Below, we look at the US debt, the Fed, the bloated bond bubble, our debt ceiling, inflation, real estate, interest rates and what may lie ahead for bears and bulls alike at Signals Matter.

Things Feel Good, No?

Despite record high markets, as yields on the 10Y UST recently passed 2.4%, 2.5%, 2.6%, 2.7% and even 2.8%, is it safe to say that the bond market is looking a bit sea-sick?

After all, yields rise as bond prices fall, and from these rapidly rising yields, we can at least speculate that an important corner has been turned in the 30+ year bond bubble.

Meanwhile, at least for today, equities are selling off too—suggesting higher bond/stock correlation than traditionally thought…

There’s a lot to consider. Bonds, after all, are about debt, and debt is the operative, 4-letter-word in today’s “new normal”—pushing up asset prices in everything from real estate to Tesla and Netflix shares…

At the governmental level of debt, we’ve discussed the pesky ol’ debt ceiling more than once and indicated at every opportunity precisely what is happening today, namely that the US sovereign debt issue would be continually can-kicked… i.e. nervously delayed.

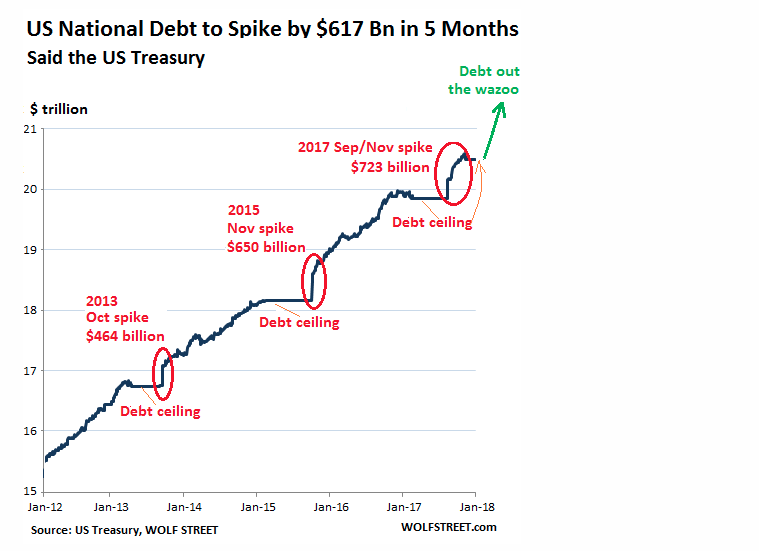

If you doubt us, the graph below makes painfully clear that the US never solves debt problems, it just adds to them, forever raising its debt ceilings…

Why? Because America is broke; worse, it’s in debt, and the only political marm/solution our politicians offer us is “expect more growth.”

Well, that’s fine. But well into one of the longest business expansions in history (thanks to debt), where will this “growth” come from? Tax cuts paid for by more debt? Tired GDP? Political consensus?

As written elsewhere, our elected officials are telling us the next 10 years of growth will be 20% higher than the last 10 years of growth.

Do you believe we can outpace the last 10-years of money printing and low interest rate steroids and pull of the largest business cycle in the history of economics in the backdrop of the largest debt burden in history?

Hmmm… That’s up to each of you to speculate upon.

As for us, the only thing we see growing in America are our securities markets—and they are dangerous, despite making most of us a lot of money—at least for a while. But projected growth won’t save us from a recession somewhere between today and the fantasy island of growth predicted out of DC.

News from Washington

The CBO recently warned that Uncle Sam runs out of cash in early March unless we raise our national credit limit—which we’ll have to do. Is that good? Well, is giving a teenager with a spending problem a black American Express card (with no spending limits) a good idea?

Nope.

If America raises its debt ceiling, the only way it can continue spending (“recovering”?) is to borrow more money, because sadly, the great America that rose the flag at Iwo Jima and saved the world from the Nazi hordes is no longer that America.

Since World War 2, we’ve slowly gone from the world’s greatest creditor and manufacturer, to the world’s greatest debtor and our manufacturing has been outsourced to China.

Pretty sad stuff.

To keep our debt-driven and broken system on a respirator, the US Treasury estimates that it will have to issue another $600+B in new debt over the next five months. That means more bonds in the supply chain, which means lower bond prices and higher yields and interest rates are likely.

As yields rise, interest rates rise too—which means the cost of money rises.

Needless to say, in a country, market and Main Street that relies till now on cheap borrowing costs to survive, higher borrowing costs to come will be a big wrench in the spokes of our broken American wheel.

These higher costs will put a dramatic end to debt-backed purchases like real estate as well. Median average home prices are pricing at greater than 30% above the long-term inflationary trend. When, not if, the next recession hits, home prices could fall dramatically in a 12-24 month period.

This, combined with higher interest rates, could make home-buying less of a priority as this bubble pops. Those who bought homes at fixed and low rate mortgages will be glad they did, though the value of their asset will fall.

Will the Fed Save Us?

Meanwhile the Fed, like some Pravda propaganda arm of the NKVD, is telling the markets and the world that all is great.

The recent notes from the FOMC in December include “data” confirming “the labor market has continued to strengthen” and that “gains in employment, household spending and business fixed investment have been solid,” while unemployment remains low.

Rah, Rah, Rah.

What the Fed has failed to admit to the public (though they can’t lie to a mirror) is that all that “good news” (itself reported with numerous flaws, too extensive for this blog to address) is just the result of debt-driven “stimulus” –i.e. totally un-natural money printing and interest-rate suppression.

But those two tricks can make us feel and look good, for a while, at least…

In short, if my son buys a Porsche with my Amex, he may look successful, but in the end, it’s all surface shine, no substance.

That, folks, is the metaphor of America today—from the NYC markets to the Washington DC circus: all shine, no substance.

Wall Street Loves Cheap Debt—While It Lasts…

We see the same distortions when we turn from sovereign debt in DC to securities leverage in NYC’s Wall Street, two addresses I know only too well.

When the US central bank used “monetarism” (which is nothing more than a euphemism for “Keynesianism”—which is nothing more than a euphemism for debt), the markets reacted as all market sheep do. It followed the low interest-rate shepherd at the Eccles Building.

That is, if money market rates are low (thanks to the Fed), traders start getting into intentional and drunken debt. And one more thing: they start levering everything!

The result? One big fat carry trade, and one big fat “everything bubble,” from real estate to AMAZON to bond markets to art.

In bond market speak, this means any bond carrying even a hint of positive yield or modest appreciation (which one could expect when the Fed was effectively the buyer of first and last resort for the US credit bubble), soon became a tool for repo-driven speculation.

Traders bought securities at 70-95% leverage with the smug confidence that they could roll their funding over and over and over again at nearly zero cost (in much the way homeowners keep re-financing their mortgages).

But as one of my favorite managers, Seth Klarman, noted years ago: “don’t ever think for one minute that debt can always be rolled over.”

At some point, the cheap money stops being so cheap, and those swimming naked in leverage get exposed when the tide goes down…

There’s a lot of naked swimmers in these markets, and as yields are now climbing, they may want to cover their naked butts.

How Did We Get in this Risky Mess?

For years, the central banks of the world, and the Fed in particular, have been telegraphing in advance (they call it “forward guidance”) every move in the rates market so that speculators could set their watches to 25 bip rate hikes and adjust their borrowing and leverage accordingly.

This is bad, very bad, because markets are supposed to be “free” rather than manipulated by a central bank. And by the way, central bank “control” is pure illusion—it can only last for so long, as eventually market forces—as real as gravity forces—humble any one or any central bank that thinks it can manage the economy the way a thermostat manages home temperatures.

The hubris of the central bankers is beyond measure, akin to thinking a yachtsman can control the waves of the Pacific… Mother nature’s forces, like all market forces, ultimately get the last word.

Even more alarming than central bank arrogance, is the complete sheep-like faith that markets (and hence traders) have in them.

Reason, as well as risk management, has been replaced by wishful thinking, keeping up with the Jones’s, greed, top-chasing and burying heads in the sand every time a realist says: “Hey, this is debt-driven crazy.”

The distortion which central banks have placed over all asset classes and indicators—from asset prices (think of those FANG’s), the yield curve, risk spreads, the CAPE indicator, real estate prices and just about every other risk indicator on Wall Street is beyond compare.

That’s why investors are paying 300X+ multiples to buy AMZN or 140X multiples to get in on the Russell 2000 wave…

I saw this movie before when minting a fortune in the dot.com bubble. All the stocks I owned then lost more than 70% within 18 months. By then, thank the stars, I was out of the markets and out of the country…

It’s crazy.

Is Inflation Coming?

But the Fed tells us not to worry. Like doctors in a laboratory, they obsess on decimal-point level data points like the PCE (personal consumption indicator) deflator to measure inflation, which is the worst possible tool available. It says not to worry about inflation.

And by the way, if any of you have kids in school, a hospital bill to pay or a home to buy, do you need the Fed to tell you not to worry about inflation, that prices are low?

Let’s not kid ourselves. Even the CPI and the BLS scale (far superior to the PCE) of inflation is a cartoon. We know there’s inflation—because we feel it. Assets are overpriced.

For a long time, however, we looked at the yields on the US Treasury and felt safe. They, like the interest rates that ride in their wake, seemed contained, and thus the fear of any higher “reported” inflation and interest rate hikes stayed buried.

But is it still any mystery to any of us today why those yields and rates and inflation numbers were so compressed?

Central Bank Data Distortion

If a central bank (rather than natural market demand) buys $4T (!) worth of bonds with money printed out of thin air (in the form of mouse-click credits), don’t you think it’s possible that the bond market is clearing at the wrong prices and that risk, as well as yield and interest rate data, is completely distorted—and hence set for a reality-check?

For far too long, yields and interest rates have been far too low relative to reality.

The bond market is an open lie that tells the truth. If, for example, I write a novel that is technically a “best seller,” but fail to disclose that my rich uncle (rather than book-buyers) bought millions of copies of my novel, I am still a best-selling author…but not really.

The bond market is no different. Its behavior, strength and data seemed “strong” for years, but since 1981 in general (and 2008 in particular), its “strength” came from a rich uncle (the Fed), not the market.

This means if you are expecting the bond market to write its own best-seller, we’re telling you bluntly: it can’t… The faith in this market’s literary skills is misguided. Though as fiction sellers, the Fed is quite strong.

In the meantime, bond-traders have been front-running the Fed in what almost feels like a public “insider trade,”—using leverage and debt-rollovers with no fear, because, alas, the Fed has been “forward guiding” the entire credit market—effectively promising borrowers that low rates and easy money are under its control.

Net result? One big fat bond bubble. When it pops, rates and yields race upwards and the whole party—from real estate purchases/loans to carry-trade leverage comes to a carnage-like halt.

Moreover, this debt-driven bubble has put Washington between a proverbial rock and an even harder place…As we look toward a 2019 deficit of $1.2T and a bond bubble on the verge of popping, no one in DC has a clue of the perfect storm brewing above it.

When the bond market, rather than central banks, re-sets interest rates, the cost of our big fat national debt pile is gonna go up, way up.

I mean, has anyone in Congress ever consulted a market history book?

Does Any of this Blog Stuff/Predictions Matter?

Here at Signals Matter, we love to poke intellectual fun at these markets in our blogs yet continue to out-perform this jaded bull market. We’ve been waiting for volatility for over five years, and it still hasn’t come.

Are we bad psychics?

Yep.

Luckily, however, we trade on data, not predictions. Despite our frustration with the fundamental’s, the Fed, the VIX, the volatility trade, the massive risks ahead and the bewildering lack of reality behind our deficit funded tax cuts, we trade on signals, not market blogs.

Long, short or hold, we follow trends, reversals and trading bands rather than just opinions. Whichever direction this market signals, we’ll trade it—long or short—for risk-adjusted returns.

And although value metrics are harder and harder to find in current distorted (overbought) markets, we also look at those dinosaur items called balance sheets.

The net result: we make money (outperforming even this hated bull market), yet always with an eye on the icebergs approaching, and we are watching the bond iceberg with great excitement.

If you want to know when and where the lifeboats are gonna matter, become a Subscriber.

In the interim, be careful out there…