The U.S. bond market is dangerous. It’s fake, it’s fat and it’s ready to crawl and then bleed out, but not before it takes a lot of blind investors with it.

In a recent video report on the 2020 summer markets, I reminded viewers of the key drivers behind the current and surreal economic disconnect between central bank supported markets (i.e. the unofficial death of free-market price discovery and genuine capitalism) and the now undeniable downfall of the real economy.

Don’t believe me? Look around…

The current and obvious disconnect between economic reality and central bank supported markets is beyond normal, even for the most fervent bulls out there.

An equally critical component (as well as symptom) of this “new (and sickening) abnormal” is the staggering level of debt being employed to allegedly “save the markets,” as if these Fed-supported markets deserved even more “saving.”

Folks, in genuine capitalism, markets tank—they’re supposed to cleanse themselves of dangerous tops.

Keeping them on a respirator is cruel, not “accommodative;” it only leads to greater suffering, the kind straight of a Shelley novel.

Frankly, the current Frankenstein market and all those who have been front-running the Fed since 2009 and making Wall Street fatter are among the least deserving anti-heroes I can think of, and yet the “accommodation” from Powell et al continues, as does the stock market’s nervous, zombie climb.

In this backdrop, how can one track the longevity of this surreal and monstrous stock market?

The answer lies in the equally surreal and monstrous U.S. bond market…

The U.S. Bond Market is the Thing

Toward this end, I have always reminded folks to get their stock market signals from the U.S. bond market, which may seem ironic at first, but is a fact (and indicator) known to all veteran investors.

I’ve written about the U.S. bond market countless times, and for obvious reasons.

As we now head into the autumn season, it’s worth underscoring/repeating certain staggering and objective signals about debt in general and the U.S. bond market in particular.

So, let’s dig in…

Debt is Fun—Until It’s a Nightmare

As anyone with a credit card knows, debt is fun—until the bill arrives. Of course, if you can print money to pay that bill, why worry? The money printer will save you, no?

Not so fast…

Since the 1980’s in general, and post 2008 in particular, the U.S. bond market has morphed from a credit exchange into a sexy yet monstrous bubble, the malignancy of which has been largely ignored and/or down-played by Wall Street and its media bobble-head/yes-Sayers for years.

But facts are stubborn things, and the facts we’ll travel together below are objective rather than pejorative. Take notes.

When a central bank artificially sets low rates for decades, and then later buys bonds directly to repress yields, the rates stay low, and hence the cost of borrowing stays low.

Result?

Simple: Corporations gorge on debt.

Need proof?

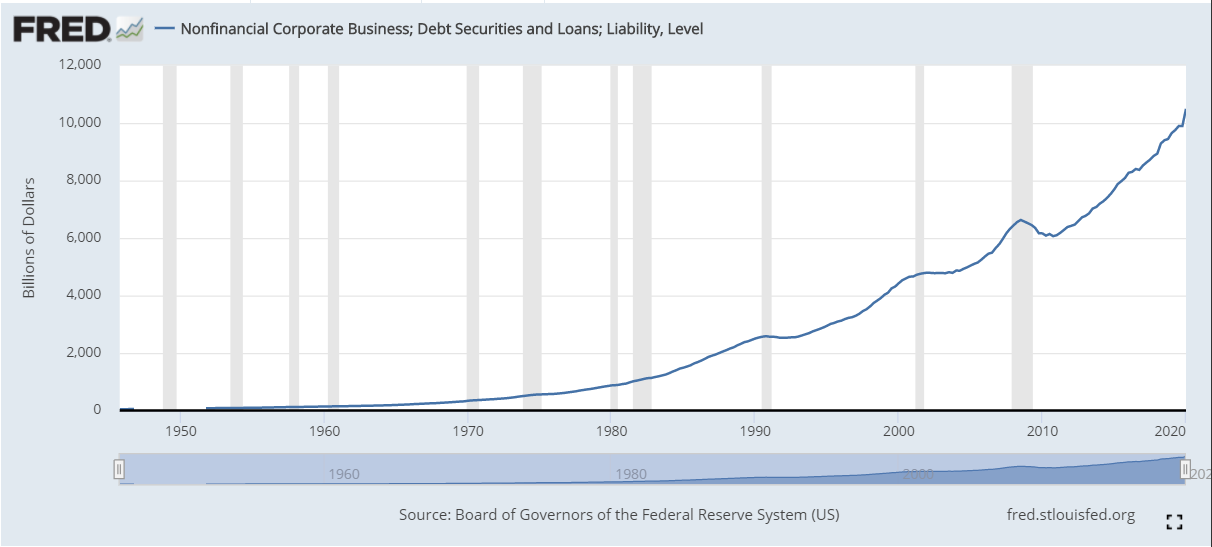

Well, for starters…corporate America is more in debt today that at any other time in our history.

In 2020 alone, another $1.6 trillion in corporate debt was added to the now $10.5 trillion tally, a number almost too staggering to fully grasp but easy enough to type and read.

Trillions in debt, as I said last week, do allow companies to roll over debt—but “rolling over” debt is not the same as paying debt. Instead, it’s a treading water process known as “extend and pretend.”

But as all good investors know, roll-overs are not permanent and at some point, the pretending stops and the suffering starts.

Using a simpler image, rolling over debt is just adding more logs to the pyre of a credit fire that will burn economies and markets to the ground the day inflation arrives and rising interest rates make this debt bubble un-payable.

As the Austrian School reminds us: The bigger the debt party, the more fatal the hangover. Eventually, we are gonna need more aspirin than Uncle Fed can offer. No wonder Harvard Business School offers no classes in German…

With Debt this High, Even Cheap Debt Becomes Unpayable

Even with rates currently forced to the basement of history by Uncle Fed, US companies can’t keep borrowing to nosebleed levels without suffering some form of balance sheet breakdown, and hence an equal (and inevitable) break down in their share prices.

You see, even if the “cash” that companies boast about is mostly in the disguised form of debt, those companies will have to dig into their “cash reserves” to pay ever-increasing debt obligations.

Of course, money used to pay down corporate debt is money that can’t otherwise be allocated to expanding payrolls, upgrading production, improving services, buying their own stocks or making new hires.

Companies will be forced to eventually dip into earnings, which means earnings will fall, and so too will stock prices.

See how signals from the U.S. bond market point toward the future of the stock market. Just saying…

Earnings & Debt—More Stubborn Facts in a World of Make-Believe

Most business owners are familiar with a thing called EBITDA, which effectively boils down to pre-tax earnings. Once upon a time, earnings actually affected stock prices…

Here are some not-so-fun facts when it comes to the ratio of total corporate debt to earnings.

Even for investment grade corporations (i.e. that tiny, tiny minority of so-called “good credits”), the debt to earnings ratio is a staggering 3.53 (white line below).

This means that even the “high-grade” corporate bond index (white line above) is suffering under debt levels greater than 3.5X their pre-tax earnings. (The twenty-year average, btw, is 2.65X).

Folks, to put it bluntly, that kind of debt to earnings ratio just sucks…and represents the highest level of debt data going back to 1998, just a short time before the markets imploded. I remember this well. I was there.

As for junk bonds, the very bottom of the credit barrel, their debt to earnings ratio is at a mind-blowing and record-high 5.42—i.e. debt that is nearly 5 and half times earnings… (See blue line above)

AVIS car rentals, for example, has a debt to earnings ratio of 27 times earnings (!!)

Once upon time, banking regulators refused to allow levered buy outs of any company whose debt to earnings ratio was higher than 6X.

But, boy how the times have changed…What was once unacceptable is now the norm.

Meanwhile, a good company, like Anheuser-Bush beer, is currently considered an investment grade bond, but its debt to earnings ratio for Q2 was at 5, a level typically reserved for junk bond rating status.

COVID, of course, killed restaurant demand for the beer (as well as traveler demand for rental cars), and thus earnings suffered.

Beer lovers and stock holders alike are thus hoping for an end to what feels like an endless pandemic. But even should a viral cure be announced today, the debt damage to many companies has already been done.

A Whole New Meaning to JUNK Bonds

If ever there was a screaming, neon-flashing red light of how stupid the U.S. bond market has become, look no further than the US junk bond market.

Today, the average ratio of debt levels to earnings in the junk bond market have now grown so high (i.e. triple the levels which would have once forced analysts to deny any recommendation), that they should simply be de-listed from consideration—i.e. given a blindfold, cigarette and a last meal.

But not today. Not in the “new abnormal” where crap is peddled as a magical beanstalk from desperate bond issuers to sucker desperate buyers seeking some semblance of yield in a world made yield-less by criminally negligent central bank intervention (i.e. “support”) in the U.S. bond market.

Today, the regulators have dropped such warnings, which means junk bond buyers are paying Tiffany-like prices for junkyard-like credits and there’s no one to stop them from hurting themselves.

Needless to say, the Fed holds a tremendous level of blame for this cancerous moral hazard of rewarding the bad.

By keeping rates artificially low for far too long, the Fed’s hideous “intervention experiment” has forced bond buyers further and further out on the risk branch for less and less yield in a world where yield (i.e. return) is almost nowhere to be found.

Out of Sight, Out of Our Minds

Meanwhile, average investors are still hoping that corporate profits will “normalize” next year, as if all these debt numbers and facts above can be pushed aside and ignored in a collective case of “out of sight, out of mind.”

As Lale Topcuoglu, a New York money manger observed: “It just seems absolutely incredible how much people are closing their eyes and buying” such distorted securities.

At Signals Matter, however, we are all about opening eyes, not pitching a doom message.

But the facts we see are loaded with doom, unless, of course, we chose to believe the Fed will perpetually save us with a money printer, an illusory notion similar to romantics who fall for the wrong partner.

The fact is that otherwise doctored earnings are plunging at the same time that corporate debt levels are sky-rocketing, a warning sign that once upon a time meant something to informed investors in a free market.

Despite the sad fact that today’s markets are centralized rather than free, these debt levels still mean something to Tom and I, and we see them continuing to rise into 2020 and 2021, so buyer beware.

Junk bond issuers (i.e. crappy companies selling crappy bonds) have already sold more crappy bonds in 2020 than in any full year in history to more suckers than an at any other time in history.

Sadly, many of those suckers are managing a pension fund near you.

As I’ve warned here , here and here, pension funds are $7 trillion deep in the red and thus desperately buying junky bonds to get some hint of yield, thereby ensuring their own eventual destruction.

Meanwhile, hundreds of both larger and smaller companies have simply thrown in the towel, and have chosen bankruptcy over the fictional cure of more debt and debt-roll overs which the Private Equity sector has effectively made impossible for most dying companies to ever re-pay.

Hope Springs Eternal

Despite such stubborn facts, most investors will ignore them and cling romantically to the hope that the Fed will save them and that a V-shaped recovery is just around the corner.

They will ignore the warning signs of history, compressed yields, and the deadly arrival of inflation, which some believe honestly is extinct.

For now, much will hinge on how much one trusts the Fed magic, which we admit is hard to fight and still has some immense power—for now.

But you already know our longer-term views on trusting the Fed. In the end, their only tool is money printing, and that ends badly for the dollar already in your wallet…Hence our gold reports.

Notwithstanding such Fed debates and hopes, the facts also tell us this much.: Across the board, companies objectively have earnings that are lower than the interest expenses they are required to pay for their current debt levels.

This summer, for example, the mismatch between earnings and interest expenses on corporate debt reached the worst levels since 2003, when the NASDAQ was on its knees.

Meanwhile, and despite grossly overpaid executive attempts to boost their share-prices (and hence salaries) be reducing the number of shares (via stock buy backs), corporate earnings per share on the S&P fell by 1/3.

The reasons for such dramatic data are simple: Debt levels are getting too high to repay, even for a market already totally “stoned” by debt addiction.

Of course, the bulls (and omnipresent BS’ers) will keep hope alive and remind the majority of retail investors and desperate pension fund managers that none of this debt matters.

Afterall, the Fed can solve anything with, alas…more debt, paid for by dollars created by a mouse click, which is QE in a nutshell.

If you trust or favor such a solution, well, I’ve got a bridge to sell you in China, that so called bastion of capitalism (?)…

Nearer term, if a COVID vaccine (however unreliable) makes a single headline, the markets will get giddy and skyrocket despite the fact they were (and are) already broken by a debt reality which no one wishes to see.

Even I can’t deny such potential nonsense, as the world has moved on headlines written by 20-somethings rather than facts compiled by experts for far too long.

Furthermore, investors have confused liquidity (i.e. fake money) with solvency. Unfortunately, one has little to do with the other, despite the current Twilight Zone masquerading as a free market.

Calling a Duck a Duck

As an old and dear girlfriend told me many years ago in the final moments of our doomed relationship, sometimes we “just have to call a duck a duck.” There was no use faking it. We were done.

And as for this over-done market, if the Fed wishes to prolong it by faking it, we have to call this new market what it really is—a nationalized market, a fake market, a government subsidized market.

In school, I was told that such artificial support from a centralized agency is the opposite of capitalism, free enterprise and fair markets. Such centralized “support” was the reason financial systems like those in Cuba, the USSR and countless other (and centralized) economies once seemed so beneath us.

Yet the ironies do abound, as the current market is objectively nothing more than a debt Chernobyl kept alive by a central bank Politburo, fake money and the open monetization of our debt—in short: Wall Street socialism.

And like all those financial systems we once mocked as fake economies, banana republics or eastern bloc fictions, this one too shall eventually rot away as historians many years from now ask how the US lost its economic soul.

For now, however, enjoy what’s left of this fantasy ride and total disregard for such arcane values like free markets, free price discovery and free enterprise (not to mention free choice, free movement, and free expression).

A central bank and centralized global economy has replaced such values with a free handout—one that has benefited Wall Street at the expense of Main Street.

How It All Ends

Of course, history (as well as inflation) reminds us how this all ends, and we are now seeing this slow ending playing out in real time, from social unrest to political division, and wealth disparity to economic disconnect. From cancel culture to no culture.

The world seems one pitch-fork, lie and illusion away from either self-censorship, resignation or anarchy, all of which, well…suck.

New market highs in such a twisted socio-economic backdrop may come, but the risk of newer lows has never been more apparent, as we’ve shown here and elsewhere.

The question for informed investors is thus simple: Are you prepared? Are you thinking of risk, or just reward? Have you surrendered your common sense to faith in a central bank whose track record for warning of a recession is 0 in 10?

To ignore risk today means you’ll likely never have a chance to hold on to any reward tomorrow.

At Signals Matter, our portfolios respect facts, history, risk and reward. Managing these elements is both an art and science, one tempered by experience not headlines, group-think or false hope.

If such ideas appeal to your mindset and you wish to stay sane and safe (at least with your portfolio), then simply join us here and let’s get to the business of thinking for ourselves.

In the interim, stay informed and stick to common sense not common illusion.

Best,

Matt & Tom