Below, we look at the Fed Experiment playing out today and what you can do to trade its signals based upon the sad fact that today, the Fed is the market.

24 shares

A Little Napoleon…

While retreating from a burning Moscow, Napoleon’s once unstoppable “Grande Armée” disintegrated into the snows of a brutal Russian winter.

Watching this epic disaster unfold, Napoleon quipped to his shivering aid: “Indeed, it is only a very small step from the sublime to the ridiculous.”

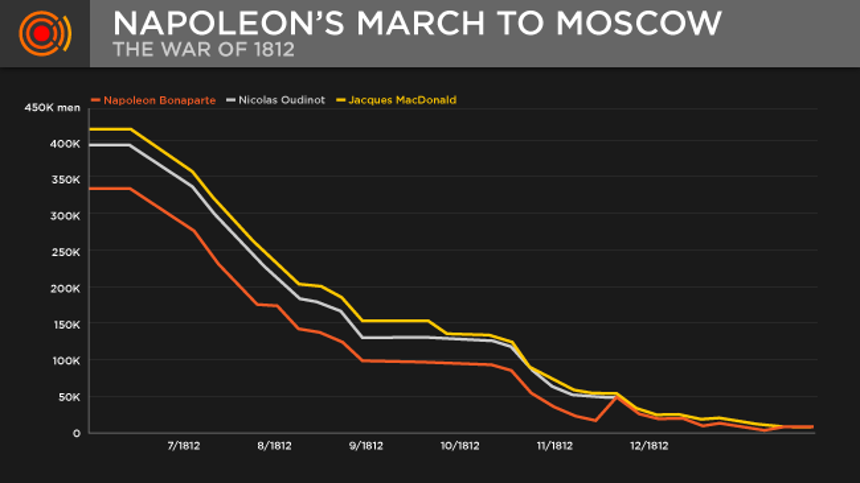

The staggering chart below shows the death of Napoleon’s army as it retreated from Russia after otherwise “conquering” Moscow.

360,000 soldiers went in; only 10,000 made it out alive.

Today, as the Fed’s power – and the markets over which it rules – reach equally historic and “sublime” heights (with more to come in 2019), we are seeing only the first signs of its slow, small step toward the “ridiculous.”

But don’t worry. In many ways, the Fed is stronger than Napoleon’s army. The current Fed experiment still has a lot of fight left in it, despite numerous signs of danger.

Still, we need to see these signs and prepare for an eventual and brutal retreat.

In order to track this embarrassing trajectory and Fed experiment, we must first understand how the Fed wields such initial and admittedly extraordinary power.

The Power of the U.S. Dollar

The bulk of this power boils down to the fact that the Fed controls the supply of U.S. dollars.

This is critical, because the U.S. dollar comprises 60% of the global currency reserves, 80% of the global banking payment system, and effectively 100% of the global oil exchange.

That’s a VERY powerful currency (“army”) to have under its control.

In 2008, when U.S. banks tanked and the Fed created money to bail them out, we saw the immense power of this central bank.

But when those really bad banks got caught swimming naked with toxic mortgage debt in 2008, the problem was in fact much bigger than just rotten mortgage-backed securities.

Trillions in market value was also lost across an entire swath of the U.S. – as well as global stocks and bonds.

Why?

It’s called the “contagion effect.”

Hedge funds and other big institutional players trapped in one large and toxic asset class had to cover their margin calls and losses by selling their “good stuff” to pay for the bleeding in their “bad” trades, causing massive sell-offs in otherwise “blameless” assets and players.

When the Fed began printing trillions of U.S. dollars in its panicked Fed experiment to save their spoiled nephews on Wall Street in 2008, other central banks around the world were forced to swap their currencies with the U.S. central banks.

You see, all banks (and hence economies) must essentially bow to our powerful, “Napoleonic” U.S. dollar just to keep international banking and currency systems precariously aligned.

In short, most of the world’s central banks literally have no choice but to follow our dollar and hence our Fed’s lead in the current Fed experiment.

The dollar and the Fed are not only “KING” – they’re a veritable Napoleon.

But we all know what happened to Napoleon… and at some point down the road (which we can track now, predict later—when market signals tell us), the Fed and even its U.S. dollar will similarly fall from their imperial throne – that is, take that “small step from the sublime to the ridiculous.”

We’re not there yet.

Until then, it’s essential that you understand and respect the twisted but nevertheless immense power of the Fed.

The Fed’s Napoleon Complex – Wanting More Until It Crashes Under Its Own Power

In 2008, when banks like Goldman Sachs, Citibank, and Morgan Stanley should have been allowed to die on the field, the Fed resurrected them.

The name given to this money-printing “miracle” was “QE1.”

Like Napoleon at Austerlitz, the Fed should have stopped “sublimely” there. Instead, it kept marching forward toward the “ridiculous.” At this point, the Fed experiment was driven by panic rather than sober reality.

After QE1, the Fed, like a greedy Napoleon, went panicked even more, and QE2 and QE3 followed with trillions more dollars printed from 2008-2014. Interest rates, more importantly, were kept at 0% all the way to 2015.

The media, banks, and politicos called this victorious march through Wall Street a “recovery.” But, again, the more honest word is “experiment” – and years ahead (or sooner) it will be a failed Fed experiment – a true “Waterloo,” as I indicated here.

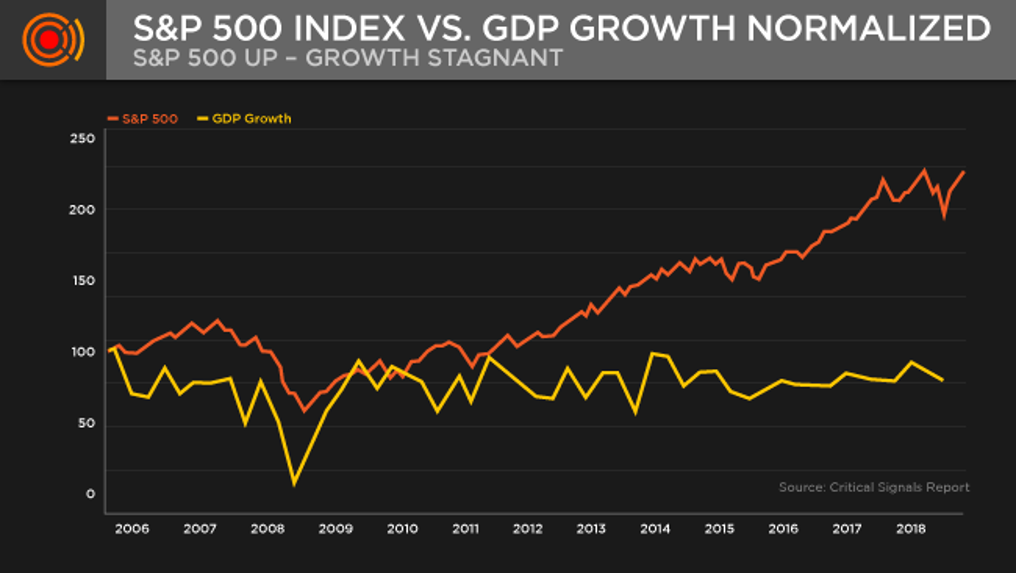

You see, all that Fed experiment “support” went straight into the banks and markets, not into the economy or GDP, which have seen a textbook “depression” in GDP growth, averaging at just 2.2% since 2008.

The S&P skyrocketed (“re-inflated”) by 300+% while our GDP was freezing in the snow.

Markets, under the Fed experiment, like Napoleon, simply got addicted to this Fed “power” to print U.S. dollars and keep interest rates stapled to the floor.

The Fed Is Fighting a Two-Front War vs. a Bloated Stock Market and a Dying Economy

But the Fed eperiment, like Napoleon fighting a two-front war with Russia and England, now finds itself in a losing, two-front war between the real economy and its dangerously bloated stock market.

The Fed’s biggest fear today is to be in the scenario in which a panic in this inflated stock market occurs at the same time as an economic recession.

In the past, for example, we’ve had business cycle recessions without market panics (like in 1989) or market panics (like that of 1987) without a business cycle recession.

In fact, the Fed is not against declining markets – such as a market losing 15%-20% over a period of 12 months.

However, what the Fed experiment and its Wall Street field marshals can’t stomach are such market declines occurring in a sudden and steep panic, as we saw in September of 2015 or December of 2018.

Such sudden panics are feared because they can quickly lead to a contagion – i.e. a rapid and widening fall across all asset classes and markets.

Which is why immediately after each of these panics, the Fed instantly “paused” further rate hikes in order to quell contagion fears and hence re-inflate its already bloated markets.

But note the key word here – paused. It didn’t cut rates, it merely paused raising them further. There’s a critical difference.

Why?

Because the Fed knows a recession is coming. Thus, it needs rates to be higher than the current 2.4% level so that it will have something to lower in the looming recession.

Sadly, however, the Fed experiment is not working, and soon the Fed will have to lower rates even further, thus depleting what little ammunition it has left.

The Fed Can’t Raise Rates to the Essential 4% Level

The Fed also knows that it needs to raise rates to a level of at least 4%, as that is the minimum amount historically needed to cut rates in order to be effective in a future recession.

It is precisely for this reason that ever since 2015, the Fed experiment had desperately tried to annually raise rates by quarterly, pre-announced increments of 25 basis points. It has tried to march to that essential 4% interest rate level.

Yet our totally doped and debt-soaked markets couldn’t handle this…The Fed experiment is starting to fail.

Drowning in debt, U.S. companies couldn’t bear even these tiny “forward-guided” rate hikes. Instead, as rates rose, we saw those two dramatic panics in which our markets tanked by greater than 11%-15% in less than 30 days.

And again, in both cases the Fed experiment immediately shifted, as the Fed stepped back and “paused” further rate hikes. In fact, after the December 2018 panic, things got so bad that the Fed promised not to raise rates at all for the entire year of 2019.

That’s a helluva “pause” – and it tells you just how weak our economy and markets really are. And mark my words, the Fed will soon be lowering rather than just pausing rates.

Why? Because at some point in 2019, Wall Street will hit a problem and the Fed experiment will be forced to shift yet again to save its spoiled nephews in the banks and trading floors.

Trapped in a Conundrum of Its Own Making: Running Out of Recession-Fighting Ammo

So, there you have it, folks – the ultimate Fed conundrum in its totally failed Fed experiment to reach the sublime: In trying to prepare for the next recession, the Fed runs the risk of actually triggering it.

If it raises rates, the markets puke; if it doesn’t raise rates, the Fed has nothing to “cut” in the next recession.

The Fed has effectively made itself impotent. The only weapon it has left is more money printing, which is why it is trying to reduce (“tighten”) its balance sheet now so that it can print more later—and we expect more printing by year end.

Why? Because the Fed experiment is fairly easy to predict once you see how it works.

The Most Critical Market Signal Is the Fed Itself

In short, the Fed is the primary force nervously guiding current markets.

By extension then, the Fed is the most critical signal to track market behavior and direction in the post-2008 “Fed experiment” from the sublime to the ridiculous.

This is both tragic and sad, for such a “Fed experiment” has nothing at all to do with capitalism or free-market pricing.

It’s nothing but centralized economic planning, which, like Napoleon’s thinning army (or Lance Armstrong’s steroids), works for years until it just ends in disgrace.

Sadly, and despite our disgust for this Fed experiment at Signals Matter, we are thus forced to listen to Fed meetings as much as we look at market data. We know the Fed’s signals because we played the Fed’s game.

Tracking the Fed’s Not-so-Secret Signals

In the hedge-fund circles, we played this rigged game for years.

As it was a hidden (and now increasingly open) secret that every time Yellen or Powell used the word “patience” or “pause” since March of 2015, we knew the Fed was signaling no further rate hikes for a given window of time.

In other words: Party on!

Front Running the Fed

We then used this totally reliable signal to make a fortune on carry trades – that is, we leveraged our trades with zero fear of our borrowing costs rising to “carry” our leverage fees and boost our returns.

In short, the Fed handed us a fat, easy pitch, and we leveraged homerun trades over and over, sending markets artificially higher and higher.

Similarly, whenever a Fed meeting omitted words like “patience” or “pause” we had to be more careful, for this “silent” signal of even a small rate hike meant a higher borrowing costs and thus a more volatile, falling market.

Simple as that: The Fed determined market direction. We knew this, and traded long or short accordingly.

In those rising rate scenarios/signals, markets offered less free juice, and we avoided the losses that otherwise hit most investors.

Stated otherwise, in an abnormal Fed market, unlike a normal stock market, there is a direct 1:1 correlation between Fed experiment signals and market direction. 1:1 folks, every time.

Again, that’s not normal stock investing, that’s a Fed-driven case of open front-running, a now clear component of the Fed experiment.

The Most Recent Fed Signal

And now, with the Fed telling us in 2019 that rates won’t rise, does that mean you, as an investor, should be swinging away and putting more risk on by front-running this latest signal?

Based on what the Fed is signaling, the answer might seem like an obvious “yes.”

Markets, after all, shot up on the Fed’s March 2019 “signal.” No surprise at all for us. This Fed “patience” will cause rates to flatten or fall lower this year, and thus send markets up.

Many experts would agree. In fact, some pretty famous hedge-fund managers have been talking, from Davos to CNBC and FOX, about a slow and continued expansion ahead, thanks to such unspoken “Fed support.”

A couple years ago, Yellen even declared that we would never see another recession, at least in her lifetime. (She later recanted, as all Fed double-speakers tend to do…)

Don’t Follow the Fed’s Step Toward the Ridiculous

But here at Signals Matter, we are not arrogant enough to recommend that retail investors with large portions of their retirement in a portfolio perpetually and blindly follow these Fed signals.

In short, I’m telling you markets will rise, but I’m also asking you to back off despite this otherwise obvious Fed “bull” signal.

Why? Because markets will rise near-term, but we are sure to hit a bump by the autumn, and though you can ride this new bull signal, we hope you stick to our recommended cash allocations, as set forth in our Storm Tracker tool available to paid subscribers.

And if you need more reasons to be cautious despite this latest “risk-on” signal from the Fed, consider the following…

From a 2018 Yield Shock to the No-Yield 2019

For nearly all of 2018, I warned of a bond wave coming out of the bond market that would send bond yields (and thus interest rates) rising, a process that started in October of 2018.

In October, the Fed began a massive (and “forward-guided”) tightening of its balance sheet, which meant it began dumping an annual supply of $600 billion of Treasury bonds into the bond pits.

As predicted, this immediately sent yields/rates up – and thus sent Wall Street into a panic—markets tanked.

After all, nothing scares a debt-driven market more than rising rates. Thus, from October to well past Christmas Eve, markets panicked – big time. Fortunately, our subscribers avoided all that carnage.

From Market Panic to Fed Pivot

Needless to say, the Fed then panicked as well. Folding like a chair to Wall Street’s woes, Jay Powell pivoted, announcing this month that further rate hikes for 2019 were off the table.

And voila – crisis averted, right? Risk is back on, and the Fed Experiment Market (aka the “stock market”) has made a record-breaking rebound based entirely on a single Fed meeting in March. Capitalism and free markets at their finest, right?

Hardly…

Is It Now Safe to Follow the Fed’s Latest Signal?

So, does this mean all is safe, that risk is back on, and that you should therefore jump all in and buy yet another Fed-induced (rather than supply-and-demand-driven), late-market rally?

For you day traders who stare all day at Bollinger bands, resistance lines, and other micro-second moves, the answer is a clear yes. So long as you are actively managing stop losses on a daily level, swing away at this latest fat pitch.

However, for you investors who appreciate risk, market history, and the simple wisdom of selling at tops and buying at bottoms, here are three reasons not to join the crowd by going “all-in” at these totally artificial, risk-heavy tops…

- Don’t Fight the Robots: 90% of the market is driven literally by robots – that is, algorithms written by code writers from Berkeley to Bombay, Cal Tech to MIT.

They know codes and micro-second trend signals (i.e. dip indicators) far more than they know market history, black swans, or Fed overreach. Quite simply, you can’t compete with these robo-markets or the hedge funds that pay for them.

Furthermore, these “robot” market traders and their AI-driven models will eventually go the other way, dumping securities at rapid rates that retail investors and even highly trained experts cannot possibly “market time.”

For now, though, the robots will be buying so markets will rise. Still, you don’t want to be all-in once these markets correct, which will eat any profits you make if you are “all-in.”

Sorry to be so blunt on this point, but trust me, this is no time to be cocky by trying to imitate the robots and defeat complexity theory like a gambler at a casino table or Napoleon in a Russian winter…

- The Charts Still Matter – and They Are Ominous, Real Warnings: Notwithstanding the sad supremacy of the Fed’s “pause” or “hike” signals in today’s “new normal/Fed-Market,” the numerous risk signals revealed thus far should remind you to be careful.

Furthermore, other highly relevant market signals confirm that today’s markets are at record-breaking levels of overvaluation.

These additional signals, which include everything from historical, objective data on corporate tax receipts to unemployment data peaks, margin debt levels, yield curves, CAPE ratios, and price-to-revenue/growth indicators are all screaming “risk ahead.”

I will be sharing these critical signals in future free reports very soon, but we are heading toward a stale summer and a volatile autumn. Be prudent rather than greedy.

Once you see this data for yourself, you’ll likely be less inclined to join the herd marching into a market Waterloo or Russian winter.

Again, these additional market signals, coming soon to your inbox, are practically begging you to get partially defensive.

As for those of you hung up on the perennial debate of causation vs. correlation, you might be saying yeah, great Matt, you’re telling me a clever story about Napoleon and a nice set of historical data on past recession indicators, but there’s no guarantee that those indicators caused prior market crashes or will be the right signals for the next one.

In other words, you’re saying the Fed can keep this “sublime” going for a long time.

In fact, I agree. The Fed market rise can go far longer than natural markets would otherwise allow. Yes. But that doesn’t mean you shouldn’t be prepared for uncertainty and obvious risk.

That is, there’s also no correlation between umbrellas and rain. Umbrellas, after all, certainly don’t cause the rain. But when one sees lots of umbrellas on the street, it’s usually a pretty good indicator it’s gonna be (or already is) raining.

The same is true of all the key critical signals I’ll be sharing with you in the free reports ahead. They each tend to appear around the same time markets start raining…

That said, if we get enough rain that the Fed is forced to print more money in 2019, then I’ll be shouting for you to add more into stocks, as they will surge in such a scenario.

- Market Preparation Is More Important Than Market Timing: No one can perfectly time a market crash, economic recession, or sudden uh-oh moment in your portfolios.

Having invested and traded through two prior market catastrophes in less than 20 years, I’ve learned (as all honest experts will admit) that that actual trigger of a market disaster is rarely (if ever) the one you predicted.

Typically, the “Lehman Moment,” trigger, or catalyst to a recession and market crash is something you didn’t have on your otherwise extensive list of possible triggers.

But just because precise crash triggers are nearly impossible to predict without tarot cards or tea leaves, this by no means suggests that one cannot otherwise be prepared.

All of the objective data we’ve already seen thus far – as well as the signals I’ll offer in future, free reports – are a clear enough warning of unacceptable risk ahead.

Folks: The risk-to-reward metrics in these current, “Fed experiment” markets are blatantly asymmetric. That is, downside far outweighs the upside today, even with a Fed tailwind.

Thus, I will bluntly tell you right now that a 2019 market event to the downside will happen, to be followed by a Fed reaction which will give us more confidence to ride the bull.

Until then, be cautious for now.

But after the next Fed “steroid” and bull signal, get ready for greater pain after the party.

That is, within one or two years of the next QE signal from the Fed, we’ll all watch the Fed take its “small step from the sublime to the ridiculous.”

As to what this precise QE-trigger will be, that is something I cannot promise. But again, that’s the wrong question to be asking.

Instead, the only question you need to ask is: What are you doing to prepare yourself today for the risks (and yes, short-term, QE-driven opportunities) ahead, all of which I am sharing with you in plain speak.

Going forward, let’s wait for an even fatter pitch from the Fed—namely when they start printing money again, which they will. They’ll have no choice in this Fed experiment.

In the meantime, look for my free signals in the following reports, and be smart; march to your own drum; and most of all, be careful out there.