Below we look at the latest data from the CBO (i.e. the Congressional Budget Office) and actually try to make it interesting…

The CBO’s latest report on our country’s national balance sheet is openly alarming and implies current as well as future debt levels that are beyond rational.

Reader beware: One really can’t make this stuff up. The numbers below come straight from the CBO…

Debt Matters

As I’ve repeated so many times, everything about the post-2008 market “surge” is based upon one word: DEBT.

In short: Debt matters. Debt buys a helluva party—until the bill arrives, and the Fed creates money to pay it.

I explained this paid-for market party in the following video link, here.

We, and our debt-soaked markets, now sit upon the greatest pile of horse-crap debt in our history, so the party on Wall Street has been a rager.

Again, debt matters.

By tracking debt data, investors are thus better equipped to track current and future market stability.

Boring CBO Reading, Sickening Facts

Driving back from a northern horse-town last week, I had hours to sooth my aching back and read while my son drove.

To help me sleep, I thought: “What better horse-pill than the latest budget report from the Congressional Budget Office (or CBO).”

But rather than put me to sleep, the CBO report made me car-sick…

Why You Need to Consider the CBO

The CBO may not be on your (or advisor’s) radar when it comes to portfolio thoughts or the bigger debt picture looming behind the volatile market moves of Q4.

But folks, what the CBO is saying (or not saying) is of critical importance, so buckle-up…

One of the CBO’s key roles is to measure, report and project spending vs. revenue on a national scale.

It’s the same thing normal folks would do at a household scale when looking at their income and then their expenses, including past-due bills.

That is, you consider your revenues against your costs, and plan accordingly.

Normal folks engaged in such tasks make reasonable assumptions about what they can and cannot do based on reality and common sense, or income vs. expenses.

Enter Mr. Big Shot

For example, if you have a bus-boy income, you would not likely be looking for a loan on a new beach-front home in St. Tropez or the latest Range Rover SUV.

Most folks just heed basic common sense and financial reality. In short: They live within their means.

Nor would you sit down with your spouse, partner or kids and say, “Hey, I think that beach-front home is prudent because I’m projecting my income to grow by massive amounts next year, debts be damned.”

That kind of thinking is pure “Mr. Big Shot” thinking…

If your spouse asked you the reason for that projection, and your only response was, “I’m just making it up as I go,” well, he or she would probably walk away from the dinner table.

Furthermore, if your Mr. Big Shot job was looking shaky due to a recession, and if employment assurances weren’t exactly robust, then making such Mr. Big Shot projections for a “hopeful” mega-boost in your income would be a bit reckless, no?

In short, a guy over-spending like Mr. Big Shot on a bus-boy salary is not exactly smart, no? And even if he got a loan, how would he pay for it?

If the above Mr. Big Shot scenario sounds a bit silly, I get it. I mean really, who thinks and acts this way?

The Congressional Budget Office—Dummer than Mr. Big Shot

Well, sadly, your own Congressional Budget Office does. Like the famous line from Top Gun, your government is literally “writing checks its body can’t cash.”

In other words: the US is spending wayyyyyyy more than it earns.

Net result: We are in debt up to our ears—and about to go much deeper.

To let this sink in, let’s move from my fantasy Mr. Big Shot scenario to basic DC math, ok?

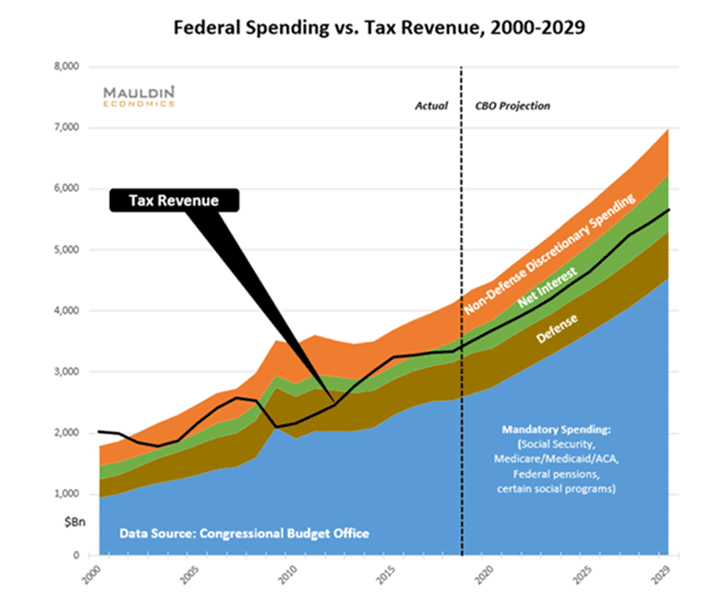

Compliments of John Mauldin, below is a chart which maps out US tax revenues against US expenses, both current and projected, as provided by the CBO in pre-COVID 2019.

The black line denotes U.S. tax revenues, everything else denotes U.S. expenses.

Ok, so what are we seeing here?

First, let’s remind ourselves that I’m not making this crazy stuff up—this is coming straight from the CBO.

What DC is assuming above is as close to pure fantasy as a government agency can go without being categorized as fiction authors.

In 2019, the CBO was projecting that government deficits would hit $25 trillion by the end of 2021. For whoever wins the White House, this number won’t change much. In fact, it will be worse.

The CBO was also telling us in 2019 that total debt will hit $30 trillion by the end of the decade. (They’ve added another 10 trillion since then…)

Keep in mind, moreover, that none of these deficit projections includes state deficits (around $3 trillion and rising) or the already near bankrupt swath of pension funds teetering for all the reasons I explained in detail here, here and here and here.

Furthermore, the CBO’s projections are assuming that in the next 10 years, recessions will be outlawed, pandemics obsolete and war will never creep up to cause any further rise in projected expenses.

How wonderful.

But, a bit niave, no?

Furthermore, that was in 2019. How has the CBO adjusted its projections based on the miserable 2020?

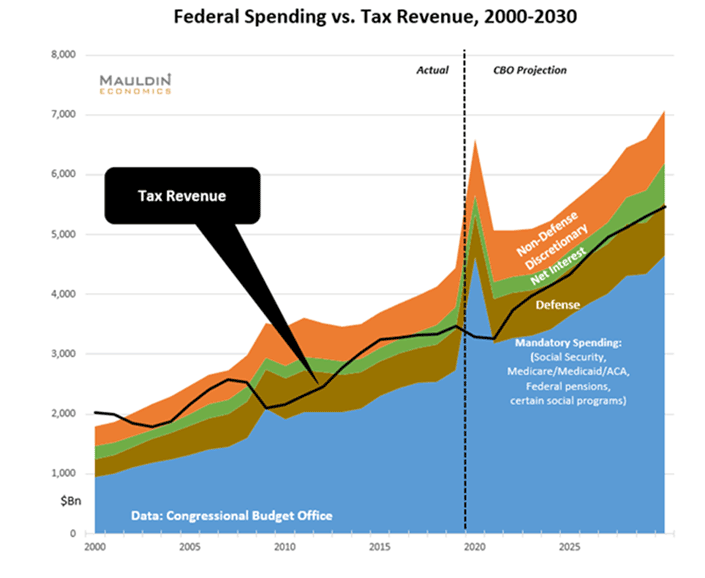

Well, here you go:

Let’s break this down together and do a little fiction review…

First, you’ll note the big spike in “Mandatory Spending” to cover all the emergency loans, unemployment benefits and other massive expenses which the COVID crisis cost us.

But look a bit more closely.

You’ll note that the CBO forecasts only a slight dip in tax revenues, following which the CBO is forecasting a massive upward slope in revenues as if everything will simply get back to “normal”—which, as I’ve shown here, was never “normal” anyway…

This V-shaped recovery in the CBO budget projection (I.e. office of creative writing), like my example of Mr. Big Shot above, is based on hope, not facts on the ground.

Furthermore, even if the V-shaped recovery in revenues were to occur, you’ll note that it still doesn’t cover all our debts and barely covers Mandatory Spending, even in a best-case scenario.

Getting deeper into the weeds and math behind these projections, let me report what it all boils down to for you.

Our Non-Fiction Review of the CBO

Basically, the CBO is assuming U.S. revenues will drop by 4.8% in 2020, and then another mere 1.2% percent in 2021.

Thereafter, they are projecting a magical 14.8% super-surge in revenues for 2022.

Really?

Yep.

Basically, the CBO is assuming that the recession we are now in (and heading deeper into) is a minor blip.

But let me remind realistic readers that by comparison, in the 2008 Crisis, we saw revenues fall by 16.6%, not 4.8%, so perhaps the CBO is ignoring a tad bit of reality, no?

What’s also worth a jaw-dropping moment is that the CBO is actually projecting that revenues from payroll taxes will rise this year, despite 900,000 Americans per moth seeking unemployment coverage.

So how can the CBO be this, well, dumb?

Justifying the Dumb—An Excuse for More Debt

Well, the simple fact is that the CBO has a mandate to be optimistic, and like the BLS (Bureau of Labor Statistics), this forces them to be creative—i.e. “bend the truth” to keep a fantasy image moving forward out of DC.

I’ve shown here and here how the BLS essentially lies about such things as inflation and employment to keep our national debt binge going based on the fantasy that inflation didn’t exist and that it can be controlled going forward.

The CBO is no different. They like to tell warm and fuzzy tales. It gives Congress and the Fed a lot of Mr. Big Shot confidence despite harsh facts that we are broke.

By getting “creative” with revenue assumptions, this allows Congress to presume it will have the projected funds to wrongly justify even more debt than any rational policy maker would deem sane.

But as most of us realists, red, green or purple, can sadly admit, nothing out of Congress has felt sane for years…

The CBO, tasked with fantasy to allow more nightmarish debt, is literally projecting that US revenue will grow unabated from 2022 to 2030.

Don’t believe me? Just look above. It’s the CBO out in DC who is making this stuff up, not me…

Folks, the last time we saw actual growth like that was in the 1990’s, and trust me, this aint the 90’s…

More to the point, in the 1990’s, our Fed balance sheet was below $600B rather than today’s $7 trillion, and our national debt was a mere shadow of where it is today.

Furthermore, the CBO bases this uninterrupted revenue surge on uninterrupted GDP growth (!!).

This ignores the fact that in Q2 of this year, GDP tanked by over 30% Year-on-Year, and prior to that, was annualizing at a pathetic growth rate of less than 2% since 2008.

So, where is this magical GDP gonna come from? Papa Smurf perhaps?

In other words, what the CBO is assuming, and handing Congress, is literally pulp fiction.

Get Ready for Astronomically More Debt

Needless to say, the CBO’s revenue projections are nonsense. Hard stop.

This means that to cover the rising expenses heading our way, the US will need to go into even more dark holes of debt.

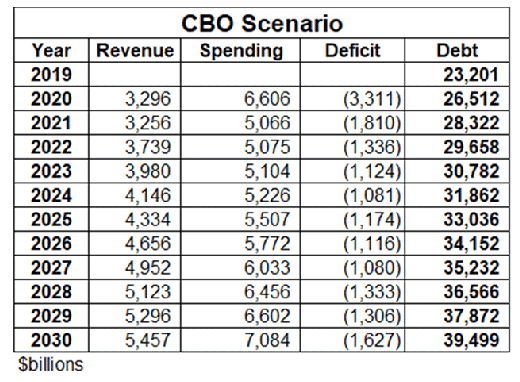

Government debt for 2020 will likely exceed $26 trillion when our fiscal year ends tomorrow, on September 30th.

Today, the CBO is itself predicting that by 2030, that debt level will rise to $39 trillion, not the already staggering $30 trillion in forecasted just 1 year ago:

Like John Mauldin, however, I think the official (and revised) CBO debt projections will realistically be even higher—closer to $50 trillion by 2030.

And that’s me being conservative.

If you add 2% to the CBO’s newest annual deficit projections (i.e. if you add a sense of realism rather than fiction), the real debt number ahead is indeed over $50 trillion, which, again is likely a conservative estimate based upon prior deficit growth rates in recessions.

In short, our government deficits will likely hit $50 trillion well before 2030.

Folks, trillions really do matter. At a dollar a second, it would take 34,000 years to reach one trillion.

Think about that.

How to Pay for This Much Dumb?

Well, the only way to pay for more debt is for Uncle Sam to issue more IOU’s—i.e. Treasury Bonds.

But who is gonna buy bonds that yield next to zero today, and below zero when adjusted for inflation?

Well, the Fed, of course.

But where will the Fed get the money to buy our own debt?

You already know the answer…

Break out the money printers folks, for MMT, the absurd fringe theory that a money printer can solve every debt crisis, is coming to a mainstream zip code near you.

MMT and unlimited QE is based on the comforting, fairytale assumption that unlimited fiat currency created out of thin air has no impact on inflation or the purchasing power of the dollar in your wallet.

But hopefully, based on reports like these here and here, you know better than that…Inflation is real, not extinct.

Bottom Line: Trust Facts Not Open Fantasy

At Signals Matter, we separate facts from fiction every week with blunt reports like this one.

We are not bears looking for a feedback loop of more bearish ideas.

Instead, we are simply realists translating core math from boring and often dishonest projections like those which slither out of DC and Wall Street on a now regular basis.

Nor do we have a political dog in this hunt. Regardless of party, we’ve seen open lies and a rigged to fail system operating from the inside of Wall Street and DC for years.

Again, DC had lied about inflation and employment long before COVID hit, and Wall Street, using bogus accounting and other reporting tricks, has lied about profits and earnings with equal and shameless panache.

Distortions of truth, as well as markets, can last for as long as investors chose to believe in such fantasy.

We are not here to time faith in fantasy nor dig up heads otherwise buried in the sand.

What we can do is repeat this simple warning: Debt can only save markets already driven by (and drowning in) debt for as long as the cost of that debt (i.e. interest rates) remains stapled near zero.

In short, interest rates determine everything, and for now, the Fed has its boot to the neck of interest rates.

How long can this charade of dishonesty layered in artificial controls and false narratives sustain a failed capitalism? How long can rates be un-naturally repressed?

We’ve addressed this many times, and again the answer is simple: The party ends when inflation is no longer “targeted” or “allowed” or “controlled” by a desperate central bank.

At some point Fed hubris will be humbled by an angry dose of natural bond market revenge, not the un-natural, artificial and walking dead, Fed-supported zombie bond market we see today.

It ends when Fed dishonesty and Fed experimentation, Fed Fraud and Fed drunkenness culminates in an historical national hangover.

Are you ready? Is your portfolio?

We Offer Solutions to the Problems We Report

Until that time, we have a portfolio carefully designed to take you honestly through a fog of fantasy and keep you safe and sane. For more on the honest math and reporting of our portfolio, simply click here.

That’s how we operate—total transparency, total candor. And, by the way, we beat the markets.

Based on what the CBO is doing above, DC operates a bit differently. Less transparency. Less candor. Its latest CBO projections are proof enough.

Be careful out there. Stay informed. Stick to facts, not fantasy (i.e. fibs) and invest with data not hope.

In short, join us and hundreds of others by clicking here to enjoy a sane and honest portfolio through a market that is anything but sane or honest.

Best,

Matt & Tom