Below we look at Asian Markets, the European Union, US Markets and the relationship between central banks, bonds, inflation, deflation and potential US safe assets and US safe-havens in a financial landscape that feels anything but rational.

The Big Questions

Uncertainty, of course, is an odd part of life. We face it in everything from romance to road traffic, market moves to surfing conditions.

Interestingly enough, I have learned that as we acquire more experience in each of these settings, we learn to navigate change and embrace uncertainty with greater maturity and skill.

As for investing in the current landscape, uncertainty and change are not only to be expected, but faced head-on, calmly and with the benefit of perspective, experience and action.

Toward that end, myriad questions present themselves, such as who is worth hearing out today? The bulls? The bears? Will we have deflation? Inflation? Is a market crisis minutes away or years away? Where is it safe to hide? Gold? Real Estate? Treasuries? Stocks? Cash?

Are the US and its markets the best safe-haven? Will our markets suddenly crash in an “08-like moment” or will they rally euphorically before finally blowing apart? Should you jump in or bow out?

These are the questions and topics on everyone’s mind.

Answers?

Do we have all the answers nicely in place? Can we forecast a date and time for the next recession?

Nope.

Our blogs are for discussing views—but our trades and market watches are based upon math and signals, not nouns, adjectives or tea leaves.

In short: no one can predict the future—but some of us can at least prepare for it.

Toward that end, it’s important to have data-based opinions and knowledge, no? That’s what our free blog sites and media-center are designed to provide. The more math-specific signals, however, are for subscribers only.

Needless to say, my views on the central banks, the bond markets and global politics are anything but kind or optimisitic…

After all, these markets are just crazy. But crazy—as we’ve seen in everything from reality TV to the highly profitable war on terror, can go on far longer than sanity might otherwise assume…

And as for markets, you don’t need our complex algorithms or trading bands to look at the graph below and wonder out loud if now is the best time to go “all in” and chase tops:

I mean really folks, does this graph not speak to your common sense? If you think such highs are normal, then I think you’re higher than normal…

Can the Crazy get Crazier?

But as absurd as the foregoing (and entirely debt-driven, central-bank engineered) securities bubble is, there are reasons why even this insane market could go higher, much higher than its current nosebleed peaks.

Really?

Yep.

Huh?

I know. Even I hate to admit it.

But the great irony in this otherwise absurdly dangerous and distorted post-08 market casino is this: as grotesquely over-valued, over-indebted, and over-stimulated as the US markets are—our bloated exchanges and anemic Main Street economy actually aren’t as bad as their equivalents in large parts of Europe, Asia and the Emerging Markets.

In short, we (i.e. our markets, laws and currency) may just be the best lame horse in an otherwise global glue factory.

And this means, if a global recession likely kicks off in Japan, China or the EU before it does here in the USA, we may actually find our bonds and stocks in temporary high demand as a “safe haven” …

Yep—even with PE multiples, debt levels and stock-buy-back distortions at all-time highs in the US, we may actually be unfairly rewarded as the relatively “safe” place to be in the next global downturn—at least for a brief time.

The Other Horses in the Glue Factory

So, let’s just pause and see how such relative absurdity may play out. In other words, let’s look at the other “horses” in the international “glue factory.”

The European Union

We can begin with the EU. As I recently wrote, things aren’t looking so good in Europe in general or Italy in particular. In fact, Italy is the proverbial canary in the EU coal mine in terms of what central banks and debt can do to destroy an economy.

As we know, the post-08 world runs on debt, not growth. Italy, in particular, can’t survive unless the ECB buys its otherwise distrusted promissory notes (i.e. sovereign bonds).

But this summer, as Italian voters pushed to leave the EU, its unlovable bonds sold off at dramatic speed, and thus Italian interest rates skyrocketed in just a matter of days.

In an instant, political and economic panic spread through the halls and fates of the EU…

The only way to save Italy’s bond markets, of course, was to have the ECB print money and buy those Italian hot-potato bonds that nobody else wanted/wants. In other words: “fake it.”

Of course, for the ECB to buy more Italian bonds, folks in places like, well…Germany and France, have to pay the larger portion of the bill.

I spend a lot of time in Europe, and I can tell you this: the French and Germans to the North are getting realllllllyyyyyyyyy tired of paying Italy’s Visa bill (as well as Spain’s and Greece’s tab) down in the Club Med South…

In the coming years, unless countries like Italy, Greece, and Spain start embracing austerity or seeing some economic growth, the greater viability of the rest of Europe (and the EU in general) will likely be pushed to the breaking point.

Unfortunately, the recent data shows that such growth just ain’t there…

In short, the EU could very well come to an end, for despite German efforts to prevent a default and Grexit in 2015, and a new version of the same in Italy today, conditions are stagnating, not growing.

As of today, for example, neither Italy nor Greece have shown any progress in overcoming the consequences of the debt crisis of 2011. In fact, and according to the IMF, Greece will continue accumulating its public debt, which is set to reach 275% of its GDP by 2060, compared to 180% today.

Folks, those percentages are just insane.

Meanwhile, Italian banks (including the world’s oldest lender, Monte Paschi), are stalling amidst insufficient capitalization, piles of non-performing loans (NPLs), and weak economic growth.

If the ECB doesn’t continually step in to absorb Italy’s bonds/debt, rates there will rise and Italian lenders would be increasingly prone to collapse.

But will and can the ECB—or any central bank—solve a debt crisis with more debt? Can “emergency measures” go on forever? At some point, such rescue measures can drown the lifeguard…

If the ECB chooses to perpetually rescue Italy and the other weak links in the EU’s southern zip codes, it will have to print more money to avoid rising rates. And the flip side to that means rising inflation—the kind of inflation that kills “unions.”

In other words, the EU and its central bank are stuck between an inflationary rock and an interest-rate hard place.

If inflation (even as bogusly reported as it currently is) starts to climb significantly above 3% in the EU, Germany will be adamant to end the ECB’s bond buyouts and push to increase borrowing costs, moves that would, shall we say, “upset” places like Italy and Greece…

Such member-state conflicts of interests might eventually trigger more EU exit headlines and speculation, thus underscoring the fragility/inability of the single currency area to blend these diverse economies into a truly integrated system. In short: the EU could splinter.

If that happens—European markets would tank.

And if that happens, European money could come galloping into the US market “glue factory”—buying up everything from Treasuries and tech stocks to high-end luxury real estate.

After all: if one is starving, one is willing to eat just about anything—including otherwise grossly-overvalued US securities like those god-awful FANGS…

And such a hypothetical short-term panicked flight from Europe into US bonds could be high because of the lower volatility in the US economy in recent years. After all, bond risk is far greater in the Eurozone and Japan, not to mention emerging markets.

Furthermore, with the Fed’s pivot to QT, US bond markets will offer higher yields to those who invest their money in Treasuries.

Remarkably, we are already seeing this “flight to safety” from Europe right now. As more money flows out of the EU into “safer” US bonds, those bond prices rise and hence their yields fall.

The yield on the 10-year US Treasury bond, for example, has fallen to 2.86%, down from 3.11% on May 17. In sum, we are seeing the first signs of a replay of the Spring of 2014 into the Spring of 2015, when European money came rushing into US fixed income markets.

This puts me in a pickle, as I’m otherwise quite bearish on the US bond market in particular.

For example, I’ve been predicting higher rates/yields, but such “safety” inflows from overseas could potentially delay or at least soften the blow of my otherwise real fear of a “yield shock”—at least in the near term.

Again, that’s why we at Signals Matter watch the flows and yield curves, not just personal opinions. Market flows, and hence market predictions, can change quickly, depending on which major segment of the global debt market “breaks” first.

Besides, and as we will see below, we can’t rule out the possibility that the US bond market doesn’t “break” first.

In short, with all the debt landmines dotting the global landscape, anything is still possible—and the US may not be the safe-haven it once was…

Asian Markets

Asia, of course, has its own ticking debt time bomb, and hence could also be a potential regional source of flows into US “safe-haven” markets.

China, for example, despite its massive growth in the last 20 years, is still in some ironic ways nothing more than a “developing country,” and one with extraordinary debt problems—its overall debt is now 256% of its GDP.

That number alone is staggering.

Moreover, developing economies in general, and China in particular, are reliant on increasingly volatile and unavailable foreign haven assets who worry about China’s market infrastructure.

For instance, China’s notoriously unreliable exchanges, legal structure, oversight agencies, and data “reporting” make it anything but a “safe haven” and in fact could be the source of a massive outflow of capital into the US “glue factory.”

Furthermore, the structure of China’s bond market, in particular, is still largely underdeveloped, while the debt burdens it carries are much higher than ten years ago.

As for Japan…where to begin?

Well, to start with: it’s the most indebted country in the world, with a debt to GDP ratio of 240%. In short, hardly a “safe-haven” and a far more likely candidate for a crisis—and hence outflow of funds into the US glue factory…

Japan’s central bank, moreover, not only invented the concept of Quantitative Easing (i.e. “money printing” to buy its own debt), but has taken it to a whole new level of crazy, buying up large swaths of Japan’s so-called “public securities.”

In many ways, the Bank of Japan (more of a “respirator” than a “lifeguard”) has literally bought the Japanese stock and bond market…

With such a massive debt burden and very little tax revenues coming its way (in 2016, Japan’s debt level was 15X its tax revenues), Japan faces a debt crisis every day.

Bulls, however, argue that Japanese citizens own most of Japan’s debt (aka “domestically held debt”)—and that they will always be buyers of government IOU’s.

Possibly. But here’s the rub—if rates rise in Japan, the government won’t have the Yen to pay the interest expense—which would lead to a disaster.

In my view, Japan is stuck in the penultimate “debt trap”: its central bank keeps printing more money to keep yields/rates in check, yet to attract foreign investment, its bond market also needs to provide higher yields. Yet if yields get too high, the interest expense becomes unpayable –hence the trap…

Alternatively, Japan (caught in the same low productivity mire of the US) could try to actually grow its economy out of its debt burden. Imagine that?

But like the US, Japan has already crossed the debt Rubicon. In short, there’s not enough growth realistically possible to dig them out of the debt hole they are already in.

Stated otherwise, I feel the die may already have been cast for the setting sun of Japanese debt.

Thus, if the sun sets on the Japanese debt markets before it does so in the US debt bubble, then yes, we could see a similar flow of Japanese investor dollars into US markets, and thus a rise in US security prices.

Again: it all depends on who breaks first…

The US Markets

And then there’s us, the great “safe haven”—the good ol US of A.

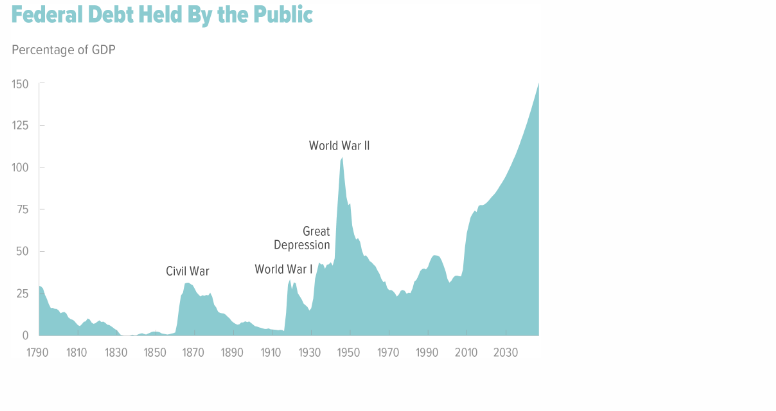

It’s hard to believe that a country which in only a decade has more than doubled its deficits ($10T to $21T!) and quintupled (5X!) its Fed balance sheet could be seen as a “safe haven”?

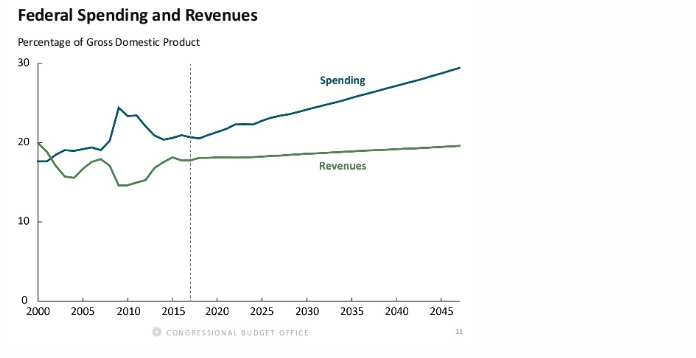

We simply spend more than we earn:

And what’s even worse, rather than produce GDP (i.e. income), our government borrows (i.e. goes into debt) to spend.

And it’s hard to believe that a market entering record-breaking debt levels, margin multiples, overbought PE multiples, and the tail (i.e.”tired”) end of the longest (fakest) business expansion in history (driven by debt and printed money)—is seen as a “safe buy.”

And it’s equally hard to believe that a US debt market which has been on a (Fed-created/low-rate) bull run since 1981 (the longest in history) and which is universally recognized as the biggest bond bubble in the history of capital markets, is equally seen as a “safe haven” for foreign investors.

Yep. It’s hard to believe.

But that just goes to show you how distorted, crazy and dangerous the global markets are in general, and the US “fantasy” is in particular.

As for the relative “safety” of our Treasury market, let’s just step back and take a deep breath before getting too comfortable.

As I’ve written ad nausea in the bond section of this site, the forces of supply and demand are more likely to control interest rates than the arrogant guidance of the US Federal Reserve.

That is, as the supply of US Treasuries begins to increase simultaneously with a decreasing demand of US Treasuries from a tightening (rather than “easing”) Fed, bond prices will fall and yields will mathematically rise (and hence seduce foreign inflows/investors).

But if yields (and hence interest rates) rise too much, then the US debt burden will break the back of an already over-indebted Uncle Sam.

In short, America may break first, or at least, very quickly after Europe and Asia. In other words, a real international mess would hit the fan.

Is that possible?

Well, let’s consider the math.

With a combined sovereign, corporate and private debt level of $70T in the US today, any meaningful rise in interest rates will cripple the US economy and markets.

Can rates move sizably up?

You betchya.

Here’s how it can unfold.

First, the US Treasury will be issuing at least another trillion worth of 10-year notes to pay for Trump’s tax cut (Supply Increase #1); secondly, foreign countries like Russia, Japan and China are slowly dumping the US Treasuries they hitherto owned; (Supply Increase #2).

In recent months, for example, Russia has all but liquidated its $150B of US 10-Year bonds.

Meanwhile China, the world’s largest Ponzi scheme, holds about $1.2T of US Treasuries—and as such is the largest holder in the world.

Like Russia, China was forced to buy these US debts simply to keep its FX rates in alignment with the drunken central bank money printing and rate fixing coming out of the US.

Japan was put in a similar quandary. They hold about $1.04T of US Treasuries (nearly 20% of Japan’s GDP!).

And now all three of these slaves to Fed mercantilism and FX manipulations are slowly starting to sell their book of US Treasuries—and thus pushing US yields/rates higher.

Now if China, Russia, Japan and even the US Treasury Department are all selling the same bonds at the same time—that’s what we call a supply-driven price fall (and hence rate rise).

Add on to this increase in supply to a decrease in demand by the Fed for those same bonds (aka “Quantitative Tightening” coming in October of 2018), and we have an even greater chance for falling bond prices and thus rising yields/rates.

And if rates rise in the US—well folks: the debt party that we call a “recovery” is over.

With all of this to think about, do the US markets still seem like an obvious “Safe Haven”? Or can we expect one more “last hurrah” of foreign investment “stimulus” before the US party ends?

As St. Exupery defined war: “It all depends on who rots last.”

Only in this case, it’s not a war of tanks and planes, but of currencies, tariffs, debt bubbles and central banks. Given the current levels of debt across the major markets of the world, everyone is eventually going to suffer heavy losses.

For now, it’s just a question of who will suffer first, second and third…

So Where Does One Find Safety in a World Heading for a Debt Iceberg?

Given all the potential landmines outlined above, where does one look for safety in the next recession?

Furthermore, how far off is this alleged next iceberg?

These are questions all of us are asking, bear or bull, and the answers are neither easy nor science.

Nevertheless, for subscribers of Signals Matter, we think our Recession Watch is the closest tool we have for being better than the rest…

For now, however, we can at least address this question more broadly, and the first issue one has to consider in deciding upon safe-assets in the next recession is the question of inflation vs. deflation.

Inflation or Deflation?

In short: which of the two can we expect in the next market downturn and recession?

Some make a strong case for deflation, that is falling prices. The main thrust behind deflationary predictions rests upon the undeniable problem of debt.

Some experts argue that given the current and record-breaking debt levels ($43T in private debt and $17+T in government debt), when the next bubble pops, lots of debt is going to be “written off”—i.e. defaulted upon—from student loans to publically traded junk and high-grade bonds.

For proponents of the deflation school, as we deleverage or write off these gobs and gobs of debt, money will be destroyed far faster and at far greater levels than it was created/printed by central banks.

As a result, U.S. dollars will become scarcer, and as a result, more valuable.

In such a scenario, the USD will emerge as the safest asset in the world—far safer than gold, they maintain, as gold only goes up when the USD goes down…

On the flip-side, are those who eloquently anticipate massive amounts of inflation ahead, as more and more fiat currencies unsupported by any precious metal lose their value in the face of over-supply from central bank money printing.

In such a scenario, gold would sky-rocket as security markets and currencies (including the USD) race globally to the bottom.

In such a scenario, farm land could also be a go-to hedge. Barton M. Biggs , who runs Traxis Partners, a multi-billion dollar New York hedge fund, and Marc Faber , have both recommended buying farmland in the event of an economic collapse.

And then, of course, there is always the option of simply going to cash in the face of all the uncertainty, debate, volatility and distortion currently facing domestic and global markets.

Unless you know how to trade volatility, go long and short, follow signals, or afford hedge-fund-level tactics, nothing beats playing it safe, missing some rallies (even melt-up rallies) and waiting for a market to tank so you can buy when everyone else is illiquid, broke or in shock.

That seems smarter than chasing these tops—even if they go higher. The risk vs. reward metrics are simply too asymmetric in the current environment to be too greedy or too “all-in.”

In periods of all-time highs, irrational “exuberance” and group-think, Patience, modesty and common sense are just as important as market signals.

In the end, it’s up to each of you to weigh the differences in your own risk profile between market risk and market uncertainty.

In the interim, be careful out there 😉