Active portfolio management surpasses traditional, passive strategies now more than ever, and below we explain why in blunt-speak.

As promised in Monday’s report on Intelligent Portfolios in Times of Crisis, today’s report takes a deeper dive into the key reasons active portfolio management is essential in the post-08 New Abnormal, and gives four specific insights into how we operate here at Signals Matter.

Key Elements to an All-Weather Portfolio

Here at www.SignalsMatter.com, we deploy four key elements to building our All-Weather Portfolios, namely: 1) active portfolio management, 2) absolute return benchmarking, 3) selective portfolio metrics and 4) security selection.

Let’s discuss.

- Active vs. Passive Management

We’ll start by describing Passive investing, traditionally employed as the most common approach to portfolio management.

Passive investing via well-diversified stock and bond allocations is the heart of Modern Portfolio Theory (MPT), a traditional and time-tested (and time-confirmed) portfolio approach which we described at length here.

MPT essentially maintains that market timing is impossible and thus smart investors should simply ride out storms and cruise through sunny days with a well-diversified yet passive approach to portfolio management.

In other words, once a well-diversified portfolio is constructed, very little tweaking or active changes are necessary—just play the long game and get passively rewarded. In short: “Set it and forget it.”

MPT is the bedrock of portfolio construction seen and practiced by the big banks and the financial advisory system throughout the US.

Passive investors have a singular goal – to build a portfolio that mirrors the investment weighting and return of a benchmark index (like the S&P 500 Index for stocks and the Barclay Aggregate Index for bonds).

A typical passive portfolio would allocate 5% to cash, 35% to fixed income (i.e. diversified bonds), 50% to equities (i.e. growth, value and international stocks) and 10% to alternative investments (i.e. something that is not a stock or a bond).

For anyone with a FINRA license and a year working in markets, such portfolios take about five minutes to create…as they are essentially based upon the same template.

We know, because we’ve sat in the banks and offices that construct them.

This “set it and forget it” approach to portfolio management is popular among financial advisors for a reason.

FAs (Financial Advisors) and RIA’s (Registered Investment Advisors) typically leave the task of allocating (i.e. portfolio construction) to the firm, so they may concentrate their time raising assets, for that’s where they make their money.

This shouldn’t be a surprise.

Here’s the problem with passive investing. It only works when markets, cycles and asset prices are determined by natural laws of supply and demand.

But those natural laws, cycles and markets have been replaced by a massive and un-natural Fed experiment in which artificial Fed intervention determines asset prices, making MPT as outdated today as roller-dial telephones.

Additionally, MPT assumes that market-timing is impossible, which it was and is, to some degree.

However, given that Fed action is fairly predictable, so are market reactions to Fed action, which means it’s fairly clear when storms are coming and when sun is shining—not to the precise second—but close enough.

This means active investors with the right experience and signals can more easily step out of harm’s way rather than a bite a stick through market drawdowns, which as rare as those drawdown bears might be, destroy wealth far faster than sunny days create wealth.

Passive investing, for example, didn’t work in the 2008 Recession and it’s not going to save you in the 2020 Recession—our third “uh-oh moment” in the span of 2 decades.

If difficult times threaten, investment advisory firms may rotate your portfolio to “safer” stocks (i.e. less small-cap, less Nasdaq, more large-cap).

But as this next recession hits, these so-called “safer “equities will all go down (even international equities) because they are all highly-correlated.

In other words, rearranging the deck chairs on the Titanic will not make a difference when the iceberg hits.

By contrast, our Signals Matter All-Weather Portfolio is actively managed.

Active portfolios are geared differently, with a goal of generating gains in any investment environment, including a melt-up (which we foresaw) or a melt-down (which we also foresaw), without regard to a benchmark or a crystal ball.

Such efficiencies require active portfolio management and the ability to stay ahead of the Fed and track warning signs as well as fair-weather signs—from the market, and not the media.

Active portfolio management is simply that. We go where the markets go, long or short across not just stocks and bonds (i.e. the “deck chairs”), but across currencies, commodities, precious metals, thematic ETF’s and other forms of alternative investment – when they are working.

2 – Benchmarking – Relative Performance is a Poor Measure of Investing Success or Failure

Here’s another issue with passive investing. It benchmarks return against stocks and bonds. By contrast, active portfolio management (applied here at Signals Matter) does not measure success by what the S&P500 and Barclay Aggregate Bond Index may be doing on a relative basis.

After all, such benchmarking is not particularly helpful when those benchmarks are down 34% as stocks were just a week ago on March 23rd.

Rather, we are a proponent of the “Family Benchmark” – the rate of return YOU need to make ends meet.

That’s a benchmark that would be a whole lot more relevant. It’s an absolute return approach to investing, not a relative return approach that measures how you’re doing against a passive index, which is fun when markets are ripping but an absolute nightmare when they are tanking.

As we warned a year ago, the number one way to make money is to avoid losing money—because digging out of a hole takes twice the performance just to get back to where you started.

Using proper active portfolio management, we miss those holes altogether, so you spend less time digging and more time sleeping comfortably.

Of course, when markets are ripping, we are not hugging the benchmark index and taking credit for simply rising with a rising tide, which almost all FA’s do in the good times, and then run for a corner in the bad times.

Instead, we simply aim to make money in all times, and will thus often lag benchmarks in delirious bull runs, but we also never get mauled to death when bears emerge from their caves.

Slow and steady, folks, wins the race. This may not be sexy, but it’s smart, and we still think smart is pretty sexy.

3 – Portfolio Metrics – Trend, Flows, Volatility and Correlation

As a leader in active portfolio management, Signals Matter digs deeply into the sectors and securities it invests in, parsing day-by-day for reliable trend, positive flows, acceptable volatility and low correlation.

A. Trend

You’ve heard it a million times, “the trend is your friend.” Never bet (or trade) against the dominant market trend. We’re believers in trend.

If stocks are falling in a recession, passive managers are losing money for their clients as they bet against the trend, which makes no sense.

Instead, you want to be short stocks or out of stocks and in cash – plain and simple, making and protecting money rather than losing it.

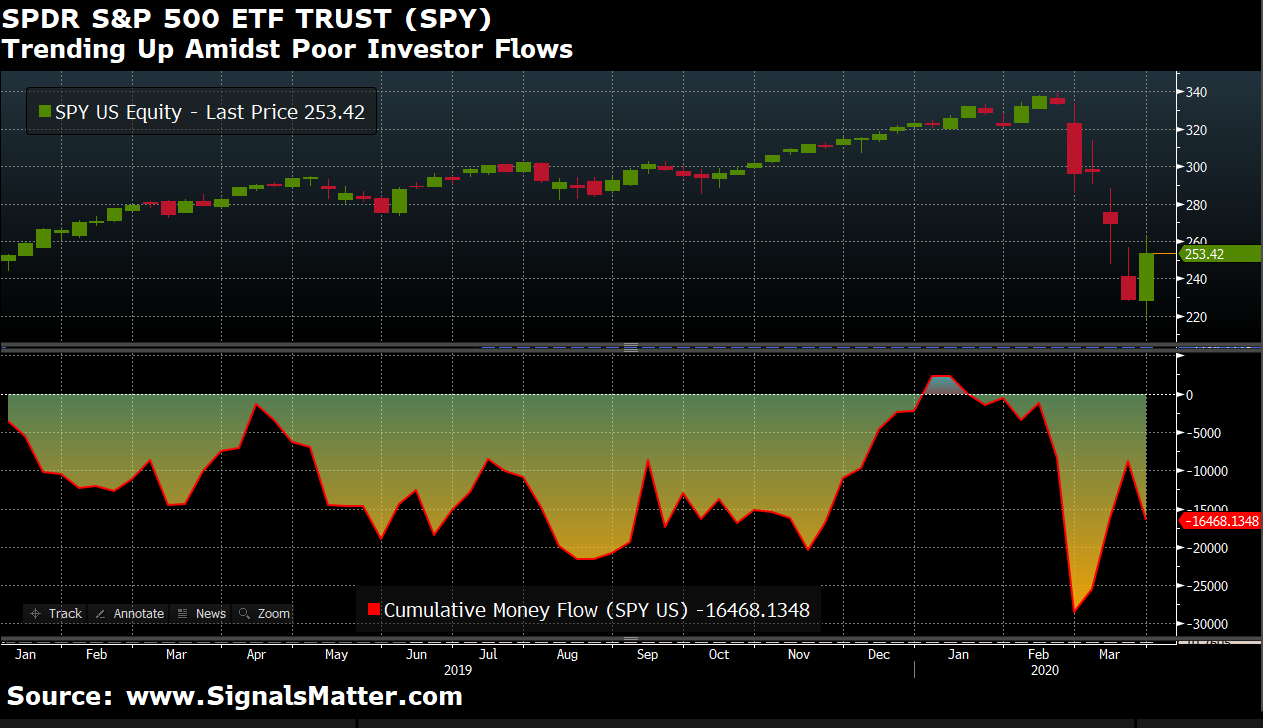

B. Investor Flows

But trend by itself is not enough for us to take a position using active portfolio management. While the trend may be up in a melt-up, the flow of investor capital into a particular ETF may be building or waning.

We call these capital moves ‘flows.”

Flows into an ETF that is trending up confirms the trend. But if flows are waning in an otherwise upward sloping trend, then that trend is poised to fail.

The relative strength or weakness of capital flows into an ETF are thus key metrics when it comes to confirming trend, containing risk and assuring smart/safe security selection.

Smart investors were thus wary of the last melt-up in stocks as far back as the start of 2019, as evidenced by the consistently-negative money flows into the SPDR S&P 500 ETF (SPY).

This was a rally based upon hope, not evidence or flow-confirmation.

That’s why we warned investors to be warry of the confirmed melt-up, as a meltdown was right around the corner.

This was not market timing or lame predicting; it was common sense supported by market signals. Plain and simple flow-following.

C. Volatility

But there’s still more to our active portfolio management. There is volatility.

Volatility in finance is simply the degree of price variation over time. Prices that move outside of defined volatility channels in the direction of (A) the trend, amidst (B) strong flows, is good.

But when price moves outside of volatility channels in the opposite direction to trend and flows, that’s not so good and often indicates a change in investor sentiment.

Here as Signals Matter, we profit from volatility when it’s in our favor and disappear (i.e. exit positions) when it goes haywire.

D. Correlation

Then there’s correlation – a statistical measure of the relationship between securities.

High correlation, say 70-90%, indicates two securities are moving in synch. Low correlation, say 10-30%, means the opposite, namely that the two securities are moving in different directions.

Combining securities that bear low correlation to one another dampens volatility within an actively managed portfolio. And that’s a good thing.

4 – Security Selection

Finally, there’s good ol’ security selection, which is pyramidal in nature. It starts with a cash position (directed here at Signals Matter by Storm Tracker) and adds fixed income, equities and liquid alternative investments that are (1) trending, across ETFs that have (2) positive flow, display (3) normal volatility characteristics and that (4) bear low correlation to one another.

Et Voila. That’s how we do it. Four easy steps…1,2,3,4…

Long story short, we build portfolios around What’s Happening Now and What’s Ahead by investing in What’s Working Now.

By constantly parsing nearly 2,000 ETFs for trend, flows, volatility and correlation, our ever-adjusting Signals Matter All-Weather Portfolio provides actively-managed portfolio suggestions for Subscribers that want to gain in melt-ups when markets are rising and to gain (not lose) in a meltdown when markets are falling.

Does this mean our portfolio is always winning and never losing? Of course not.

YOU know better than such claims, and so do we.

What it does mean is we lose small and win big, which is the key to our approach, because as the famous line from Money Ball goes: “We hate losing more than we love winning—and there’s a difference.”

Think about that. In the end, it just boils down to more victories—and hence better returns with less pain along the way.

This Week

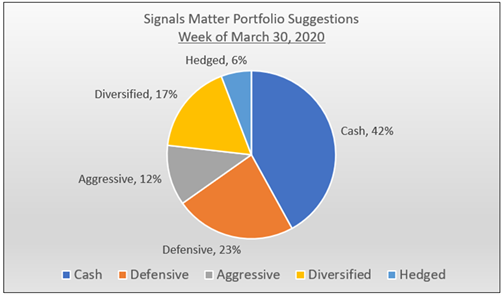

As March turns to April, we’ve updated our Portfolio Suggestions at www.SignalsMatter.com to take into account of the “good news” stimulus and the short-term equity pop this news enabled. Needless to say, we are still questioning how long this “stimulus” will work, as today’s declining open is hardly giving us much confidence in the Fed.

Toward that end, we remind our subscribers to check their dashboards here for our updated recommendations.

We further recommend that our non-subscribing readers join our team by signing up here. It’s worth more than a coffee a day, no?

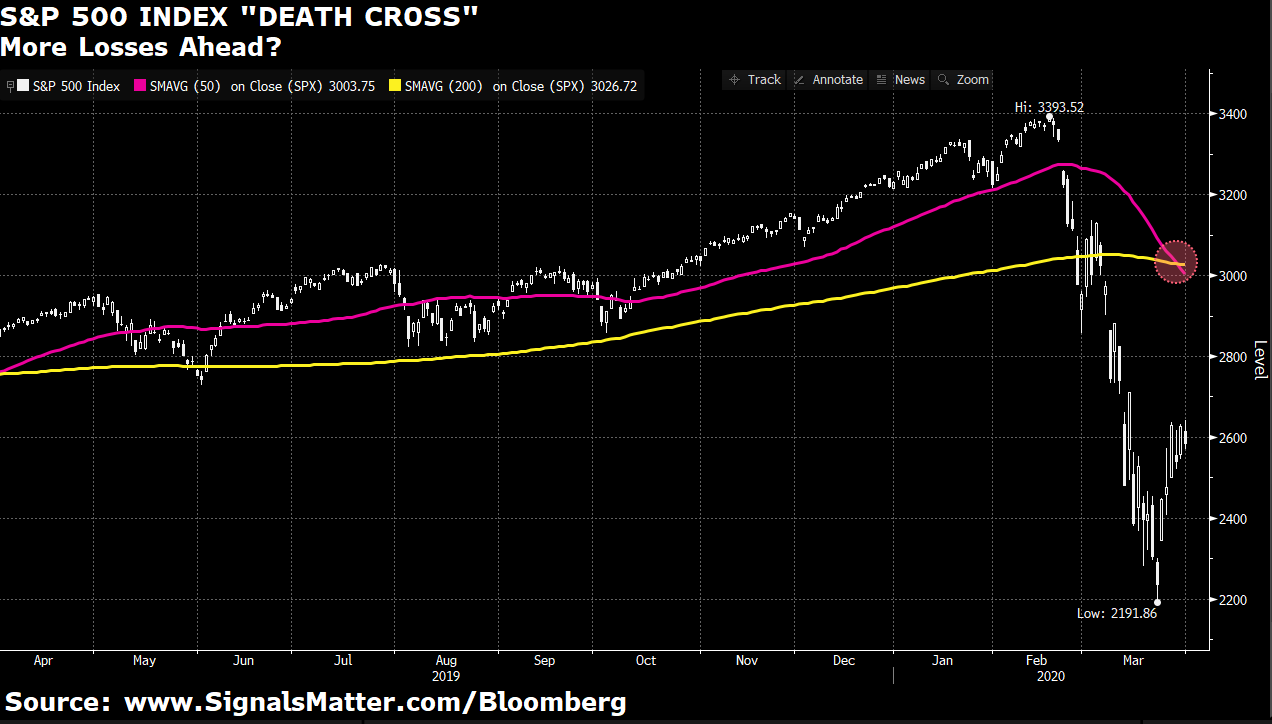

As a quick market update, just yesterday, a series of increasingly shallow up days that followed the recent stimulus announcements turned south, technically triggering a “Death Cross” in the S&P 500 Index.

A “Death Cross” is a grizzly technical chart pattern that triggers, in this example, when the S&P 500’s short term moving average (50-day) crosses below its long-term moving average (200-day line), putting a damper on recent gains and suggesting more losses ahead.

Is the Fed stimulus running out of magic? Is more on the way? Too soon to tell, but we are tracking this obsessively, and protecting your portfolios along the way.

As to our Portfolio Suggestions for this March 30 week, they have been suitably fine-tuned and are illustrated by risk category (rather than specific allocations) below, to protect our Subscribers.

Again, for deeper visibility into individual ETF selections for this week and the weeks ahead (and for an entire year ahead for just $195), please Subscribe Here. It’s just that simple. And it’s just that cheap, for now.

SignalsMatter.com

So, if you’d like to know What’s Happening Now, What’s Ahead and our Portfolio Suggestions for this week (and the weeks ahead as the 2020 Recession rolls out), or if you just want to benchmark (or smell-test) your advisor (for less than $200 bucks) and know what questions to ask, please visit our website at www.SignalsMatter.com and Sign Up.