Japanese markets are a warning template for informed U.S. investors.

44 shares

Growing up in the 1980s, Japan’s sun was rising big time. There was even a popular tune by the Vapors which some of you might recall entitled, “Turning Japanese.” Remember that one-hit wonder? Ugh.

During the ’80s, the Japanese markets and economy (along with bad pop music) seemed unstoppable, as its economic empire stretched from Sydney, Australia, to the iconic Rockefeller Center in New York City.

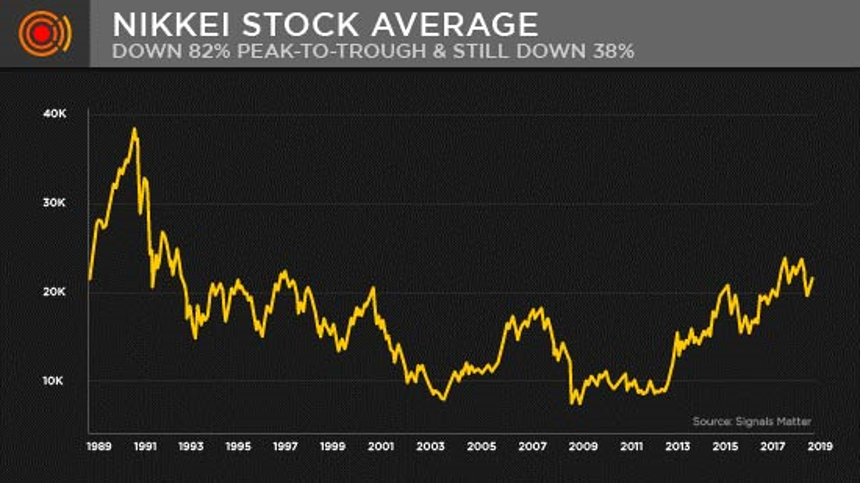

Much like today’s S&P 500 and DOW in the U.S., Japan’s Nikkei knew one primary direction: up and to the right.

Investors, market “experts,” media bubbleheads, and even pop culture all agreed that Japan was a phoenix rising from the ashes of and a true “miracle.” Euphoria ensued with borrowing and debt levels in Tokyo and beyond went off the charts.

And then, in 1989, the Nikkei tanked, sinking under the weight of its own debt spree. By 1992 its economy was in full stagnation and soon the Nikkei was down more than 80% from its highs.

Today, 30 years later, the Nikkei has yet to recover those highs. Thirty years later. Ugh.

But that was not the end of the Japanese markets horror story, as we’ll see below.

What’s even more disturbing is that, in many ways, the horror story from Tokyo is a template for the horror story now playing out in Wall Street and across the U.S.

Let me explain.

What a Debt Godzilla Looks Like

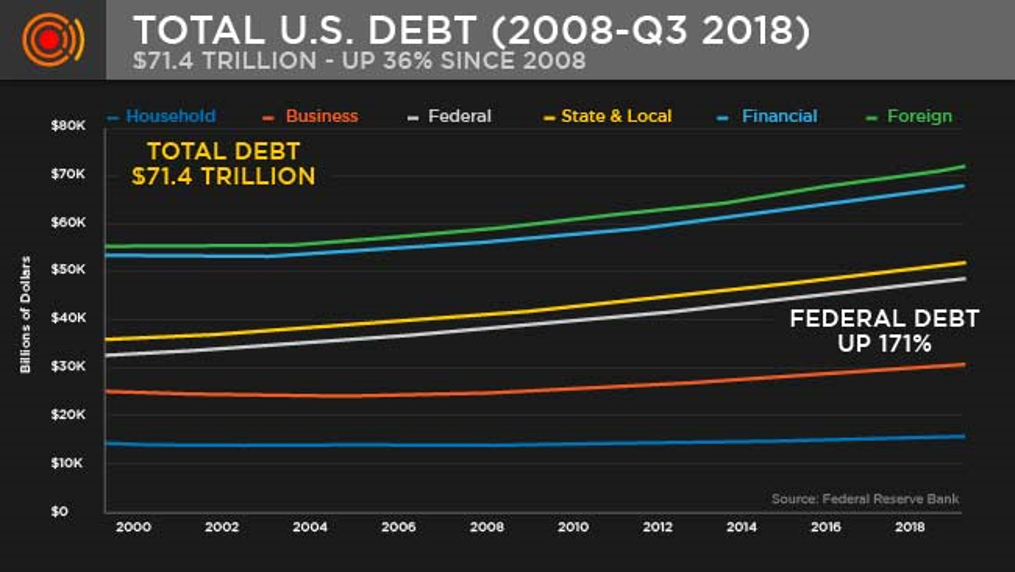

The U.S. markets, like the Japanese markets from the 1980s to now, is a monster essentially fed by debt rather than GDP.

We run an annual deficit of $1.2 trillion, and the Congressional Budget Office (CBO) projects that number rising for the next 10 years.

The CBO also assumes that the U.S. will not see a recession in the next 10 years, which is simply, well, ridiculous.

Furthermore, the CBO and media conveniently ignores over $400 billion in annual U.S. “off-budget expenses,” which adds to our deficits each year. When one combines these numbers, we are looking at a national debt of $40 trillion in the next decade.

In the meantime, the U.S. will need to do some “mandatory spending” for Medicare, Social Security, and other “entitlements,” plus over $800 billion in annual “discretionary” military spending to fight wars that I, along with my many brave friends in uniform, can no longer even begin to fathom or explain.

The question we must all (red or blue) ask today is how in the hell will the U.S. pay for this?

What Keeps Our Godzilla Debt Bubble Alive? More Debt…

And the answer I’ll provide is as obvious as it is sad. Namely, the U.S. will do what it now does best – borrow rather than produce. That is, we’ll go into more debt. The U.S. Treasury will thus issue more bonds.

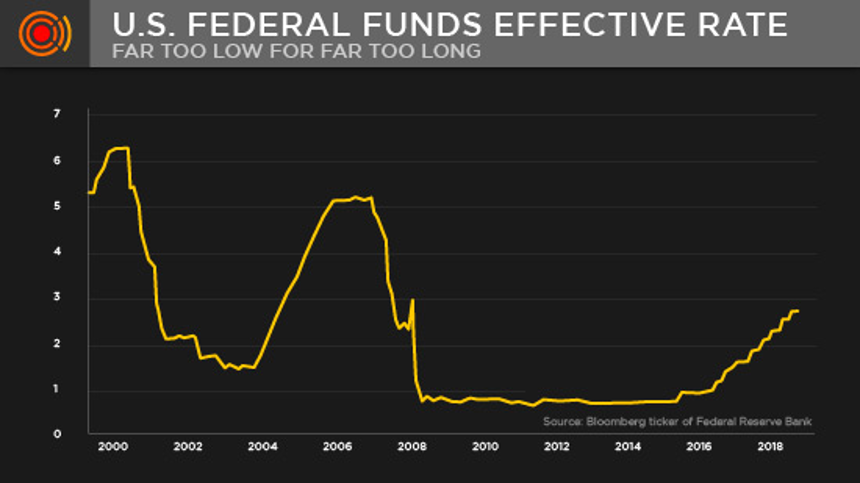

Of course, for the U.S. to pay the interest on these bonds/IOU’s, it will get the Fed to make sure interest rates are stapled to the floor. Because, if rates go up, the debt monster would mathematically be too unfathomable to even consider, let alone repay – even for our “rich” Uncle Sam.

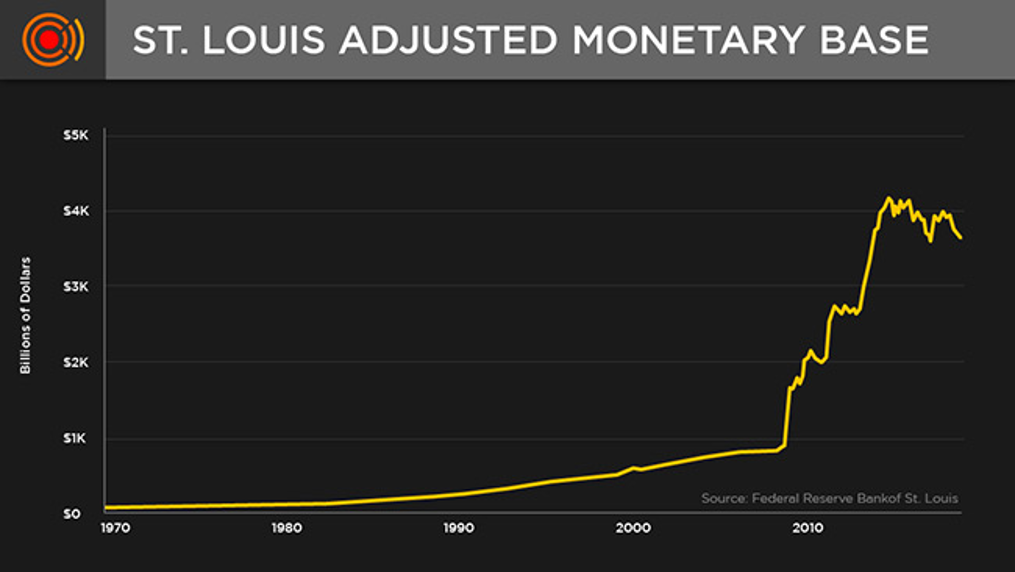

Cranking rates to the floor, of course, kills what little savings the U.S. Main Street has left. And after crushing the “savers,” the Fed will then move on to the next dirty tool in its two-hammer toolbox – namely, it will start more money printing, aka “QE.”

Sound pretty disturbing? Well, such a monstrous horror show is in fact the very template Japanese markets have used since its 1989 crash: suppress rates and print money.

Can Anything Stop This Debt “Godzilla”?

The next question then is this: Can this monstrous Fed thereby borrow and print the U.S. out of any further pain?

Can we literally have “deficits without tears” and avoid inflation, which is what normally happens when money is printed? Can we simply limp on, seemingly indefinitely, on a deflationary respirator artificially engineered by an all-powerful central bank?

Some, especially the PhD’s at the Fed, think so.

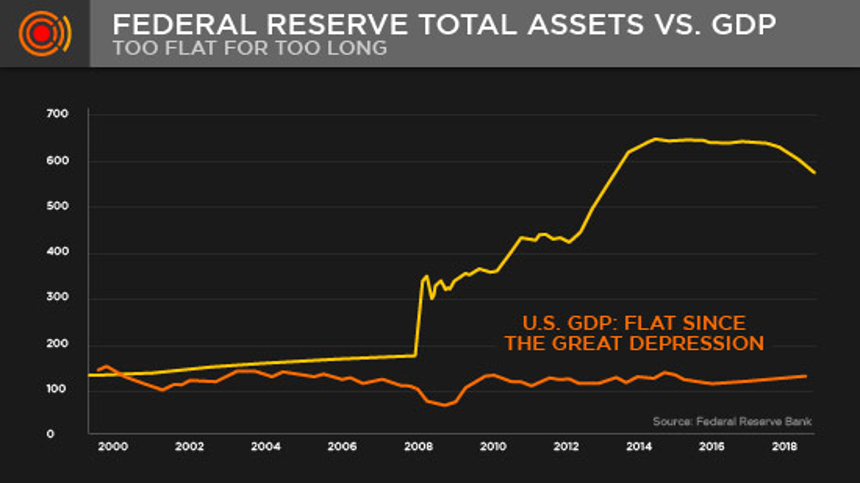

Just as the post-Nikkei crashing Bank of Japan repressed rates and printed money, the post-2008 Fed has repressed rates like this…

And printed money (i.e. expanded the Fed’s balance sheet) like this…

As our government and nation went into debt like this…

Of course, such astronomical debt is typically a perfect setup for a disaster in normal, non-Fed-engineered markets.

That is, in genuine markets, debt disasters are triggered by insolvency – i.e. the lack of cash to pay the debt. But when nations have central banks that print money on demand, this solvency issue is quickly – albeit artificially – “resolved” by pushing a button and adding fiat dollars to our money supply.

Pretty sweet, no?

I mean imagine how easy it would be to solve our own personal debt problems if we each had a money printer in our basements? We could just borrow and print, set on repeat.

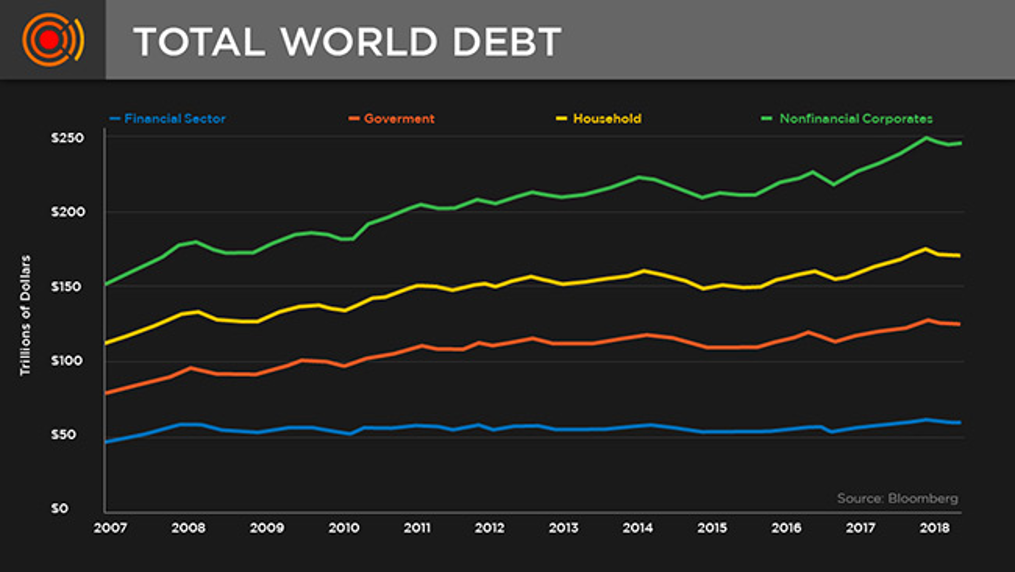

Today, thanks to all these central-bank money printers from Washington to Tokyo, the world sits on nearly $250 trillion in total debt, of which about 30% is government debt.

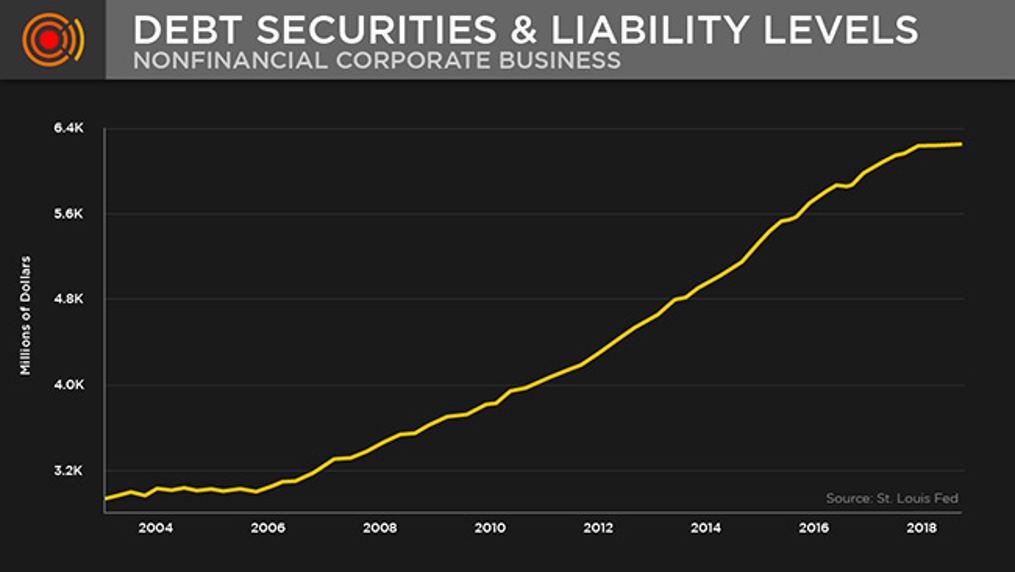

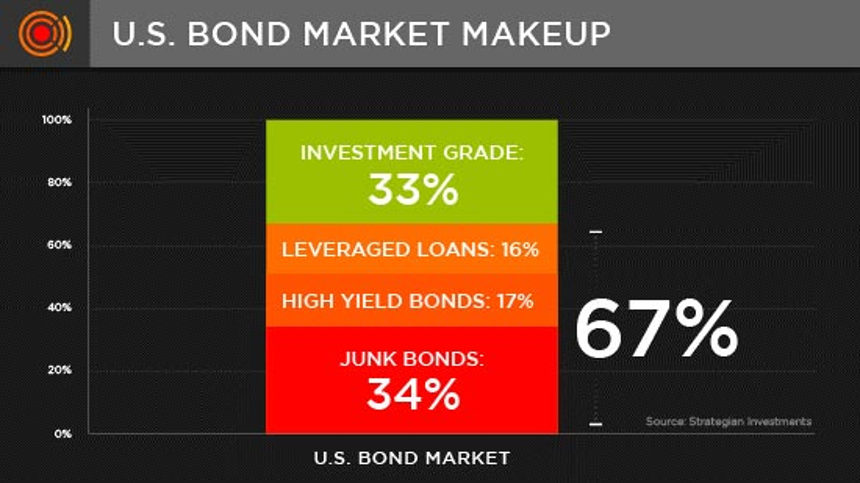

Governments, of course, were not the only suckers for this low-rate debt. Corporations jumped on board too, as the graph below of “securitized” (i.e. publicly traded) debt clearly shows…

If you add private corporate debt, the graph above gets even worse, much worse. You’ll note as well that our little hiccup of a recession in 2008 (the shaded area) did absolutely nothing to kill this monstrous debt binge.

Why? Simple: Interest rates were at zero…

The Other Monster in the Room – Debt Rollovers

But companies, unlike governments, do not have money printers in their basements. They can’t bail themselves out if they run out of cash to pay for their loans.

Instead, they’ll just borrow today to pay for yesterday’s debt, and then borrow again tomorrow to pay for today’s debt. On Wall Street, we call this a debt “rollover.”

Folks, it is essential that you understand this critical point: Debt rollovers end, and hence the party on Wall Street ends, when the cost of that debt – i.e. interest rates – rises.

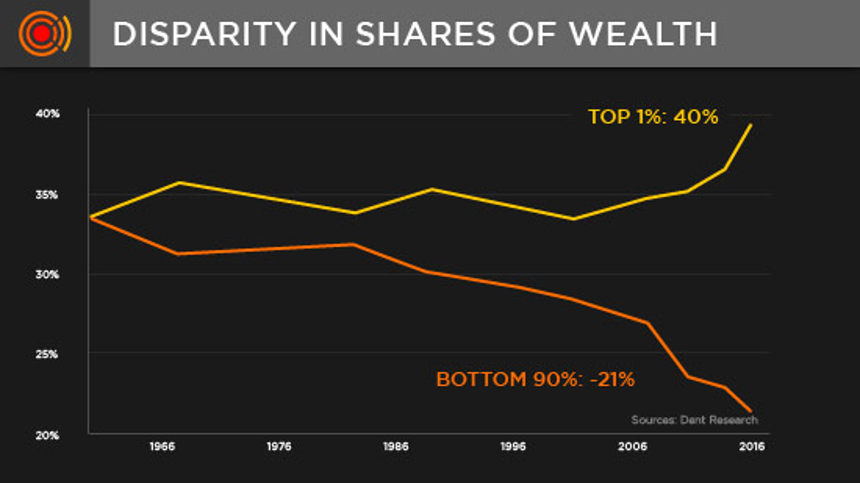

The Fed, of course, knows this. So rather than give companies their own personal money printers, the Fed simply keeps rates stapled to the floor to keep Wall Street binging while Main Street “savers” get slaughtered.

Still think the Fed has your interests in mind?

As a Wall Street veteran (and yes, even “insider”), let me tell you what all of us hedge-fund types have always known: The Fed serves one master – the market, not YOU, the people.

But here’s the rub. Bogus companies like Tesla, and bogus IPOs like WeWork, eventually die under their own stupidity, despite even the best efforts of the Fed to keep them alive with low rates.

I saw this firsthand in the dot-com bubble and the litany of crappy IPOs and companies that rose like rocket ships and then later sank like Titanics – even when rates were low.

As for now, today’s many, many, many crappy companies are borrowing (i.e. issuing bonds) at all-time highs like crack addicts, poised to add another $800 billion in new bond issuance in 2019 alone just to keep the rollover party going.

What’s Next?

So, what does all this mean? Where are we headed? And, what does any of this have to do with the Japanese example I opened with?

Well, Japan’s central bank (led by a nut named Kuroda under the consultation of a false prophet named Bernanke heralding over the world’s third-largest economy) has spent over 30 years repressing rates with over 20 years at zero percent, while also printing trillions to keep a debt party going without Japanese markets totally tanking… yet.

Meanwhile, guess what the investor yield for a five-year Japanese bond (JGB) is today? Drumroll please… it’s negative 0.16%. Investors are literally paying to lose money.

Could the U.S. enjoy a similar and surreal, no-yield zombie “recovery?”

Scenario 1: A Long Japanese-like Zombie Market

I suppose that’s one possibility that the U.S. could simply “sneak by” on decades of central-bank “faking it,” limping along on engineered, low-rate debt, money printing, and “turning Japanese” and taking its que from Japanese markets.

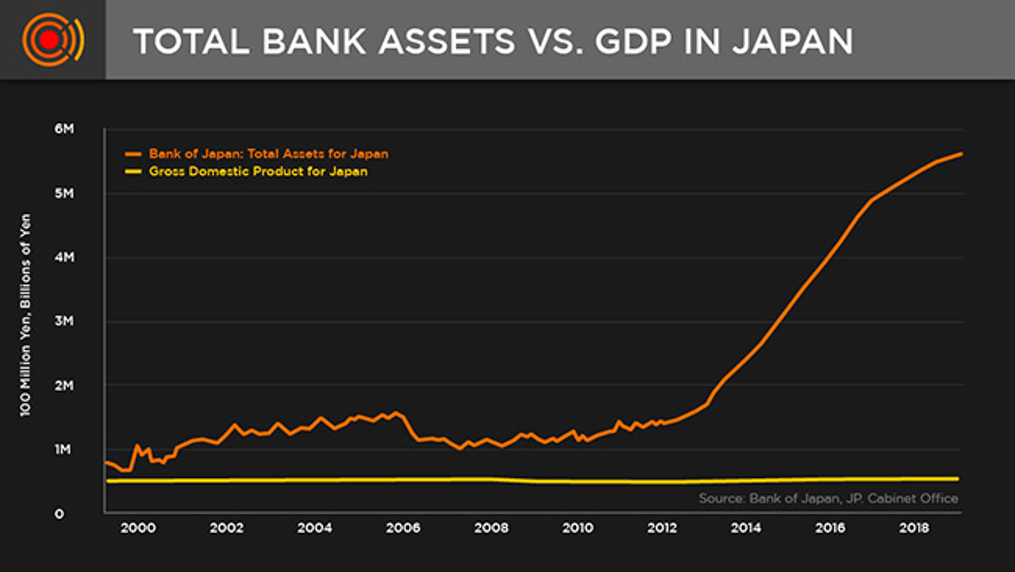

Does this sound smart? After all, Japan’s annual growth rates for the last 20 years was 0.25% against a central bank whose balance sheet grew 125 times faster. Today, its public debt-to-GDP ratio is a world-leading 235%. Boy, what a “success story,” what a great example…

In short, debt and money printing bought Japanese markets a debt-soaked central bank (see the rising line) and a flat-lining GDP that looks like this…

Needless to say, the picture of the United States’ pathetic its own central bank’s balance sheet (i.e. money printing) looks terrifyingly familiar…

Together, the central banks of the U.S. and Japan reside over a $10 trillion balance sheet and, along with the support of a clueless media and sell-side Wall Street, have tried to convince you that interest rates don’t mean squat in this new, horrific “normal.”

But the world in 2019 is not the Japan of 1989. The “debt-rotten” playing field has not only changed, but expanded, as the entire world – from Argentina to China – is in debt up to its ears.

The EU is on the brink of a recession with Italy and even Germany crawling toward negative GDP prints while France, which I know well, is reeling under dire political pressures. As for China, it’s gasping under the weight of its own debt Ponzi-scheme, real estate bubble, and slowdowns from its principal suppliers in Japan and South Korea.

Furthermore, business cycles are old and dying. In the U.S., this “growing cycle” is now 117 months old and about to break another new record – based entirely on debt.

At some point, we can expect a collective series of government and corporate debt defaults, as is already percolating in the emerging markets. Even the Fed and the Bank of Japan, for example, can’t print away the world’s problems.

In short, something has to give.

Scenario 2: The Fed’s Self-Inflicted Lose-Lose Conundrum

Our Fed (lead by a patsy, Powell), like Tokyo’s Bank of Japan (lead by a maniac, Kuroda), has not only lost its mind, but it has backed itself into a lose-lose corner.

If it raises rates, the cheap-debt party ends, which means the bond market (over-filled with high-yield crap) tanks, and the Japanese markets with it.

But if it doesn’t raise rates, the Fed will have no “rate-reducing tool” to help the U.S. in the next recession.

Similarly, if the Fed tries to “tighten” its balance sheet (i.e. offload all the toxic private and sovereign bonds it bought to bail out the very too-big-to-fail banks who killed the U.S. economy in 2008), this, too, will cause bond prices to fall and rates to rise, thus killing the Wall Street debt rollover charade. We saw the first hints in Q4 of 2018.

So, if the Fed can’t tighten/reduce its balance sheet past this autumn, then the amount of money printing/QE it will need to unleash in the next recession will reach insane levels – too insane even for this already QE-mad market. Such money supply expansion would trigger a deadly inflation.

Alas, the Fed is now stuck in a conundrum of its own making.

It can neither raise rates nor tighten/reduce its balance sheet without killing the market. Because even if it reduces rates and “loosens” its balance sheet (i.e. prints more money), we buy time by slowly taking the U.S. into a Japan-like hell.

For now, the U.S., like Japan, can repress rates, lock-and-load the money printers, and lie about trying to reach “target inflation,” which, as I’ve shown in a separate article, is a pure and utter lie used by the Fed to justify its ongoing, pro-Wall Street policy of keeping rates low.

Scenario 3: The Bond Market Falls Through Its Own Ice – Party Over

But here’s the big rub, folks. Like Japanese markets, the U.S. is sitting on the biggest debt bubble in its history. At some point the low-rate debt “rollover” game we are currently playing to keep this bubble from popping will end.

And I know what all of you are saying: Thanks a ton, Matt, but WHEN?!

Well, I’d like to give you a quick answer, but unfortunately, the markets don’t give us a timeline. Instead, we have to create our own “storm tracker” while contending with a moving target, the Fed, which is fickler than a bad pop band from the 1980s.

Here at Signals Matter we are thus carefully tracking the ever-increasing cracks in the ice under which our current bond market now stands (shivering).

Low rates or not, so many of the companies issuing these bogus, egregiously risky bonds will simply fall through that ice. After all, our bond market is full of crappy credit scores…

Until then, skate these markets at your own risk.

Sure, the Fed is keeping investors relatively safe for now. We are already seeing signs of a melt-up. But despite its experimental arrogance, the Fed cannot stop market forces any more than a man can stop the forces of nature.

That is, at some point, the ice melts. We’ll be tracking this meltdown every day for you.

In the interim, and as always, be careful out there.