Below, we continue our analysis of US debt and rising yields.

More Pork…

I’ve been watching the waves lately, but even with palm trees on my mind, I can’t help but notice that over in DC, McConnell and Schumer have added another $400B to the budget for the next 2 years, and a nice tidy sum of $3.5T over the next ten…

They call this “The Government Shutdown Prevention Act.”

The new debt is to keep the DC bureaucracy (and 3.7 million Capital City employees) running at full steam, taxpayers be damned. Folks: the swamp just got thicker. By 2027, our deficit is projected to hit $35T.

Such numbers almost mean nothing; they are tossed around the beltway and the MSM like talking points rather than the hand grenades that they really are. But hey, what’s $35T to the good ol’ US of A?

How Much is Too Much Debt?

One has to ask this: just how much debt can the US take? I’ve stopped acting amazed, and frankly, just don’t know the answer. We are in uncharted territory.

For the past five years, I, like so many other relatively sober fiscal and monetary minds, have been waiting for the debt shoe to drop. I’ve been waiting for market volatility, for a day of debt reckoning—for investors and markets to say: no more!

And what has happened? Despite an occasional hiccup (recently), markets keep rising and my common sense keeps getting assaulted. Meanwhile, US private debt has hit the $15T mark. Main Street, like DC and Wall Street, is enjoying a credit card spree at the mall.

Total public and private debt in the US stands today at $67T. The U.S. leverage ratio is now 3.5X.

You may want to re-read that.

Temporary tax cuts and corporate green lights have given renewed confidence to use tax savings for more corporate stock buy-backs ($86B since the 21% tax rate); net result: short term tax relief has pushed the everything bubble further higher, and further into long-term crazy territory.

Don’t’ Worry?

The politicians tell us not to worry, because their budget also projects that between now (105 months into a tired business cycle) and 2027, the US will grow more than it did in the last 10 years. According to our leadership, the word “recession” no longer applies.

That means we are being promised a 220-month run without a recession. This fantasy projection is literally baked into Washington’s budget analysis. Such optimism (propaganda…), by the way, has never happened before. What our elected officials are promising is recovery lasting 4X the average recovery cycle in post-World War II America.

So, if you want to go long (i.e. believe in) such record-breaking optimism, ask yourself this: “Do you feel lucky?”

As for us, we don’t feel that it is anti-American to not believe, but we keep trading the trend—with one eye on returns and the other on the iceberg watch.

Realty Indicator: Rising Yields

But as bemused as these artificially engineered markets feel, one thing that is showing a tad of normalcy is the rising yield on the 10-Year UST. As we have said so many times—keep your eyes on this great kink in the national armor.

As argued repeatedly, the Fed has so completely tossed fundamentals and traditional warning signs out of the current market analysis that old-reliable risk metrics like PE multiples, GAAP accounting, and CAPE ratios just don’t seem to matter.

Even banks like Goldman and BofA have publically admitted that markets are past normal risk warning signs and riding on crazy rather than caution.

Debt + Rising Yields = Bad

But rising rates in the backdrop of a market bubble is a bad thing. Very bad. Ironically, however, the pundits are using traditional analysis to suggest that rising rates are a sign of a strong economy.

But that’s only true if one ignores the debt reality, and most people, it seems, are doing precisely that—burying their heads in the sand.

That is, the politicians, pundits and long-only investors still think debt doesn’t matter and that rates don’t either. They don’t want to think about the trillions in new Treasury issuance coming to an auction near you– adding to bond supply at the same time the Fed cuts bond demand in a shift from QE to QT.

If you took econ in high school, then you know that rising supply and lowering demand is bad for pricing. This means bond price declines ahead, and hence yield surges (and rate surges) around the corner (and already in motion).

When debt becomes expensive (i.e. as rates rise) rather than cheap in the backdrop of the greatest debt bubble in the history of US markets, the party that an entire generation of traders has been enjoying shifts from euphoria to uh-oh very fast.

This is not fear mongering. It’s common sense. Please consider this.

Debt Matters

Debt matters. For example, we have 60 million social security recipients about to hit 80 in 2027. Guess what? We can’t pay them.

Growth, moreover, is far less exciting (and reported) than our market bubble. GDP simply isn’t rising in a sustainable manner.

Weak Housing Recovery

And despite years of artificially low mortgage rates, we are seeing the weakest housing recovery in history. Single family housing completions stand today at a 2017 year-end figure of 818,000. Yawn. And when rates rise, as they will and are, that number gets worse…

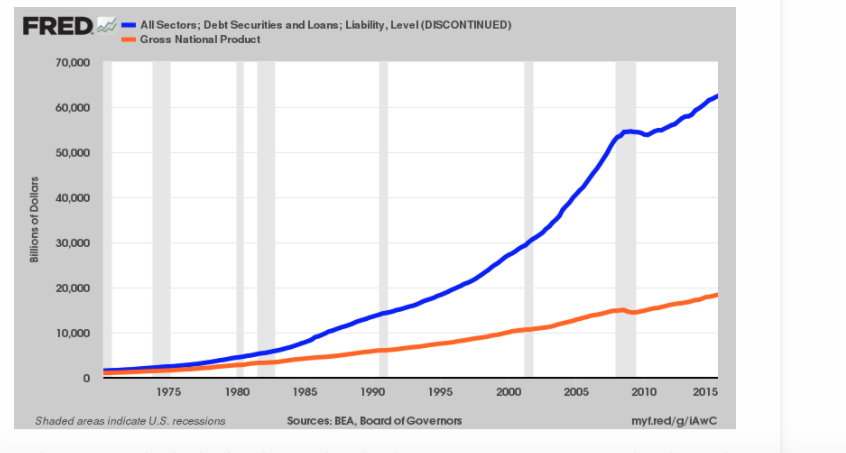

The simple fact is we have this $67T debt number about to collide with rising rates. Furthermore, ever since Nixon’s return to fiat currencies in 1971, US GDP has increased by 18X (1.1T to 19.6T), while US debt has increased by 42X (1.6T to 67T).

The graph below might help this sink in—and it’s compliments of own government statisticians. Take a gander. The blue line is debt, the orange line is productivity. Ugh…

When the yield shock finally hits this debt bubble, the party is over folks. If you’re asking us when, we won’t toss you a crystal ball, but our subscribers know this much: we are ahead of the curve.