Pitchforks Ahead or Just Market Bears Running in Circles ?

Below, we consider the timeless struggle of market bears and market bulls in the backdrop of current market conditions.

Bear or Bull, Does It Matter Today?

As we always say at Signals Matter, we follow complex data and money flows not just market bears or market bulls. That said, and based purely on fundementals (PE ratios, CAPE data, valuations etc.) we do think markets are crazy, and thus share more of a bear profile today than a bull.

At a macro level, these markets do qualify as irrational. We get that, but we still trade ahead of macros—crazy or not. After all, one has to play the tape, not just economic views; for a while at least.

But do bulls or bears or even sound reasoning and analytics matter in a market driven by robo trades, historically unprecedented central bank stimulus and media support from marketing alumni rather than trading desks?

Fair question.

Bears or Chicken Littles?

We recently published a guest blog from John Montgomery, who shares a similar curiosity with these bearish realities yet feels an equally bemused realization that current markets, like current weather patterns, seem to defy predictability.

In short, the bears have been wrong for so long, that even if they are one day proven right, it seems a little bit too late to roar, “I told you so.”

Fair point.

“Volatility” What?

I myself have been waiting for a return of volatility and a severe correction for almost five years. And like many other hedge fund managers with higher profiles, I too have been proven wrong by a smiling bull market.

Are bears just chicken littles?

One bear who has been warning of a bursting market bubble for years is David Stockman, a former Congressman from my home town and state of Michigan. I have always respected his blunt realism, his exceptional writing style and candor. And I still do.

It would be unfair to say that David Stockman has been “crying wolf” for too long to be credible anymore. Given the massive degree of central bank stimulus of which we (and he) have written so prolifically, no one can deny the risks ahead nor the difficulty of timing (or fighting) the Fed, no matter how reckless its market engineering (distortion) has become.

Pins and Bubbles

In short, David Stockman’s warnings are not only sincere, they are valid. The simple problem is that he is fighting a market and central bank on too many steroids for anyone (including himself) to effectively “time” the pin that eventually pops the current “everything bubble” of which he has so carefully warned.

These “pins” are still out there, waiting to pop this market bubble. We too are waiting for them, watching for them, and that’s part of the reason our Recession Watch is such a vital aspect of Signals Matter.

But does that mean we (or anyone) can “time” any pin?

Nope.

Again, rather than act as psychics, we trace data not intuitions. Why? Because flows are far more predictive than even the soundest views of market bulls or market bears. Subscribers know where we stand (and what we stand by) as to current risk levels. That’s why they subscribe.

But this doesn’t mean we don’t respect the inevitable pin-prick, and you should too. 105 months into this “recovery cycle,” debt levels are indeed too high to “price in” more DC support or revolutionary magic tricks. In other words, risk is high, even higher than current market tops.

That’s why we respect the signals, beat the markets (bear or bull) and yet still acknowledge the dangers. Below, are the specific “pins” which David Stockman rightfully noted could pop this market bubble. We feel they are worth listing here as well.

Below is “Stockman’s List,” namely:

- the virtual certainly of a recession within the next two years and a typical 30%-50% drop in earnings;

- the epochal Fed pivot to QT (with other major central banks to follow) and the consequent massive drainage of cash from the bond pits;

- the mad man in the Oval Office and (among other follies) his swell new Trade War, which absolutely will get out of hand globally;

- the impending “yield shock” which will thunder through the financial markets when Federal borrowing hits $1.2 trillion in the coming year–on the way to $2 trillion+ annual deficits as far as the eye can see;

- a deeply impaired underlying main street economy which is groaning under $68 trillion of public and private debt and a reverse robin hood financial regime that has left 80% of the population on welfare or struggling to make ends meet on earnings that barely keep up with inflation; and

- the swaying giant red elephant in the global economic room—meaning China’s historically unprecedented and freakish explosion of debt, manic building, monumental speculation, systematic lying and fraud and serpentine centralized command-and-control that is destined to end in a spectacular implosion.

Whether you be a market bull or market bear, the foregoing danger “pins” are undeniably valid and supported by numbers, not just notions.

Class Consciousness – Two Americas?

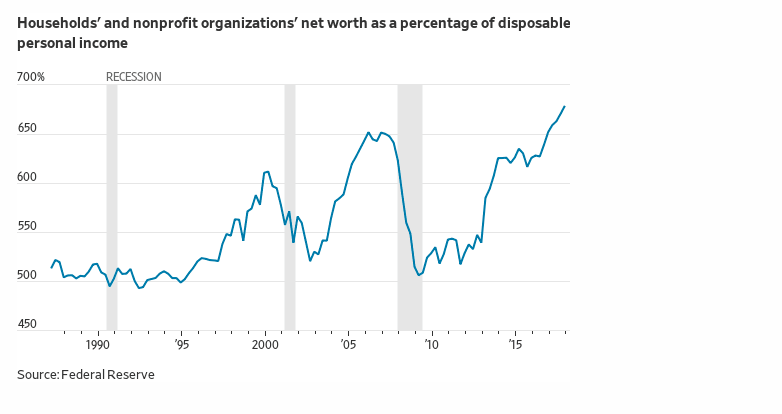

Those in the top 10% of the US ( and thus understandably bullish) are riding high on inflated assets. The graph below makes this abundantly clear:

What is equally clear, however, is that when a recession does come (after all, bears and bulls agree that even the Fed can’t outlaw or prevent a recession, someday), this asset inflation (and temporary wealth) gets slammed.

Yet even while the rich get richer, large portions of the other 90% are living week to week, and more than 80 million Americans in the bottom half of that wage pool live on less than $30,000 a year.

Is that the kind of country we have become—a modern kind of aristocracy vs a kind of modern peasantry? Historically, such spreads never worked in the long run; just ask the French or the Russians…

Are we really that kind of country without even knowing it?

What the Data Says

The numbers suggest this, yet Americans get lost in Facebook and other diversions, from sports to politics, and are afraid to admit that we are not the balanced country we aimed to become in 1776.

How (and when) the next recession hits, one might ask how those Americans at the bottom of the economic food chain are going to feel, vote or react?

Pitchforks or a welfare state could be looming…Yet can a government as deep in debt as ours pay for another welfare solution? Right now, the bulls are running, but they may also be running right past both the numbers and lessons of history.

Hmmmm.

Of course, Stockman is correct on all points. Nothing makes sense until the music stops (Feds pull the money and raise rates). However, the only thing that does work, and always did, are the charts that are extremely accurate. They are basic, and they point the way which caused me to go into cash just as the current rollover began.

Best,

Steve

P.S. Maybe we should have another Zoom meeting?