Below, we look at retail sales, commercial real estate and other factors confirming there is a total disconnect between promised market sustainability and economic data.

Don’t Fight a Desperate Fed

We may not trust the Fed nor its long-term road toward socializing not only of the S&P (now just one big and hobbled “US 401K” paid for by printed dollars) and the country, but we also refuse to fight the Fed—for now.

After all, rapid and unlimited money printing as per the chart below buys time and market rallies (think April), even in the backdrop of Depression-Era fundamentals.

Volatility Swings

But artificial Fed support also screams of desperation, and many investors are naturally spooked/nervous. This means a perpetual seesaw of up and down markets—i.e. volatility, aka “vol.”

After an entirely absurd rally (and 30% surge from the March lows) at the height of the COVID death count and record-breaking slides in GDP and employment, May 2020 saw a tepid (even rational!) return to risk-off, and last week we saw the S&P’s slide steepen.

Again: up and down, up and down…

Not Chasing Vol

We don’t like to chase volatility. Instead, we wait for clear signs of a directional trend, and the trend downwards is merely a matter of when, not if.

Why so certain?

Because economic facts still matter, despite a desperate Fed’s attempt to put everything, including the markets, on a Washington VISA card and a counterfeiter’s printing press.

The Hard Facts

As for economic facts, there are many. Heck, even before COVID caught the world’s attention we were bewildered by a total disconnect between market fundamentals and market pricing.

As for today, we’ve already shown how official unemployment numbers are now at 15% and rising. Furthermore, GDP is forecasted to tank by 30% this quarter despite the market’s delusional call for a V-shaped “recovery.”

Again, Wall Street’s definition of a “recovery” is merely adding more debt to fuel to a debt fire. Such “recoveries” are merely new set-ups for greater and greater stagnation ahead.

Thus, don’t let yourself or your portfolio be suckered into false hope or even a temporarily false tape, especially when data regarding a COVID redux remains unknown and current economic data remains simply deplorable.

Retail Sales

As I indicated from Seattle last week (and hope to report from France next week), retailers are simply getting massacred, as the data on retail sales confirm.

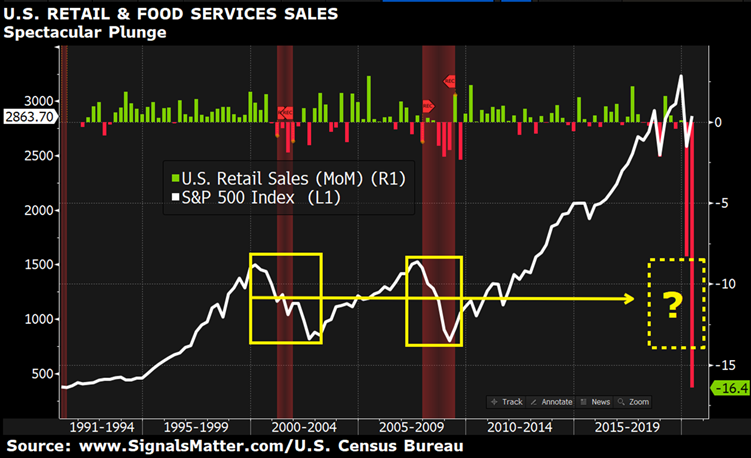

On Friday, the Commerce Department revealed the April data on retail spending, which showed the biggest drop on record.

This customized chart and many more at www.SignalsMatter.com.

Call us crazy, but given that retail sales are the heart-beat of the real economy and the key pulse-rate of consumer strength, which in turn comprises 70% of GDP, we still think such data on retail sales ought to matter.

The fact that U.S. market’s saw a record surge in the very same month that retail sales saw a record nosedive is effectively all the proof one should need to see not only the total disconnect between markets and economics, but just how completely distorted, artificial and rigged our current markets actually are.

To be fair to the optimists, however, it’s equally worth noting that consumer spending and retail sales rebounded sharply at the end of April, prompting Bank of America to describe the data as a “meaningful return of spending into May.”

Unfortunately, American shoppers, like their government and central bank, are equally prone (reliant upon) to that same four-letter word that so defines our once-great nation, namely D-E-B-T.

In short, consumers are simply whipping out more credit cards to stay afloat.

Still, no one, including us, can ignore the impact that stimulus payments and a slow re-opening of the economy had (and will continue to have) on rising consumer spending and “improved” retail sales.

Tap on to that the rise in unemployment checks, and yes, the data will reveal more spending and retail sales by those who have the least amount to spend and even less to save.

This might explain why “shop therapy” retail sales have seen increases in online spending in May on such items as online furniture but less spending on such items as restaurants, transit and department stores—where viral fears remain entrenched in the national psyche.

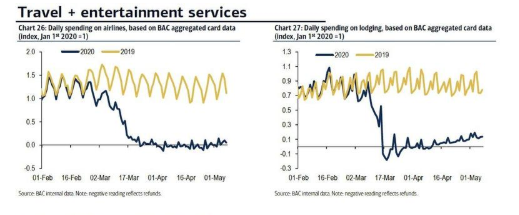

Toward this end, retail sales tied to entertainment and travel sectors remain near all-time lows (as my recent empty-airplane trips confirm):

Commercial Real Estate

As online shopping and credit-card debt ramp up, commercial real estate is heading toward a WeWork-like Apocalypse.

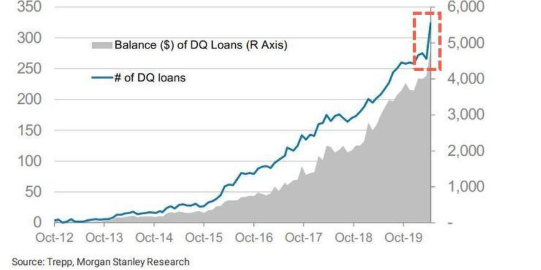

Morgan Stanley’s latest TREPP data shows that greater than 25% of the CMBS (commercial mortgage backed securities) are on the verge of default—prompting what may be another toxic mortgage bailout from a Fed that can’t stop printing.

CMBS delinquencies peaked in April to new highs.

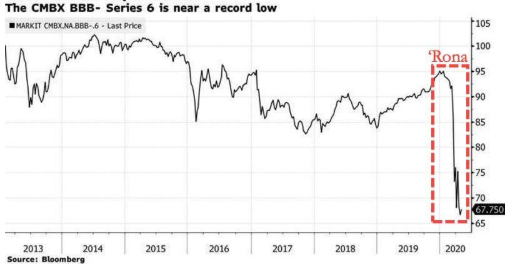

With the retail sector in pain, there is a genuine risk ahead of massive CMBS defaults on the buildings that once rented to the slowly dying era of brick & mortar businesses, as the value of these commercial-backed securities (CMBX Series 6 BBB-tranche) is tanking.

This comes as little surprise to those already tracking our broken bond market, otherwise dying but for the respirator-effect of more ongoing Fed “support” (i.e. debt and fiat dollars) for the larger bond market in general and the CMBS space in particular.

The Architecture of the S&P

Meanwhile, the S&P itself is facing undeniable realities as many of its member-companies now merit removal due to diminished market caps—i.e. massive price declines/losses in the backdrop of COVID.

Typically, the S&P requires the companies listed on that exchange to post a 4-quarter profit.

This means companies like TESLA, whose market cap would otherwise make it the 64th largest company on the 500-member exchange, wouldn’t qualify for inclusion, as TESLA won’t be profitable for several quarters, and wasn’t profitable for several quarters prior to COVID…

Then again, who needs profits in a Fed-respirator market?

But for Apple, Microsoft, and Google, the S&P’s returns over the last decade would be 20% lower, which reminds us that the S&P “500” is in essence just propped up by a handful of big tech names. Hardly a “robust” exchange…

Our guess is that the S&P, like just about every other aspect of Wall Street, will lower its standards and put more lipstick on the financial pigs of its crippled exchange while simultaneously telling the world all is fine.

For now, the Tech sector is, and will continue to be, the real force behind the S&P.

Currently, Tech comprises 36% of the crippled exchange (if you include Amazon, Google and that horrid thing called Facebook). Smaller tech names will either fall off the vine or be allowed in at lower standards.

Total Disconnect

Whatever remains to be seen or unseen in the days and months ahead, the simple facts before us today are this: critical metrics like unemployment , GDP, earnings and profits, retail sales and commercial real estate are tanking in the backdrop of near negative rates.

Such signals, along with the S&P’s own structural weaknesses, are all screaming signs of trouble now and ahead, regardless of if (or when) COVID is “solved.”

Such objective facts, among so many others, are not just grist for the bearish mill, they are simply bearish.

Which brings us back to the total disconnect between market prices and economic reality.

Even for you proud bulls, this disconnect is impossible to ignore, yet so is the temporary yet undeniable power of the central banks to continue faking another recovery with more fiat currency creation and extreme debt levels.

For portfolios to successfully navigate such tensions, facts and unknowns, the wisest course, as we see it, is to remain active, cautious and signal-driven, which is precisely how our portfolios are designed.

To join us in this historical voyage, simply click HERE.

For those already onboard, please see our most recent market and portfolio recommendations HERE on your own dashboard, updated over the weekend.

Sincerely,

Matt & Tom