How will the U.S. Dollar cycle fair in a COVID-19 setting and why does this matter?

Well, it matters a lot. Below we discuss why.

Coming into the current crisis, there weren’t enough dollars. But are we now facing the risk of having too many? More on this below.

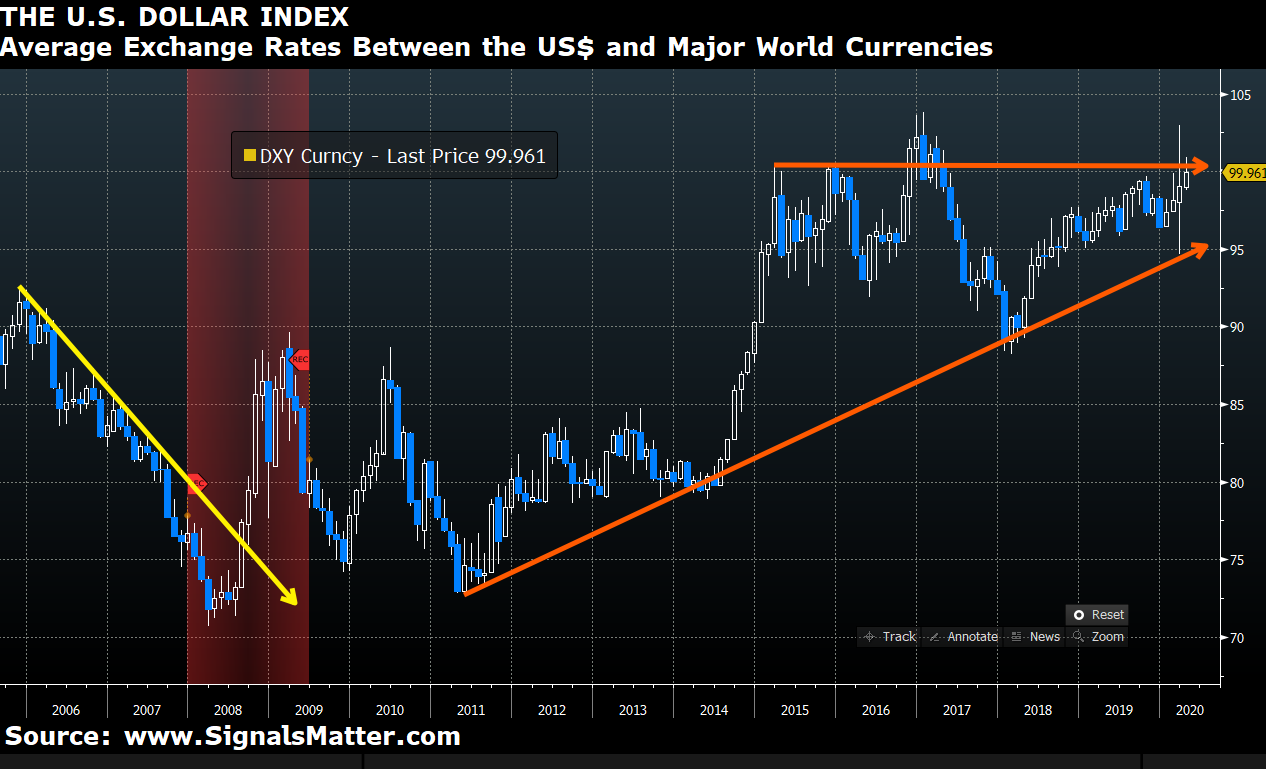

With so many indicators (GDP tanking, QE expanding, and employment nosediving etc.) spinning around us in the current COVID cyclone, it is worth returning to the one basic metric whose importance cannot be overstated enough, namely the U.S. Dollar cycle, as measured by the US Dollar Index.

Folks, the US Dollar in general, and the U.S. Dollar cycle in particular, are of immense importance when it comes to tracking the direction, as well as risk, of our markets.

Since the 1970’s, the dollar cycle has risen and fallen in a myriad of scenarios not worth unpacking here.

Suffice it to say, however, that markets follow the dollar cycle like shadows follow a sunny day.

Tracking the U.S. Dollar Cycle

Given the tremendous importance of the dollar cycle, where are we today in that cycle, and what does this tell us about tomorrow’s markets with more accuracy than guess-work and a crystal ball?

In the past, I’ve written extensively about the US dollar cycle here and here, and for those who are new to the subject of dollar cycles and indicators, I recommend a quick review of these reports to get a broad yet blunt understanding of the forces at play.

Yesterday’s Reality: Dollar Illiquidity

Frequent readers will recall what I consider to be the most important, yet ignored force in the dollar cycle debate, namely the issue of dollar illiquidity (i.e. not enough of them) due to forces in the media-ignored Euro Dollar markets.

This stuff gets fairly complicated and is thus ignored by the media, which I find effectively useless as a guide for eager and data-thirsty investors.

Hedge fund veterans like myself and Tom, however, follow this carefully.

And given our express mission to bring the best of hedge-fund level knowledge to Main Street level disclosure at SignalsMatter.com, it’s important that this data be shared in a way that makes common sense to ALL of YOU, not just the fancy lads in (or managing) fancy (i.e. expensive) hedge funds…

The core arguments of this dollar-illiquidity theme boil down to just not having enough dollars to keep the markets greased (i.e. “liquid”).

Again, for more detail (i.e. facts) on this liquidity issue, just click here.

Of course, when there’s not enough supply of dollars, markets fall apart.

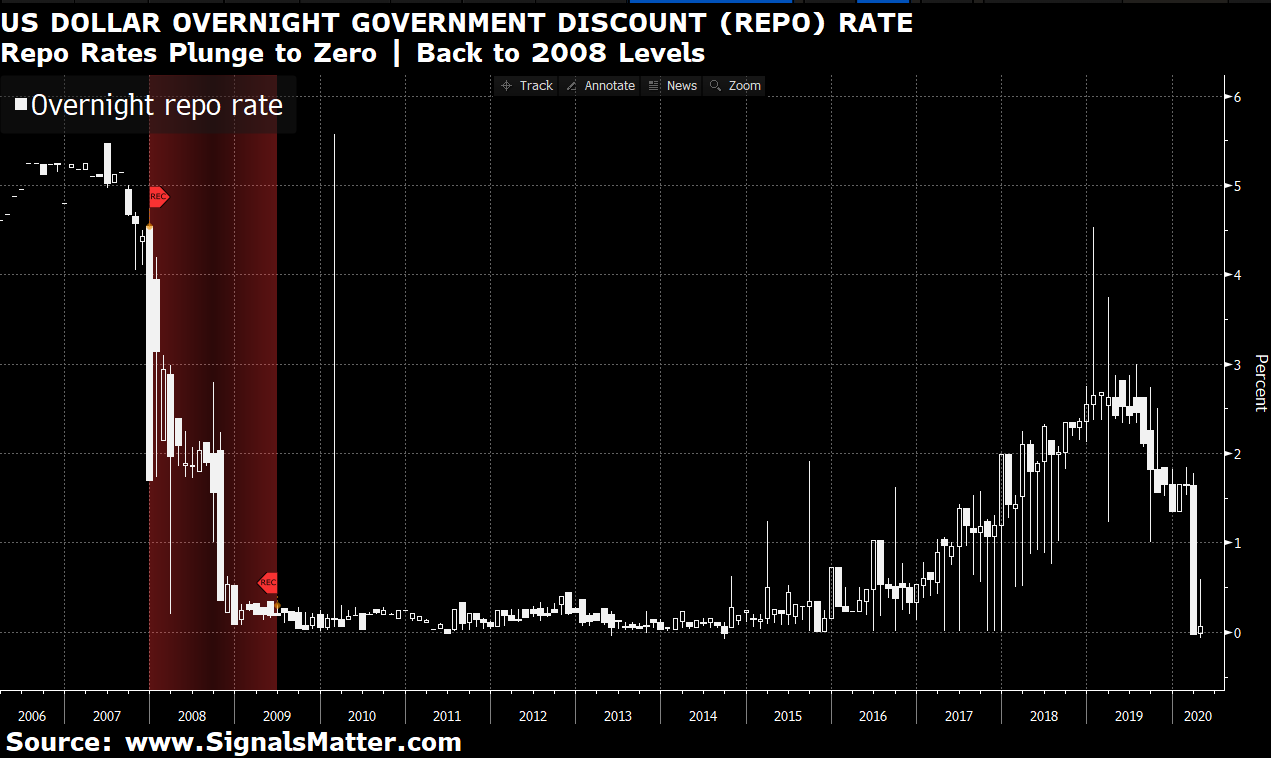

We warned of this in late 2019 and saw this dollar illiquidity play out in dramatic fashion when the repo markets ran out of dollars in September of 2019. Repo rates soared.

But since then, repo rates have plunged as they did in 2008. Why? Well, the Fed tossed a ton of liquidity at the repo markets—over $100B a day…

That repo spike, however, was a BIG Deal, and a foreshadowing of tremendous stress ahead, a stress punctuated by the very dollar illiquidity we warned of last fall.

Why such a BIG DEAL?

Simple: When dollars run dry, market do too. It’s just that simple. The dollar cycle matters. And when the Fed throws billions of dollars per minute at a problem, it tends to get better.

But for how long?

Yesterday a Credit Crisis, Today a Liquidity Crisis

In 2008, we saw credit markets run dry on the back of bad loans. That was a credit crisis. This time around we are seeing a different kind of crisis, namely a liquidity crisis—i.e. dollar supply swings on top of bad loans.

A double wammy…

Last year, we faced a shortage of available dollars.

But then came the COVID headlines and all that followed-i.e. mountains of more printed U.S. dollars.

Here’s how this played out.

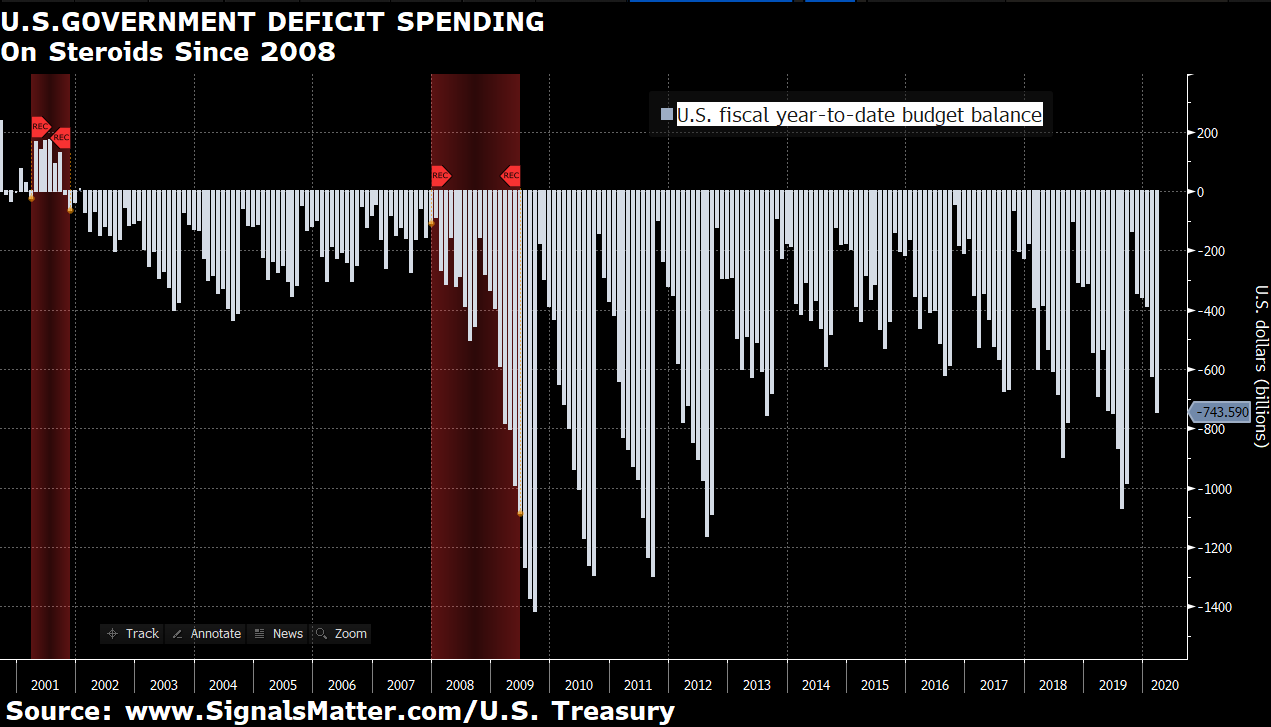

As markets tanked, the policy makers (i.e. governments and central bankers) around the world unleashed a flood of printed currencies and deficit spending the likes of which were never seen in even the great crashes of 1929, 2000 or 2008.

Folks, we’re talking about a fire hose of money (i.e. “liquidity”) at levels even I never expected, and yet there’s even more to come.

I’ve talked about this already, namely the new abnormal of unlimited QE that is now US official policy.

Are there risks associated with too much money printing? You betchya.

From Not Enough Liquidity to Too Much?

Recently we’ve seen the Fed roll out what the fancy lads call “swap lines” to its G7 peers—which is just market talk for more liquidity (printed money) given to our overseas “friends” in a matter of 3 days than we saw in the entire first year of the Great Financial Crisis of 2008.

We’ve also seen repo market support by the Fed that simply inspires a kind of awe, as the Fed has provided more liquidity grease (printed money) in a matter of days than seen over a period of years.

That is, the Fed is money printed out of thin air to repurchase Treasury bonds to allow over-night cash markets to keep corporate and financial big-wigs “liquid.”

We’ve also seen extreme IMF lending measures (more liquidity) of upwards of $1 trillion to lend to a whole host of needy players thirsty for dollars.

In short, with all the liquidity now pouring into the markets in the wake of the COVID disaster, are my pre-COVID concerns about a lack of liquidity still in play today?

Well folks, as facts change, signals change, and as signals change, so do my opinions.

A Different Kind of Liquidity Crisis…

What’s ironic today, however, is that we still face a liquidity crisis. It’s just a different kind of crisis.

Let me explain.

Pre-COVID, there was a concern about not enough liquidity. That’s a crisis. Post-COVID, we face a problem of too much liquidity. That too is a crisis. Why?

Well, too many printed dollars means a loss of faith in those dollars, and that’s never a good thing.

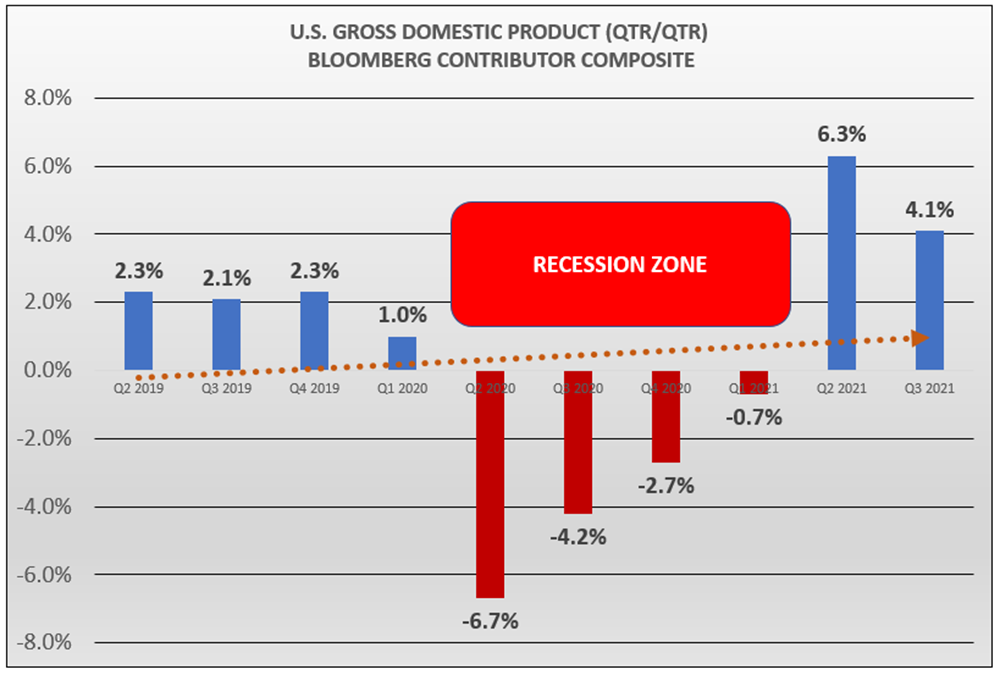

For now, market fundamentals (and headlines) scream “risk ahead” as stocks, GDP, employment and investor sentiment race toward the floor of history in a backdrop of hysteria, hope and media-fanned anxiety.

In such a scenario, the world is screaming for “liquidity.” This impacts the dollar cycle.

And as mentioned above, that world is getting trillions of “liquidity” each week.

For now, that liquidity (printed money) has been used to buy bonds and keep rates low and “in control.” That’s a temporary good thing.

But as any hopeless romantic knows, good things don’t always last forever.

The Trillion Dollar Question

The trillion-dollar question today is how long will and can policy makers aim a fire-hose of printed money at a global stock and bond market that is otherwise burning to the ground?

Or more bluntly spoken: Which force will win out—trillions in printed money or the stark reality of a dying global economy as measured by every traditional metric known to mankind?

In terms of the US dollar cycle, we all know that printing trillions of them in a matter of weeks tends to weaken the dollar.

This is just common sense. And we saw the dollar weaken for a brief spell after unlimited QE was announced earlier this month.

But then the dollar rallied.

Why? How? What gives?

As discussed previously here, this is because lots of foreign countries, banks and institutions (i.e. pension funds) are borrowers and/or buyers of US dollars.

As such, there is great demand for the US dollar, and when demand is high, so is the price of the dollar.

Simple as that.

Always a Flip-Side

But then there’s a flip-side to this… there always is.

You see, the US is not only a lender and supplier of US dollars, but a borrower as well. That throws a new wrench into the equation when tracking the all-important US Dollar cycle.

In order to meet its own debt obligations, the US needs foreigners to keep buying US assets—i.e. US stocks, and most importantly, US debt—i.e. bonds.

But with the post-COVID Fed now ballooning its balance sheet and the US deficit hitting record highs, what if those same foreign buyers of our “assets” get cold feet?

After all, as the Fed kicks into unlimited QE (i.e. fire-hose money printing) to “save us,” the rapidly expanding supply of US dollars could get so high that the very credit worthiness of the US could come increasingly into question.

And with the Fed effectively putting a cap on Treasury yields (i.e. returns) via yield-curve controls (i.e. manipulation), how may foreign countries or entities are gonna have an appetite for US bonds that yield less than 1% even before adjusted for inflation?

And as for US stocks, just how confident can anyone (here or abroad) be in a US stock market facing seriously negative GDP, along with 20% unemployment?

After all, one just can’t nonchalantly whistle past such hard facts.

And what if US markets, once seen as the best horse in the global glue factory, simply turns to glue like all the rest of the broken markets of the world?

In short, in order for the US to continue to borrow and run massive budget deficits to survive (such is the modern madness of using debt to get out of a debt crisis), foreigners need to keep buying US “stuff”—in particular US stocks and bonds.

Who Wins: The Dollar or Market Forces?

Can this continue for much longer?

I’m frankly not sure.

That’s why Tom and I track signals not guesses, and this is where we stand today, and this is what we are tracking for tomorrow.

Getting back to the all-important issue of the US Dollar cycle, this much we can say.

If foreigners balk and start buying less US stocks and bonds, the Fed will have to print even more US dollars to monetize our debt.

If this happens, the dollar will slowly weaken, which would make us bearish, rather than bullish on the dollar.

As Hemingway said of poverty: It starts slowly at first and then all at once.

The same Hemingway-Effect could be true of the US Dollar. Slow declines at first, then declines of 25% or greater thereafter.

For now, the US Dollar is hanging in at 6-year highs, but as market conditions weaken, everyone heads for the exits.

Watching & Waiting

In the near term, perhaps the US markets will see some new hope if unemployment claims per week fall from 5 million to 3 million.

Hard to believe that such data would be seen as “hopeful,” but that’s where we now stand in these unprecedented times.

And perhaps the fire hose of unlimited money printing can prevent markets from hitting new lows in the near-term, but how many of you actually expect markets to hit new highs in this post-COVID world?

Even if everything were back to normal in the snap of a finger, the debt and employment damage already done to our markets makes the thought of a V-shaped recovery almost absurdly naive.

Realism vs. Fantasy

In the backdrop of such realities, all that informed investors like you and I can do is continue to track the events (and hence market signals) as they unfold and adjust our portfolios for the risks and even opportunities ahead with a sense of realism not fantasy.

For now, we are obviously proceeding with caution, as our view is that these rigged to fail markets can buy time, but not miracles.

In the end, debt is never solved with more debt, and at some point, all such can-kicking “tricks” do is end badly.

We’re not there yet. Markets can still rise on headlines and hope, but hope is never a wise investment plan if one is investing for the long-term, which are the kind of investors to which we speak.

Toward that end, our subscribers should click here to see our latest dashboard recommendations.

For the rest of you, stay informed as best you can and keep your eyes on the US Dollar. The ride ahead will be extreme, but we’ll be one step ahead. Join us?

Sincerely, Matt & Tom

https://www.zerohedge.com/markets/us-will-never-return-free-market-capitalism-guggenheims-minerd-warns-current-crisis-lead

It’s over….

Well mon Ami, when it comes to free market capitalism, you are right—It’s over. In fact, and as you’ve likely known, it has been over for quite some time, as we wrote exactly one year ago (April 21, 2019) here, in “How Capitalism Died.” We factually explained this same sad reality (i.e. the death of free markets) page by painful page in our book, Rigged to Fail. We should at least give Guggenheim’s Mr. Scott Minerd some genuine credit for being one of only a small minority of major Wall Street “big boys” who had the courage to “go public” and say it like it truly is, as he’s been one of only a small few to remain consistent in his honest message regarding Fed policy. Hats off to that, at least.

Hi Matt,

As one who follows and loves the wisdom from this site, I want to make sure my brain cells are still firing correctly:-) I made a lot of money in Feb and early March…then I forgot your wisdom of NOT fighting the FED. My bigger mistake was saying to myself, “Nah, the FED can’t do that. That’s illegal”. What a Dumba$@ I am! Lost a bunch. Still ok, but mad at myself. Would you consider buying longer term puts on FXE and UUP out to Sept or longer a good use of capital? They seem rather inexpensive and even if they’re lotto tickets, ok. The mistake I made last month was going too short on my expiration. Thoughts? I’m struggling with the when, not the if:-)

Thanks!!!

Hi Jeff–I hate to play the “compliance lawyer” but I’m reluctant to give specific advice to allocations not otherwise recommended in the broader portfolio recommendations on the back-end/subscriber portal. To the extent you have the risk profile and risk tolerance and means for such longer-dated puts, the decision is ultimately your own. That said, I would advise you to follow the trend signals in currencies on the back end; timing currencies is a slow rather than sudden process as per my recent reports on the dollar and the “Hemingway” reference made therein–the declines begin slowly, then all at once. Nearer term, the dollar’s ability to remain irrationally strong can outlast the “put’s” premium ability to remain green…