As we head into May and a state-by-state phasing out of lockdowns, many are wondering what a post-Covid rebound might look like.

As usual, we ask the markets for the answers, not the politicos.

GDP? Look Out Below!

The GDP data is coming in.

Ok. We get it: GDP is boring.

But not anymore…

Reminder: GDP represents our nation’s income, and 70% of that number comes from consumer strength.

In short: GDP matters. A lot. It’s the ultimate pulse and reality-check of our real economy–you know, the part the Fed forgot about for years as it focused on juicing up the stock market…

Perhaps Powell is finally no longer able to hide from the fact that the stock market is not the same thing as the real economy, measured by an already pathetic 12-year GDP that annualized at less than 2% even before the virus rocked the headlines.

Scary?

Oh, it gets a lot scarier…

We track GDP as a key component among hundreds of market indicators to build your portfolio safely in all conditions, good, bad or ugly.

Applying such facts to a forward analysis of a post-Covid rebound, the outlook is strained, to say the least.

Based upon the GDP data we’re seeing off our economic bow, our proprietary portfolio is bracing for a ton of ugly ahead…

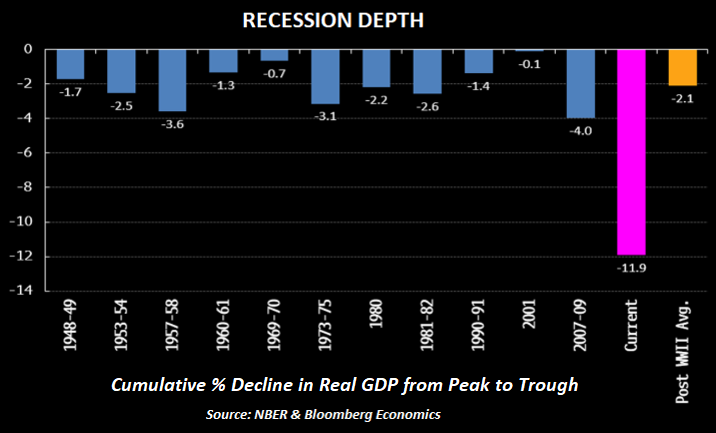

The data coming off our screens sees what Bloomberg Economics describes as a “moderate -4.85% (!) contraction” for Q1 and record-breaking dive of -37% GDP for Q2 (!!).

We are now living through the fastest and deepest dive into recessionary depths ever seen, even deeper than our World War II emergency economy:

What Kind Post-Covid Rebound Is Possible?

Given the Q1/Q2 lockdown that sent most of America indoors over a still highly controversial policy reaction to a viral outbreak, the above GDP damage is no shocker.

I mean, if forced to stay at home, it’s hard for consumers to either earn or spend. Pretty basic.

What remains unknown, however, is how quickly, if at all, the US economy will experience a post-Covid rebound.

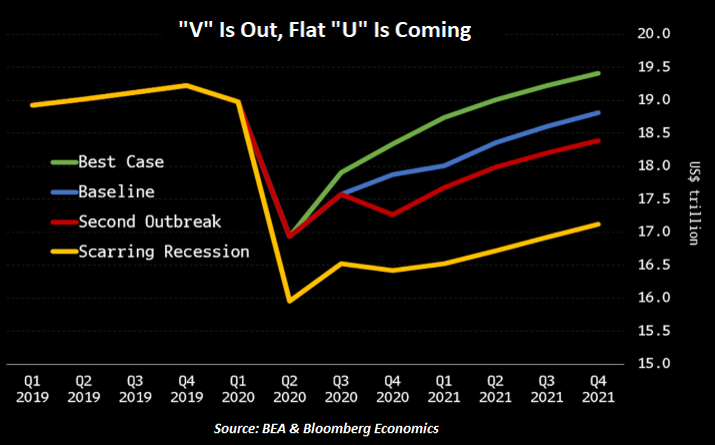

Should we expect V-shaped recovery, a U-shaped recovery or an L-shaped recovery?

Bloomberg is calling for a “Wide U,” which one could just as easily see as a narrow “L”…

In other words, don’t expect a miracle.

Here are four scenario’s the Bloomberg folks are considering as to a post-Covid rebound when it comes to increased Treasury debt pain ahead:

•

•

Uncertainty and Certainty

This much we know for certain:

• Our post-Covid rebound and economy is facing a massively dislocated labor market (on “furlough” for now) at 20% unemployment by May which the pundits are hoping will fall to “only” 10% by year-end in a post-Covid rebound.

• In addition, the quadruple whammy of 1) tanking oil prices, 2) weak commodity numbers, 3) a still strong dollar, and 4) declining core price trends means a ton of deflationary (i.e. price decline) headwinds blowing against the post-Covid rebound.

• With rates already at zero, the Fed’s only “steroid” for now is more money printing to come, and there’s no point at all even dreaming about a Fed rate hike anytime in the foreseeable future.

As for what remains uncertain, well, there’s a whole lot…

• Will current deflationary realities morph into an inflationary nightmare?

• Public ownership of Fed Treasuries is passing the $17 trillion mark, and even a small natural rise in rates makes that very hard for Uncle Sam to repay without printing more fiat dollars while desperately trying to cap rates via “yield-curve control”—i.e. suppressing natural market forces.

Inflation, however, is not an extinct species, and like the laws of gravity, can’t be “suppressed” forever.

• Will “furloughed” jobs suddenly return to full-time jobs in a post-Covid rebound?

• Will the viral hysteria and further enforced lockdowns put a deeper dent into once Constitutionally protected civil liberties like silly-ol free speech (i.e. the right to question or disagree with current virus data and policy reactions) or the freedom of assembly (it’s hard to protest 6 feet apart)?

• Will virus-impacted sectors like restaurants, travel and entertainment see a “surge” or a “slack” in a post-Covid rebound?

• Will consumer spending, the core driver to economic growth heading into year-end, miraculously rise from the ashes, or will an already ignored and beaten US middle class emerge shell-shocked in the post-Covid rebound?

• Will trillions in more government spending to keep the country fed and housed push the ratio of US debt to GDP so far past the 100% level that not even Papa Smurf or the Twelve Magical FOMC Elves can save us?

And as for the Stock Market…

Turning from the real economy to Uncle Fed’s favorite nephews on Wall Street, the outlook ain’t much better for a quick, post-Covid rebound.

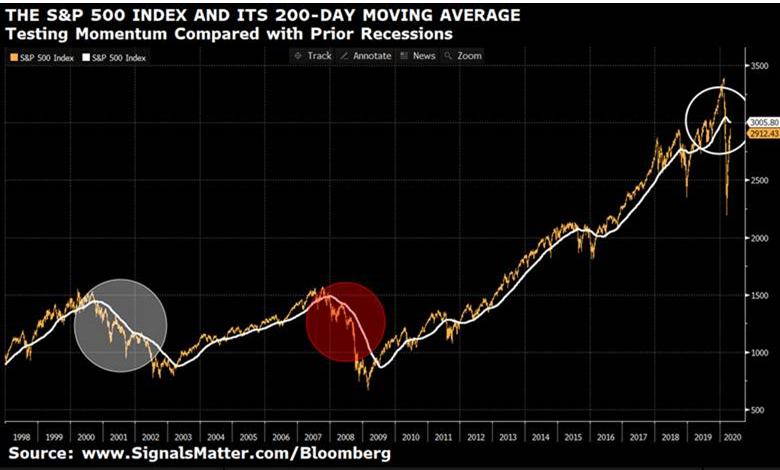

A Key 200-day moving average support line was tested yesterday.

If the last two recessions of 2000 and 2008 are any guide (circles below), the S&P is heading for some real pain ahead rather than a quick, post-Covid rebound. The Dow is down over 400 points this morning as we pen today’s Market Report, retreating from the 200-day trendline, as expected.

Thus, if price-swing volatility makes you seasick, break out the Dramamine, because you’re gonna need it.

Whether owing to Dr. Fauci, Bill Gates, Gilead or the White House, headlines count, ripping single-day stock prices north or south on a dime.

Moving against stock market “surges” (as we’ve seen in April), is the longer-term reality of the economic pains/fundamentals discussed above and elsewhere.

As for earnings and other such old-fashioned indicators to track a post-Covid rebound, Tom and I still think earnings matter, don’t you?

Toward that end, have a look at the chart below on revised earnings as we head into another week of earnings reports. This chart suggests choppy waters ahead. Again: break out the Dramamine.

The current disconnect between random market surges and Main Street reality is frankly staggering and just confirms the central thesis of our best-selling book, Rigged to Fail, namely that the Fed system on Constitutional Avenue clearly favors market “accommodation” over Middle-class pain.

At least low rates and pandemic fears allowed the ethical masterminds at Apple to do what grossly overpaid CEO’s and executive boards do best in the post-08 orgy of moral hazard—namely: Buy back their own stocks.

The optics are never good, moreover, when both Harvard University and the LA Lakers look for (and get) public handouts while many deserving small businesses overlooked by the SBA are teetering toward Chapter 11.

Steering Portfolios Through the Waves

All of these factors, from tanking GDP to bleeding earnings, deflation to inflation, inform not only our outlook on the post-Covid rebound, but more importantly, on how portfolios should be positioned in times of such obvious uncertainty vs. certainty.

We are all about portfolio stability, not daily stock picking or instant solutions. If long-term wealth preservation and patient wealth creation fits your agenda, then join us.

If, however, you’re looking for penny-stock miracles or instant wealth gurus, there’s plenty of that out there in the internet of things.

But that’s just not how we roll.

The markets, however, are rolling like a storm off Cape Horn and we’re here to guide those of you looking for a safe harbor.

Stay informed, stay safe and have a great weekend.

Sincerely,

Your Guides, Matt & Tom