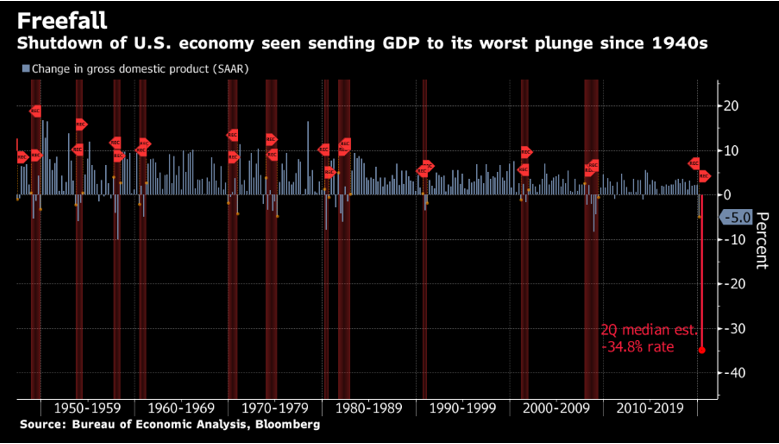

Today, at 8:30 am EST, the first official print on Q2 GDP came out and the drop was -32.9%.

Before today, the Q2 GDP figure expected by Bloomberg economists was a negative 34.8%, so the above print is hardly good news, nor much of a surprise.

As my colleague, Tom Lott, reminded our paid subscribers on the Signals Matter Portal last evening, such a Q2 GDP report card on the US economy confirms just how much hurt has been wrought by the COVID pandemic and the US economic shutdown that ensued in April and into May.

A -32.9% print represents the greatest decline in government records dating back to 1947.

More than the Q2 GDP print, however, we’ll be looking to see how the markets react today. Markets that go up on bad news signal near-term good news for investors. Markets that go down on bad news are, well…just bad news, and suggest further losses and a longer recovery. Already, even before the market’s open (at time of this writing), the S&P futures is down -.78%.

Let’s see how the rest of the day plays out.

Consumer Spending

As for getting forensic on the GDP data, let’s start with this simple point: GDP matters.

GDP effectively represents the income statement for the US as a total economy, and 70% of this GDP figure is driven by consumer strength.

Thus, tanking Q2 GDP = tanking consumer spending and confidence, plain and simple.

Obviously, the stay-at-home orders in March and April had a massive impact on the Q2 data, as consumers had little to no choices when it came to spending at retail shops, travel options, restaurants or other consumer hot-spots.

By way of comparison, in 1958 there was a global flu pandemic and the quarterly GDP drop was 10%–a record until now. Thus, today’s Q2 GDP figure underscores just how bad things truly are.

This time around, personal consumption is projected to have plummeted at an annualized 34.5% in the quarter, which would also be a record.

Other Declines

Beyond consumer data, we are also looking at the following hard realities:

-40% declines in residential investment;

-50% drops in equipment spending;

-Increasingly bad news from net exports and inventories;

-Global trade is slowing as supply chain disruptions continue to stall business activity;

-Global growth is tanking as well; according to Fitch Ratings, the top 10 economies are all seeing revised growth numbers heading further south for the year ahead;

-Corporate profits are plunging, demand remains weak;

-Business fixed investments have deteriorated by greater than 23%;

-Business inventories have seen sharp declines;

-Real estate activity tanked in March and April, but absurdly low interest rates are hopeful signs of more home buying despite slowed construction of new homes (i.e. more cheap debt and more buyers over-paying at the worst time…)

Will There be a Rebound?

Many, of course, are saying “Yes,” but even in a best-case scenario, the majority of the hard economic data will likely remain well below pre-pandemic levels for several years.

Furthermore, the so-called “recovery” is already showing signs of stalling as increasingly bad COVID data makes the headlines.

A Bloomberg survey of economists, for example, expects the economy to grow from this current bottom at an annualized rate of 18% in the third quarter. Risk on?

But realists aren’t holding their breath…for regardless of what near-term markets do, the hard data is just, well…hard to swallow.

Given a surge in virus cases in the South and West, many states have paused or even reversed reopening plans as policy makers debate another round of fiscal stimulus (i.e. more deficit spending, i.e. more debt), with the supplemental $600 in weekly unemployment benefits about to expire.

Reality Check—COVID, COVID, COVID or Just Plain Bad Then, Bad Now, Bad Tomorrow?

But folks, what bothers me is how the pundits, whether bearish or bullish, keep pointing to the COVID narrative to determine their outlooks.

In other words, if there is a decline in COVID rates, everything will return to normal. If not, everything will get worse. That’s the party line out of Wall Street and the media bubbleheads.

In short, the entire story is COVID, COVID, COVID…

In part, this is fair. There’s no denying that COVID, and the policy reactions to it, have created a Grand-Canyon-like crater across the global economic landscape. This is beyond dispute.

But please, let’s think deeper, better and more bluntly than the journalists, pundits and Fed propaganda artists masquerading as information sources.

As we have shown for years, rather than just months, the state of the US and global economy was grotesquely “sick”—i.e. debt-ravaged and sustained by Fed “experimentation” (aka drunk money printing) long before the first viral headline hit your screen or Sunday paper.

Thus, when optimists speak of “rebounding” or getting “back to normal”—just what in the heck to they mean by “normal”—a Twilight Zone of debt paid for by record-levels of central bank faking it and interest rates stapled below the floor of history?

Is a middle class, deteriorating by the day and juggling an average of 3 credit cards per person to pay rent “normal?”

Is a US bond market that is effectively 70% junk rated credit “normal”?

Is a grotesquely inflated stock market supported by stock buy-backs, corrupt accounting, greedy CEO’s, bad IPO’s and dishonest inflation, earnings and unemployment reporting “normal”?

Is a banker’s otherwise dead repo-market supported by hundreds of billions in fantasy (i.e. printed) dollars “normal”?

Are hundred-year bonds and negative yielding, fatally yield-compressed sovereign debt instruments “normal”?

In fact, getting back “to normal” is an expression just loaded with irony, as our pre-COVID depression-era data confirms that the US and global economy was, by EVERY normal measure, profoundly sick before COVID added insult to our national (and rigged) injury.

There is No Normal Anymore

Nope. Nothing was normal before COVID, and nothing will be normal post-COVID. Today’s Q2 GDP print, no matter how one tries to spin it, is just one of many elephants in a room of fragile china just waiting to break apart.

That’s not doom and gloom, just math, history and, again, common sense.

Sure, markets can and will rise on any scrap of headline good news going forward, as if a sudden “surge” from a Grand Canyon bottom is all investors need to feel safe under the protective arms of their money printers, rate suppressors and “calm-peddlers.”

But I’ll just say it again: Debt matters. And more debt, even when justified by (or hidden behind) a convenient (?) global pandemic, is never cured by more debt.

In short, don’t abandon your own judgement, your own information and don’t build portfolios based upon hope or passive faith in the “elites.”

Instead, build and protect your portfolios based on market signals and experience.

Today’s market signal was a doozey, but we are here to keep you grounded in facts, not fantasy, hope or even fear—just facts.

And the fact is, Q2 GDP data like this is more than a temporary “glitch.” It’s the culmination of countless glitches of which we’ve been writing and warning for years.

Sincerely,

Matt and Tom