Stock Market PSYOP — One Big Rigged Game

Today we’re keeping it short.

Why?

Utter awe. Markets have been rising despite a tanking global and national economic crisis.

Still think this game is not rigged? Still think two Ivy League Wall Street insiders with decades of experience in hedge funds and TBTF banks are just out to “scare you”?

Even the folks at Blackrock can’t hide this stock market PSYOP anymore. This not a free market, it’s a Fed market, which means the USA, which we’ve served and loved, is in deep doo doo…

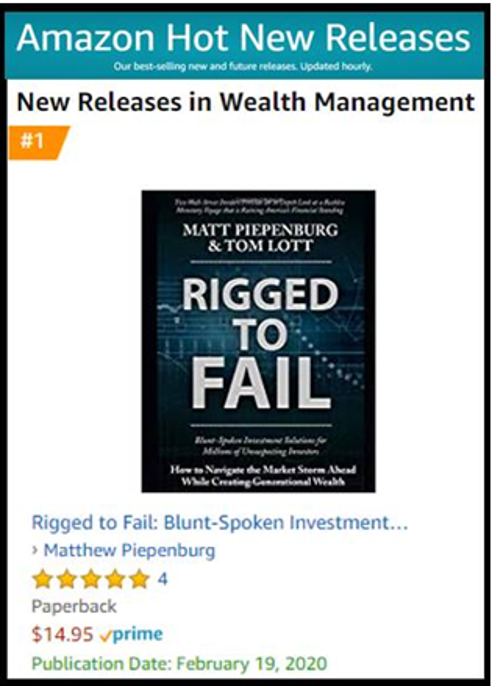

In 2020 we got so frick’n frustrated that we published Rigged to Fail, which became an Amazon No#1 Release.

In July of 2019, we published a smaller special report on how both our markets and broader economy were, indeed, rigged to fail. Please simply take a moment to re-read that special report here.

Why?

Because long before COVID-19, we warned that the Fed and its paid-for rubber-stampers on the Hill alongside Wall Street’s lobbying power would always be in bed together to assure their own survival at the expense of a totally duped Main Street America. In short, this stock market PSYOP has been in play for awhile.

We weren’t just saying this to be dramatic. We were telling you this as Wall Street insiders, not 30-something blog writers with a chip on our shoulders.

Folks this is serious. Read it again. Furthermore, we warned in April of 2019 that any extraneous black swan event would send us outside of Capitalism (which is now dead) and inside of an Orwellian state of centralized economic and hence social control. We are seeing this stock market PSYOP playing out in real time today.

In short, a global virus was never out of the realm of the possibility, and we said as much in APRIL of 2019. Don’t believe us? Again, just click here. Global viruses today are to be expected, not ignored or pointed to as some “unexpected event.” Always were, always will be. This was not a black swan, but a grey swan.

We warned as well of the inevitable need to print more money to fake our way into even more debt to solve a debt crisis.

Seem like an absurd plan to you?

It is.

Yet that’s exactly where we are today, with DC effectively pushing “war bonds” in the form of 20 or even 50-year bonds as the next phase of Wall Street support in this stock market PSYOP.

Why such dramatic steps from DC?

It’s simple, as well as predictable. Such measures allow the markets to survive on more debt by issuing more bonds in order to keep yields (i.e. interest rates) from rising, as rising interest rates (i.e. rising costs of borrowing) would otherwise be the natural death knell to a debt-driven and failed policy “experiment” at the Fed, and the death knell to civil liberties and free market economic principles.

In August of 2019, for example, we calmly called all of this, and used the 100-year Austrian Bond as an example of what stupid looks like.

In that August report, we said: “Just wait, the US will be forced to do the same (stupid) thing.”

Few believed us then, but here we are today…

Wall Street is trying to save itself as Main Street is locked inside and suffering more economic harm by the day.

They say such emergency measures are essential for public safety, but there are many (too many) arguments as to why this is not necessarily or even mathematically true, but I’ll save those admittedly controversial facts for later (or the Swedes).

For now, I do know that at least one person in North Carolina was arrested for what was otherwise (once) known as the right to Free Speech, but apparently, the new normal today is that such rights “are non-essential.” Sorry Mssrs. Thomas Payne and Jefferson.

Meanwhile, more Americans are getting furious (as they should be) at a Wall Street that rises despite every indicator suggesting we are in a depression already.

But that’s what $5T in combined fiscal and monetary “accommodation” can do in a stock market PSYOP: Prop up Wall Street at the expense of both Main Street and math and then call that a “care package” under euphemistic congressional labels like “CARE 1” or “CARE 2.”

In short, the DC policy pushers behind this stock market PSYOP are experts at putting lipstick on economic pigs, and they have now placed us square on course to a rigged to fail end-game as names like Boeing and AA get more “debt support.”

Even Jim Cramer of Mad Money is confessing that “there’s a seething anger sweeping this country,” as the staggering disconnect between DC and the stock market becomes nearly impossible to ignore, as stocks rise despite all normal economic indicators tanking.

Cramer is only half smart, for his explanation for this disconnect is that it’s just the way things have to be, as the “big boys” on the markets—i.e. the big companies—are crushing small businesses simply because they have “pristine balance sheets.”

Cramer has indeed gone mad. Pristine? Pristine what?

Folks, if the “big boys” on those publicly traded exchanges had such “pristine balance sheets,” then why on earth would they have needed over a decade of perpetual “accommodation” from NYC and DC in the form of total debt, unhinged QE and a bond market that is nearly 70% junk, BBB or levered loan rated?

Again, I won’t go into balance sheet detail here, as I’ve done it in so many other reports.

But let me just say this, Cramer is simply wrong, and there’s nothing at all “pristine” about “Big boy” balance sheets, unless you consider toxic levels of debt and the constant need for a handout as “pristine.”

Meanwhile, the “Ministry of Truth” in the main stream media and DC are still trying to convince the masses to trust them, stay afraid, stay inside and do what they are told as this stock market PSYOP plays out.

But as every PSYOP covert planner knows, the best way to control and manipulate a large mass is via a smart combination of fear-pushing at the expense of civil liberties.

Welcome then, to our new normal folks, as COVID-19 has been the exploitable excuse, rather than trigger, of massive and financial coup and stock market PSYOP in which the markets rise while Main Street watches Netflix.

How long can this rigged game last? How long will this “seething anger” stay indoors? And how long can this stock market PSYOP defy the laws of natural gravity on the back of central bank steroids?

That’s what we track daily, for YOU.

For now, please don’t think the Fed has YOUR back. They don’t.

The proof is in the S&P pudding, but even that s0-called “surge” is nothing to brag about, and the volatility and pain ahead is only just beginning.

Stocks will soon enough sink on dire economic data, because data, despite all the DC “faking-it,” still matters, dspite a stock market PSYOP in full swing. Markets and sectors can and will tank, in the blink of an eye, as we are seeing at Goldman, BofA and Citigroup.

And here’s a fun fact—even JP Morgan is forecasting that GDP will shrink at an annualized 40% in the second quarter. But folks, we’ve been saying this for months as well…

At Signals Matter, we don’t chase tops nor follow or trust desperate Fed head-fakes in the face of unprecedented uncertainty and headline dishonesty when it comes to protecting and making money.

Instead, we stick to data, market signals and common sense. This works for us and hundreds of subscribers, all of whom have been protected rather than duped through this entire and surreal Twilight Zone.

We hope you’ll join us, as now more than ever we need to face facts not fantasy, and buy at bottoms not tops. And we’re not even close to a bottom yet.

Sincerely, Matt & Tom

Matt/Tom,

I am literally sick to my stomach at the corruption and complete disregard for moral hazard we are living.

We are led by criminals. The government is nothing more than an incompetent bunch of Mafiosi in league with the Wall Street Banksters. When they feel their power slipping away or their financially engineered sandcastles sliding into deserved dust, they print money and go to battle stations to rescue their buddies in finance (that they hope to go to work for when they exit government).

There is ZERO doubt that if this doesn’t stop there will be a revolution in this country. The typical American rube is not THAT stupid. And the infrastructure to support that revolution is also already in place. On one side, the rubes can organize and communicate with each other in large groups very quickly via social media, and on the other side the government can monitor your every move at virtually zero cost and put you down with brutal force with their militarized police forces in armored personnel carriers and SWAT teams. Witness the practice dry run on total shutdowns they are running through right now! And how effective they been!

This has got to stop!

Peter Schiff: Nobody Should Be Bailed Out!

Peter Schiff nails it….

https://www.zerohedge.com/personal-finance/peter-schiff-nobody-should-be-bailed-out