Below we revisit the key sword by which markets shall both live and die: Unsustainable U.S. debt.

Rather than write something new on a topic that never improves, I decided to cheat.

That is, I dug up an article I published just under one year ago to remind us that the more things change, the more they stay the same.

Or in the case of unsustainable U.S. debt, the more things change, the more they get even worse…

And when it comes to unsustainable U.S. debt, I’ve simply updated last year’s 2019 report by occasionally adding new data/commentary in bracketed [ALL CAPS] along with some updated graphs for 2020.

This means that we can plainly see that what was true yesterday about unsustainable U.S. Debt is just as true today, an even worse for tomorrow.

As importantly, it becomes clear just how predictable central-bank-driven markets truly are.

So, here we go, last year’s report through today’s lens…

The Financial Media vs Debt Realism

December 4, 2019

As markets reach for new highs, no one (especially the financial media) is seeing the debt storm on the ground.

49 shares

The U.S. has crossed the debt Rubicon of no-return yet all we see in the headlines is, well… gibberish.

[THAT CERTAINLY HASN’T CHANGED. MEDIA GIBBERISH IS NOW A MAINSTREAM INDUSTRY—AS MEDIA OPTICS TILT DELIBERATELY TOWARD RISING STOCK MARKET DATA WHILE IGNORING DECLINING REAL ECONOMY DATA.]

In the spooky world of intel and clandestine services, we are trained to spot liars not by what they tell us, but mostly by what they don’t tell us.

It’s a fairly common trick used as well by the Fed’s PR department, namely the mainstream financial media, which has as much to do with investigative journalism as Dr. Seuss has to do with complex brain surgery.

This cadre of financial media prompt readers, left, right and center, learned long ago to tow the “be calm, carry on” line by ignoring the obvious (i.e. a massive national debt cancer) while focusing on the hype (i.e. the latest stock to hit new highs).

The rest of the mainstream financial media is little better. They deal in distraction and infotainment not realism.

[AGAIN, NOTHING NEW UNDER THE SUN, AS MY RECENT REPORT ON HOPE VS. FACTS REMINDS…]

As the financial media ruffles its collective feathers making opinions, rather than analysis, their top priority on everything from the Impeachment hearings to Prince Andrew’s party plans, they are literally ignoring the most dangerous headline of all: The US is drowning in debt.

In fact, “drowning” is not the right word— “sunk” is a better description.

The Debt Truth

I know. Debt is boring. It’s just a number. Billions here, trillions there. Whatever. It can’t be all that bad, right? The financial media gives it no real attention.

The interviewed experts on the financial media must know what they’re doing, because, hey, they wear nice suits, speak well on TV and went to fancy schools.

Besides, the stock market is ripping. Everything is fine. Be calm, carry on, right?

Wrong.

What those financial media prompt readers and politically-appointed experts are failing to tell you is very simple: No country with debt levels as high as ours can thread this needle safely.

In fact, no country (or empire) in the entire history of the world ever has. Period. Full stop.

So, what do the financial media “experts” do instead?

They ignore both history and math, and look to a magical money printer to bail us out of every problem, from mounting and unpayable pension plan benefits to a war here, bailout there, and broken repo market somewhere in the middle.

[AGAIN, NOTHING NEW WHEN IT COMES TO DELIBERATE DISTRACTIONS OUT OF DC AND THE MEDIA TO KEEP OUR MINDS OFF THE DEBT ELEPHANT IN THE ROOM.

DISHONESTY, OBFUSCATION AND DELIBERATE “TWEEKING” OF DATA ARE IN FACT FED POLICY TOOLS, AS WE RECENTLY EXAMINED HERE.]

But most of us know that printing money out of thin air to solve any and every budgetary, military, monetary, and social woe is not a long-term solution but a short-term fantasy masquerading as a recovery.

Meanwhile, and in this backdrop of renewed calm, we melt-up straight toward a perfect storm of debt-driven complacency enjoying the Phase 3 Fantasy Cycle that always precedes the Phase 4 Moment of Uh-Oh..

But here at Signals Matter, we spend our time doing the math rather than the spin from the financial media.

Basic Math is Better than Financial Media Adjectives

Over the weekend, we sat down to do a little year-on-year number crunching, which I’ll share with you now.

First, the October 2018 to October 2019 budget numbers just came out, and folks they tallied an increase of 34% year-on-year. Twelve-month deficits just crossed the trillion-dollar mark of red-ink for the first time since 2013.

Headline response from the financial media? Crickets. Nothing. Nada. Nichts.

[BY THE WAY, IF YOU THOUGHT 2019 DEFICIT DATA WAS SCARY AT CROSSING $1 TRILLION, THE DEFICIT DATA FOR 2020 IS ALREADY AT $3 TRILLION+ AND THE YEAR ISN’T EVEN OVER YET.

AGAIN, THE MORE THINGS CHANGE…THE MORE THEY GET WORSE.]

Instead, our esteemed financial media was taking sides on everything from the Jeffery Epstein suicide to presidential impeachment odds, while our national deficit slumped with a gun to its ignored head.

Meanwhile, our country just borrowed another $1 trillion dollars without fanfare.

[REMINDER, THIS YEAR WE BORROWED AND PRINTED TRILLIONS MORE.

FUN FACT, IT TOOK THE FED 80 YEARS FROM ITS IMMACULATE CONCEPTION IN 1913 TO PRINT ITS FIRST TRILLION DOLLARS. IN 2020, THE FED PRINTED 1 TRILLION IN JUST 5 MONTHS.]

This latest trillion is dangerous, not just for its sheer size, but also for its bad timing.

You see, the stock markets in October were reaching new highs thanks to renewed money printing to bail out our Treasury markets.

Furthermore, by October, we were already in month 124 of the longest business expansion ever recorded.

With the financial media headlining record-high markets and “business expansion,” why then, did the U.S. need to borrow another $1 trillion in the span of twelve months or add another credit facility of equal amount to the repo markets in the span of 90 days?

[AND THIS KIND OF “EMERGENCY-MEASURE” BORROWING WAS BEFORE COVID!

HENCE OUR REPEATED REMINDER THAT THE US WAS ALREADY DEBT SICK BEFORE COVID BECAME THE MOST RECENT EXCUSE FOR MORE UNSUSTAINABLE U.S. DEBT.]

Fake Calm, Real Debt

The answer is simple: We are broke and thus rely on borrowing (i.e. issuing bonds) to stay afloat.

[NO BIG SHOCKER THERE…)

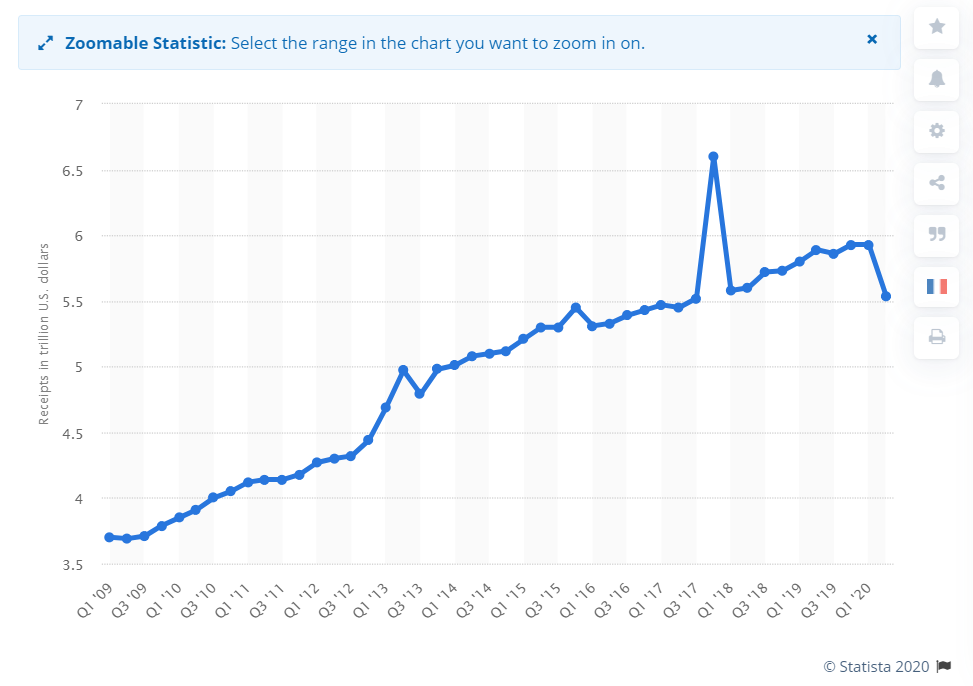

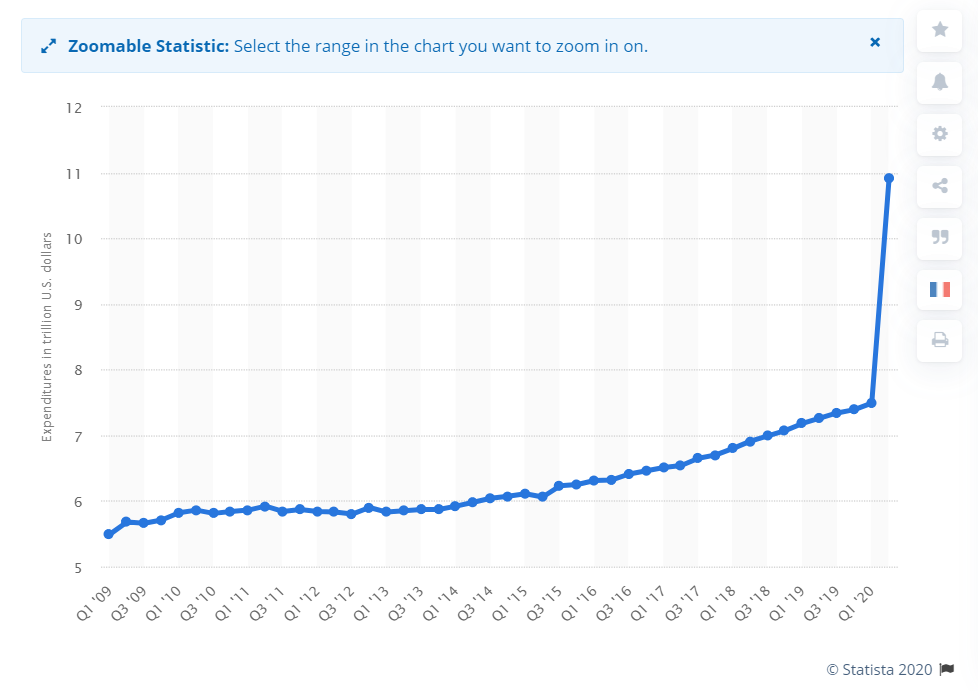

Don’t believe me? Well here are the numbers for October 2019 which the financial media largely ignored. The U.S. took in $3.4 trillion in receipts but then found itself staring down the barrel of $4.4 trillion in outlays (expenses).

[WELL FOLKS, AS WE RECENTLY REPORTED HERE, THE DATA FOR 2020 IS EVEN WORSE.

THE OFFICIAL NUMBERS FOR Q2, 2020 (WHICH THE MEDIA, AGAIN, LARGELY IGNORED) CAME IN, TELLING US THE U.S. TOOK IN $5.4 TRILLION IN RECEIPTS…

BUT FINDS ITSELF STARING DOWN THE BARREL OF $10.91 TRILLION IN OUTLAYS/EXPENSES…

SEE WHAT I MEAN ABOUT UNSUSTAINABLE U.S. DEBT?

IN SUM, WHAT WE WARNED ABOUT 1 YEAR AGO HAS ONLY GOTTEN MUCH, MUCH WORSE.]

Net result? An additional $1 trillion in annual deficits, thus adding to our already nosebleed national debt to the tune of $23 trillion as of November.

[TODAY, OCTOBER 13, 2020, THE U.S. DEFICIT STANDS AT $27.1TRILLION. FOLKS THAT’S A $4+ TRILLION DOLLAR INCREASE IN LESS THAN 12 MONTHS.]

As importantly, if we are taking on debt like this in month 124 of the “good times,” just imagine what kind of borrowing and debt we will be taking on in the bad times, which the Fed has not yet outlawed?

[NEEDLESS TO SAY, WE DIDN’T HAVE TO WAIT LONG FOR THOSE “BAD TIMES” TO IMAGINE THAT KIND OF DEBT AND BORROWING GETTING WORSE, AS COVID CERTAINLY CAUGHT OUR DEBT FRAGILE MARKETS AND ECONOMY OFF GUARD IN MARCH OF 2020…]

Folks, the facts speak for themselves rather than for the financial media content editors at CNN, CNBC or FOX.

We live on debt and our markets, supported by the Fed, live on printed money to buy otherwise unwanted debt.

That’s a recipe for long-term disaster.

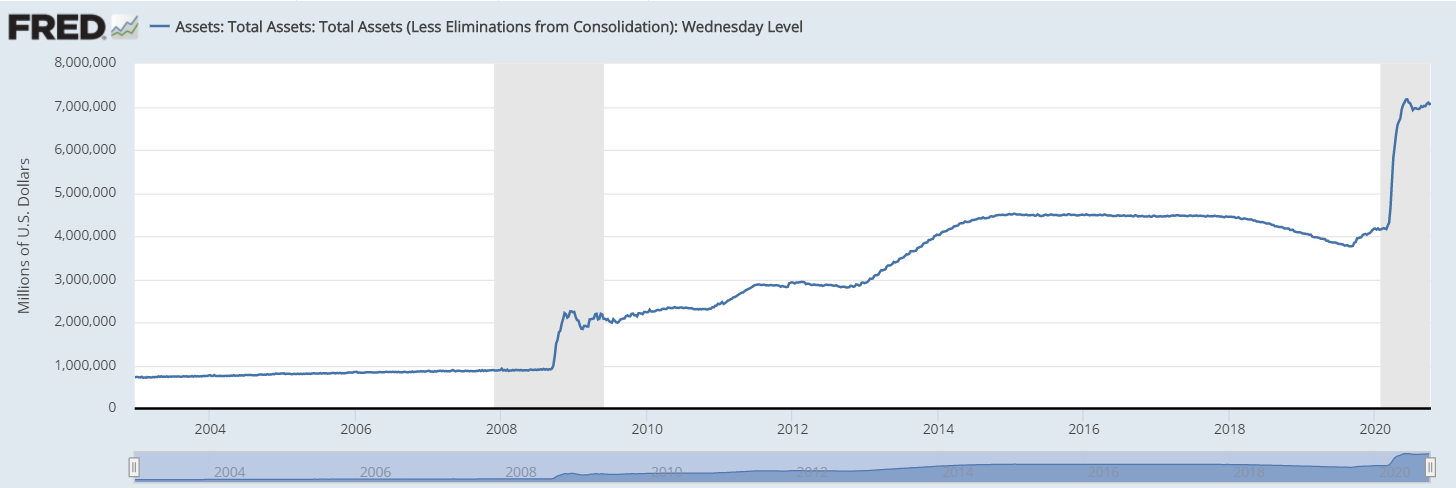

[AND SPEAKING OF LONG-TERM DISASTER, JUST LOOK AT THE KIND OF FED-SUPPORT THE MARKETS GOT WITHIN 7 MONTHS OF MY WRITING THIS “REVISTED” REPORT…UNLIMITED QE AND MORE MONEY PRINTING IN THE SPAN OF MONTHS THAN THE U.S. SAW IN THE SPAN OF YEARS FOLLOWING THE GREAT CRISIS OF 2008.

NOW THAT’S WHAT I CALL MONEY PRINTING…FAR MORE THAN I EVER DREAMED OF JUST ONE SHORT YEAR AGO WHEN I FIRST PENNED THIS REPORT.]

What to Expect—No Choices but More “Stimulus”

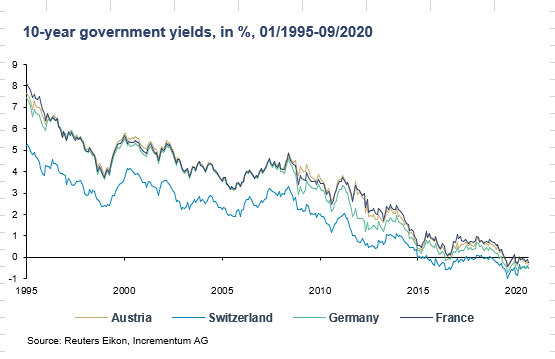

Given that the US now lives off debt and prints its own dollars to buy its own debt (what the fancy lads call “debt monetization,” but the rest of us call “faking it”), it goes without saying that the Fed, the financial media and Uncle Sam are desperate to keep the cost of that debt low—which means they have no choice but to keep rates low.

No choice at all.

[WELL…RIGHT AGAIN. RATES HAVE RETURNED TO THE ZERO-BOUND, AS WARNED. IN FACT, YIELDS AROUND THE GLOBE ARE EFFECTIVELY NEGATIVE. THAT’S A SCREAMING INDICATOR OF DESPERATE RATE POLICIES GONE MAD:

And the only way to keep rates low is to push bond demand (and prices) up. Since natural demand no longer exists, they have to create artificial demand—i.e. the Fed printing money to buy unwanted Treasuries.

This, of course, is a pure scam, but it’s officially lauded by the financial media under fancy terms like “easing,” “accommodation” or “monetary support.”

This means that you can expect more money printing to come–a lot more.

[RIGHT AGAIN…SINCE I WROTE THIS REPORT, THE FED HAS NOW TAKEN ON UNLIMITED QE.]

Why? Again, because we literally have no choice at all.

The numbers just confirmed that the U.S. is a debt-driven monster supported by printed money to sustain the only tool we have left to keep the lights on: a rate-suppressed borrowing binge (aka debt bubble) supported by printed, fiat dollars and lauded by the financial media as a “recovery” or “solution.”

How Long Can Faking-It and Financial Media Spin Work?

The trillion-dollar question, as always, remains the same: How long can we print, borrow and spend before the “Uh-Moment” phase follows the “Fantasy” phase?

[NEEDLESS TO SAY, THE UH-OH MOMENT PHASE CAME IN MARCH, AND BY APRIL AND MAY OF THIS YEAR, WE GOT MORE OF THE FANTASY PHASE—I.E. MORE UNSUSTAINABLE U.S. DEBT AND UNLIMITED QE.

The short answer for now is equally blunt: We don’t know.

The Fed is now in a perfect lose-lose-lose scenario. They can’t “stimulate” forever, but they also can’t keep the market up without stimulus, as last December’s market disaster confirmed.

Meanwhile, Wall Street uses cheap debt to buy its own stocks rather than invest in CAPEX, so Main Street will get hammered even more when the next market crash hits. Nothing new there…Of course the Financial media has mostly ignored such realities.

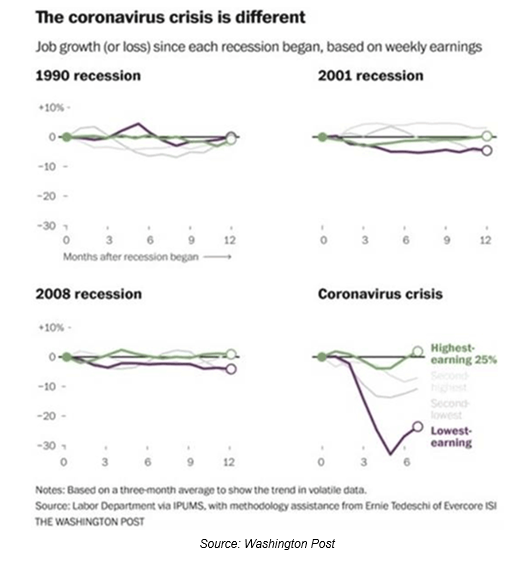

WELL FOLKS, WHAT CAN I SAY…WE GOT THAT RIGHT AGAIN. AS WARNED IN 2019, MAIN STREET ALWAYS TAKES IT HARDEST WHEN A DEBT-SOAKED ECONOMY AND FED-SUPPORTED MARKET HITS A REALITY CHECK.

AS WARNED, LET’S LOOK AT THE FOLLOWING 2020 GRAPH REGARDING THOSE HARDEST HIT BY THE CURRENT ECONOMIC RECESSION:

The entire Fed experiment and market bonanza has been an equally open economic failure as we finish the fourth consecutive year of global economic contraction—a streak which began long before the trade war even started.

[AND LONG BEFORE COVID MADE THE HEADLINES.]

Many respected names in the hedge fund space are warning of a recession in 2020, others are predicting the pain will be postponed (via stimulus) till after the 2020 elections and thus likely hit in 2021.

But again, no one really knows–certainly not the financial media.

[WELL…WE GOT OUR RECESSION IN 2020 AFTER ALL, WHICH THE EXPERTS ARE PINNING ON COVID. BUT WE THINK COVID JUST BECAME THE PERFECT PRETEXT FOR ANOTHER MARKET BAILOUT…]

No one, that is, but the markets themselves, and they will tell those who know how to listen what to do and when to do it.

Only Mr. Market Knows

That’s why we track market trends, rates, spreads, yield curves and data rather than a financial media of 20-something journalists who studied marketing and click-bait SEO tricks rather than markets and bull-traps.

All we can do now is translate the markets’ daily, weekly and monthly reactions and warnings and then report back to YOU.

The dollar liquidity risks we spoke of here and the recent yield curve steepening discussed here are two extremely important signals otherwise totally ignored by the financial media dimwits.

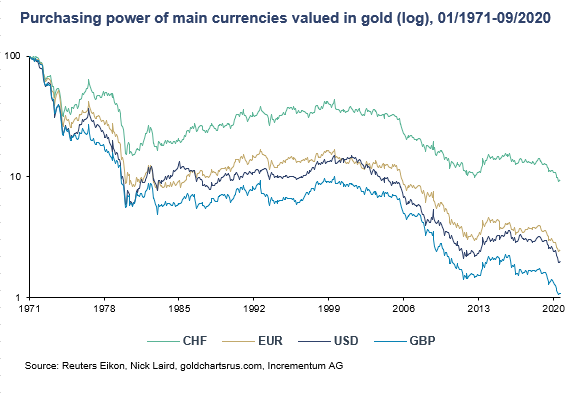

[AND AS FOR THE US DOLLAR, IT’S PURCHASING POWER, AS WARNED SO MANY TIMES IN 2019, JUST KEEPS GETTING WEAKER AND WEAKER:

But YOU are already deeply in-the-know as to the risks they imply and we face.

For now, however, the volatile melt-up is on, and thus so is the nervous party on Wall Street.

Our Storm Tracker cash recommendations remain a key component of managing such risks despite the seductive highs of late, and we urge you to click above and follow the same.

As the USD becomes worthless what do things look like from the eyes of modern Americans?

Would dollars be treated like unwanted grass clippings bagged and brought out to the curb for trash collection?

Would the IRS reject payment in dollars and demand payment in Community Service, coins or other properties…?

Would picking up old pennies found on the sidewalk be more profitable than finding paper dollars dumped on the same sidewalk?

Tell us Matt,

What is in store for us at the end of this Twilight Zone…

EZ…whwwww that’s a series of very important and good questions. Plus, I love the imagery you employ 🙂

Although not yet ready to join the ranks of Confederate currency circa 1865, the US dollar and frankly all the major global currencies, as you know, are backed by, well…nothing. The Fed is launching desperate new initiatives like the Fed Now accounts and other clever tricks to eventually force Americans to accept a government-like crypto alternative directly into their checking account as the USD slowly loses its role in one’s actual wallet. You already know my view on precious metals, and I recommend you check out the chart in my October 14 post as to where currencies have been heading ever since 1971 when Nixon took us off any gold standard–and thus fired the chaperone at the currency keg party that is now current policy in DC and Wall Street. I’ll post a link soon on this very topic, but my long-term belief is that a major debt and currency re-set is inevitable, and included in this will be some new form of government crypto backed by some ratio of gold. Even the Fed knows it can’t “re-set” one failed fiat system by simply replacing it with another “fiat crypto.” Thus, precious metals like gold (which central banks have been quietly amassing) is likely to have some new role in tomorrow’s crypto world when the dust settles and the rubble that was this absurd post-08 experiment ends.