Dear Reader, if you’re looking for real financial advice and ways to manage your own portfolio, you’ve come to the right place. Signals Matter is your lighthouse in the current market fog.

171 shares

Based on old-school fundamentals of debt levels, tanking GDP, twisted earnings, real vs. reported inflation and just plain common sense, there is a nasty storm offshore heading our way.

But you wouldn’t know it from the eerie calm that now surrounds us. In fact, markets are poised to rise higher for the near-term, not lower.

This calm is based in part upon the undeniable fact that, at least for now, all those old-school fundamentals (like healthy balance sheets, actual earnings or profits, price multiples, growth rates etc.) have been pushed aside by extraordinary central bank intervention, aka “accommodation.”

In short, the Fed has all but taken over natural market forces and placed our markets on one massive air-bag of record-breaking debt-monetization paid for by trillions of printed, fiat dollars and a now no-turning-back policy of artificially repressed interest rates.

Unfortunately, no one can easily predict just how long that airbag will last, as the Fed, as well as the U.S. dollar (the world’s reserve currency) won’t go down without a valiant fight, and as most of you know, it’s not wise to fight the Fed. Many of you may even see it as our friend, as it has prevented a recession for over a decade and kept your retirement accounts thriving.

At some point, however, this eerie calm will be shattered, and the borrowed “prosperity” as we know it today will evaporate with historical elan.

That’s just real financial advice. Below we show why–and with facts rather than Fed opinions.

Our job is to stay away from current (yet entertaining) bear or bull debates and simply track the market’s signals, prepare for the inevitable and carefully make, as well as protect, your money along this historically unprecedented voyage.

I’m here to tell you what’s actually happening, how you’ve been deliberately mis-informed, and what you need to do to protect and then massively grow your wealth down the road.

I’m here to offer real financial advice.

This is not a rant like you have already heard – nor the ordinary doom and gloom. Think of this as a legal opinion from a market lawyer who has reviewed the evidence and laid it before you.

So buckle up. This isn’t about opinion; it’s about objective facts. You be the jury.

Let’s get started…

The Calm Before the Storm

We’ve been enjoying a long and profitable calm in the markets since the Fed stepped in to bail out the very Wall Street banks who crushed the U.S. economy in 2008.

Remember the Troubled Asset Relief Program (TARP)? Remember Quantitative Easing (QE) 1–3? Remember Operation Twist(ed) in late 2011 and 2012? You know, when D.C. (and you, the taxpayer) bailed out the very foxes who just raided our economic hen house?

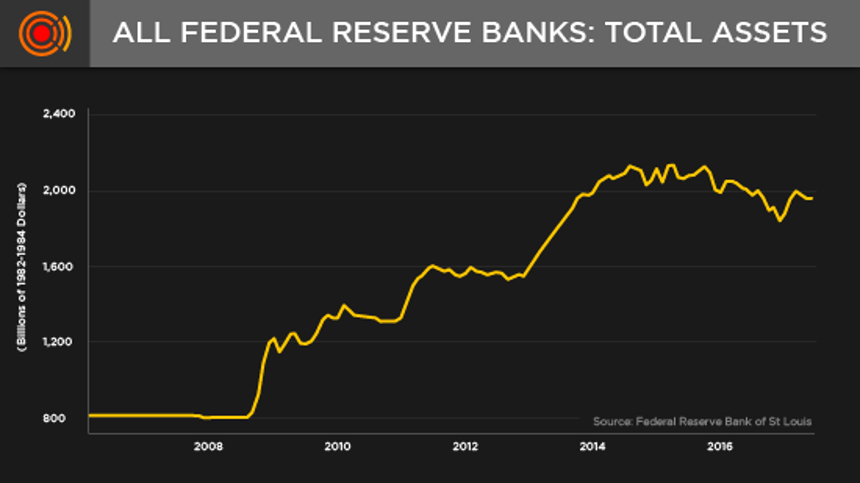

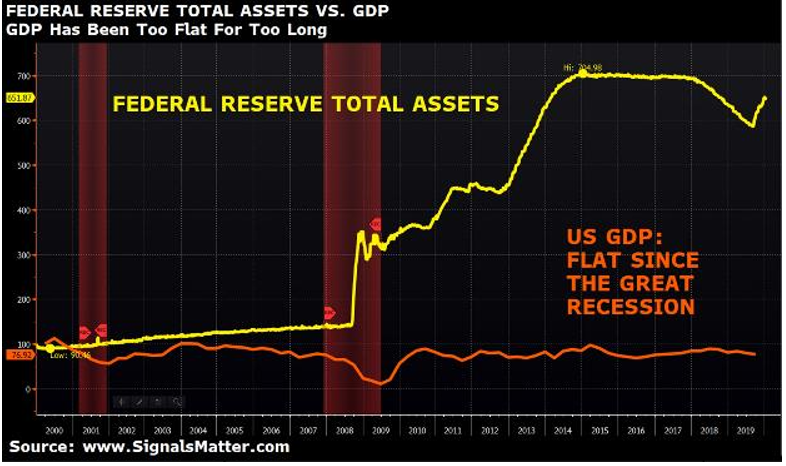

After all, $3.5 trillion in central bank money printing like this…

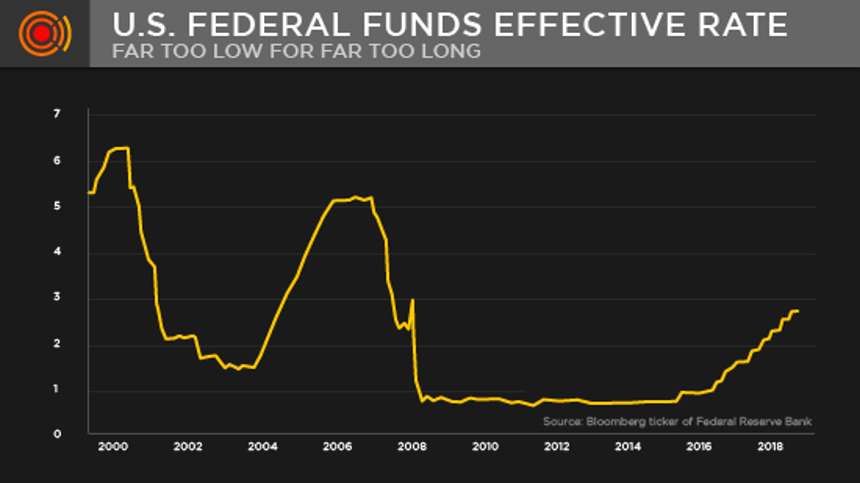

And 11-plus years of artificially suppressed interest rates/borrowing costs like this…

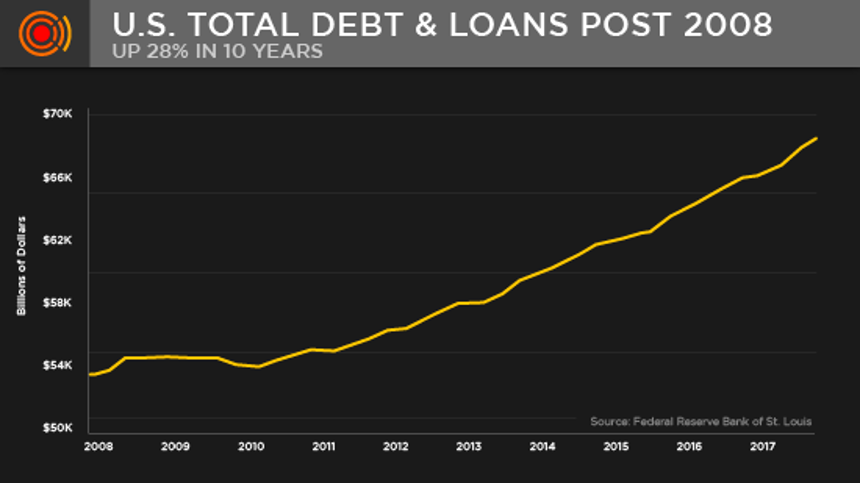

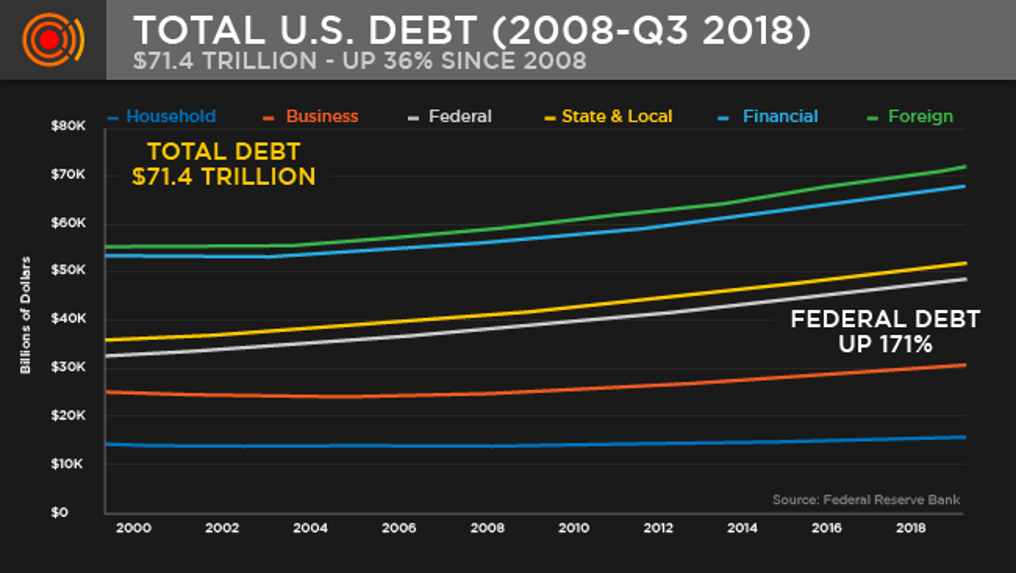

Plus $74 trillion in a record-breaking private, corporate, and governmental debt party like this…

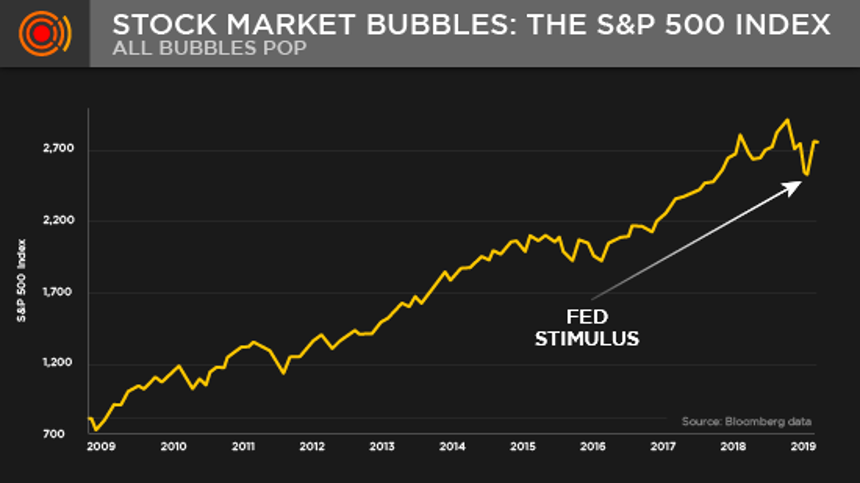

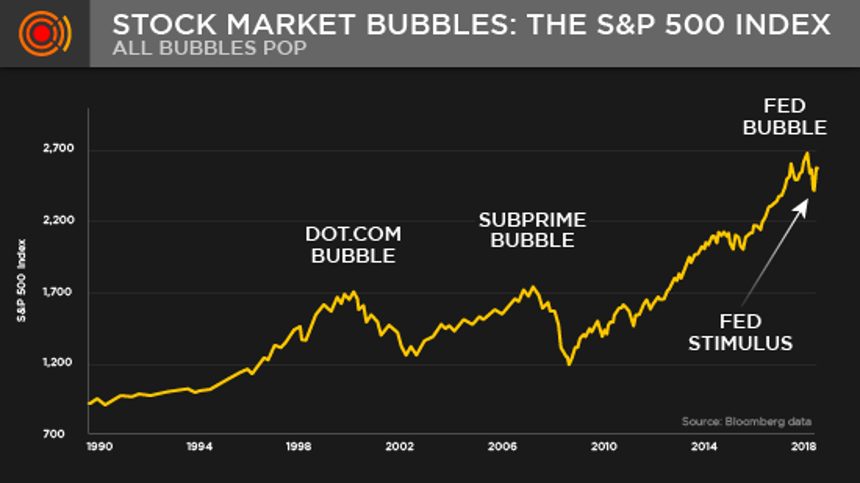

Buys a helluva day at the “market” beach, like this…

Such “debt-addicted” highs, however, are dangerous because investors lose sight of common sense, math, and natural as well as historical market forces.

Artificially low rates cause governments, companies, and individuals to borrow like debt addicts – and nearly $74 trillion worth of market “meth” will one day to lead to a collective death by overdose.

“High on hype,” investors forget the unavoidable reckoning that always hits every investor and every economist who arrogantly thinks that debt without growth is a “recovery.”

That’s just real financial advice.

In fact, debt-driven market bubbles plus flat-lining productivity like this…

..is not a “recovery.” It’s just a spoiled kid binging on a rich Uncle Fed’s credit card at the expense of the real (i.e. GDP-driven) economy.

When the bill comes due and there’s no money to pay it (or rising rates make it too expensive), that day of beach breeze turns into a cyclone…Again, this is just real financial advice.

The Storm Clouds Are Gathering

For now the clouds are merely gathering. A perfect storm, one that will become an historically unprecedented economic nightmare for millions of investors, is converging off a distant and hence ignored horizon.

Fortunately, for informed investors who prefer facts over spin, reality over fantasy, and blunt speech over fairytales, not only will you avoid this disaster by making a few simple changes, you’ll also make an equally simple fortune while others are clinging to floating logs and broken portfolios.

There’s still plenty of time to educate yourself and make your own choices. The facts you face and the decisions you make right now will determine whether you drown or triumph.

It’s just that sad, that serious – yet that real…And this is just real financial advice.

How Do I Know This?

Simple. I’ve seen this movie before – twice. Once as a 20-something dot-com millionaire in the tech bubble of 2000, and again as a family office CIO in the sub-prime crash of 2008.

And what did I learn? Well, I’m about to share that with you now.

Why?

Because after years of amassing wealth for myself and the 1%, I’m deeply of the opinion that everyone – and not just the uber-rich – deserve the best counsel and the bluntest straight-talk.

In short, everyone deserves blunt, real financial advice.

After all, I grew up on the dirt roads of the Midwest, not among the palm trees of Malibu or the doormen-lined buildings of Park Ave.

I genuinely care about all hard-working investors, not just those who can pay high fees to the so called “best and brightest” sitting at those desks where my colleague, Tom Lott, and I have sat for years.

Am I an all-knowing oracle with a perfect timing trick up my sleeve?

Of course not. No one is. But I am blunt. More importantly, I am a realist with real concerns about our economic future and only have time for real financial advice.

The real financial advice I’m giving you is the same I give my parents, who spent their entire lives working very hard for very little.

As a veteran Wall Street insider who has invested billions of dollars during the last 20 years around the globe – from Beijing to London and from NYC to Frankfurt – I’ve also screened, traded beside, and shared insights with the very best (and the very worst) portfolio managers in the world – in every asset class and every kind of market cycle, bull and bear.

In short: I’ve learned a few things, and I’m sharing those lessons and real financial advice right here…

Big Debt Equals Big Market Climbs… Followed by Even Bigger Market Crashes

One thing I learned is this: When debt, rather than real growth (GDP), induces a stock and bond bubble, the crash that follows is always equal in size to the debt binge that preceded it.

Always. No exceptions. Full stop.

History, from 1st century Athens to 21st century Wall Street, is filled with confirmations of this simple rule, crash after crash after crash…

And if market catastrophes are measured (and predicted) by the size of the debt bubbles that precede them, the fact that we are currently enjoying the greatest debt-driven “recovery” (i.e. “bubble”) of recorded history ought to make us pause for a reality check, no?

Check it out…

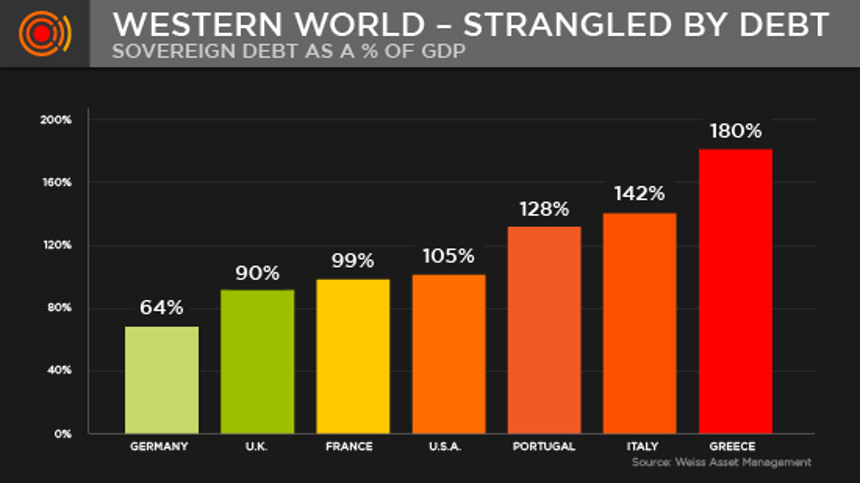

And check out sovereign debt levels that are skyrocketing all around us…

It doesn’t take long (or an MBA) to realize that such record-breaking debt without equivalent growth/income is going to result in an equally record-breaking catastrophe for the markets, the economy, and your portfolio.

Again, this just blunt, real financial advice.

After all, would you trust or invest in a household or business that lives off credit cards but produces no income?

Sadly, our economy and our markets are precisely that: all debt, no income. Or as they say in Texas, “all hat, no cowboy.”

You may not want to believe this. I get it.

After all, for years you’ve been told by the financial media, the D.C. elite (red and blue) and that massive cadre of consensus-thinking advisors (from the corner office to the Wall Street banks) that “all is rosy.”

As a chorus, they’ve been shouting: “Income and economic growth are surging. The economy is booming! Inflation is in check (or even extinct); employment is at record highs; GDP is rising; earnings and profits are soaring; and the smart folks at the Fed know how to save us, as they did in 2008!”

Well… as a Wall Street insider who spends a lot of hours talking with the world’s best traders and wealthiest families, and even a few Fed governors, I don’t consider the foregoing as real financial advice. It’s just group-think driven by an understanable desire to keep the party going for as long as possible..

And let me tell you another well-known but unspoken fact that most of these folks already know: None of those “rosy” reports are objectively true…

Bluntly Speaking: You’ve Been Lied To

Stated otherwise, they are lies – every one of them: From the data on inflation, employment, and GDP to the hype on profits and earnings. But rather than rant, let me prove it.

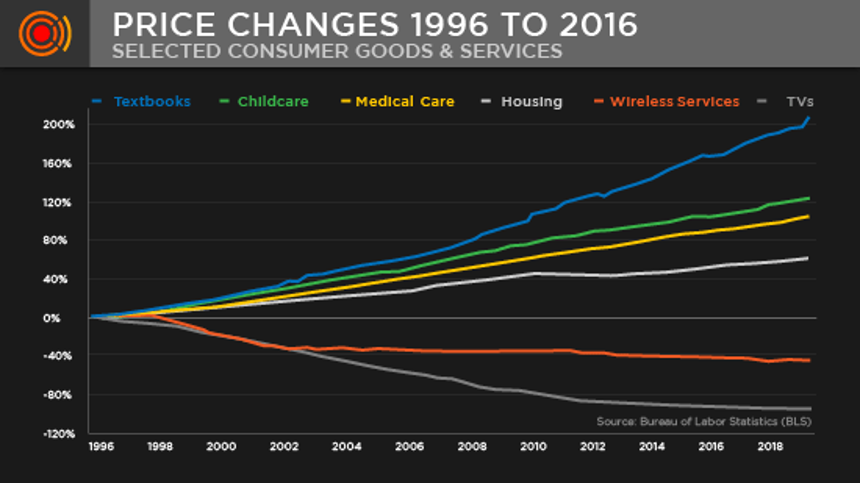

- The Inflation Lie

Inflation is not 2%; it’s closer to 10+%, as anyone who pays tuition, medical bills, grocery expenses, or even the toll on the GW Bridge knows. Costs are rising astronomically.

For example, since 1999, even the U.S. Bureau of Labor Statistics (BLS) reports show a 105% increase in medical costs, an 80% increase in energy costs, a 51% increase in food costs, a 64% increase in housing costs, and a 197% increase in the costs of a college education. Meanwhile, U.S. median household income is below 1999 levels.

That’s all pretty bad inflationary news, wouldn’t you say?

So, what has the Fed and Bureau of Labor Statistics (BLS) decided to do with these annoying facts?

The answer is simple: They ignore them.

So, if you are asking how the price of the American “basket of goods” – i.e. our CPI inflation “gage” – has been hovering around 2% for years on end despite the fact that the above costs are skyrocketing at double and triple digits, the answer is simple: It can’t.

And that is because the BLS (your government) was forced to do some fudging of the numbers – i.e. what the rest of us call lying. They need inflation to appear low, because this keeps rates low and allows our government and companies to survive on cheap debt rather than genuine growth.

In short, those Ph.Ds. in Washington are so clever… they can make 2+2=1 with a simple tweak of their CPI input screen – the equivalent of making the bathroom scale go down for every pizza and beer you consume.

Really? Yep. Government agencies like the BLS, upon which the public so blindly relies, purposely under-report the massive increases in the foregoing costs in order to reduce the reported level of inflation.

Specifically, the BLS leaves out the rising costs of certain goods that they feel are of “lesser importance” when weighing the living costs of average Americans; you know, silly, extraneous costs like medical care, housing, food, education, or heat.

In short, the inflation lie is a lie of omission, the most common trick on Wall Street. For now, however, lies keep the market greased on cheap debt costs and thus reaching new highs after every dip paid for by Fed money printing.

Fun?

Yes, until the grease dries up and the lies no longer work in the face of naturally rising rates. This, of course, is hard to “time.” Instead, one must simply track those rates (and the forces that influence them) and be prepared. Our portfolios do precisely that: Prepare you.

That, at least, is our real financial advice.

- The Employment Lie

But what about all the “rosy” employment news? Things must be good with a country at full employment, no?

Well, that, too, is simply a lie.

Frankly, America’s unemployment statistics are some of the most cleverly distorted magic tricks of math ever concocted by the wunderkinder in D.C.

Today’s employment-to-population ratio for men has been steadily declining for decades, and at 66% represents an all-time low.

By 2018, there were 125 million men of working age, of which just under 83 million were reported as “employed.” The majority of those “employed” included part-time jobs that can’t support a household.

Other facts include the much-overlooked reality that 11 of our 50 states now have populations where those receiving government handouts outnumber those who have actual jobs.

According to the U.S. Census Bureau (more honest than the BLS), one in four Americans (25%) lives below the poverty line. Think about that, too.

Do you still feel those heavily touted U-3 unemployment numbers are all that comforting? After all, the BLS considers two hours a week flipping burgers as “fully employed.”

- The GDP Lie

Then there’s the GDP myth… the 4.1% rates seen in 2018, for example, and the back-to-back 3% GDP quarters at the end of 2017 are often tossed about as yet another reason not to worry – to just keep buying stocks and bonds in order to make our economy appear strong.

But the stock market is not the same thing as the economy, and both are at peril.

And when you step back and look at the real story, that is, the annualized rate of GDP growth since the post-2008 “recovery,” you soon discover that the average GDP for the U.S. during that period is a rather pathetic 1.7%.

That’s 1.7% GDP against a 128% rise in Federal debt for the same period, the equivalent of a busboy “income” against a Ferrari-sized debt level.

- The Profits and Earnings Lies

But just as Washington and the prompt-reading cheerleaders are lying to you about such critical matters as inflation, employment, and GDP, your bankers and brokers in Wall Street have been lying to you about earnings and profits.

Really?

Yep. Really.

But in a record-breaking and artificially “Fed-doped” stock market that seemed to only go up since the ’08 crisis, one would assume that profits and earnings – the very heart and soul of a healthy stock market – were doing the same thing, right?

The mainstream financial media sure thought so. In fact, the bobbleheads and bankers in September of 2018 were on a blatant mission lauding (and promoting) “booming” profits and earnings as the market peaked only to see genuine pain and volatility beginning in October and a complete market bust by December.

Well, let’s look at the math and see for ourselves whether their “booming” reporting was based on truth or, well… lies.

- Profits?

If we look, for example, at the pre-tax profits of corporate America for Q2 of 2018, the number came to $2.2 trillion. But if we look at the same data for Q2 of 2017, we see that the profit numbers were essentially the same.

In fact, one can go all the way back to the pre-tax profits of Q2 2012, and guess what, profits back then were also around $2 trillion. In short, corporate profits were not “booming” at all. Instead, they were nearly flat, annualizing at a meager rate of 1.3%.

This is not opinion. This not “gloom and doom” talk. It’s math.

- Earnings?

Turning from profits to earnings, let’s look once more at facts rather than headlines and myths.

Here, I’ll tell you another “insider” secret we math geeks in the hedge funds know all too well. It’s called the “ex-items” accounting scam.

As an Associated Press report recently concluded (and your advisors probably over-looked), 72% of the companies they reviewed had adjusted profits that were higher than net income.

Please read that again. How can companies have more profits than they do money coming in?

Well, to be blunt: They’re cheating. What’s even scarier? They are allowed to. Because we are about real financial advice, let me explain more.

- The Ex-Items Scam

It all comes down to a clever book-keeping scheme called “ex-items” accounting – a parallel little accounting universe (and an open secret in the hedge fund world) where CEOs are allowed (a bit like Al Capone’s accountant) to carry two sets of books: one (honest GAAP Accounting) that they report to the SEC (nod to Sarbanes-Oxley) under penalty of prison, and another (dishonest, ex-items accounting) that they report to sell-side analysts and retail suckers (i.e. you).

This little accounting trick has opened the door for totally gaming earnings season, which means you are the one getting “played.”

This “second book” basically allows CEOs to skip past (i.e. ignore) overhead and just report cash flow. That’s a bit like a lemonade stand that reports only lemonade sales but not the cost of lemons…

These legalized write-offs allow executives to sweeten their valuations and “beat earnings expectations” at nearly every earnings season.

P.S. Another Wall Street trick is for bank analysts to set earnings expectations deliberately low, so they are then easy to beat – a bit like your kid’s teacher telling you, “Great news! Junior’s report card beat expectations: He got a C- when we only expected a D+.”

And if you leave the fake world of ex-items accounting (lies) and enter the real world of GAAP earnings, here’s what the real numbers have to say…

First, annualized GAAP earnings for June of 2018 came in at $122/share for the S&P500. The pre-crisis peak earnings 11 years prior to that date was $85/share, which means we’ve seen earnings grow by an annualized rate of just 3.4% since 2007.

Again, this is fact, not opinion; this is math, not spin. It’s our version of real financial advice.

Now I ask you: Does 3.4% annual growth over an 11-year cycle (against 38% debt growth) feel like a “boom” in earnings?

Nope. It’s just a debt-driven, shady-accounting “boom.”

- The Stock Buy-Back Scam

Here’s some more real financial advice. Ever since the wise Fed stapled interest rates artificially to the floor, companies have been borrowing like mad to buy back their own shares, over $4 trillion worth since the 2008 crisis.

Now, that’s a helluva artificial way to push up share prices and earnings-per-share “data.”

Why do executives do this?

It’s simple: Their salaries (not your investing safety) are based on share prices. They pump up shares and make short-term fortunes while Main Street investors (the “suckers”) get crushed when those same shares later tank down the road.

Reality Check

OK, so based on pure math (as opposed to opinion), we can objectively conclude that since the last market peak in ’07… 1) profits are empirically flat, and 2) annualized earnings are paltry, legally misleading, and not “booming.” Period.

The obvious next question for those seeking real financial advice is this: With earnings annualizing at 3.4% and actual profits mathematically flat-lining, how is it that U.S. equity markets have soared to all-time highs?

In fact, we see a similar boom year for 2019, as the Fed will inevitably be forced to lower rates and print money to keep this debt-driven market alive—for as long as possible.

The Debt Truth – The Skunk in the Entirely Fake Market Woodpile

If you want some real financial advice on how markets have been ripping since 2008 despite the fact that such crazy “old-fashioned” indicators like GDP, profits, and earnings were otherwise stalling, the answer by now is simple: Cheap debt did it, and it was handed to us by the Fed, a central bank that serves Wall Street, not Main Street.

If you don’t want to believe me, let’s look at another colorful picture and, again, do the math.

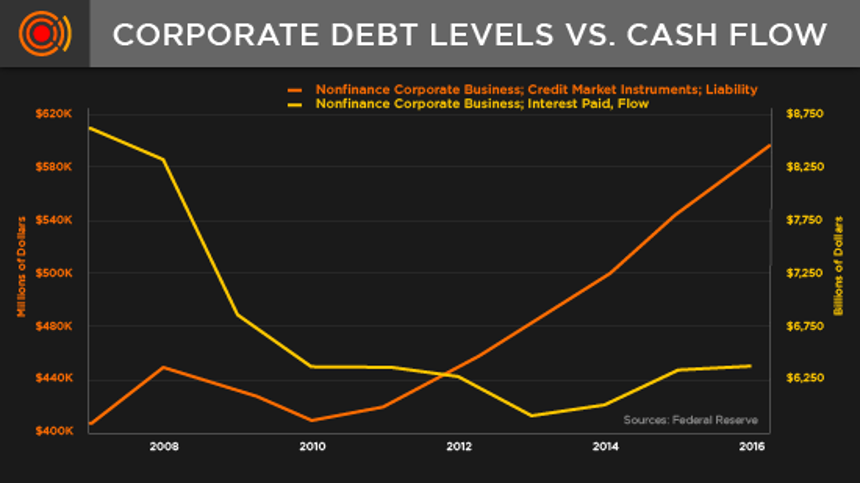

The falling yellow line represents the cost of borrowing; the rising orange line shows corporate debt levels…

Needless to say, when bad or profitless companies see a chance to cheaply borrow their way out of an otherwise well-deserved grave, they always do so.

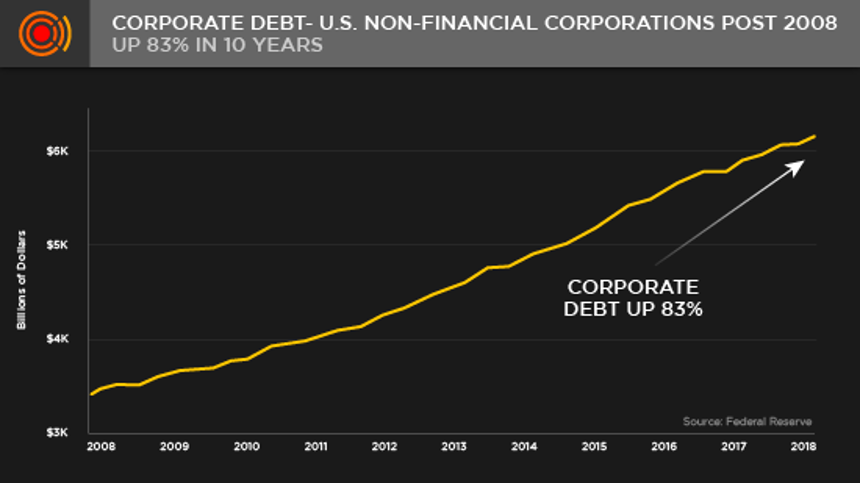

Alas, rising corporate debt like this…

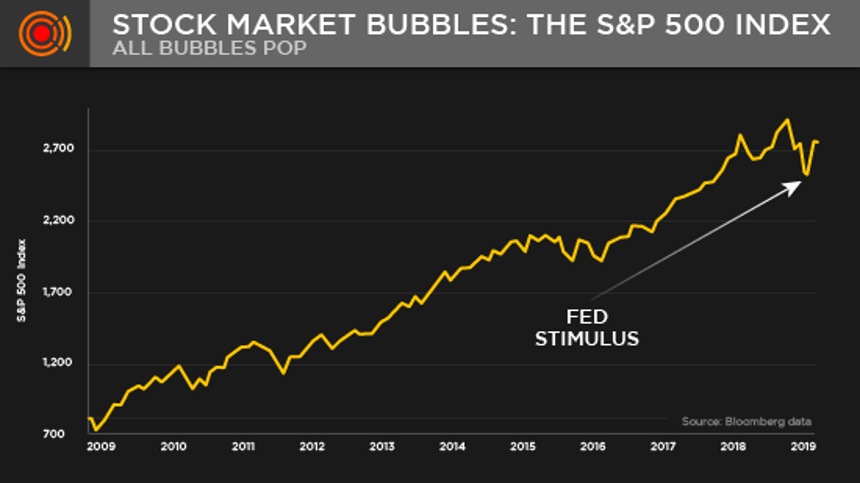

…buys a lot of fun and time for otherwise dead-beat companies. Namely 10-plus years of markets abnormally and absurdly rising like this…

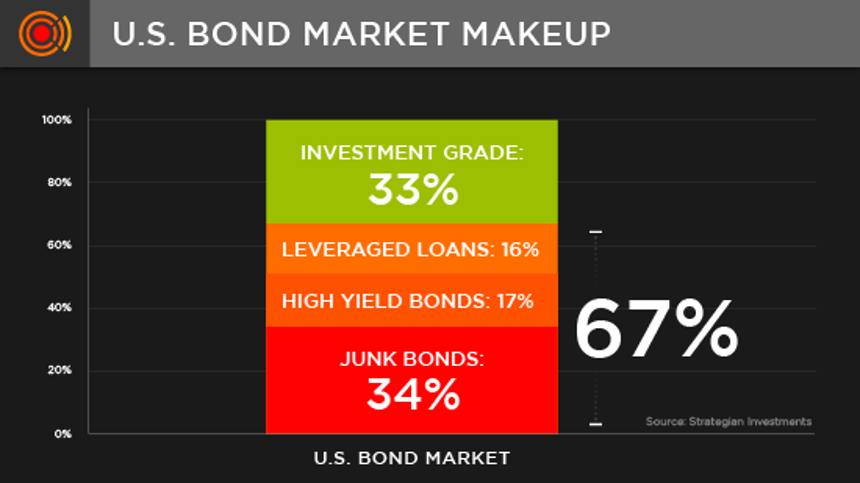

And if you need even more proof (and real financial advice) that American companies are just junky, debt-ridden zombies, here’s another unreported “fun fact:” 60% of the U.S. bond market – i.e. American companies that you invest in – are classified as junk, high yield, or leveraged loans, which are the very bottom of the credit score barrel, the veritable D- students of the corporate-balance-sheet world.

And when it comes to real financial advice, this is the REAL KILLER: THE CORPORATE DEBT BOMB.

After eight years of money printing and over a decade of artificially low rates, the larger domestic debt bubble has grown to $41 trillion, dwarfing the size of the domestic stock bubble of $30 trillion.

Junky corporate debt is now the new “sub-prime bubble” of today. The only thing keeping it from blowing apart is cheap debt—i.e. low interest rates, which for now, the Fed has artificially compressed.

For years, investors have gone further and further out on the risk branch seeking minimal yield for higher risk by over-paying for junky bonds in debt-soaked names like GE and AT&T.

As growth slows, many indebted companies will either default or dip into earnings, sending markets down.

To that end, I have a fat list of over-indebted companies to short…but only when the market signals me to, and for now, the Fed has made shorting bad names nearly impossible. Many of the best hedge funds I know for shorting the markets have simply given up doing so, as the Fed has made such trades temporarily obsolete. Of course, once the jig is up for the Fed, the short-sellers will spring into action in the backdrop of a real bond crisis.

What could trigger this bond crisis? Any number of things…

- Political issues like extending tariffs that harm U.S. exports or the markets finally catching on to this rigged bond game, or…

- Bonds simply falling under their own excessive weight, or…

- Any number of black swan potentialities – i.e. once “safe” companies suddenly running out of low-rate debt rollovers and new cash to pay old debts.

Up until March of 2019, the Fed had promised to “tighten” its balance sheet and begin unloading/selling $600 billion of U.S. Treasury bonds back into the market, which would have ensured a fall in bond prices and a rise in bond yields – and interest rates.

This “tightening” in fact began in October of 2018, and immediately the markets began a three-month free fall, which I predicted months in advance, warning subscribers to brace for a bad year-end for 2018.

Needless to say, this “tightening” recently caused a panic in D.C. and Wall Street, as markets tanked by 20% in a matter of days.

Faced with the tough choice of either continuing to allow rates to rise via the promised “tightening” and thus allowing overvalued markets to fall (sober up), or offering more low-debt “meth” to the markets by welching on the prudent yet painful “tightening,” the Fed took the dumber approach and welched…

By doing so, it merely added more low-rate meth to the debt-addict bubble, thereby making the overdose to come more fatal and harder to time.

The simple fact is this: No one rings a bell on Wall Street and tells you: “Hey, the party is over; it has been fun, now it’s time to get out.” Instead, YOU have to make common-sense moves now, before the you-know-what hits the fan.

It’s Time to Get Real

I’ve just hit you with a bunch of blunt, real financial advice.

Knowing what you now know – i.e. that you’ve been lied to about inflation, employment, GDP, profits, earnings, and corporate debt levels, why on Earth would you want to be “all-in” a topping market infected with fatal levels of debt and dishonesty?

I mean, would you loan or invest your life savings to a deadbeat with a crappy credit score, no income, and a history of lying to you?

Well… if you are fully investing today in the U.S. stock market (driven almost exclusively by five FAANG stocks with crappy balance sheets) or the U.S. bond market (60% of which is essentially a junk-bond market offering all risk and nearly zero reward), then that’s precisely what you are doing.

Seem like a wise plan? Not if your following real financial advice.

And not when a perfect storm is brewing right above us.

Smart investors seeking real financial advice must balance cash allocations to manage risk rather than chase these seductive tops “all-in,” even if the good times continue for months or even years ahead.

What a Perfect Storm Looks Like

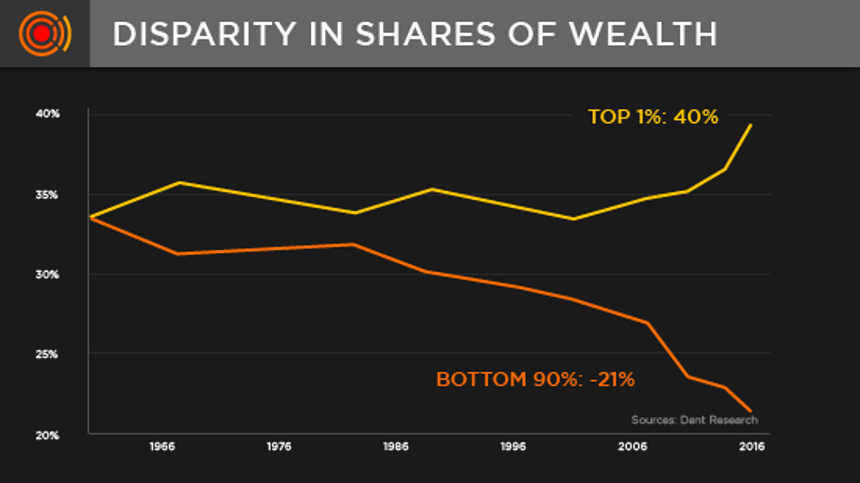

A perfect storm is one in which: 1) an overvalued stock market bubble driven by 2) massive debt levels collides with 3) political instability and 4) unsustainable wealth disparity.

As for overvalued stock markets, let me ask you again: Does the following graph of the S&P look like an overvalued market bubble/top to you?

And did you know that the main force behind the market cap of that S&P “500” is in fact driven by only five FAANG stocks (Facebook, Apple, Amazon, Netflix and Google)?

In many ways, the S&P 500 is really just an “S&P 5.” We expect these stocks to rise big time in 2019, for no other reason than we expect more Fed tailwinds which favor tech.

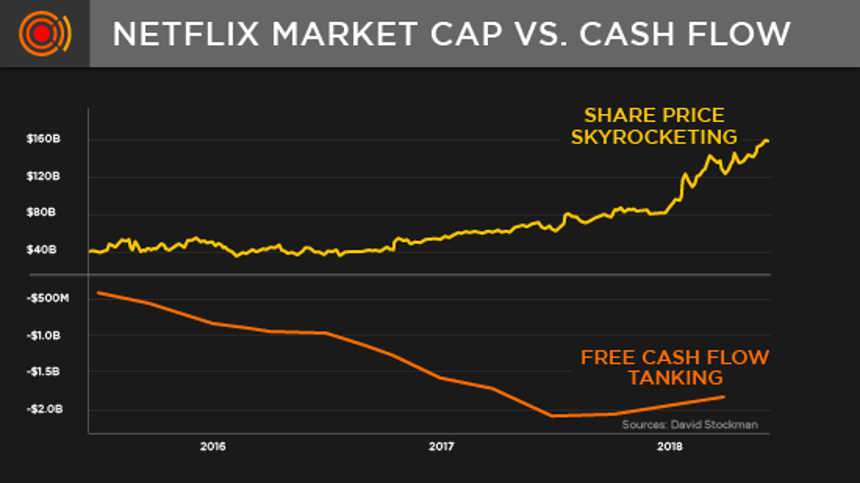

And did you know that despite their rising, post-2008 share price “surge,” these FAANG stocks have declining free cash flows?

Just consider Netflix. The top line shows share prices rising, the bottom line shows its free cash flow. This is plain crazy.

Furthermore, these same five stocks lost a third (33%) of their share value in just six months in late 2018 (and fell 20% in 24 days in December 2018) on a mere hint of rising interest rates?

They will fall much further when rates really rise – which the Fed can and will postpone, but can by no means prevent. But not now, and not yet.

You see, right now the Fed has halted rate hikes. It will more than likely even lower them in 2019. Expect a dash of money printing too. This will greatly favor the FAANG’s…

But the Fed has no more control over the coming debt crisis (i.e. rising rates) than a seasoned sailor has over a cyclone. To think otherwise is pure hubris.

As for the second storm front, i.e. massive debt levels, at $73-4 trillion, we are sitting on the largest debt pile in our nation’s entire history. Today, however, most of this debt is government debt, which means the party can drag on longer than wisdom would otherwise allow. Governments, after all, can print their way out of near-term dangers and hand the cost and pain to tomorrow’s innocents.

And as for political instability, no one, red or blue, can deny that the United States has never been such an un-United States since the Civil War…

Finally, when it comes to the final storm front – i.e. wealth disparity – never in the history of our nation has the empirical gap between the rich and poor been greater. Never.

Today, 60% of Americans can’t save $1,000; 40% can’t survive a $400 emergency without having to sell something; 50% of U.S. children live in welfare-assisted homes; seven million Americans have defaulted on car loans; student loan defaults reached $164 billion for 2019; and currently, with 480 million credit cards in circulation, there’s an average of 1.5 credit cards for every man, woman and child in the U.S.

Meanwhile, this morning in New York City, I literally overheard a fancy lad on Madison Avenue brag about making a $1 million “character purchase” for a rare sports car…

Yep. The perfect storm is coming. For many Americans, it’s already arrived. But we ain’t seen nothin’ yet…That’s our real financial advice.

How It All Ends

It’s very simple. Artificially low rates (nod to the Fed) and cheap debt have given us the fakest, most debt-driven “recovery” and market inflation in the entire history of capital markets and global economies.

But when rates rise, that historic debt “recovery” becomes a historic debt nightmare. Again, just more real financial advice.

And know this, we at Signals Matter track the forces behind interest rates with obsessive attention, tracking hundreds of indicators to keep us (and YOU) ahead of the “Uh-oh” curve to come based on, you guessed it: real financial advice, not spin, false hope or fear-selling gimmicks.

As we saw in Q4 of 2018, when the Fed tried to raise rates by even 25 basis points (1/4 of 1%), the markets went into a tailspin…

Wall Street then shouted “stop” and the Fed bowed to its master, buying markets time, but just adding more fuel to the debt fire.

Imagine what will happen when rates rise by 1%? By 2% or more? I’ll tell you: Markets will sink faster than the Titanic, and most investors are going to drown.

But not to worry, you might say, as our brave Fed leadership just announced they won’t raise rates at all for 2019…

Well, we fully agree. In fact, we can assure you the Fed will be lowering rates this year—so expect another party on Wall Street for 2019. That’s our real financial advice.

But here’s more real financial advice and another insider secret: In the long run, it’s not the Fed that determines interest rates; it’s the bond market.

And guess what? That bond market (driven by natural market forces of supply and demand) will one day get the last evil laugh over the Fed…

Today’s credit (bond) markets are fatter than ever, and when it pops under its own weight, interest rates will soar, which means markets will tank.

The end really is out there. And I’ll be tracking this storm for you rather than making arrogant, psychic-like date-stamps today.

The Needle Peak Before the Crash – a Bull Case?

Despite the inevitable debt storm, markets don’t simply announce a crash date and then go straight down. The four storm fronts discussed above converge in natural ways, which can even include periods of extreme upside.

For example, as sick as growth and the U.S. debt markets are, they are equally if not more distorted in Europe and Asia.

It is quite possible that inflows from those areas to the U.S. could occur first, with U.S. markets perceived as the “best horse in the global glue factory.”

Such an ironic scenario could push security prices temporarily up, rather than down – kind of like the Titanic’s bow rising briefly out of the sea before sinking to the bottom.

Again, in such scenarios, our primary aim is to simply get you off the Titanic, so cash allocation lifeboats are still the key here.

That said, we’ll be providing interim signals to capture some of the near-term upside, albeit with a lot of your investment dollars already safely to the sidelines.

How You Can Make a Killing Rather Than Get Killed by These Markets

In the interim – i.e. during this “calm before the storm” – what can you do now to not only avoid this cyclone, but make a fortune the old-fashioned way?

As promised, I have organized some real financial advice and thus compiled a blunt list of steps you can take today to protect your wealth and make it grow like never before, and you’ll be surprised how simple it really is, even coming from a Wall Streeter…

So, What Do You Do?

It’s not that hard to follow our real financial advice, but you have to do it, and some of this takes preparation, contrary wisdom and, most of all, patience.

Let’s get started.

Here Are a Dozen Ways You Can Protect Yourself

- Get comfortable with the notion that markets can, do, and will crash.

By 2003, the NASDAQ had crashed 80% from its 2000 highs; in 2008, the S&P fell by 38% (57% from the October 2007 top to the March 2009 bottom). The crash that’s coming is nothing new – in fact, it’s going to be even worse.

- Get to shore – i.e. go to cash!

The number one rule to making money is to not lose money. For example, if your portfolio suffers a 50% loss, you’ll need markets to rise by 100% just to get back to where you started. If it falls more, the journey back is even worse. Why start from a loss, when you can simply avoid it? The elite investors I know are already 30% to 50% in cash now.

Why? What are they PATIENTLY waiting for? Well… see #3…

- Buy low, not high.

The number two rule to making money (from Baron Rothschild to John Templeton) is selling at tops and buying at bottoms – “when there’s blood in the streets.” As simple as this historically confirmed market secret is, it is overwhelmingly ignored.

Nor does this require market timing. It just requires common sense.

No one can perfectly “time” a top or a bottom, but I can get you close enough. We are certainly at a top now. Get some money in cash. Sure, you’ll lose some obvious upside—but you’re playing the long game, not chasing near-term tops en route to a massacre.

The real fun begins when you have the cash (rather than the bleeding) to buy watch-list stocks near the bottom, not the top. This requires patience rather than hope, which is why few investors actually do it. Don’t be like everyone else…

- Rethink conventional stock/bond pie-chart asset allocations.

Stocks may be way too big an allocation for you, and as we’ve seen above, bonds are no longer the “lesser risk” allocation they traditionally were. Indeed, they are even more over-priced and risky than stocks. Again, the best “safety” asset today is cash, and our Storm Tracker tool tells you what cash levels to be in as markets trend up before melting down.

- Think gold.

I’m no “gold bug,” but the Swiss have known for generations to keep at least 10% of their portfolios in precious metals (silver is a good value too) as a long-term insurance hedge against the declining purchasing power of currencies.

Given that central banks around the world have printed $15 trillion in fiat currencies since 2008 (and they’ll print more again when markets tumble), common sense confirms that global currencies are going to be even more devalued.

Precious metals are historically the best long-term hedge against weakening currencies. Use our search box and type “gold” to see more on our thinking about this oh-so precious metal.

- Stay calm, play dead.

Again, simple to say, hard for most to do. It’s essential to keep a long-term perspective, avoid chasing frothy tops, and patiently weather the storms so you can buy at bottoms.

Patience is key. In many ways, this actually requires you to play dead. During a bear market, the bears rule and the bulls won’t stand a chance. There’s an old saying that the best thing to do during a bear market is to play dead – it’s the same protocol as if you were to meet a real grizzly in the woods. Fighting back would be very dangerous.

By staying calm and not making any sudden moves, you’ll save yourself from becoming a bear’s lunch. Playing dead in financial terms means putting a larger portion of your portfolio in money market securities such as certificates of deposit (CDs), U.S. Treasury bills, and other instruments with high liquidity and short maturities.

Boring? Yes. Missing out on easy profits? Yes. Getting caught in a portfolio-crushing disaster? Nope.

- Get rid of those concentrated positions.

The three biggest mistakes investors make is concentration risk, timing risk, and leverage risk.

As far as concentrated positions, know this: They could kill you. Instead, consider an “Exchange Fund” or “Swap Fund” for whatever non-cash allocations you make before the storm hits. Exchange Funds, or “Swap Funds,” are private-placement limited partnerships. These vehicles allow an investor to “exchange” an individual stock for shares in a pooled fund of many stocks.

The funds are managed, so the stocks are from different sectors and industries to provide immediate diversification.

If your original stock should drop in value, you hold the value of the diversified fund. Using an Exchange Fund also allows the original amount of the stock to be invested without first selling, paying taxes, and then investing the remainder.

Or even more simply, just subscribe to our portfolio service and we’ll keep you constantly updated and directed toward the best allocations in this bull-before-bear backdrop of crazy. For less than a one-month gym membership, we’ll protect your portfolio better than all the fancy lads on Wall Street.

- Make options an option.

Again, once you’ve put proper amounts of your portfolio in cash (or cash-like, short-term bonds as per above) to avoid the storm (better months or even years early than a second too late), some of you more seasoned investors may consider using options for value protection.

You can control downside risk as well as make money when markets inevitably fall by buying a put option, a contract that gives the buyer the right to sell a security at a specified price for a fixed period. For example, if you own a stock trading at $50 and buy a $45 put option, it gives you the ability to sell the shares at $45.

It doesn’t matter if the stock goes to $0, you will still receive $45 per share. The put option only has a given amount of time that it is in force. The contract time can range from 30 days to two years.

A put option strategy is expensive for long-term protection but is more attractive for shorter periods of time, when our signals confirm (not yet) that this market is trending toward the floor.

Using put options may be a good short-term strategy, but costs make it difficult to use long-term. Again, I’ll let you know when to bet against this market by purchasing puts. Better yet, we’ll be signaling inverse ETF’s to allow some of you to bet against this market when the time comes in a much simpler way.

Our service, however, is not about trading signals, but exclusively about broader portfolio solutions. Why? We stick to signals and solutions that any one can follow, not just the fancy lads. Our singular aim is to do the most good at the simplest level—your portfolio.

- Gift your way to shore.

Gifting is a great strategy for partially reducing your stock holdings before the storm while simultaneously avoiding capital gains.

A popular choice is gifting stock directly to non-profit charities. By donating stock instead of cash, you reduce your stock position and are likely to receive a tax deduction. Donors are eligible for an income tax deduction for the full market value of the stock, up to 30% of adjusted gross income.

You benefit by reducing your position and capital gain exposure, and the charity benefits by selling the stock while paying no tax because it is a non-profit. Everyone wins!

- Go alternative with an allocation to “liquid alts.”

Liquid alternative investments (liquid alts) include diversifying Exchange Traded Funds (ETFs) and Mutual Funds (MFs) that invest in asset classes other than stocks, bonds, and cash.

Liquid alts are typically long-only vehicles that invest both long and short across fixed income, stock indices, emerging markets, gold, silver, and commodities generally, real estate, and other trading strategies, managed futures trading strategies, with varying levels of leverage.

Investors in liquid alts generally have a different mindset than investors in long-only stocks, bonds, and stock/bond ETFs or Mutual Funds.

Rightly, they seek liquid alts to diversify away from traditional asset classes, lowering correlation without sacrificing return. During periods of recession, liquid alts are deployed as a safe haven and can typically enhance return as stocks and bonds fail.

We’ll be signaling the right liquid alts to our subscribers even if (or when) markets temporarily rally before they head Titanic-like below the waterline.

Again, the key message here is have healthy levels of cash already in a safe lifeboat. For what remains in the market, you’ll need to follow careful signals and allocations, which is why Signals Matter was created.

- Get rid of those ARM mortgages!

Also, if you are currently in an adjustable-rate mortgage, change that now to a fixed mortgage while rates are still low. Interest rates will inevitably soar, depleting your income.

- Most important of all… make sure your financial advisor “gets it.”

Financial advisors typically get paid by a percentage of the money you have invested in the markets. As a result, they often convince themselves and you to “stay the course” through all market cycles rather than go to cash when the clouds above are otherwise obvious.

Most advisors collectively believe in modern portfolio theory, which values diversification and avoiding “market timing” – i.e. exiting the markets.

I respect this view, but I don’t fully share it, as the old ways have greatly changed since the Fed took over normal price discovery and market action.

When markets are clearly topping and future risks far outweigh the probabilities of future reward, putting healthy allocations to cash is simple common sense. (Remember rule number one!)

Given the information you’ve gathered above, ask your advisors direct questions about debt dangers, stock overvaluations, the risk of rising rates, stock buy-back distortions, misreported earnings, etc. and make sure you are comfortable with their knowledge and responses.

Do they see a recession coming? Will they tell you? Do they truly “get” the notion of “buying low and selling high,” and if so, why would anyone be “all-in” at these tops?

Also, is your advisor qualified to put you in alternative investments? Many firms require FA certifications to do so.

Be Smart

There you have it: 1) a Fed that serves Wall Street as Main Street crumbles… 2) the largest debt bubble in history preceding the largest economic collapse in history… 3) a rigged political and financial system that lies to you about inflation, employment, GDP, earnings, and profits… and 4) a nation divided by the greatest disparity in wealth ever recorded.

The perfect storm.

As the Fed desperately postpones the inevitable by stalling (or likely even lowering) interest rates in the year(s) ahead, they are merely stacking sandbags on the beach against a debt tsunami – that is, desperately buying (borrowing) time in a losing war against history, math, facts, and common sense.

So now it’s your time to calmly consider our real financial advice and weigh the foregoing facts, not myths; be smart and patient, rather than desperate; and make money, rather than excuses.

In sum: Be smart; be patient; be careful. As such, you’ll be swimming in money while everyone else is swimming for their lives.