Below we look at Fed fraud masquerading as a Fed rescue.

First—The Newest Data from DC

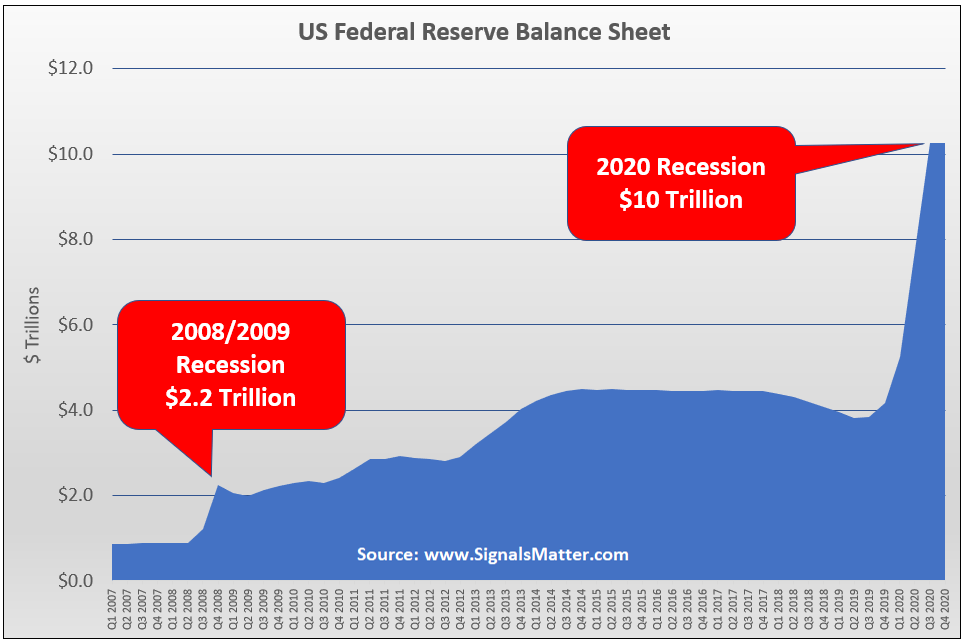

Bloomberg’s Rich Miller recently announced that numerous analysts are predicting the Fed to more than double its current $4.7 trillion balance sheet to levels as high as $9 to $10 trillion in order to help the US economy survive the coronavirus shutdown.

Given that the Fed’s balance sheet was less than $1 trillion on the eve of the 2008 Crisis, we are now looking at the possibility of a 10X expansion, which would (unbelievably) look like this:

Obviously, such an aid package (QE plus deficit spending from Congress) would dwarf the unprecedented “stimulus” offered by the Fed in the post-2008 disaster and thus underscores the true economic seriousness of the current crisis.

The Fed is terrified of rising rates, a broken bond market or a tanking stock market. They are now acting pre-emptively, tossing more debt and money around than ever imagined.

Folks, every debt bubble pops, and every debt cycle, is followed by a massive deflation (i.e. painful fall in stocks and other financial assets) followed in tow by massive inflation (thanks to the money printing mania and Fed fraud we are currently seeing).

Given that we are currently seeing a combination of the greatest debt/credit and money printing expansion ever imagined by homosapiens, the crash we are postponing today will be devastating tomorrow—it’s simply a matter of math, history and cycles, which apparently the Fed has forgotten.

As JP Morgan’s chief US economist, Michael Feroli observed, “The Fed has effectively shifted from the lender of last resort for banks to a commercial banker of last resort for the broader economy.”

Our take-away from this observation, however, hinges on the operable words “last resort,” for this is INDEED it folks—”our country’s last resort.”

As the Fed moves towards extreme fiat money creation, we are literally going from a Twilight Zone market of Fed “over-intervention” into a Danger Zone of effective centralized Fed fraud control over the entire economy.

Naturally, some will legitimately and understandably argue that we have no choice—that our country is under an invisible attack and we need to do “whatever it takes,” to win this viral “war.”

We get this. Truly. We do.

But we need to look deeper at this and other issues (below) before we resign ourselves to such a thesis.

Fed-Speak, Fed Fraud

In the meantime, Fed Chairman Jerome Powell said just yesterday that he has no concern about “running out of ammunition” (money printers technically never run out of ink), telling NBC’s Today Show that the Fed will act as an heroic and necessary “bridge” during this time of crisis so that by Q2, the US can see “a resumption of growth.”

As our subscribers know by now, however, the Fed’s words have more than one face, and more than one motive, the controversial truth of which we will discuss at greater length.

For now, however, I’d simply like to ask Mr. Powell what “resumption of growth” is he referring to?

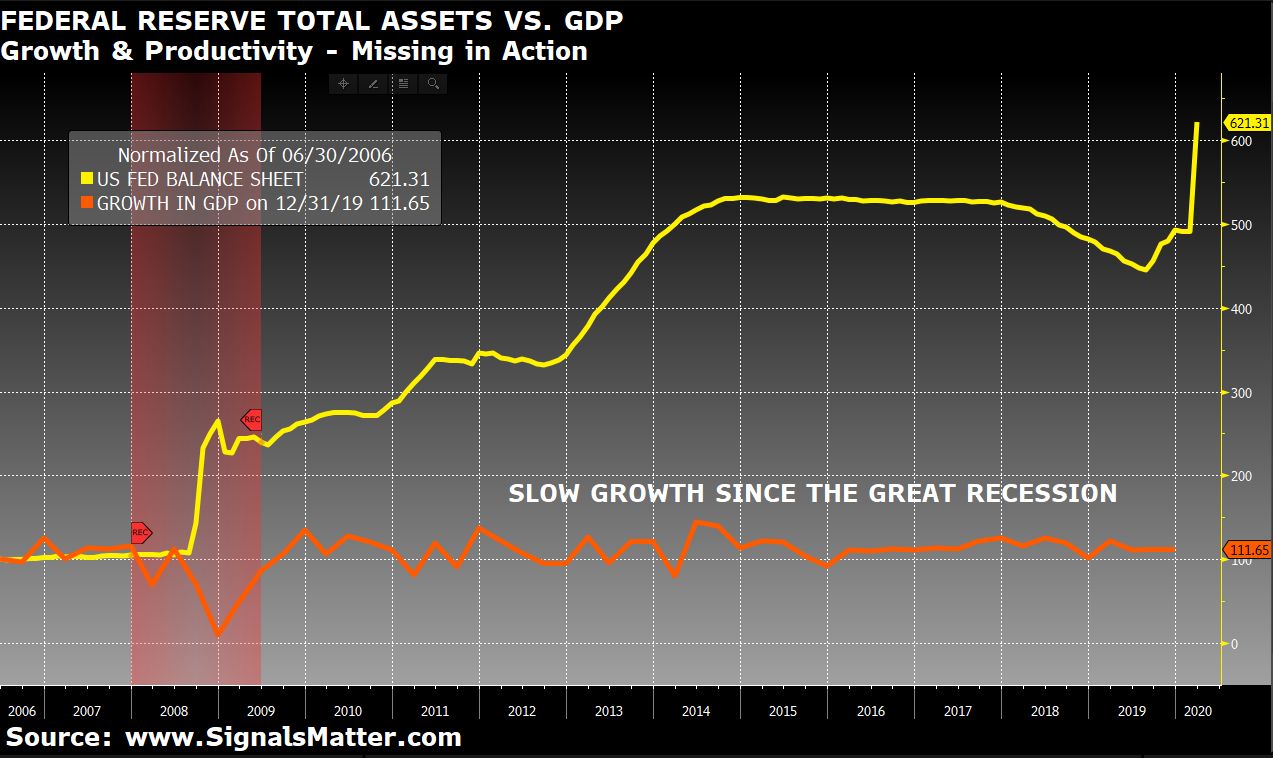

Factually-speaking…the US has not seen any growth or real productivity in years, as the following chart of 2% annualized growth makes objectively clear.

Note as well that the Fed’s balance sheet has grown by hundreds of percentage points since 2008, while our so-called economic “growth” grew by an annual rate of 2%. Some success story, eh?

In short: Powell is simply lying about growth, among other things, including earnings, unemployment and inflation and GDP.

This is not opinion, it’s math. Just read the links.

But public lies and hidden motives are nothing new to the Fed, or Fed fraud committed for years.

Congressional Aid

Meanwhile Congress is addressing the “suddenly” virus-battered Main Street economy, whereas we’ve been describing it as battered for years, well before COVID-19.

The recent bill does include direct payments to lower and middle-income families of $1,200 for each adult and $500 for each child.

That’s all fine, but it’s also a drop in the bucket compared to what the Fed has given Wall Street for generations.

Don’t believe me? Just look here, here and here…and verify the math rather than angry adjectives.

Unlimited Money Printing—Miracle or Postponed Nightmare?

As of today, the Fed is embarking upon a policy of unlimited Quantitative Easing, which means it can simply create as much money as it wants to pay for any and all debts incurred by Uncle Sam.

Some may see this as a miracle solution. But is it?

Does anyone actually believe more debt will solve a systemic debt crisis, one that pre-dates COVID-19?

Is more debt, even “emergency debt” truly a legitimate “solution”?

After all, if we each had, say, $500,000 in debt, and could simply walk down into our basements and print $500,000 of cash, we could call that a miracle, no?

But the US District Court would call that fraud and the US Criminal Code would call that counterfeiting, punishable by years in a Federal prison.

Luckily, however, the Federal Reserve, is apparently exempt from Federal prisons and Fed fraud, despite the fact that the Fed is not “Federal” at all…

Instead, the Fed is a private bank legalized by Woodrow Wilson in 1913 to act outside of Congressional oversight (or Article 1, Section 8 of the U.S. Constitution) and whose creation Wilson later described as the darkest day not only in his life, but in the life of this country.

Now those are pretty intense words coming from the very President who signed the Fed into existence.

So, why was Wilson so afraid of the Fed?

Because he knew it was a sham bank from Day 1.

As we wrote in both our Amazon #1 Release, Rigged to Fail, and a prior report of similar title, here, the Fed was not created for, nor interested in, Main Street.

Despite the face time, book tours and self-congratulating arrogance of Greenspan, Bernanke, Yellen and now Powell, the Fed is a banker’s bank whose primary master, and motive, was (and remains) Wall Street.

Sound crazy? Kooky? Conspiracy-Theory unprofessional? We get this too.

But if you take a moment to read the aforementioned book or short-report, you can see for yourselves, so I will dispense with those details here.

Instead, I’ll focus on what’s happening now, as the Fed swoops into “rescue America” like some mythical super-hero.

Oh, how the ironies abound…The current rescue will lead to the greatest depression the US has ever seen. This is, alas, not only our “last resort,” it’s our last hurrah.

What’s Really Behind the Emergency Measures

The bill passed by the Senate on Wednesday will go into law and soon the Fed’s first directive will be to—you guessed it—create more debt on top of a nation now thoroughly soaked in debt–$75 trillion and rising.

DC is calling this “emergency lending facilities” and they are directed primarily to corporations who were surviving on debt pre-virus and obviously need more debt now to stay alive, despite never really doing anything but go into debt.

It’s good to be a modern rat in the C-Suite…Just go into debt, buy back your own shares, pay yourself a fortune and wait for a credit-bailout.

The Fed is then expected to establish a generous “Main Street Lending Program” to provide help to smaller firms, and God knows at least some of these small business (not hitherto on the S&P cheat-sheet) actually deserve it.

We’re talking about $2-3 trillion in more debt to be added to our already unpayable debt party in the US—and I’m not even talking about the unfunded liabilities of Medicare, veteran’s benefits or social security…

Again, we understand how this whole $6 to $10 trillion “stimulus” may seem like a really natural and necessary policy to most of you. Really: we get it. Desperate times call for desperate measures, right?

But look deeper behind the fancy talk in DC, which naturally, most American’s don’t have the time or expertise to decipher.

Understandably, Americans see needed money ostensibly going to Corona-impacted businesses who require and deserve support.

Unfortunately, and as shown below, the vast bulk of this “stimulus” money is going to buy Treasury bonds, and thus keep yields and rates continuously and artificially low, so that Wall Street and Uncle Sam can continue their low rate debt binge even longer and then call the same a “recovery.”

Meanwhile, Congress is telling YOU it needs this new credit and fiat money to help the heroic Fed to absorb any losses it may incur in making “risky emergency loans” to potentially “riskier borrowers.”

But folks, the Fed’s entire history is one of making risky loans, or giving free money, to risky borrowers, and if memory serves correctly, the riskiest and most supported beneficiaries of the Fed’s support has always been Wall Street and its complicit, insider banks.

Remember 2008? A small minority of NY-based banks were so overloaded with crappy sub-prime securities that they were on a well-deserved path to a lower Manhattan firing squad.

But what did the Fed do? It bought all those crappy subprime securities that no one else wanted at top dollar from the very banks who were drowning in a cesspool of bad debt which they alone created.

Thereafter, Wall Street rose like Lazarus from the dead and the media called the debt-driven S&P price inflation (and historical wealth gap) a “recovery” while our real economy and GDP sank to the basement of history.

Again, the ironies just abound in this era of Fed fraud.

Now, the media, the Senate and the Fed are acting as if Powell is doing the US economy another “Bernanke-like favor” by helping the smaller, more risky credits.

But folks, that’s a classic Fed head-fake hiding Fed fraud. The real beneficiaries, again, are the big names on the S&P and all those junky credits we otherwise call “investment grade” and a Wall Street repo market that is as fake as a 42nd Street Rolex.

In fact, the Fed fraud unfolding before our closed eyes is exponentially more of what has always gone on at the Fed, and hence the reason President Wilson so regretted its imposed birth upon his desk in 1913.

Fed Fraud: The Fed Is Once Again Concerned with Wall Street, not Main Street

And if you fear this is just the opinion of a Wall Street cynic, I get that too. It’s a normal assumption.

Toward that end, let’s stick to the facts rather than my bewildered eyes as history plays out the last hurrah for our economy and once-free markets as the Fed marches the United State toward the danger zone of near complete Fed-reliance, and hence the final nail in the coffin of classic capitalism.

The Fed is not YOUR friend.

Exploited Hysteria

What we are experiencing today in the backdrop of COVID-19 is hysteria in DC, the media and Wall Street that likely dwarfs the combined impact of 9-11, Pearl Harbor and the ride of Paul Revere.

More than hysteria, however, we are seeing Fed fraud and the pillaging of economic natural laws as the US, led by the Fed, destroys the last vestige of monetary sanity in order to buy a market rebound and short-term corporate bailout so that our children inherit a centralized, debt-ravaged and statist nation in which the Fed acts as the top dog as we suffer through the inevitable deflation and crippling inflation cycles which always follow.

Again, see why Wilson regretted signing the Fed into existence?

The only consequence of this much debt and printed money down the road is a socialized stock market rather than a free-market democracy willing to allow exchanges to naturally and occasionally tank, as all free markets are supposed to do. In trying to outlaw recessions, the Fed is only making the depression ahead the worst ever.

Sound crazy? A bit extreme?

First, let me say again that neither Tom nor I wish to disrespect, minimize or underestimate the horrific personal and national impact of COVID-19. All who can, and especially those at the highest risk, should take all measures possible to ensure their safety.

Nevertheless, the economic and police-state measures we are taking right now are ultimately far more dangerous than the virus.

Like the media-maligned Texas Lieutenant Governor, we recognize that we are in a terrible scenario in which no choices are good choices.

As such, we must accept the reality of this virus without fully placing our entire economy in lockdown or creating more debt or money than can ever be normalized, as such a “cure” will be economically more fatal than the disease’s current morbidity rates.

COVID-19 is scary. It scares you. It scares us. And lives matter more than markets. We get this too.

Based, however, upon the evidence at hand today, including the findings of the world’s leading epidemiologist, Stanford’s Dr. John Loannidis, the accurately analyzed mortality rate of COVID-19 is less than 1%.

Horrific? Yes.

Debatable? Yes.

But worth shutting down the country for months and crippling our economy for generations? YOU decide.

COVID-19 is a terrifying black swan, but it’s quantifiably no black plague, no DEFCON 1 emergency worthy of being classified as the Great Depression 2.0 and thus no justification for the shutting down of an entire country or the printing of simply unimaginable levels of money while incurring staggering and unsustainable levels of debt than our country can absorb without becoming a memory of its former self.

Something Sinister, Something Hidden in Plain Sight—Fed Fraud

In fact, there’s something far more sinister at play in America today than COVID-19. More on that below…

Tom and I are not immune to COVID-19 nor its human costs. We are equally vulnerable citizens but are now more concerned about the economic cadaver of a nation our generation is handing to our children’s generation.

Why so appalled?

Simple. The economic math behind this Fed fraud just terrifies us, even more than the virus stats.

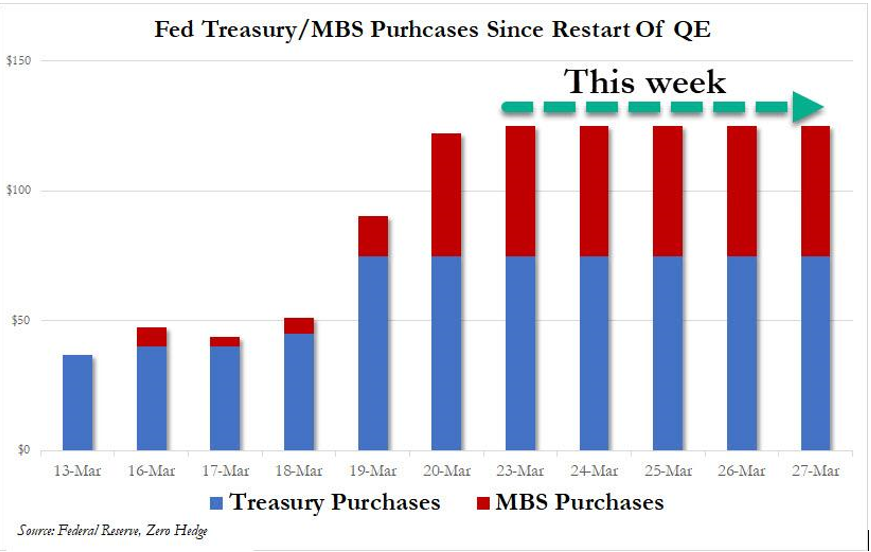

As per the chart below, the Fed is literally buying $125 billion worth of US debt (i.e. Treasury bonds) and mortgage backed securities (i.e. the toxic waste from 2008) a day.

Yes, $125 billion a day.

This means, in just the last 10 days, the Fed has spent over $1 trillion to buy our own debt with money created out of thin air. That’s Fed fraud pretending at “assistance.”

This is not only utter madness, it’s pure debt monetization. That’s more fiat money creation in just over a week than the Fed created in the first 94 years of its existence.

The Real Story?

COVID-19 has now become the excuse rather than reason for the current hysteria. But frankly, not even an invasion from Mars would justify this much new debt and fiat money creation.

Japan, for example, has not shut down its country, despite being equally aware of the real health risks COVID-19 imposes despite fostering the oldest population on the planet and the largest percentage of life-time smokers anywhere.

Are the Japanese just stupid, greedy, callous or less empathetic for their fellow citizens that Americans?

Nope. Instead, Japan objectively recognizes and accepts that as horrific as COVID-19 may be, it’s not the Armageddon moment which DC, the Fed and the hysteria-driven (ratings-chasing) media would otherwise make it out to be.

Instead, the Fed, DC and Wall Street, who were staring down the barrel of a debt crisis, earnings crisis, and inevitable market disaster before the virus, are now exploiting a genuine crisis to justify their own massive “bail-in” and “bailout” while pointing the finger at COVID-19 rather than the debt-disease (and rigged game) they began (and exploited) years ago in the wake of the last financial crisis in 2008.

By printing trillions of new fiat currencies, extending trillions in more debt to “support” public companies already on the verge of a well-deserved debt-death before COVID-19, Wall Street and the Fed fraud pushers are essentially writing themselves (and Boeing and other junky friends of the Fed and Wall Street) a blank check just in the nick of time to extend their own egregious, debt-addicted survival.

See why President Wilson so feared this central bank? It’s not what you think it is, despite the smiling faces on bubble-vision.

Instead, such Fed fraud is part of a great insider and rigged Wall Street con, and the only ones being played are YOU.

How do we know this? Well, it’s because we played this rigged game for years, and from the inside…

Markets Surge

As for the current markets and portfolios, well…trillions of dollars can certainly buy a “surge,” despite all the mathematically objective indicators of debt-broke companies and a real economy already in a growth depression before COVID-19, as backed by math and facts here, here and just recently here.

Again: Not opinion just fact. Please verify for yourselves. Take your time. Read the data. It’s your call.

Yet despite how insidious and rigged this Fed fraud game with Wall Street is, one cannot fight the Fed nor Fed fraud.

At Signals Matter, we expected such an emergency measure as inevitable, we just never thought the Coronavirus would be the excuse for the massive MMT-like insanity we are now experiencing in real-time.

As for our portfolio suggestions, we remain loyal to what the market signals rather than headlines tell us, and are bracing for price inflation (short-term), price deflation thereafter, and then mega-crippling inflation long-term, which will benefit those patiently owning gold down the road.

For now, the real data from the markets is objectively bad and defies the recent mega-sugar high handed to us by DC, but then again, a nuclear bomb could go off in Cleveland and markets would still rise if the Fed wants to double its balance sheet and DC blast U.S. debt levels to the moon.

DC and the Fed’s most recent multi-trillion-dollar tailwind (Fed fraud) is entirely uncharted territory and for now, we can’t gamble “all-chips-in” on this latest tailwind when uncertainty and risk are at far higher levels than reward, even with DC steroids pumped to levels no history or econ book could ever imagine.

For now, subscribers can check their dashboards to see our updated suggestions in this highly distorted backdrop.

For the rest of you, please take a moment to verify the data above for yourselves and then step outside the norm and consider the surreal, for that is where we are today, and Signals Matter was formed to help you through it.

Stay smart, stay safe. We’ll be back on Monday.

Your Guides, Matt & Tom

Matt, awesome write up. You also want to talk about the coming supply shock, doubling-tripling of the price level of BASIC goods (food, energy, healthcare, etc.), and collapse in REAL terms of financial assets. So deflation AND hyperinflation at the same time! And lets not forget crime, with millions of of unskilled and low skilled workers out of work and doubling/tripling of the price level of basic goods, the crime rate will soar. It is going to get VERY dark.

Thanks Alfonso, I hear you loud and clear. Like Napoleon’s Grande Armee heading toward Borodino, the Fed has been marching with inflated chests (and printed dollars) toward a market that is set to burst into Moscow-like flames and then a long, DARK and cold winter to limp home through thereafter…And thereafter alas, our economy, and that of the globe, will have its collective “Waterloo Moment.”

I have noticed that you are no recommending buying gold or gold ETFs or gold miners. What is your reasoning for avoiding them?

Hi Tom, I specifically noted in today’s post (and linked therein to a prior gold report) that gold will continue to be a smart, long-term play for patient investors. Given the deflation and inflation gyrations which the current “mega-stimulus” (aka “mega-fraud” and stock market and debt/bond boost disguised as an emergency measure for Main Street), I just wanted investors to know that gold too will gyrate short-term. I am absolutely committed to gold for the long-term, but our portfolio solution on the back-end goes in and out of gold depending on market signals. Individuals can make their own choice as to how they hold gold outside or inside the portfolio. My personal opinion is that gold should be bought (ideally in physical form, as the paper gold ETF’s and Trusts are tied to futures contract pricing and 3rd party risks) and held as a perpetual currency hedge and not traded in and out. That amount each individual investor commits to gold is entirely up to each investor; my own view is that once it is purchased, one should simply ignore the daily price action and hold, and hold and hold gold for the years, as eventually I see a massive inflationary reaction to the current “miracle solution” which will send our economy and currency into longer-term pain. That is, once the fanfare of the current “miracle” dies down, at our markets and economy with it, gold investors will one day look back and be glad they bought gold. In the interim, however, one should be prepared for price swings without trying to time or speculate the same. Gold miners offer significantly more upside and downside price swings and are thus good or bad depending upon one’s own risk tolerance and personal situation. When gold does surge, properly managed mining stocks (and streaming co’s) will do exceptionally well. That said, the road can be bumpy–too bumpy for may investors not familiar with the space.

Most of my renters and other people I know carry a lot of debt and I hardly think they will see very much of the bail out money since that is designed to go to wall street, so how will inflation ever take off properly when the masses have no cash?

HI Joseph, great question. The great inflation and deflation debate and cycle is going to get far more attention now and has many layers and definitions and explanations of inflation spread. Many, many readers and subscribers are posing similar questions. First, I would direct their attention to my report on the Euro Dollar “ticking time bomb” and the ironic shortage of US dollars despite the massive “printing” by the Fed since 2009 in particular. Inflation, as traditionally understood by figures like Milton Friedman (in econ classes which deliberately favored Keynesian thinking over the Austrian School), is seen as an issue strictly related to money supply, not the price of goods, which is how inflation and deflation are more liberally used/discussed by the financial media–i.e. as strictly a measure of the price of goods as measured by the CPI (which is more fiction than reality as reported by the BLS…). But splitting hairs over the proper use or semantics of academic “inflation” and “deflation” is likely not your primary question. In short, if we just take the common usage of inflation (rising prices) and deflation (falling prices), we can assume the following dynamics to play out in the years and months ahead: 1) Whenever (and however) a debt cycle blows apart (be it COVID-19 “driven” or just the inevitable popping of over-inflated bond markets made grotesquely FAT by wayward central bank “bond support”) a a massive decline (i.e. “deflation”) in asset prices of all classes (i.e. stocks, bonds, real estate valuation and even commodities –including gold) typically follows. Then, in the ashes of this “deflation”–i.e. price declines, comes the subsequent “inflation” in asset prices due to due supply shocks, cyclical upturns etc. But more importantly, and this time in particular, we should see the more “academic” definition of inflation rear its brutal head–namely the “type” of inflation that stems from absurd levels of money-supply resulting from the QE bachanalia exhibited by global central banks since 2008–i.e. massive currency creation used to “recover,” “support,” and “accommodate” the economy (or more to the point, the markets), as this fiat money binge was basically used by central banks to buy their own sovereign debts to keep bond yields and (and thus interest rates) low as bond prices were artificially supported (i.e. bought) with gobs and gobs of printed money. (Governments who live off issuing debt need to keep rates low to pay their own wayward IOU’s…) That printed money will eventually manifest itself in the form of “inflation” which essentially means less purchasing power for currencies gone wild (i.e. over-created/printed since 2008). This dive in currency purchasing power from over-the-top currency creation) will lead to price inflation (as more currency units will be needed to pay for once cheaper widgets), and be painful for renters forced to pay higher rent prices with increasingly less “valuable” and inflated currencies. Will checks from the government be enough to “save” those beaten down masses who did not enjoy (or experience the “trickle-down) of the same “fun” (i.e. wealth creation) which the artificially inflated stock market class (i.e. the top 10% of the population) enjoyed since 2009? I think you already answered that question yourself. The central bank experiment is now failing, and the pain ahead is mathematical as well as historical in its confirmations. The report I wrote on MMT foresaw the inevitably of the kind of money printing we are now seeing. In MY OPINION, COVID-19 is being co-opted as the “excuse” for a kind of money printing (MMT) that was nevertheless going to play out anyway one day soon, as the economies of the world, and the US in particular, literally have (and had) no other choice but to one day gorge themselves on even more money printing to “solve” the debt crisis they otherwise created (yet falsely called a “recovery”)… With rates already at zero or below around the globe, the only “tool” left was more money printing (and the inflation that eventually comes with it). With or without COVID-19, the money printing we saw last week was gonna come one way or another. No surprise here at all. For now, much of that printed money is simply used to roll-over debt issued by the Treasury and held in “reserve” by the Fed–i.e. one big dam wall holding back inflationary flooding. Once that dam breaks, the flood (“velocity”) of that printed money goes into the real economy, and even a bogus CPI won’t be able to hide its crippling inflationary reality. That said, I can’t time nor fight the Fed and make “predictions,” I can only watch the markets reactions and prepare for history to repeat itself and the laws of natural markets to wash over the artificial markets the central banks have handed us since 1981 in general and 2008 in particular. The Fed (and the media) won’t go down without a fight–and will continue to convince markets and masses that printing money never leads to inflation–especially when the foxes who guard the henhouse also “report” inflation on their own (false) terms. That said, such money creation (beyond absurd and without precedent in history) can’t and wont’end pretty. It will end badly–for your renters in particular. What we are seeing play out now is the Fed’s last hurrah, and we have no way to predict how long that “hurrah” will last–only how it will END. The uncertainty as to how long central banks can fight off the sins of their past or the laws of natural supply and demand remains to be seen, but the die has been caste and we can only prepare accordingly. As a property owner with renters, I think demand for your properties will rise as markets tank and home ownership becomes harder for more and more folks to achieve down-payments in a recession. Rents will adjust with deflation and inflation–either way, you will be the supply that meets a rising demand. Depending on how renters are subsidized, paid or liquid, rental prices will be determined. Real estate is ultimately a great inflation hedge, and if you own real estate, you are already in a better position than most. I hope this helps 🙂

Hi Matt,

Awesome update on what is unfolding.

What are your thoughts on when/if physical gold supply will catch up with the current demand.

Dealers here in central Canada have no supply available…and are only taking orders for gold or silver after attaching huge premiums over spot. Delivery is is estimated to be months away in most cases. GLD is easier to buy…..but will it truly offer upside $ protection when hyperinflation strikes?

C Robert, as you likely know, gold supply is tighter than rising demand and the manner in which gold is traded (and priced) in the public markets hinges more upon futures contracts than the literal (and honest) supply and demand dynamics as Adam Smith would otherwise have it…Deflation, which follows every busted debt cycle, may slow gold’s price moves (or even drag them down–temporarily), but the inevitable inflation to come as central banks fire their last and massive cannons to sustain the now debunked “recovery” since 2009 will ultimately send gold higher–in MY OPINION. In all my gold reports on the public side of Signals Matter, I’ve stubbornly insisted that gold be bought for the LONG play regardless of interim price volatility as the deflation to inflation cycle slowly plays out in this last, desperate effort (and war) with the money printers of the world’s central banks to postpone the inevitable inflation, which has been forced to the floor for decades… Ultimately, I see gold as fire insurance for global currencies already soaked in gasoline, nod, again, to central banks everywhere. In short–gold is a currency hedge against purchasing power declines in currencies ruined by years of drunken monetary policies from Australia to Washington. Those seeking to acquire actual physical gold NOW, as you noted, are finding a lot of closed doors and heavy premiums. GLD and PHYS are the two best publicly traded options for gold seekers not looking for direct gold ownership, but given that HSBC “holds” the GOLD as a 3rd party to GLD raises undeniable concerns, and even PHYS, which Canadians know quite well, has intermediary counterparty risks detailed in the fine print which could become an issue as gold demand rises along with rising levels of fear and uncertainty. I understand that not everyone has the luxury to vault gold personally allocated bars in Switzerland (I’m a big fan of Matterhorn and Egon von Meyer for those with such means and longer-term gold aspirations, as once one owns gold there, one can convert it to any currency one needs, as currencies will behave in their own dynamics [and slow deaths] differently depending on the zip code they were born in) but recognize this is not a path for everyone. As for timing gold’s “surge,” I will avoid crystal balls and stick to macro common sense. That is, I ignore daily price action and stick to history: gold loves to punish bad central banks, loves a recession and rises along side fear levels–all of which are playing out in real time (and down the road) to become the perfect setting for gold’s many days in the sun. Thus, yes, when hyperinflation finally gets the last (dark) laugh at “heroes” like Greenspan, Bernanke, Yellen and Powell, so too will gold and those who had the foresight to buy golden “insurance” before rather than after the fire. GLD is easier to buy than GOLD stored in a Folgers can in the basement or a vault in Idaho or Switzerland, and failing an internal disruption between GLD and HSBC, should offer protection when inflation becomes the headline on everyone’s mind. Note as well, that the Fed and other reporting bodies have (and will continue) to misrepresent actual inflation, which is now closer to 10% in the US rather than the “reported” (and equally debunked) 2% spun to the general public. I plan to write a far more detailed report on gold in general and publicly-traded names like GLD and PHYS in particular soon. There’s just so mmay topics to hit daily as the world now turns toward the karmic hangover from years of debt and drunken fiat money creation. In sum, however, I can not say that GLD or PHYS are “bad” nor promise there is no risk inherent to their structures, but for now, they are the best horses on the public track to play this market for those unable to get actual physical gold.

Dear Matt, Appreciate your macro view without any dressing. Do you think because of stimulus, there could be short melt-up and then complete melt-down by Q3/Q4 ?

Hi JM, naturally stimulus has an impact, as steroids impact bike racers, so too do negative rates and money printing impact markets–as we saw in the record surges last week on the back of new (and expected) stimulus; that said, and as Lance Armstrong reminds, it all ends badly. Trying to time and trade in and out of this stimulus just to capture some volatile upside (when the risk so outweighs reward) now makes little sense unless you are a day trader and experienced hedging maverick, and our solutions are portfolio-driven and focused–i.e. slow and steady wins the race. By almost every sacred measure, the meltdown is here already, but the Fed keeps the market cork from totally sinking via extreme accommodation. This is new, uncharted territory to make a nice and neat timing prediction. The key is simply to tread carefully now. Unlike October of 2019, when I SCREAMED “risk on” when the Fed secretly kicked in more QE, now is a totally different, as the QE is more desperate and the global backdrop far more treacherous. In short, I’m not just riding the Fed tailwinds today as I did in October of 2019 or in March of 2019 (and the rate pause/cut signals indicated then). Instead, we are watching the trend lines and technicals far more carefully now to test just how real and sustainable the Fed “magic” is. Time will tell for now–but this may indeed be the Fed’s last hurrah. Once their magic wanes, there’s literally nothing left to keep these markets up unless we simply socialize the entire securities market and make it one big 401K paid for by the Fed in an zobie-like permanent debt-roll over scheme between the Fed and US Treasury. If that occurs, well, what’s the real point of even calling this a stock or bond market at all?