numbered.”

In short, many nations around the world (fairly or unfairly) are tired of what they perceive as a “weaponized” post-2008 dollar whose imposition on the rest of the world has forced others to go to now $11 trillion in negative returning sovereign bonds just to stay afloat and keep up with the Fed and its itchy trigger finger on the money printer.

Citizens as well as nations are slowly catching on that massive debt burdens can’t be solved by adding more debt (and fiat currencies) into the mix. Again, even Germany is losing patience with such illogic, as I reported in October.

Geopolitical Risk: Police States?

Another key theme discussed in this three-hour call involved the growing sense that the world is tilting dramatically toward greater unrest, and hence greater governmental controls over civil liberties sacrificed in the name of security and a world tilting toward AI rather than humans.

In the U.S., more police officers are armed like Navy Seals. Some may find this to be a good thing to sustain domestic order and the rule of law, while others fear an Orwellian police state suffocating Main Street and thus adding to geopolitical risk.

But turning from Main Street to Wall Street, most of us veteran free-market thinking “elites” can agree that capitalism, as we once knew it, left the building in 2008 when the Fed unofficially took over the reins of what was once natural supply and demand and printed so much money to support the banks that we effectively created “Wall Street socialism.”

My open opinion on this topic and larger geopolitical risk is no secret. I was in Germany when the wall came down in 1989, and we were all relieved to see centralized states like the Soviet Union crumble.

But when I fast forward two decades to see the Federal Reserve kidnap the stock and bond market in the name of “economic recovery,” I cannot help but bemoan the ironies.

The Fed is now its own economic Politburo. Meanwhile, revered “capitalists” like Jamie Dimon and other so-called elites are openly caught in price-fixing scandals. This is not capitalism folks.

But nothing in the U.S. comes even close to the Chinese when it comes to geopolitical risk, who are far more accustomed to dystopian norms, police-state violence and population control/surveillance.

Desperate times often invite desperate measures, and China has been desperate for generations.

This national red Ponzi Scheme is in debt up to its ears, with a debt to GDP ratio that surpasses 300% as its GDP hits 30-year lows in the mountainous backdrop of $40 trillion in debt.

In short, China has a lot to control and lose, which may explain its growing use of facial recognition measures and social scoring where citizens who criticize the government can immediately lose “points” and thus travel rights, personal freedoms or even an ATM card.

Let’s hope that such desperation and geopolitical risk doesn’t lead to cop-out distraction-solutions, such as more saber rattling in the S. China Sea… After all, war has often been the last resort of broke sovereigns, and for some countries, even good for the stock market.

Summing Up

Regardless of one’s politics, wealth, zip code, optimism or cynicism, we can all agree that the world is teetering toward increasing unrest and thus geopolitical risk, and I haven’t even mentioned Iran…

For investors, however, such global macro concerns and realities as to geopolitical risk cannot be ignored or glossed over from pundits on the left or right.

My crystal ball as to such geopolitical risk is no better than yours, but each of us needs to at least be aware of the issues that surround us and plan accordingly.

I am not suggesting global revolution is around the corner, nor am I convinced that we are living in the best of times.

Any number of scenarios, from the sublime to the ridiculous, bull to bear, can and will be played out in the years ahead.

That’s why we watch the moods of the world as well as the markets of the world; not so that we can predict the future, but so that we will know what signs, and hence allocations to make, as that future plays itself out.

Our aim is not to be psychic, but simply prepared. Understanding geopolitical risk is just one component of this preparation.

Today, we are surrounded by political, military and economic hotspots at every corner of the globe, from North Africa to South America.

Nor can we blame all of these red flags of geopolitical risk on the trade war, which even the IMF admitted accounts for only .8% of the slowdown in global GDP.

The fact, for example, that car sales in India tanked by more than 40% in 2019 had nothing to do with Trump and China.

Instead, this is just one of countless signs that the real economies of the world are tanking as US and even European markets are hitting new highs.

Please don’t confuse market highs with economic strength or smooth waters ahead.

Instead, simply consider the data on geopolitical risk and watch the markets for signals, bull or bear, peace or war.

However it plays out, we’ll be tracking these signals for and with you. In short: You’ll be prepared.

6 responses to “Insider Secrets: Geopolitical Dangers You Must Consider”

- dave swansonsays:

This is the first of your reports I’ve read so you may have covered this question in previous releases. What are your thoughts on a world wide return to asset backed currencies (a gold standard), a complete rejection of fiat money?

- Martyn Sinclairsays:

As a U.K. citizen , whilst I would love to see a different central bank governor , we are nonetheless stuck with Mark Carney not Michael Carney .. I’m sure Michael could do a better job though!

- Edouard d’Orangesays:

“It was not an altogether uplifting conversation…” Is that ever an understatement. Topics: Wealthy apprehensive about wealth inequality, U.S. Federal Reserve printing more and supporting markets, the world (ex U.S.) angry at U.S. dollar hegemony, dollar destabilization and general unrest and state control. Is there a single positive aspect in the world and economies?

- Barry Yagersays:

Great, well rounded overview of today’s economic outlook.

Thanks

- Signals Matter Infosays:

Arg— yes Mark not Michael Carney— apologies to my neighbors in the U.K.!

As for the Fed, I’ll just stick to my view that it will bring more harm than good, but this is impossible to see right now during continued “stimulus” and stabilization. What some see as a solution is seen by us as a very effective bandaid. That said, I respect the corner the central banks got themselves into (more debt to save the markets —vs GDP and the real economy—and hence no choice but to keep the cost of that debt —i.e. rates—artificially repressed until the bond market implodes under the growing weight of natural market forces, which like the laws of gravity, always prevail, even against central banks). The Fed is not evil, simply doing its best, but it’s mandate from President Wilson to today was never to float the entire economy or market, but provide liquidity for banks. They’ve been asked to do far more than what any enterprise can sustain. I genuinely respect that sad irony placed upon Powel.

In the interim, knowing the big picture is a critical part of knowing where and how to invest. But we hear you and will answer the call very soon!