With yesterday’s announcement of direct Fed ETF purchases, American free market capitalism officially died. Bye, Bye Ms. American Pie (chart).

If there was ever any doubt as to which master the Fed serves—i.e. the real economy or the stock market–the evidence is now undeniable.

The US Markets Are Now Officially Fed Markets

As of yesterday, the Federal Reserve Bank of New York announced that it will begin making direct purchases of corporate bond ETF’s on the major US Exchanges in order to “support the economy and financial system in the Coronavirus crisis.”

Holly cow. Holly cow…

The once desperate notion of direct Fed ETF purchases is now real.

Frankly, given the amount of money behind the Fed ETF purchases (starting at $750 billion) in this new twist on unlimited QE (i.e. money created out of thin air to “support” corporations), one might wonder that if the Fed really wanted to “support the economy,” then why not just print a $100,000 check to every American over the age of 18 (not otherwise guilty of felony murder) and let each of us decide for ourselves who needs another bailout?

But I digress…

For now, here’s where we are. The Fed is literally and directly buying US securities in the open market.

BlackRock, Inc.—The Big (Ugly) Winner

Needless to say, Wall Street’s good ol’ warm and fuzzy mega-insider, BlackRock, Inc. (with a market cap of $77 Billion) was conveniently hired to “manage” the Fed’s new program.

That’s very nice for BlackRock, given that they are already the nation’s largest issuer of ETF’s, with more than $1 trillion in ETF assets under management.

In short, the BlackRock Fox was just given a big fat bid from the Fed, as well as an obvious front-run moment in the rotten henhouse that is the US bond market.

Sadly, this too is no big “shocker.” Carl Icahn predicted this 5 years ago:

Ah… three cheers for the “new (insider) capitalism” masquerading as a “support measure” for the “economy.”

Bonds, including seemingly immortal junk bonds (from issuers otherwise worthy of a cigarette and blindfold), are now getting yet another artificial boost despite their membership in the largest, longest, fattest and most artificial credit bubble in the history of capital markets.

COVID-19 might be a nightmare for most of us, but for companies already on the verge of a debt implosion pre-COVID, this pandemic (and these Fed ETF purchases) has become a veritable life-saver.

Fed ETF purchases are simply mana from an Eccles Building Heaven for otherwise (and fatally) debt-soaked markets.

More Debt to Solve a Debt Crisis

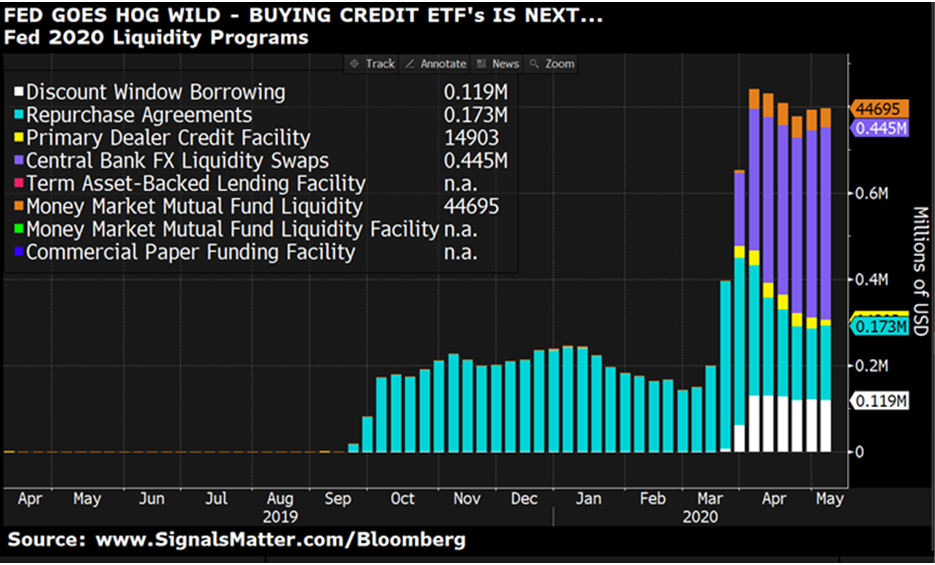

In the meantime, the same jokers behind the Fed ETF purchases have already slashed interest rates to nearly zero and have bought massive amounts of Treasury bonds, not to mention all those unwanted mortgage-backed toxic bonds (MBS) from our last crisis (remember ‘08?), thereby expanding its balance sheet from a “mere” $3.8 trillion last September to $6.7 trillion today.

This means almost no yield for taking massive bond risk over the long-term.

Ah, but’s what’s a trillion here, or another trillion or two there? We’re America, right?

And why worry about history, math, debt, natural market forces or even the moral hazard implications of ethics 101 when the Fed and its Wall Street and DC lobbyists are in need of another sugar high?

From Twilight Zone to Open Fake

I’ve written elsewhere about the Twilight Zone in which the Fed was becoming the market’s perma-bidder before recently taking us into the Danger Zone of slowly just becoming our market.

But today, even I find myself at a loss for words, as the Fed has now begun toe-dipping into a place that I warned of last week yet hoped would never happen—namely going from a borrower to a direct spender.

I highly recommend you re-read that warning and its implications once more HERE.

That said, the writing was already on the wall by March 23, when the Fed first announced its initiatives to “support” the credit markets.

This spurred an unprecedented rally in the bond markets despite an economic backdrop of just tanking, and I mean tanking fundamentals in everything from GDP to unemployment, or from earnings nosedives to heightened public cynicism, fear and distrust.

But as we’ve all been conditioned and taught to believe, there’s no problem that a couple trillion in printed dollars can’t solve. Again, the writing was on the wall as to the inevitable Fed ETF purchases.

Fed ETF Purchases: Near-Term Solvency, Long-Term Fantasy

Despite open and record-breaking economic bleeding by every traditional market indicator of risk, value and sanity, bond markets have never been insanely fatter, with prices now climbing magically to their pre-pandemic levels and thus sending bond yields to the floor as if there was never anything to worry about.

But folks, there’s a lot to worry about when it comes to the future of our country and our markets—whatever that is.

More on that on Friday…

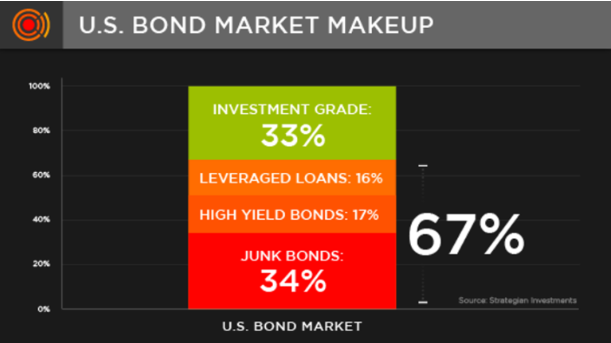

Over a year ago, we reminded readers that the US bond markets were basically just a junkyard of poor credits in which greater than 60% of its bonds were the D- students of the credit-quality class, namely junk bonds, high yield credits and levered loans:

Now, that same bond junkyard will be receiving a fresh delivery of scented flowers in the form of printed dollars compliments of Mr. Powell.

Again: No shocker here. COVID-19 was the perfect pretext for bailing out a clearly (and already) very sick credit market.

And as for that upper minority of so called “investment grade” bond issuers—names like Caterpillar and ViacomCBS, they might as well stop convening their boards or planning for any rainy days, as they’ve been taught to rely upon an omni-present umbrella from the central bankers.

See the moral hazard here folks?

Odd. When I studied markets (or even great executive managers), we were taught that sometimes “Sh—happens,” and thus legitimate companies and CEO’s needed to prepare for rainy days. If not, they’d die. That’s the harsh truth of constructive capitalism.

But today, our modern class of C-/D+ CEO’s can keep on trucking (borrowing) while those few others A+ executives who actually managed sound balance sheets, employee benefits and affordable debt levels get zero reward for doing the right thing.

Again, welcome to the new capitalism, which isn’t capitalism at all.

An Open Front Run—What’s Ahead

As for the other $2+ trillion in economic relief packages passed by Congress, we are genuinely glad that otherwise hard-working Main Street workers (among the 30 million claiming unemployment benefits) received support for losses incurred during a forced lock-down based upon either science or science fiction.

Of the 9 relief programs approved thus far, only 4 are up and running. But know this: Corporate relief programs will get the most focus, as Wall Street tends to, well…get the most focus.

And as for our focus going forward, it’s fairly safe to assume (and front run) that some of BlackRock’s multi-billion-dollar ETF’s will continue to go up rather than down, names like the iShares iBoxx Investment Grade Bond ETF (LQD) or the iShares iBoxx High Yield Corporate Bond ETF (HYG).

We’ll also be looking at Vanguard’s Short-Term Corporate Bond ETF (VCSH) as well as the iShares Short-Term Corporate Bond ETF (IGSB).

Why?

Because they’ve just been given a highly anticipated steroid dose from the Fed that would make Lance Armstrong blush.

In short, rather than tracking the fundamentals of natural markets, we are now forced to track the insider games of rigged markets.

Sadly, and again: No shocker there.

Here at Signals Matter

For now, the markets in general, and the bond market in particular, is once again enjoying more short-term relief at the expense of my children’s (and nation’s) long-term economic security.

The Fed’s goals, it seems, are decidedly myopic—that is: short-sighted solvency at the expense of longer-term distortions of our currency, our credibility and our economic growth.

Despite these fowl-smelling tailwinds from the Fed, we must nevertheless accept that they are tailwinds. Portfolios will be adjusted if our signals confirm the same.

That said, the longevity of these tailwinds behind the Fed ETF purchases is still difficult to measure and determine.

And given such risk and uncertainty, as well as profound distortions taking place in real-time, our subscriber’s portfolios will remain cautiously hedged, yet opportunistic, as the signals so determine.

As always, we invite the rest of you to join us SUBSCRIBE HERE if any of the above raises as much concern as it does eyebrows when it comes to the future and safety of your portfolio and money.

For a limited time, we are offering next subscribers: (1) a FREE Conference Call with us to ask anything you want about these markets, (2) a FREE Portfolio Check to help determine if YOU are safely-positioned for what’s ahead and (3) we’ll deliver a FREE Copy of Rigged to Fail, our recently-published Amazon Best-Seller, straight to your address on file so that you too can get into the factual weeds on topics like foolish Fed policy if you so choose.

In my next report, I’ll dig deeper into the implications of the Fed’s ETF purchases by comparing and contrasting such policies with those already well in play in that growth zombie-land otherwise known as Japan.

In the interim, stay informed, stay safe and don’t get too comfortable with these temporary tailwinds, as they wreak of desperation.

Sincerely,

Matt & Tom