The housing bubble has not received as much attention as the stock and bond bubbles of late.

As we’ve warned in recent reports, a Fed tapering (i.e., rate hike and balance sheet reduction) signals bad news for just about every risk asset in general and bubble asset in particular—all of which grow fatter when interest rates are artificially forced lower.

Of course, if low rates feed bubbles, rising rates will pop ‘em.

And one more thing: All bubbles do pop.

The Usual Suspects/Bubbles

As to asset bubbles, stocks and bonds are the most obvious examples, each direct beneficiaries of an unprecedented, multi-year amount of low-rate/cheap debt support from the biggest bubble maker in history—our very own Fed.

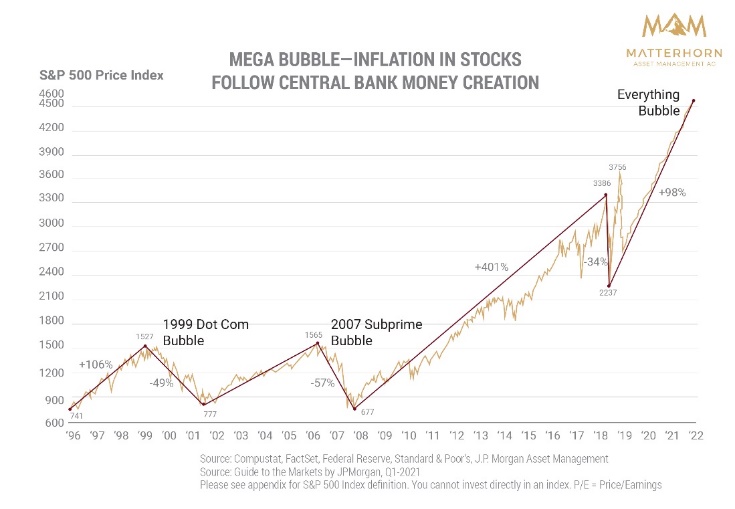

The following (and by now familiar) chart of the S&P confirms just how high a stock bubble can rise…

And years of negative yielding bonds compliments of rate-suppressing Fed policy are an additional confirmation of how crazy a bond bubble can get, as the world has never seen negative yields in over 5000 years.

Again, all of these distortions in modern equity and credit markets are compliments of an experimental Fed addicted to cheap debt and engaged in a long-term monetary DUI whose consequences are about to get even more dangerous.

Real Estate—The Other Big Bubble

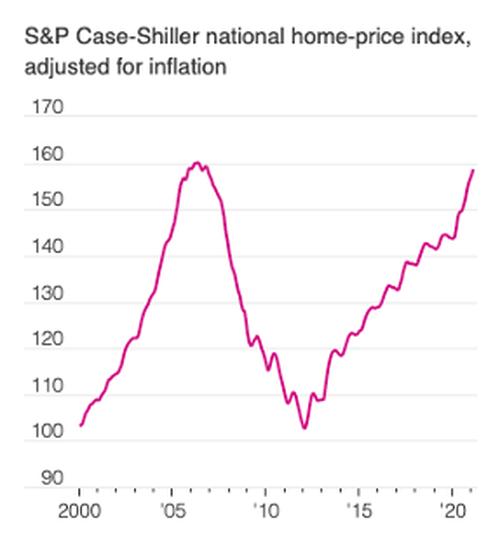

No discussion of asset bubbles driven by years of un-naturally low interest rates would be complete without addressing the real estate market, a topic we’ve been admittedly remiss in revisiting of late.

For most homeowners, like most stock and bond holders, the Fed has been pretty good to us real estate folks, no?

After all, and depending on your zip code, we’ve seen record-breaking home prices rising at +20% year-over-year levels, with sales up by 35%.

Again, pretty good, right?

Well, the farmer who feeds a turkey every day is pretty good to the turkeys too—at least until the week before Thanksgiving…

In other words, don’t be fooled by the euphoria and complacency that all bubbles create. The cheap debt the Fed has been feeding us will have its own Turkey Day…

And to be clear, housing markets are a bubble.

Another Inflation Metric—The Housing Bubble

Although inflation as measured by the bogus CPI is finally making the headlines, for years many, including the math and history-challenged fiction writers behind MMT, even tried to convince you that inflation was extinct.

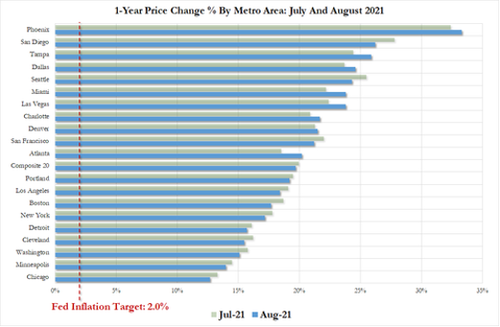

But while the rest of the world was waiting for a CPI confirmation of inflation, the evidence of inflation was hiding right beneath our noses—or in our front yards/home prices:

More Crazy

Of course, crazy begets crazy, and the evidence of the crazy in the current housing bubble is all around us—at least for those willing to look.

In most real estate markets, there are literally more realtors today than there are listings.

Homes, which typically list for periods of less than 21 days are selling at an average of 1.7% above their asking price as high-bidding buyers battle for what’s left in a housing market whose inventory has fallen by greater than 30% in the more competitive area codes.

That’s crazy.

Equally crazy is the amount of decay in once popular (i.e., formerly tent, crime and opiate-free) cities like San Francisco and New York, where inventory is actually up by 28% and 77% (!) respectively.

And yet even where home supply/inventory is higher than demand, prices in these failing, police de-funded cities are increasing.

Again with the crazy…

The Consequences (and Beneficiaries) of Cheap Debt

But such distortions are precisely what happens when a central bank spends years making bubbles and/or manias out of cheap debt (repressed rates) and historical wealth disparity.

As always, it’s the deeper pockets and the higher income brackets who grab the most of the mania’s good times.

But when it comes to deep pockets, the biggest winners (and exploiters) of this home-made bubble in home prices are the big boys (i.e., institutional investors) riding the Wall Street-induced low-rate wave.

The permanent capital from the big private equity shops is buying 25% of the single-family houses for rentals or quick arbitrage (i.e., “flipping”)—think BlackRock et al…

Such mania is fun when borrowing costs for the big boys is 0.15% despite unreported inflation above 10% and even year-over-year official CPI inflation hitting the 7% handle.

See how the Fed’s low-rate addiction makes manias, kills saving incentives and builds mega bubbles?

Such Fed-induced (as well as completely coo-coo) demand for housing is uniquely benefiting the all-cash (i.e., wealthy) buyers, who didn’t need to pause for a mortgage application, even when borrowing was essentially free.

What Rising Rates Do to the Housing Bubble

But whether today’s home buyers are all-cash or mortgaged, what happens to their asset class (i.e., homes) when the housing bubble does what all asset bubbles do in a rate spike?

Short answer: They go underwater.

This is because all the institutional and levered big boys (i.e., housing speculators) will be dumping their housing assets/portfolios en masse (and retail buyers making “strategic defaults) when rates rise to levels too high to be fun anymore.

And as high school econ class reminds, a supply flood means tanking prices. The same goes for home prices.

The Fed/Bubble Trap

Thus, whether your mortgage be fixed, paid or non-existent, the value of the underlying asset itself will be falling.

And even for those who wish to sell-high today before the housing bubble pops and your home value falls, where will you move into during the next cycle if rates are too high to acquire another home/mortgage?

Or where will you go in the current cycle, when your next home is more over-priced than the one you just sold?

See the bubble trap?

More importantly, do you see why a rate rise is more than just an academic topic or pundit debate?

Many are so worried about the implications of a rate hike in the housing bubble that they are convinced the Fed won’t let a rate spike happen.

This is possible, but for how long?

And even if the Fed could control interest rates like a home thermostat, how long do you want to bet that such “control” can really last when natural bond market forces, rather than un-natural central bank forces, get the final say on interest rates?

This is why hawkish chest puffing, taper-talk, and interest rate debates are far more than just debates. They speak to the very roof (and bubble) over your head.