Below we examine a credit market losing all credibility as rising bond yields, like rising-rate shark fins, circle in for the kill.

Treasuries Matter for the World Un-Deserved Currency

The yield on the 10Y UST is known by most investors to represent the real cost of capital/borrowing.

In short, it is the most important yield in the world, as it prices the cost of the world’s reserve (undeserved) currency.

Thus, when the yields rise, the cost of debt rises, and in a world awash in USD-denominated debt, such rising yields are like approaching shark fins to stock and bond markets.

Yields, of course, rise when bond prices fall; similarly, yields fall when bond prices rise.

Thus, markets like to see strong and natural bond demand to keep yields low and markets healthy.

Recently, there have been signs of rising demand for UST’s, which should be good for the bond markets, right?

Well, not so fast…

Head Fake in the Bond Markets

Recent numbers from the Treasury International Capital (TIC), for example, indicate that YTD foreign investment/demand in 8-month USTs has reached a solid $556B.

Does this mean that Powell and Yellen’s deliberate plan to rase rates and strengthen the USD has succeeded in enticing foreign buyers (suckers?) to purchase US IOUs as the proverbial best horse in the international glue factory of otherwise negative-yielding sovereign bonds?

As hinted above, the answer is no.

But given such ostensible rising foreign demand for Uncle Sam’s IOU’s, shouldn’t bond prices be rising and hence yields and rates falling to more comfortable/affordable levels?

In fact, yields on the 10Y UST are fatally climbing—so what gives?

Well, the hard reality is that USTs are in fact unloved and oversold rather than in high demand and overbought.

Hedge Fund Demand is Capricious Demand

And as to the TIC data above, it’s worth noting that a lot of that foreign bond buying has been coming in via the Cayman Islands, which (if my hedge fund memories with offshore docs serves me correctly) suggests that most of those foreign buyers are (US) hedge funds rather than global central banks.

This distinction is critical.

The profile of money managers and hedge fund buyers is not that of long-term political holders or true believers in UST’s.

Instead, the money managers are buying USTs to arbitrage FX positions and lever quick returns—i.e., pump then dump rather than buy and then hold.

Foreign Bond Demand Just Aint There

The more alarming issue in the Treasury market is the lack of buying interest from central banks, all of which suggests that the real, sticky and once politically-dependable buyers of Uncle Sam’s increasingly unloved IOUs are no longer drinking the US Kool aide nor trusting Uncle Sam’s bar tab.

The trader in me feels strongly that the hedge funds and money managers buying USTs to hedge FX positions today will be net sellers tomorrow because the USD is just too strong, rates are just too high and hence the bond market is just too broken.

As warned above, more selling (and hence supply) of UST’s means rising shark fins approaching your markets.

How to Keep the Rising Shark Fins (Rates) Away?

In simplest terms, these deadly fins won’t go away until the USD weakens and rates are paused and then cut.

Until then, the US bond market will be too scary for sticky money.

Meanwhile, the Tightening Continues—And Hence the Shark Fins Multiply

Another reason bond yields are rising and bond prices are falling is that the Fed is not only raising the Fed Funds Rate, it’s also tightening its balance sheet—which means it’s dumping treasury supply into the open market.

This new tidal wave of bond supply pushes bond prices down and hence their yields (and rates) painfully north. In short, the shark fin is getting bigger and faster.

Cue the Jaws music…

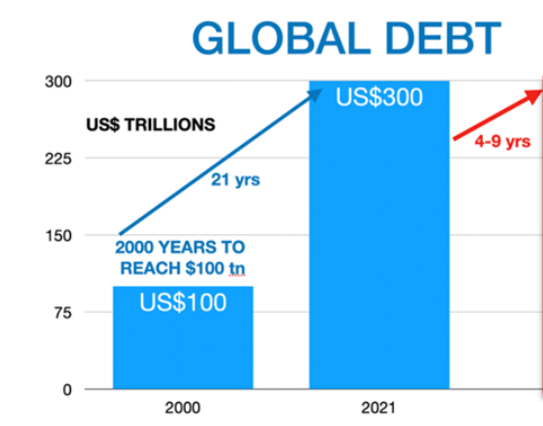

Folks, rising rates (i.e., the cost of debt) are no joke in a world that lives atop the biggest debt bubble in recorded history…

Foreign Holders of UST’s—The Great White Shark Just Below the Surface

What’s even scarier, in my opinion, is the bigger picture (and shark) behind Uncle Sam’s unloved IOU’s, namely the $3.9T worth of those bonds currently held by other foreign nations (think China, UK, Japan, EU etc.).

As I see it, a lot more of those USTs are about to get dumped.

As winter gets colder and energy gets scarcer, and as the intentionally strong and weaponized USD unloads more and more inflationary, debt and currency pain upon America’s foreign enemies and friends alike, many of those duped/wounded countries holding UST’s today will be selling them this winter to keep from freezing as their currencies melt away beside a hot Greenback.

Like Japan, more and more nations will be forced to dump more and more USTs to strengthen their own currencies (which the deliberately rate-hiked and hence strong USD have crushed), so that they will in turn be able to buy oil and gas from the East.

Hmmm…it looks like all those sanctions and strong USD ideas in February are backfiring as predicted at even greater speed, no?

I wonder how smart (and poorer) the Germans and other NATO partners are gonna feel come winter as those energy prices spike and their Dollar-crushed currencies tank?

Like Japan and the UK, the EU’s ECB will eventually both pivot to QE and dump USTs to strengthen their Dollar-bullied currencies and find some cash to buy energy.

Already, and outside of the EU, the Swiss National Bank is begging for (and receiving) billions in Fed swaps (i.e., USDs).

As more countries dump UST’s, their yields rise and hence their rates rise, causing even further harm to a debt-soaked nation, Main Street and securities market.

From Sharks to Pyromania

As warned so many times, the ticking timebomb of both US and global debt is a like an open barrel of gasoline to which rising yields and rates, described above, are an obvious and slowly approaching blowtorch.

As the hawkish (and apparently pyromaniac) Fed sends global markets and USTs into a tailspin, the debt gasoline and rising yield/rate blowtorch will collide; thereafter, the entire and debt-soaked global system slowly burns alive.

The dangers of an oversold Treasury market are thus not fables but credit market facts, facts which a cornered and desperate Powell and others will ignore until their fingers (and our economy) are already burned.

At that point, of course, and always two steps too late, the Fed too will pivot toward its openly inflationary money printers and flip from hawk to dove almost as fast as precious metals go from south to north.

Will more QE save the West? Yes, but Hell No…

Well…Yes but No.

Money Printers, as Powell knows, can theoretically save everything and every market—from stocks to bonds to Malibu real estate–except they can never save the purchasing power of the underlying “money” they print or the markets they “accommodate” or inflate.

In the end, and as even a young and once honest Greenspan admitted long ago, printing money can benefit markets, but too much of it kills currencies (and sends gold to the moon).

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” –Alan Greenspan

For now, frustrated yet macro-conscious gold holders must wait patiently at the launch pad as Powell’s inevitable pivot from tightening to easing (and a high-rate strong Dollar to a low-rate weak Dollar) follows a percolating yet inevitable global credit crisis.

This new wave of printed (worthless) money, of course, sends gold up, up and away.

Gold: Still Waiting on the Launchpad

But gold hardly feels up, up and away today. In fact, the stress levels on the gold price have rarely been higher.

I’ve endeavored to explain gold’s current headwinds in macro terms on numerous occasions, all of which boil down to an un-naturally manipulated and strong USD as well as a totally (yet legally) rigged COMEX trade.

Backward Games and Backwardation

For those, however, looking at technical hints, history and signals from the derivatives casino, the set-up for gold is quite interesting of late.

In fact, gold seems as stressed as ever—or at least as stressed as it was in 2015.

The COMEX athletes, for example, will remind that 1st to 2nd month gold contract backwardation has reached levels not seen since late 2015, when the gold cycle reached the December low of just over $1000/oz.

Translated into basic English, this backwardation means that the offer price of contracted gold is lower than the current bid.

Paper Fiction vs. Physical Reality

From where we sit in Switzerland, however, the physical story looks a lot different than the fictional story on the COMEX.

According to the World Gold Council, for example, physical gold exports out of Switzerland and into Turkey, China, the UAE and India are ripping.

This disconnect between physical reality and paper fiction is nothing new…

If the physical purchase of gold is ripping at a pace of 100% monthly mining supply, why would the paper gold price be going backward in the futures market?

Well, as we’ve written many times before, the COMEX market papers over reality for a living—that is, a handful of bullion banks levers a permanent short against all other long contracts to artificially repress the paper price.

This is done to keep the spot price from embarrassing otherwise worthless paper currencies from the pound to the Dollar, the Yen to the euro.

As also written, however, the days of this shell game of open fraud at the COMEX are numbered as derivatives markets march toward a crisis of both credit and credibility.

For now, current backwardation appears to be signaling a gold bottom and hence an opportune moment to acquire gold for long-term, informed precious metal investors.

By the way, why do you think all those other nations are buying gold rather than USTs?

Just saying…

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.