The residential real estate markets are sending mixed signals.

Although we focus on risk assets, currency markets and historically-confirmed precious metal insurance, many subscribers are naturally asking about the one asset that so many concerned readers have in common—their private real estate.

I’ve touched upon the residential real estate markets here and there, and continue to view this sector like just about every other sector driven by cheap debt: It rises until the music stops and the debt gets too big to ignore and then, well: It falls.

Like the bond market, U.S. residential real estate markets have enjoyed low rates and easy credit, and like the bond market, residential real estate markets are now over-valued and poised for an inevitable, though not necessarily imminent, day of reckoning.

Unlike bonds, however, the Fed is not directly buying residential homes to keep this particular bubble afloat, although many emergency measures (below) have been put in place to give it a life-jacket.

Primarily, buyers and brokers engage in an odd kind of delusional dance to fool and please each other to keep this odd game of smiling crazy going in the backdrop of a seemingly ignored recession.

Residential Real Estate Markets—Big on of Face-shots, Small on Advice

Residential real estate markets are driven by brokers and sales agents who have a kind of seductive way of selling charm rather than candor.

Have you ever noticed that most real estate brokers, unlike just about every profession other than personal injury lawyers, place a high degree of attention on adds and business cards that prominently feature face-shots?

There’s an entire industry built around this…

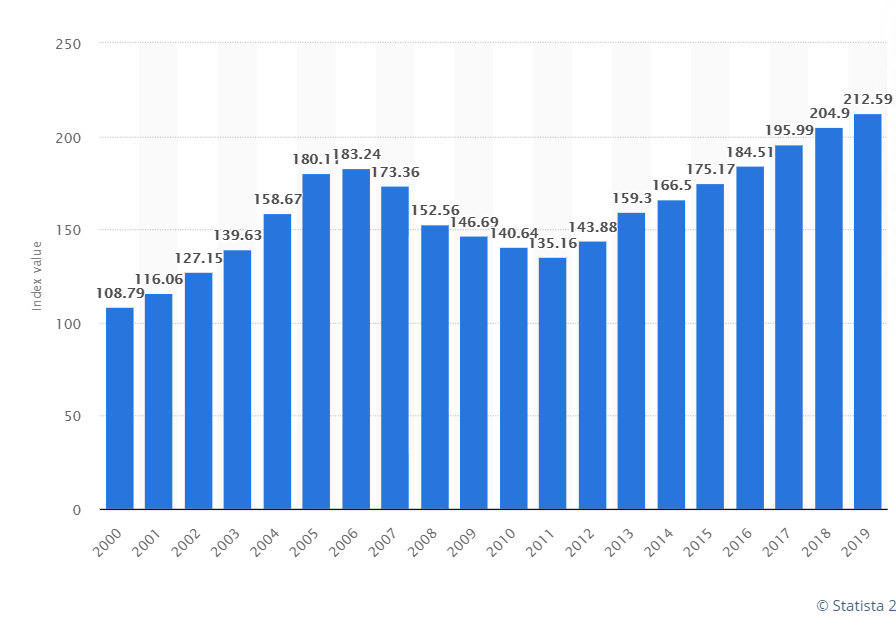

What’s not advertised or even discussed in those broker “get-togethers” are data points like the Case Shiller Home Price index which demonstrates a clear price bubble, inflated by over 110% since 2000…

From the low end to the high end, one often finds realtors in bizarre relationships with their competitors or colleagues (either in-fighting or weird intra-office “stories”) as well as with their clients, who are wooed by such face-shots and charming dinners in which honest market facts are rarely discussed or even grasped.

In short, realtors are agnostic in who they “represent”—whether buyers or sellers. Instead, they’ll charm, flirt, cajole or worse—but very rarely will they bluntly advise.

After all, real estate agents, like stock brokers, are driven by commissions not economic data, macro savvy or a knack for candor.

For those of you more interested in the future of the residential real estate markets than attractive photos, let’s leave those glossy pictures in the glove box and look instead at the economic forces which will impact the actual value of home prices now and going forward.

But first, and as with any asset class, we need to place the pricing of residential real estate markets squarely in the context of familiar market forces and dumb actors like the Fed, the rates market, wage data and the price trends.

Let’s dig in.

The Fed, Of Course…

With interest rates at the zero bound and likely heading toward an embarrassing turn to the negative, it would seem that there’s never been a better time to get a mortgage and buy a house.

And with “unlimited QE” and Fed “yield curve controls” (euphemisms for “faking it”) now the new abnormal in a world gone bonkers, some (and your realtor in particular) might think that recessions have been outlawed and that home prices will only go up.

Then again, we’ve heard that meme before, right around 2007…

But it would be unfair to compare the 2020 liquidity crisis to the 2008 credit (and housing) crisis.

Credit quality in today’s residential housing market has vastly improved since the hey-day of the Fannie and Freddie sub-prime debt bubble.

Less Flirting, More Economic Thinking

But informed investors may want to re-think their realtor’s charms, as it’s equally clear that the central banks (and hence the markets and economy) are running out of rational tools to sustain this steroid-driven game of “all is fine” forever—and this includes the residential real estate markets as well as the stock markets.

Folks, look around you: Does the economy seem to be thriving? Improving? Does this really seem like a good time to over-pay for yet another over-valued asset in the backdrop of the biggest corporate, governmental and private debt bubble in history?

No matter how low the rates, many would-be buyers simply have less jobs, less money or less faith to confidently take on a big buy.

In fact, if we look closer, all is not fine in the real world, and those looking for a smart buy in the residential real estate markets would be wise to wait for a price decline rather than lunch or dinner with another mysteriously charming realtor promising a quick closing.

After decades of injecting dirty needles of printed money and cheap debt into the global economies, there has been no return to “robust growth” even before COVID made such projections comical in the current period.

Instead, all those central-bank steroids went into the stock, bond and residential real estate markets—inflating their prices to levels way past anything resembling actual value or a smart buy. After all, this is what years of cheap credit always does: Inflate asset classes toward a breaking point.

What Goes Up…

And as any cycle-watcher in the markets knows, what goes up, eventually must come down—despite the Fed’s arrogant attempt to can-kick reality well past its natural limits. Residential real estate markets are no exception.

As nearly every asset under the sun has risen in the wake of over a decade of central bank “faking it,” wages and other key economic indicators have remained stagnant and declining, and will only continue to stagnate and decline further as the world, and the US, flirts with zero to negative rate policies which mathematically lead to tanking economic growth and declining demand ahead.

To add insult to injury, the embarrassing wealth gap in the US continues to break new records as the worst in our history.

The Fed’s Pavlovian response to such concerns/realities?

Keep doing what wasn’t working—i.e. more money printing, more cheap debt, more artificial asset-price support, including pricing in the residential real estate markets.

The Wealth Gap

But who can afford these new homes as wages stagnate and prices rise? And what about spending power in the post-Covid world?

In the high-end zip-codes, it will take more than brochures, dinners and new realtor “friendships” to sell a home, but at least the buyers (often “all-cash”) are richer and the dinners more engaging…

Furthermore, affordability will be less of a concern, as the rich will always buy—but the informed buyers will expect lower prices, if they’re patient and smart.

In middle-class markets, affordability will be a more glaring issue, and thus demand as well as prices for those properties will soon continue to fall.

Even before the COVID crisis, and with rates at the floor of time, less and less folks were buying for the simple reason that they just couldn’t afford to.

In the summer of 2019, for example, the otherwise high season for face-shot-focused realtors saw a bizarre price drop from July to August that extended from San Jose, Ca and Boulder CO all the way to Miami Beach.

In 2019, US household debt was rising as wages stagnated. Affordability was an issue, which meant demand was falling, which meant prices were falling in the residential real estate markets.

Now, as home buyers head into a post-COVID world, the longer-term outlook is even scarier for consumer confidence.

This means demand for homes faces increasing risk, which means home prices—especially in once sexy “urban” locals like LA and NYC, are heading south not north.

COVID Re-Thinking

Zip codes where prices were hitherto grossly inflated are now seeing an exodos, as the COVID experience has made many home owners reconsider just how wise it is to be in a city when the next virus or social riot hits…

This will be good for suburban realtors capturing a wave of city-dwellers forever spooked by their recent COVID experiences in high density (and hence high disease) places like NYC, DC, San Francisco, Seattle and L.A.

Indeed, the very notion of what it means to be in a “home” during a lockdown has possibly changed forever. Co-op and condominium sales have tanked by double digits. (Apartment REITS, by the way, are facing a sharp decline in revenues as tenants struggle to pay rent.)

Flip-Flopping Signals from the Residential Real Estate Markets

As in the stock markets, the residential real estate market saw a massive decline in sales during the height of the March Coronavirus fears, followed by a subsequent and surreal resurgence in sales and mortgage applications during the otherwise magical (i.e. Fed-induced) April “rebound.”

As of this writing, pending U.S. home sales have posted a record gain, crushing the doomsday forecasts.

Pending home sales went up 6% in the last week of the magical “Fed April” after having fallen for five consecutive weeks prior, and mortgage applications rose 12% for the same period.

On an equally “positive” note, home prices, unlike stock prices, never took a massive nosedive during the market correction. Price growth in the residential real estate markets simply slowed (from 4.4% to 0.3%) year-over-year rather than tanked.

In short, neither appreciation or depreciation—just treading water.

Furthermore, the realtors will tell you that the time to lock in cheap rates has never been better, and they are correct.

Unlike the 2008 crisis when no one could get a loan after a mortgage crisis, now low-rate mortgages are there for the taking.

Optimists will also remind you that unlike the 2008 residential real estate markets crisis, people have a lot more equity stored in their homes and the underwriting process has so markedly improved that credit risk is less corrupted today in the mortgage space than heading into 2008.

This too is true.

Furthermore, the recently-passed CARES Act allows homeowners with government-backed mortgages (3/4 of the US mortgage holders) to get mortgage forbearance for up to a year for those who can demonstrate hardship.

But Here’s the Rub…

COVID has not vanished and the real economy, which the Fed forgot about years ago, is not thriving. As of now, sales of previously owned U.S. homes have fallen to their lowest level since 2010.

Also worth noting is that U.S. mortgage delinquencies rose in May to their highest levels since 2011. Get ready for more of the same down the road.

By the end of May, closing transaction decreased 9.7% from the prior month of “Fed hope” according to the National Board of Realtors.

But the almost surreal flip-flopping continues, as more recent data suggests a renewed increase in loan applications as if the world was going to return to its robust “abnormal” of spiking debt, tanking income and stagnate wages.

Median home prices have actually increased rather than decreased, despite all the economic headwinds facing Main Street.

Like the bond bubble, the obvious bubble in the residential real estate markets doesn’t want to face economic reality—yet.

And if COVID returns with more pain rather than solutions, we could see a return to the April spike in delinquencies driven by over 20.5 million unemployment benefit filings.

This might explain why the banks themselves are slowly losing confidence in the sector, as home equity loans dropped by 20% between March and May.

In short, there’s all kinds of flip-flopping indicators coming out of the residential real estate markets, and this kind of surreal up-down behavior typically precedes an “Uh-Oh” moment in which the recessionary “cat” pounces on the “flopping fish” housing market.

Summing It Up

The residential real estate markets continue to pretend that 12 years of debt-driven, low-rate growth has no consequences, or that even adding a COVID insult to an already stagnate GDP injury has no effect on just about any asset class or price, including residential real estate markets.

Informed investors, however, know better. They think long-term. However, uninformed investors, like real estate brokers, think only about today’s illusional valuations and tomorrow’s commission check.

For those of you with cash, I’d wait patiently for home prices to tank along with everything else in this unsustainable bubble. Again: Buy low, sell high.

For those of you with second homes that you’re looking to sell, now’s the time to sell high.

For those of you worrying about your future income in the backdrop of a Q2 GDP about to tank and a COVID rate about to rise, don’t sign a mortgage you can’t be certain of paying, regardless of what your handsome broker tells you…

Sincerely,

Matt & Tom

Having been a developer of new residential real estate (an unequivocably cyclical business), I can attest that buyers primarily base their purchase decisions on what their monthly payment will be. They then buy as much house as they can. This modus operandi on top of a fractional banking system and suppressed yield curve fosters the potential for overleveraging. Besides default due to loss of income, what quite possibly has changed since the mortgage mess of a decade ago may be the speed with which homeowners walk away from their mortgage if the debt exceeds the property’s value.

Another flavor of moral hazard? Various kinds of government “guaranties” do buffer the system; however, this structure does add further drag on the Fed’s willingness to raise interest/mortgage rates. Doing so will both raise monthly payments and depress property appreciation. Banks don’t like oreos (other real estate owned) on their books resulting from receiving deeds in lieu of foreclosure, and now they may also be required to take back a slice of cdo’s (collaterealized debt obligations) when debts sour. So, looks like a case for keeping those monetary printing presses humming or else.

Thanks John, much appreciated further commentary with a clear knowledge/perspective of the sector. Fully agree with your observations and ultimate conclusion: Those money printers will keep on humming, as that is the “new normal” of a global and national economic system now fully dependent upon a central bank respirator and the illusion that “all” can be solved (including real estate markets) with more fiat currency creation despite every lesson of history, markets and math to the contrary. Good grief…

Much appreciated!

Matt and Tom-

Did you say in the beginning part of this report the FED is now buying SFR homes to support the bubble in this sector – did I read that right – or am I dozing off and suffering from a long day of blue light burnout???

The “Lender of Last Resort” Is now becoming the Buyer of Last Resort on single family homes – no way !!!

Hi Richie, perhaps I was dozing off when I penned this 😉 but no, as of yet the Fed is not becoming the Buyer of Last Resort on residential homes; what I was indicating is that unlike the bond market, which is now Fed-“supported/accomodated”–the residential housing market is on its own–however, there are programs in place through govt-supported mortgages (75% of US homes) that do allow mortgage forbearance for those impacted financially by COVID for upto 12 months–which is an indirect form of support, but not nearly as questionable as what the Fed has done to the over-all bond markets.

OK – now understand. You are correct those FB (forbearance) provisions are out there for homeowners. Also FB (In form of payment deferrals thus far) is being encouraged and done in the commercial loan space.

Wow – for a moment there I was thinking if the FED is now buying folks houses, we are certainly at the end of this depraved debt cycle!

I predict it is VERY likely the FED and other CBs will end up buying Commerical Bank’s “loss paper” if portfolios start going down. Perhaps a full blown “debt jubilee”. Wonder what that might look like? Maybe load all that “loss paper” on next SpaceX flight and fire it into outer space. Pay Elon billions to be an intergalactic garbage disposal company!!! Hmmmm… maybe You and Tom should raise some equity for that new line of business?

Greatly appreciate the candor and integrity that comes through Signals Matters. Keep up the good work!

Ha! Thanks Richie. I’m not sure there’s a rocket ship big enough to hall that level of garbage 🙂