Below we consider COVID-19 insanity in the backdrop of our dying economy now in a lock-down straight jacket.

Tremors, Quakes and Aftershocks Amidst COVID-19 Insanity

There are tremors, there are earthquakes and then there are aftershocks.

Tremors

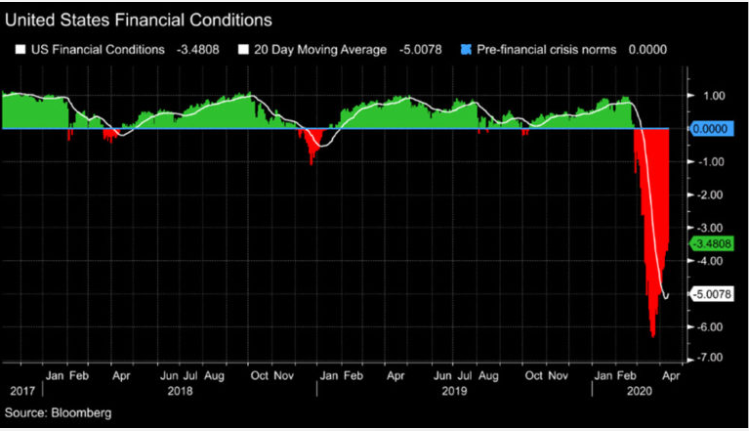

Long before the “COVID-Earthquake” rocked our world, the market’s Richter Scale sent us an ominous warning when the repo markets saw a single-day spike from 1% to 10% in September, warning informed investors that dollar liquidity just wasn’t, well, liquid…

This hidden ticking time bomb of dollar illiquidity was something we warned subscribers about long before the Coronavirus made the headlines, the implications of which we subsequently updated here and here.

Earthquake

Then, of course, came the COVID earthquake and COVID-19 insanity, wherein households, businesses, cities, states and countries were forced to shut down in a media-supported effort to contain its spread, a policy reaction whose implications (brave wisdom, dark PSYOP or utter insanity?) will one day become the topic of every high-school history class—virtual or otherwise.

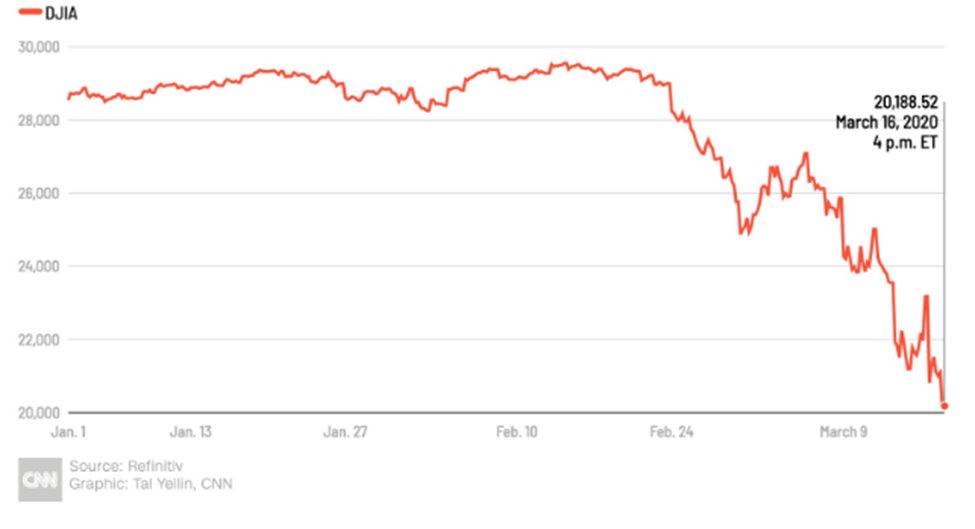

Markets then tanked like this by March 2020:

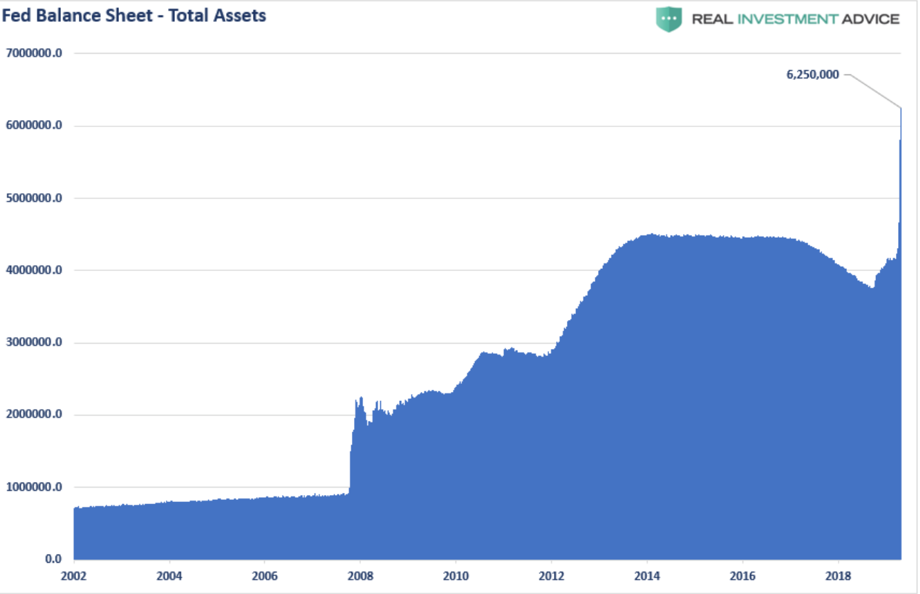

…and right on que, the money printing and deficit-spending kicked into full trillion-dollar gear and COVID-19 insanity like this:

Washington and the Fed acted quickly to help millions of individuals and businesses destroyed by the imposed lock-down.

Some businesses deserved this “aid,” many more did not. That’s an entire other report and story…

The staggering debt that resulted from the COVID-19 insanity, and the further dilution of the printed, fiat dollar to come, however, will eventually do more harm than the “good” we just borrowed and printed…

This is because we’ve crossed the Rubicon of realistic spending and printing in the midst of a genuine crisis.

The Small Business Administration churned out $350 billion in the first wave of loan “under-writing” at a rate of 109 loans per minute.

Just yesterday, another $500 billion was added to the SBA coffers, sending the overall COVID-19 insanity deficit-spend tally to $3 trillion in a matter of about 4 weeks.

Emergency money was needed. We get it.

But there’s a big difference between legitimate “aid” and just bad aid.

Which brings us to the topic of oil…

The Oil Aftershock Amidst the COVID-19 Insanity

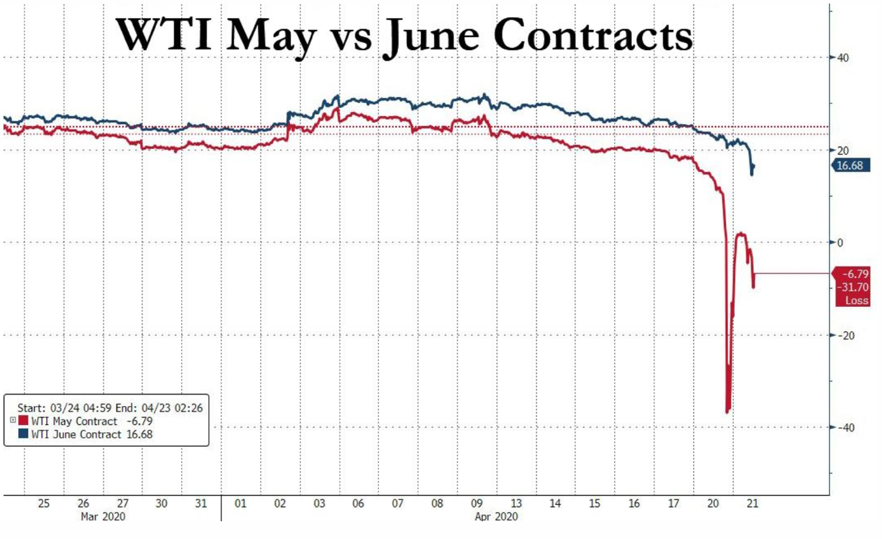

Perhaps you noticed that yesterday’s front month futures contract price for oil went deep, and I mean deep, into the negative—i.e. -$37 per barrel.

As oil contracts expired by 2:30 PM, the futures market was basically saying holders of WTI were willing to pay anyone $37 a barrel just to take it off their hands, because they had no place to store it.

Folks, if that sounds crazy, even absurd, well…that’s the aftershock world of COVID-19 insanity in which we now find ourselves.

But if paying money just to lose it seems insane, let us remind you that well before the COVID-19 insanity hit the oil markets, upwards of $15 trillion in negative-rate debt around the world meant that bond holders were already willing to pay to lose money in market gone mad.

In short, even before the global virus broke our already broken global credit system, sinister signs of an implosion were already building. Few investors took notice.

Energy Sector Sympathy? Bailing Out the Baby with the Bathwater

If the oil companies seem weak today in a world where no one is allowed to drive or fly, the carnage in fuel prices has only just begun.

The panic selling in WTI futures contracts which continued yesterday (Tuesday) has spread to the June contracts, and that red line below is cutting through the US shale patch like a knife through butter.

Should the US feel sorry for its energy companies in the same way we sympathize with Main Street American businesses (i.e. the corner café to the neighborhood care wash) forced into shutdown by DC in this COVID-19 insanity?

As of this writing, WTI oil is trading at $25.09 per barrel, and as anyone who knows this sector also knows, oil needs to be priced at a minimum of $27 per barrel just for producers to meet operating expenses.

This means that with every barrel produced at these prices, oil producers are literally burning (i.e. losing) cash. Lots and lots of it.

Needless to say, the energy sector, already the poster child of the junkiest of junk credits, will need to issue more junky bonds—i.e. more debt.

Are oil producers innocent victims of a virus or just bad boys victimizing their bond buyers? And if no one wants to buy their bonds, there’s always Uncle Sam. Is that wise?

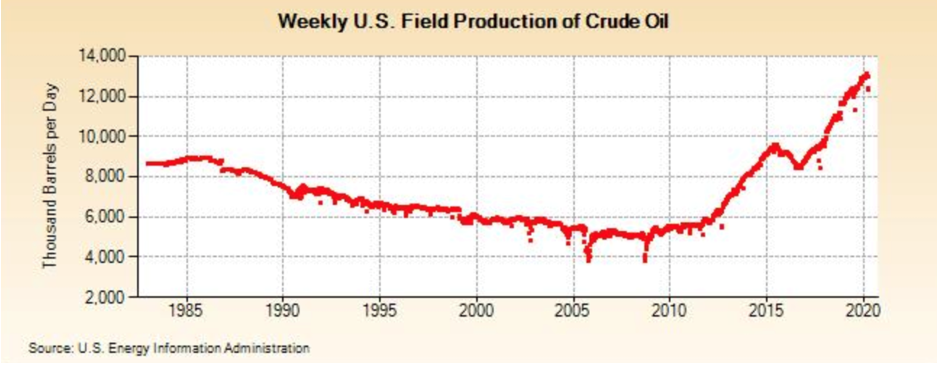

I mean, was it wise for oil producers to be expanding operations for years without ever considering that oil prices might actually do what all commodities do—namely swing radically in price?

Instead, these debt-soaked producers were acting as if oil would always trade at or near its $125/barrel peak (2014), apparently forgetting that it can also fall to $25/barrel or worse (2017), a market reality which sent over $200 billion of energy bonds into Chapter 11 once before.

Since the turn of century, oil producers have always been among the largest issuers of junk bonds due to the risk inherent to the price of this turbulent commodity. In short, they had to assume risk, right?

Since 2006, shale producers and service companies have borrowed over $300 billion to lose money. Does such a track record warrant a bailout? Aid? Sympathy?

And if you bought their junk bonds, should we feel sorry for you? After all, you assumed the risk too.

In a real, rather than Fed-supported bond market, sectors with this much debt relative to risk are ordinarily taken to the woodshed with a blindfold and cigarette.

That’s just the dark yet necessary side of capitalism.

But in a Fed world already gone mad before the COVID-19 insanity, these companies were allowed to borrow beyond their means or risk realities.

That’s what over a decade of artificially coiled rates does: distort risk, price and markets.

Now, DC is making headlines again to bail out the oil names and their junk bonds.

Such a move screams of “mal-investment.”

In a real, rather than now totally rigged and artificial market, oil producers guilty of this much massive over-production (below) at a price-killing rate of 13 million barrel per day would never be entitled to a bailout. Never.

Even in the aftershock of the COVID-19 insanity, sectors drowning under this many years of their own debt-binge should be subject to a mercy killing not a sympathy vote from DC.

Capitalism, if I recall, was designed to accept pain, not pretend it doesn’t exist. Some companies simply deserve to be put down. Others don’t.

Sympathy for Whiting Petroleum?

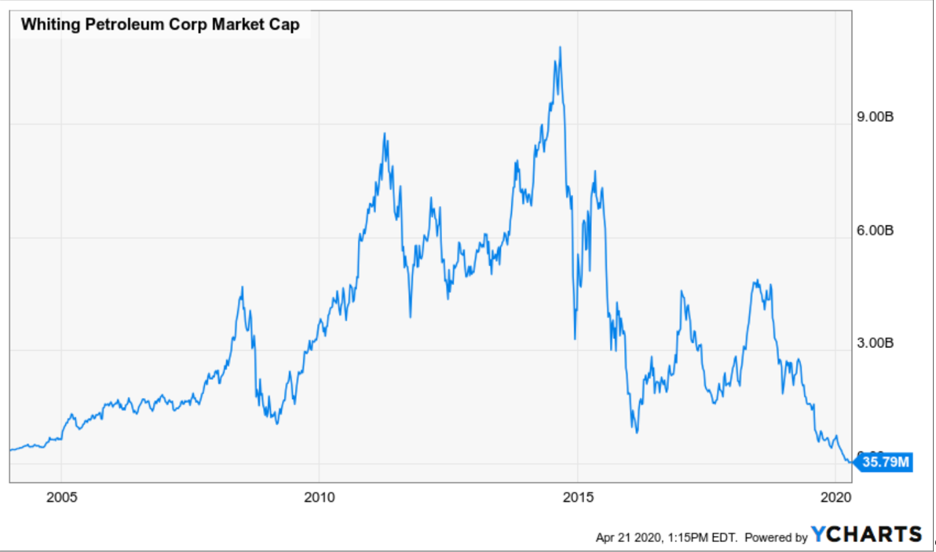

In the energy sector, the reality of this moral hazard is epitomized by one name in particular: Whiting Petroleum.

Over the last decade, Whiting incurred $16.4 billion in debt against $11.2 billion in cash flow, which means a cash LOSS of $5.2 trillion. Seem like a safe bet then?

In short, even before the COVID grey-swan, Whiting was a loser.

And yet now DC wants to give them a little “support.” I’d rather see that money go to millions of other deserving and prudent small businesses who through no fault of their own were forced to shut down…

The Bigger Picture—Lockdown Sanity in a World of COVID-19 Insanity?

Whatever one’s view of oil in general or Whiting Petroleum in particular, the price of crude oil is not the only thing getting slaughtered in lock-down America.

Nearly every sector we track is heading in a similarly horrific direction—from retail to auto sales, pizza shops to local banks.

As unemployment claims hit 5.5 million per week over the last month, our economy is dying in real time, and real fast.

If you still think such economic mortality rates are justified to protect human mortality rates, I get this. I really do.

But at this point, I don’t fully agree.

Is this because I don’t value my life or yours? Or the lives of those I love, all of whom are vulnerable to viral infection, from Australia to Michigan?

Hardly.

It’s because I learned math and common sense long before I traded my first stock or took my first law exam.

COVID-19 Insanity vs. Closer Scrutiny and Basic Facts

And based on the math and the balancing of the facts before us, the current lockdown-cure just doesn’t measure up under closer scrutiny.

In fact, the policy cure now appears to be far worse than the disease, and the news spewing out the “Ministries of Media Truth” in our national media circus are beginning to look more like distortions than facts. No shocker there…

It now seems that closer scrutiny is something our Orwellian main stream media, in all its zealousness to spread fear and hysteria, has failed to provide.

The same indifference to math or “closer scrutiny” appears to be true of mayors, governors, and Congressmen, many of whom are exploiting headlines to look tough on the “war on COVID” to boost their public appeal. One Chicago mayor comes to mind…

Fortunately, the greater population is increasingly beginning to ask itself if the surrender of their civil liberties and jobs is worth a $1200 check or a lucky shot at an SBA credit infusion.

In every war, there are casualties. They can be measured. Both human and economic.

In the current war and COVID-19 insanity, the numbers (as well as facts) just don’t add up.

COVID-19 Insanity, Dr. Fauci & Neil Ferguson

First, Dr. Fauci, along with the NY Times and DC swamp, made the central pivot in early March to scare/force the entire country into a stay-at-home (and economically devastating) prison sentence.

This policy move was based almost exclusively on the non-peer-reviewed “sky is falling” data of a certain British epidemiologist, Neil Ferguson.

Let me remind you that Mr. Ferguson was the same “scientist” who told Tony Blair in 2001 that tens of thousands would die from foot & mouth disease when only a handful did, despite the slaughter of over six million cows and sheep at a cost of 10 billion British pounds.

Ferguson was also the scientific force behind the 2002 prediction that 200,000 would die from mad cow disease, when only 177 did.

In 2005, Ferguson said the bird flu would kill 60,000 Brits, when the death toll was in fact 457.

He’s also the same charlatan who said that 2.2 million Americans and 500,000 Brits would die from COVID-19, prompting the US and UK to opt in early March for a total shut down rather than the herd immunity pursued by Swedish epidemiologists who debunked Ferguson in prior periods.

How Did We Get to COVID-19 Insanity?

So, how in the heck did Ferguson become a guiding star for 2020 policy decisions based on his horrific track record?

From February 4 to April 11, for example, the CDC projected 620,760 deaths from all disease causes for the entire USA outside of New York City.

The actual data has come in, and the total number of non-NYC American deaths, including those attributed to COVID-19 and seasonal pneumonia, came it at 561,490.

In other words, the death rate for the US is actually running below its typical death rate (with or without COVID-19).

The real problem, it seems, is not just COVID-19, it’s a) COVID-19 in massively dense urban settings like NYC and b) a disease whose profile disproportionately impacts a highly vulnerable (and identifiable) population of aged citizens with specific pre-conditions.

If so, (and the math rather than media hype confirms this) why not do everything possible to protect the most vulnerable and obvious rather than shut down the developing economies of the entire world at a cost that will take years, if not a generation, to pay for?

Personal Questions

This raises a question that each of us much answer for ourselves: Is the current global, national and household shutdown the best way to manage the viral threat?

Or has the self-inflicted wound of a global shutdown been far more pernicious to our nation than the natural wound of a virus whose untested infection rate is likely infinitely higher than what is reported?

If so, then the death rate with which the media terrifies the masses on a daily basis is likely much lower than reported, as thousands more have the virus than can be tested/confirmed.

And might it not be better to therefore isolate those at the highest risk of dying, rather than forcing nearly ever liberty-loving member of the global community into isolation?

In short, are we really seeing the greatest health threat since the black plague or just the greatest moment of mass hysteria since the Salem Witch trials?

Again, each of us has to answer this question on our own. It would be nice if we actually had the right to do so…

In purely economic terms, however, this much is certain: If we want to help the oil sector, or just about any sector now racing toward the basement of market history, bailouts and lock-downs simply won’t work.

Letting people get back to work (or in their gas-operated cars or planes) may be a better plan…

The absolute insanity of shutting the entire world inside over a viral threat whose tragic yet misunderstood and de-contextualized facts don’t seem to merit such a reaction, and makes one wonder: What is really going on?

Are policy makers and prompt-reading bubbleheads just stupid, corrupt or something far worse?

And are Americans, 74% of whom (Hill Harris poll) are now of the opinion that their civil liberties are more important than the viral threat, going to put up with this for much longer? Do they have a right to decide for themselves, or does DC, DR. Fauci and Mr. Ferguson really have the right to decide what’s best for us?

That remains an open and personal question, but this much is beyond question: Our economy is certainly on a respirator today and dying right before our eyes.

Sincerely, Matt

The Salem Witch Trials were a hoax? Who knew?

I hate to be on the same side of an argument as Donald Trump but opening the economy asap ,at least relatively, safely beats the hell out of the Potlach the world is doing.

JEM