Unlimited QE (Quantitative Easing—aka money printing) is now here, which means we are now experiencing the most distorted and dangerous inflection point in the history of our capital markets.

How’s that for dramatic?

Drama is one thing, but facts are another. As usual, let’s try and stick to the facts.

Normal Folks Aren’t Seeing the Full Story

Currently, I am concerned that the full reality, as well as disastrous (and I mean disastrous) implications of unlimited QE have not fully registered within the minds of average Americans.

There is no shame nor condescension meant by this, as most Americans (be they neuro surgeons, electricians or poets) would understandably have no reason or recourse to take a daily interest in the economic nuances of extreme monetary policy or unlimited QE.

Nor do most public defenders, school teachers, UPS drivers or musicians track or follow the hidden-in-plain sight collusion between an empirically rigged Wall Street, the Federal Reserve and the politicos on both sides of the DC aisle.

Instead, and for many, they understandably trust the officials in high places to simply do the right thing.

That’s an honest impulse, as well as an honest mistake. Let me explain why…

Insider Insights, Insider Lessons, Insider Warnings

Tom and I, who were literally educated, reared and trained in the heart of wall Street’s white-gloved graduate schools, banks, hedge funds and family offices, see (and have seen) the rot in these financial policies as easily as a dentist recognizes a cavity.

For many years, we have therefore sought to share and translate this experience transparently (rather than bitterly) to our readers, outlining the blunt yet disturbing details of this rigged and rotten game with plain-speak facts rather than dramatic opinions.

A History of the Absurd

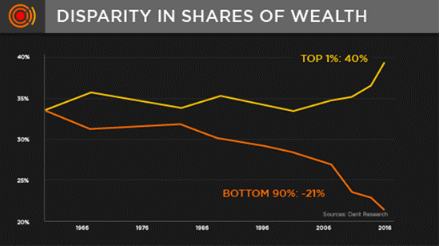

In our March 2019 report on Real Financial Advice, for example, we charted the undeniable correlation between Fed policy and Wall Street wealth creation, which has undeniably benefited the top 1-10% of our country at the expense of the bottom 90%, who have been forced to exist on debt rather than the laughable “trickle-down” effect from the rising wealth of a small and exclusive minority.

Meanwhile, the financial media had described the debt-soaked, and money-printed “solution” to the 2008 debt disaster as a “recovery,” thus lulling the masses into over a decade of false confidence that the elites (i.e. Harvard guys like Larry Summers) in DC and New York actually knew what they were doing.

But what they were “doing” amounted to little more than serving their own primary interests, not those of the broader economy. This may sound radical or opinionated, so again, let’s just survey the facts.

Across the board and across the years, Americans have been told that these “best and brightest” all “have your back,” i.e. by brilliantly solving one debt crisis (2008) through the creation of an even bigger debt crisis (2009-2020), and then conveniently attributing unlimited QE and now unthinkable debt levels (March of this year) to COVID-19 rather than the bathroom mirror of just about every Fed governor, Congressman or bank CEO.

But as we have mathematically demonstrated here, here, and here, the US economy was already in a GDP-growth depression years ago and our markets, based on every traditional metric, were quantifiably broken long before the first Coronavirus death made the headlines.

Additional reports in January and November of 2018 further revealed the unequivocal disconnect between Wall Street and Main Street and the quantifiable weakness of our dying middle class well before the first $1200.00 check was sent to the locked-down average American Jane and Joe.

In both reports, we explained how the so-called economic “recovery” from the post-2008 crisis was a mathematical (debt-disguised) sham, as was the so-called record low unemployment meme/lie which has been masquerading as fact for years in the media and in DC.

Additionally, our seemingly endless reports on the Federal Reserve described its dubious origins and insider-incentives with almost cinematic detail.

And in both our best-selling Amazon book and special report of equal title, Rigged to Fail, we reminded readers that for every member of Congress there are four financial lobbyists out of Wall Street and corporate America who influence their so-called democratic “policies.”

In short, we’ve gone to extraordinary lengths to reveal (rather than rant) just how anti-heroic the anti-heroes passing as elites really are along the Acela Corridor between DC and NYC.

Thus, if you want this proof, as well as data, just click on all or any of the foregoing links and do your own math, critical thinking and awareness-raising.

You’ll quickly confirm that the truth is not only stranger than fiction, it’s scarier.

More importantly, by reading or re-reading these critical reports, you’ll learn how the sausage is really made in our financial markets, and see directly why and how classic, free market capitalism died years ago.

Speaking of capitalism, if you want to identify or date-stamp the final nail in its coffin being hammered in real-time, let’s get back to my opening remark and concern, namely…

The Absolutely Disastrous Implications of Unlimited QE.

QE Crazy…

As most of you know by now, QE is simply a nice euphemism for creating money out of thin air to pay for our own sovereign debt (i.e. Treasury bonds) as well as the still-radio-active sub-prime mortgage debt that no one else wanted to buy from the TBTF banks that once owned this debt in 2008.

Luckily for these nuclear banks, YOU the tax-payer helped DC buy those toxic assets (MBS—or Mortgage Backed Securities) and thus directly took a heavy load off the very banks who created the 2008 Crisis in the first place.

DC then called this disguised piece of fraud the Troubled Asset Relief Program (“TARP”), which justifiably raised a lot of angry eyebrows with its $700 billion price tag.

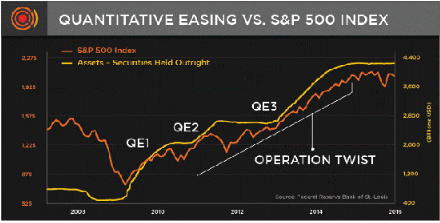

Thereafter, the Fed came up with another nice euphemism for counterfeit, i.e. “Quantitative Easing,” and within a matter of six years of QE 1, 2, 3 and Operation Twist, managed to create $3.5 trillion out of thin air to keep Wall Street and the otherwise brain-dead Treasury market ripping up and to the right.

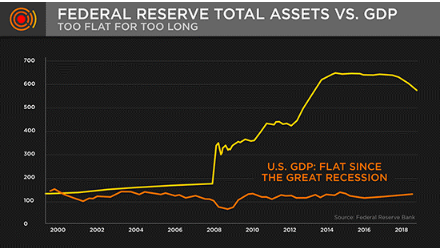

The Fed called this “stimulus” and “accommodation,” but based on charts like this…

… it’s fairly clear that the only beneficiary of this “accommodation” was Wall Street and a stock market that rose by 350% while Main Street GDP, the very heartbeat of our so-called “economy,” flat-lined at annualized rate of 2%.

This disconnect between the stock market and US GDP tells you ALL you need to know about who the Fed really serves—and folks: It aint YOU or the ignored real economy…

QE Absurdity

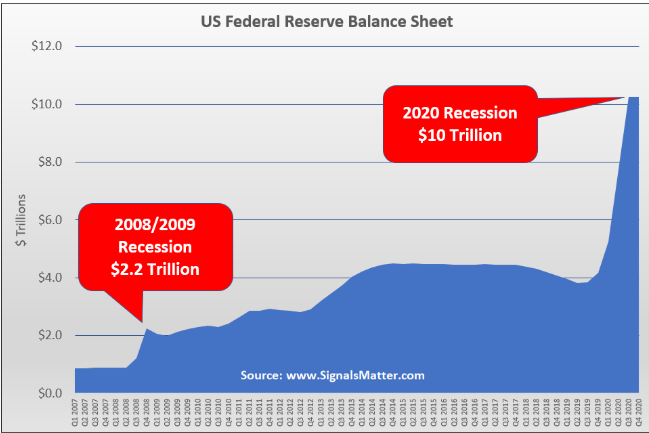

But if programs like TARP and QE 1-3 seem a little crazy, distortive or unfair, what we are seeing as of April of 2020 and the new policy of unlimited QE is just plain parabolic when it comes to measuring the absurd.

QE 2, for example, raised a ton of stir years ago when the Fed agreed to print $500 billion in the span of 8 months to “stimulate” the economy, which the Fed had confused with the stock market and thus declared as “essential”, as it seemed Wall Street had lost its stomach for actually experiencing a natural recession, which is a key and necessary component of any free market system…

But folks, in the first volley of unlimited QE, last week the Fed printed more than $500 billion (i.e. greater than all of QE2) in a matter of just 5 days.

As reported here, the Fed’s balance sheet is now projected to more than double from the current level of $4.7 trillion printed dollars to upwards of $10 trillion.

When you combine such money printing levels (i.e. “monetary policy”) with the recent $2 trillion of COVID-19 support (i.e. “fiscal policy”), the sum tally of new debt and printed money (used to buy every otherwise unwanted bond from Treasuries to corporates) and then tag on to that the trillions already being thrown at Wall Street’s dry repo and commercial paper markets, we are talking about a $10 trillion dinner bill.

Ten Trillion. Folks, that’s 47% of our GDP, the Main Street equivalent of a debt soaked college-grad buying a fleet of yachts, vineyards and Range Rovers with money printed in his frat house basement. In short, lots of debt, no real income.

Free Markets or Just Free Money? Let’s Call It What It Really Is…

And here’s the rub—such figures and unlimited QE have absolutely nothing to do with capitalism nor sustainable reality.

When a central bank and centralized government (rather than natural supply and demand) creates money to buy corporate and government debt at levels like these, the only real name for what it looks, tastes and smells like to us is simply this: Wall Street socialism.

Luckily, however, the spin-sellers in DC and Wall Street are absolute masters at putting lipstick on a pig by hiding something otherwise awful behind clever acronyms or policy labels, in this case, the fancy name they most recently chose is “Modern Monetary Theory,” which basically maintains that a government can create all the money it wants (i.e. unlimited QE) with no hangover effect for the simple reason that it owns a money printer.

This sounds too good to be true simply because it is, and we rip the logic of MMT to shreds in a separate report you can read here.

For now, however, the Fed, media, DC and the Wall Street beneficiaries of this unprecedented hand-out of unlimited QE will try to convince YOU that such measures were necessary to “sustain healthy credit markets” (actually on a respirator) and support the millions of Americans in need of COVID-19-related support.

This too is just mathematically NOT honest or true.

The vast bulk of these trillions is going toward the bond markets, not Main Street.

Nevertheless, the pushers of this MMT fantasy magic will claim otherwise, as they’d prefer that the uninformed masses ignore such pesky details as outlined in all the various links and charts above.

After all, it’s better to give trusting Americans hope, headline bailouts and a check rather than truth and a pitch-fork. As per a bumper sticker I saw in Virginia today:

“Give me liberty or give me a $1200 check!”

Folks, what we are seeing unfold right now, in real-time, is the complete and utter destruction of free-market fairness replaced by Fed-market control and absolute DC fantasy masquerading as “economic policy.”

Moreover, and more importantly, by creating these trillions in new money supply and new debt, such policies are absolutely guaranteeing that the US will enter into an unprecedented economic and debt depression—and eventual inflation—the likes of which we have never seen before.

Inflation always follows deflation, which is where we currently sit.

You see, MMT and unlimited QE only works if interest rates, and hence, inflation are magically extinct forces.

For now, the printing press at the Eccles Building is creating unlimited QE dollars at warp speed to create enough money to buy enough bonds to keep their prices artificially up and hence their yields (i.e. interest rates) artificially down.

“The Bond Market Is the Thing”

This is critical, and as I’ve said hundreds of times: Everything now hinges upon the bond market in general, and bond yields in particular.

Why? Because with the deficit now skyrocketing well past the $23 trillion mark in which we opened the year, the Fed and DC literally cannot support or sustain such debt if interest rates (as tracked by the yield on the 10-Year US Treasury) ever rise past 2.6% or more.

Why? Because that would require more money than even unlimited QE can pay for without totally diluting our dollar and landing us in a world of hyper-inflation and currency-debasement.

If you add ten gallons of water to a martini, the vodka gets diluted. It’s the same with currency purchasing power…

In short, like 120 fingers in every hole of a broken dyke, the panicked 12 members of the FOMC are in a life and death struggle to keep bond yields (and inflation) artificially compressed.

But as I’ve argued in greater detail elsewhere, such dangerous yield compression is mathematically, historically and financially impossible to sustain.

Inevitably, natural bond market forces, rather than Fed fingers, will determine bond yields, and when they spike (or spring up), so does inflation, interest rates and the funeral march of the US we once knew and loved.

When Will These Bond Yields Spike?

I have absolutely no idea.

I just know they will, just as I know an apple falls down rather than up.

The laws of physics, like the laws of natural markets, eventually get the last say in any debate.

What we are seeing right now (in terms of debt and money creation) is simply and factually beyond the scope of anything I studied in school or saw at a trading desk, including my wild memories of the dot.com disaster or the sub-prime crisis of 2008 and the absurd stimulus policies which came in their wake.

These are truly uncharted waters, and all sailors know how dangerous it is to navigate without charts.

For now, all Tom and I can do is track the market weather as it plays out and prepare our subscribers based on market signals rather than cynical histories of “distortion, dishonesty and debt”—the three-D’s which define Fed policy in a nutshell.

Whether rising yields (and hence inflation and rates) humiliate the Fed in five months or five years, we need to prepare investors now rather than later, as we have successfully been doing for years at Signals Matter.

Again, this is not market-timing, just common sense with a dash of market skill.

Needless to say, for those who understand inflation and gold, the case for precious metals just became even more obvious, but that’s a whole other story…

For now, and as always, stay informed and thus safe. And for those who can, stay inside.

We’ll be back on Monday with more market weather to discuss. And if you haven’t already, get your affairs, and portfolio, in order by signing up with Signals Matter, here.

Best, Matt and Tom

And what about the mortgage market? The biggest market in the world. With all the moral hazard the politicians are encouraging, i.e. don’t pay your mortgage or your rent, you wont get evicted!, “we wont let that happen!”, how long before the commercial and residential market completely implodes? And will it take the banking system with it? We are headed for unimaginable disaster. All made possible by your friendly neighborhood politician!

I believe what you say is true and love your work. However I think they know exactly what they are doing. They know their time is up and hence they will pay checks to the masses who will thank them and print currency that is worthless. They hide the crash behind Covid and claim to keep us safe. 50,000 deaths in 3 months ! It’s the flu.. 99.9 % of the population believe them and are grateful for their protection. 55,000 deaths and the shutter the global economy. Really? Next they will free us before Or just after civil unrest takes hold (the military are already being positioned) blaming the whole collapse on Covid ( we know it was long overdue). Then they will roll out digital currencies using block chain and the very controversial 5G (weapon). By then the $300 trillion of un payable debt won’t matter. It will be cheaper to give the masse free digital currency to start them off again than repay $300 trillion The 99.9 % will thank them for protecting them from the virus (flu) they will thank them for the worthless bailouts then thank them for the digital currency and welcome in the new age of traceability and cashless hence 100% taxable society… Just saying …. Best Jim

Peter, I hear you. COVID-19 has been a nice pretext and curtain behind which to hide deeper financial sins, all of which were in place (as you know) well before the first Coronavirus case. Frustrating indeed…

Corona: if they lied then, why wouldn’t they lie now?

Mar26 by Jon Rappoport

by Jon Rappoport

March 26, 2020

(To join our email list, click here.)

In a recent article, I accepted public health stats on ordinary flu and COV, and showed the insane contradictions in numbers and in government containment strategies.

In this article, I take another angle. The CDC has been lying about ordinary flu for decades. So why wouldn’t they continue their fine tradition of lying about COV? Why should you believe ANYTHING they say about COV? Why should you accept their case numbers, their ominous warnings, their insistence on lockdowns which wreck economies?

It’s simple. If a boy shows up at a grocery store the first six days of the week and steals an apple every time, when he shows up on the seventh day, why wouldn’t he steal an apple? And if that boy were the de facto president of the United States—enabling him to impose draconian measures on the population—should you trust him?

The first issue is: how many people in the US die every year from the flu?

The CDC reshuffles its estimates. It used to parrot an annual figure of 36,000. Recently, it claimed 12,000-61,000 deaths per year.

In December of 2005, the British Medical Journal (online) published a shocking report by Peter Doshi, which created tremors through the halls of the CDC.

Here is a quote from Doshi’s report, “Are US flu death figures more PR than science?” (BMJ 2005; 331:1412):

“[According to CDC statistics], ‘influenza and pneumonia’ took 62,034 lives in 2001—61,777 of which were attributable to pneumonia and 257 to flu, and in only 18 cases was the flu virus positively identified.”

Boom.

You see, the CDC created one overall category that combines both flu and pneumonia deaths. Why do they do this? Because they disingenuously assume the pneumonia deaths are complications stemming from the flu.

This is an absurd assumption. Pneumonia has a number of causes.

But even worse, in all the flu and pneumonia deaths, only 18 revealed the presence of an influenza virus.

Therefore, the CDC could not say, with assurance, that more than 18 Americans died of influenza in 2001. Not 36,000 deaths. 18 deaths.

Doshi continued his assessment of published CDC flu-death statistics: “Between 1979 and 2001, [CDC] data show an average of 1348 [flu] deaths per year (range 257 to 3006).” These figures refer to flu separated out from pneumonia.

This death toll is obviously far lower than the parroted 36,000 figure.

However, when you add the sensible condition that lab tests have to actually find the flu virus in patients, the numbers of flu deaths would plummet even further.

In other words, it’s promotion and hype.

“Well, uh, we’ve said that 36,000 people die from the flu every year in the US. But actually, it’s probably closer to 20. Who knows? However, we can’t admit that, because if we did, we’d be exposing our gigantic psyop. The whole campaign to scare people into getting a flu shot would have about the same effect as warning people to carry iron umbrellas, in case toasters fall out of upper-story windows…and, by the way, we’d be put in prison for fraud.”

[Note: Prior to Doshi publishing the above piece about flu deaths, I engaged in a series of emails with him about that issue, and independent researcher, Martin Maloney, made a major contribution to uncovering the CDC deception.]

The second big issue is: how many people diagnosed with the flu really have the flu?

Peter Doshi again, writing in the online BMJ (British Medical Journal), reveals another monstrosity.

As Doshi states, every year, hundreds of thousands of respiratory samples are taken from flu patients in the US and tested in labs. Here is the kicker: only a small percentage of these samples show the presence of a flu virus.

This means: most of the people in America who are diagnosed by doctors with the flu have no flu virus in their bodies.

So they don’t have the flu.

Therefore, even if you assume the flu vaccine is useful and safe, it couldn’t possibly prevent all those “flu cases” that aren’t flu cases.

The vaccine couldn’t possibly work.

The vaccine isn’t designed to prevent fake flu, unless pigs can fly.

Here’s the exact quote from Doshi’s BMJ review, “Influenza: marketing vaccines by marketing disease” (BMJ 2013; 346:f3037):

“…even the ideal influenza vaccine, matched perfectly to circulating strains of wild influenza and capable of stopping all influenza viruses, can only deal with a small part of the ‘flu’ problem because most ‘flu’ appears to have nothing to do with influenza. Every year, hundreds of thousands of respiratory specimens are tested across the US. Of those tested, on average 16% are found to be influenza positive.”

“…It’s no wonder so many people feel that ‘flu shots’ don’t work: for most flus, they can’t.”

Because most diagnosed cases of the flu aren’t the flu.

So even if you’re a true believer in mainstream vaccine theory, you’re on the short end here. They’re conning your socks off.

Let me give you a gigantic example of this massive flu-case-counting deception. It involved a flu “epidemic” you might remember called Swine Flu.

In the late summer of 2009, the Swine Flu epidemic was hyped to the sky by the CDC. The Agency was calling for all Americans to take the Swine Flu vaccine.

The problem was, the CDC was concealing a scandal.

At the time, star CBS investigative reporter, Sharyl Attkisson, was working on a Swine Flu story. She discovered that the CDC had secretly stopped counting US cases of the illness—while, of course, continuing to warn Americans about its unchecked spread.

Understand that the CDC’s main job is counting cases and reporting the numbers.

What was the Agency up to?

Here is an excerpt from my 2014 interview with Sharyl Attkisson:

Rappoport: In 2009, you spearheaded coverage of the so-called Swine Flu pandemic. You discovered that, in the summer of 2009, the Centers for Disease Control, ignoring their federal mandate, [secretly] stopped counting Swine Flu cases in America. Yet they continued to stir up fear about the “pandemic,” without having any real measure of its impact. Wasn’t that another investigation of yours that was shut down? Wasn’t there more to find out?

Attkisson: The implications of the story were even worse than that. We discovered through our FOI efforts that before the CDC mysteriously stopped counting Swine Flu cases, they had learned that almost none of the cases they had counted as Swine Flu was, in fact, Swine Flu or any sort of flu at all! The interest in the story from one [CBS] executive was very enthusiastic. He said it was “the most original story” he’d seen on the whole Swine Flu epidemic. But others pushed to stop it [after it was published on the CBS News website] and, in the end, no [CBS television news] broadcast wanted to touch it. We aired numerous stories pumping up the idea of an epidemic, but not the one that would shed original, new light on all the hype. It [Attkisson’s article] was fair, accurate, legally approved and a heck of a story. With the CDC keeping the true Swine Flu stats secret, it meant that many in the public took and gave their children an experimental vaccine that may not have been necessary.

—end of interview excerpt—

It was routine for doctors all over America to send tissue samples from patients they’d diagnosed with Swine Flu, or the “most likely” Swine Flu patients, to labs for testing. And overwhelmingly, those samples were coming back with the result: not Swine Flu, not any kind of flu.

That was the big secret. That’s what the CDC was hiding. That’s why they stopped reporting Swine Flu case numbers. That’s what Attkisson had discovered. That’s why she was shut down.

But it gets even worse.

Because about three weeks after Attkisson’s findings were published on the CBS News website, the CDC, obviously in a panic, decided to double down. If one lie is exposed, tell an even bigger one. A much bigger one.

Here, from a November 12, 2009, WebMD article is the CDC’s response: “Shockingly, 14 million to 34 million U.S. residents — the CDC’s best guess is 22 million — came down with H1N1 swine flu by Oct. 17 [2009].” (“22 million cases of Swine Flu in US,” by Daniel J. DeNoon).

Are your eyeballs popping? They should be.

In the summer of 2009, the CDC secretly stops counting Swine Flu cases in America, because the overwhelming percentage of lab tests from likely Swine Flu patients shows no sign of Swine Flu or any other kind of flu.

There is no Swine Flu epidemic.

Then, the CDC estimates there are 22 MILLION cases of Swine Flu in the US.

So…the premise that the CDC would never lie about important matters like, oh, a vaccine causing autism…you can lay that one to rest.

The CDC will lie about anything it wants to. It will boldly go where no person interested in real science will go.

It will completely ignore its mandate to care about human health, and it will get away with it—as long as people are willing to accept falsehoods instead of the truth, as long as people would rather cling to what authority figures tell them.

And now, with the CDC spearheading the operation called COVID-19—from confirmation of the discovery of a “new virus,” to guidelines for diagnostic testing in patients, to case number counts, to containment policies, lockdowns that wreck economies and lives—do you really want to believe what they say?

They went to the grocery store and stole an apple every day. Then they turned around and said the grocery store could only admit ten people at a time. Then they shut down the city around the grocery store.

They sit high above the city looking out the window while they eat the apples.

The Matrix Revealed

(To read about Jon’s mega-collection, The Matrix Revealed, click here.)

Jon Rappoport

History is full of examples where foreign governments flooded their markets with fiat currencies to pay for out of control government spending and unserviceable debts. The results are all the same, an implosion of their economy due to run-away inflation and economic collapse.

We are seeing the central banks in Europe, Canada, Japan, and the US doing “what ever it takes” to print money and inflate their balance sheets in order to fund massive spending programs governments are undertaking to fight the pandemic and to lessen the economic impact. But if MMT was credible, the national economies of Germany in the 1920’s, Zimbabwe, Venezuela, and many other countries would not have collapse when their government put the money printing presses into overdrive. Why should we believe that this tine the result will be any different?

Richard, take a look at my report on the French in the 1790’s–I think you’ll enjoy the narrative…

Yo Tom and Matt;

The Ben Bernank explanation of QE from Nov. of 2010 is still relevant today. The feckless Fed, the panicked politicians and the Wizards of Wall Street will do everything ,and anything, possible to keep the game going.

Did you notice that Tom Coburn died (I think of despair) recently.–much like Professor Irwin Corwin ( The World’s Greatest Authority) died right after Trump was elected.

GLD, TLT and HDGE.

John