There’s a rising rates problem rising to the surface, and yet no one seems to notice?

Hmmm.

Meanwhile, the Squawking Continues

In a recent report, we poked some much-deserved fun (and some typical sarcasm) at the growing cadres of experts suddenly demanding a hawkish taper in Fed accommodation after getting unusually fat for over a decade of dovish Fed easing.

In short, and as usual, the ironies (and hypocrisies) abound as the QE (quantitative easing) narrative virtuously shifts to a QT (quantitative tapering) narrative with all the comical confusion of last year’s transitory inflation narrative shifting to this year’s narrative of persistent inflation (7%, by the way, as we warned well ahead of Powell).

Like Dr. Fauci, it seems our bankers can’t decide if masks work or don’t work, so for now, the group-thinking bankers can just mask the facts as to QE or QT.

But as we’ve shown with quantifiable evidence rather than literary drama, the long-history of anti-heroes posing as policy experts is now a fairly open and empirical secret.

As to facts vs. masks, we thought we’d return to the stubborn honesty of simple data to reveal where distorted markets are today and where both history and math confirm they are heading tomorrow.

Let’s dig in.

The QE Bubble

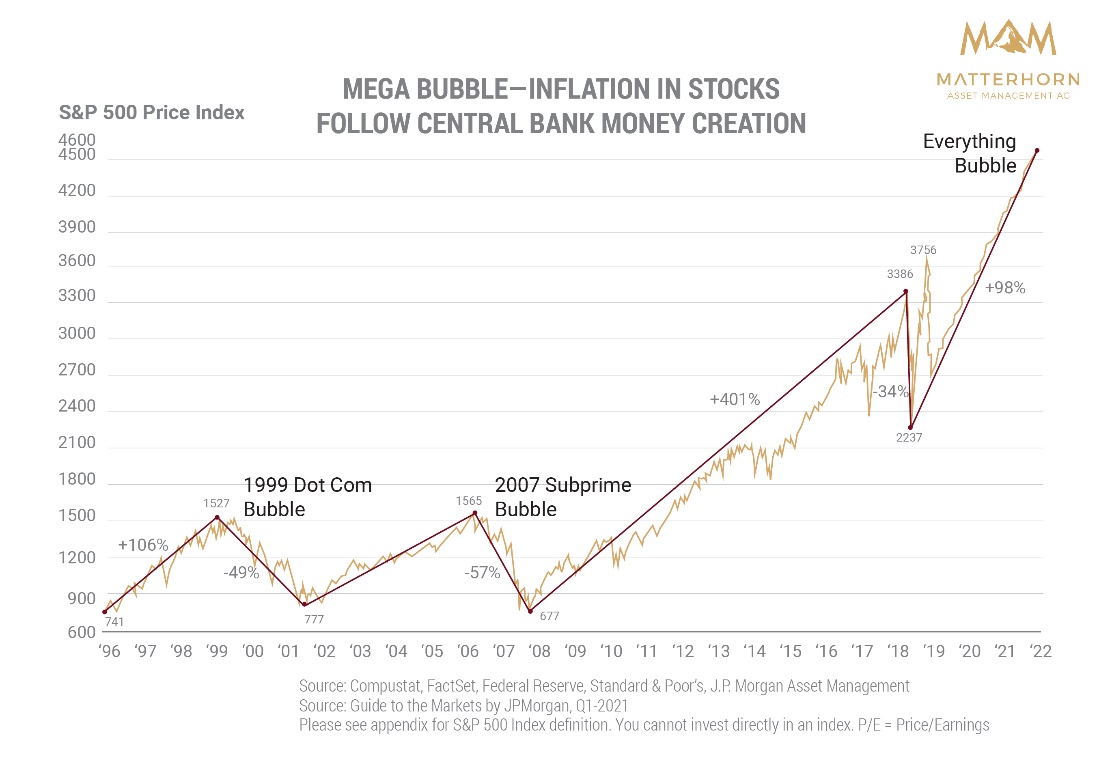

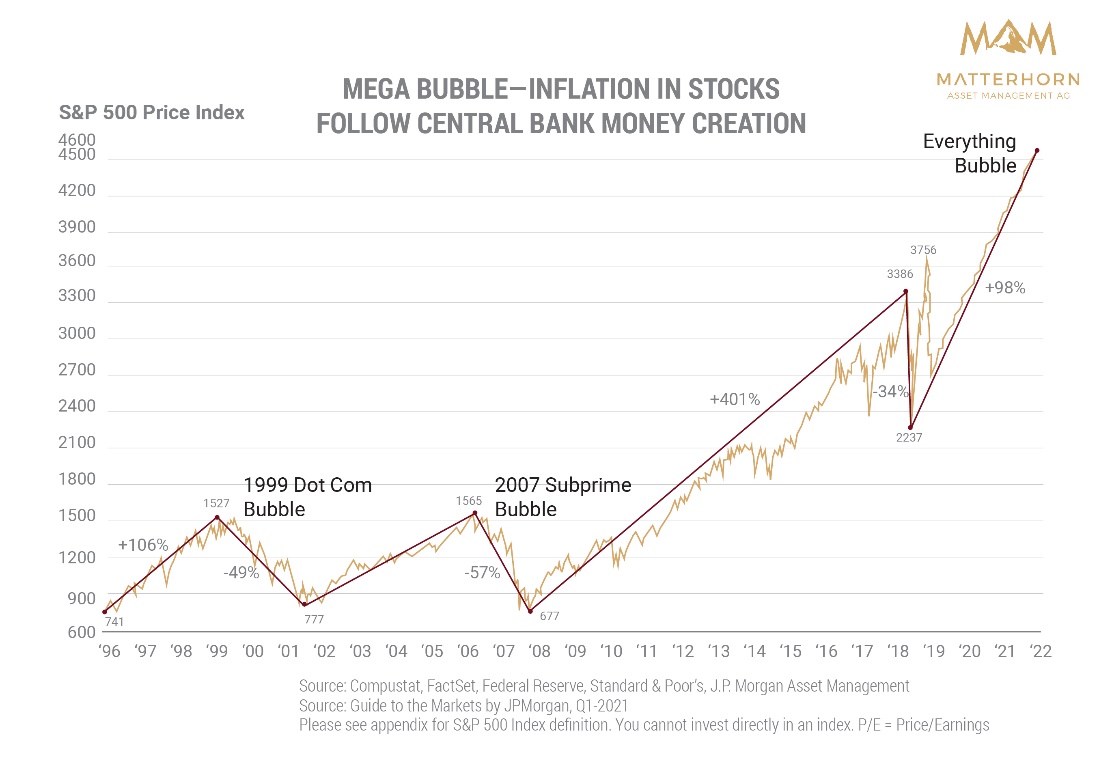

In case you are still wondering what an asset bubble looks like, here’s a simple picture:

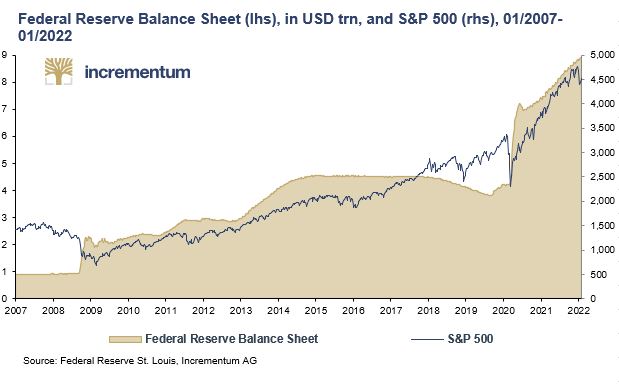

And in case you wonder who and what was responsible for this inflated stock monster, simply track the direct 1:1 correlation of expanding Fed balance sheets to rising stock prices, as evidenced by this equally simple picture:

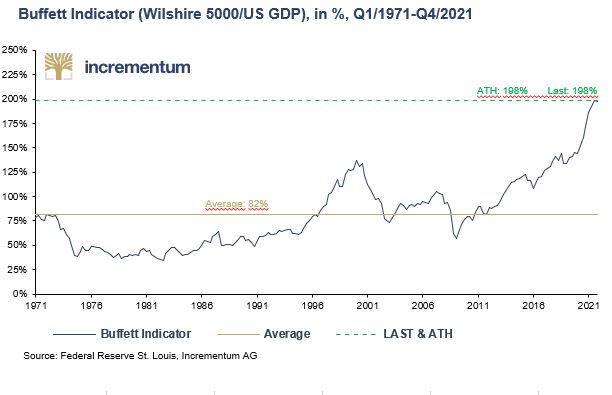

OK, so that’s what money printing and low rates gives us: The greatest equity bubble ever recorded, as confirmed by record high PE multiples and record high ratios of stock prices to GDP, as good ol’ Mr. Buffett’s indicator makes equally, and painfully clear:

The Debt Cancer

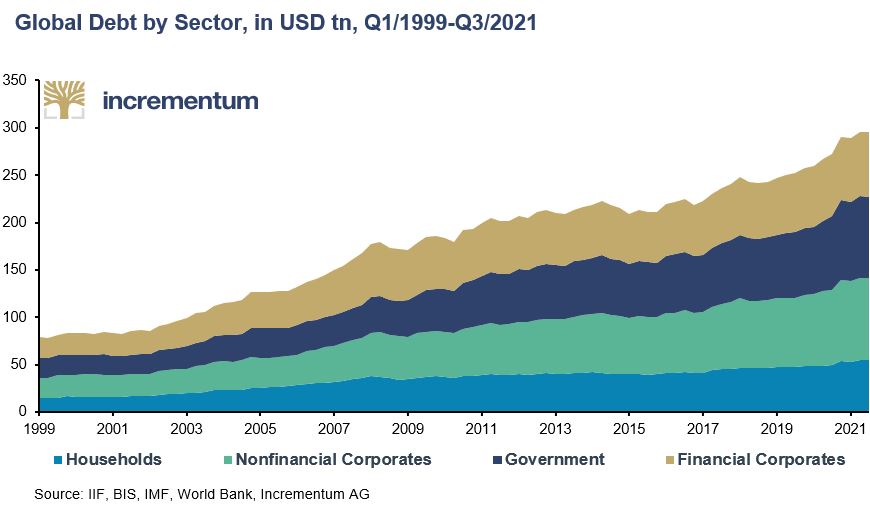

Looming behind the scenes of the most grossly distorted risk-asset market bubble in history is the patient-zero of the same, namely the largest global debt bubble ever recorded.

We’ve warned countless times that great debt always and every time kills once great economies, as Mr. David Hume warned us centuries ago, and Thomas Jefferson and Andrew Jackson confessed long before the Fed’s not-so-immaculate conception under Wilson’s shaking pen.

If you need an X-ray of this debt cancer, here’s a recent picture:

Debt, of course, can be fun, and when central bankers spend years artificially repressing the cost of that debt, they create years of cheap tricks like stock buy-backs, debt-roll-overs, and balance-sheet red enterprises that rise to the moon in price despite basement level free-cash-flows and revenue streams.

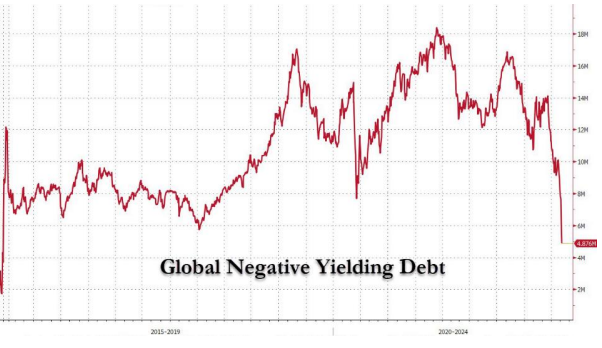

And when central banks spend years printing trillions of dollars to buy government bonds to keep their prices artificially high (and hence yields artificially low), we get something never seen before in over 5000 years of market history: Namely $19T in negative yielding (and hence technically defaulting) bonds.

How’s that for total distortion in a nutshell?

But again, cheap debt can be fun; it fuels stock bubbles, as we remind again here:

But the Fun is Coming to End

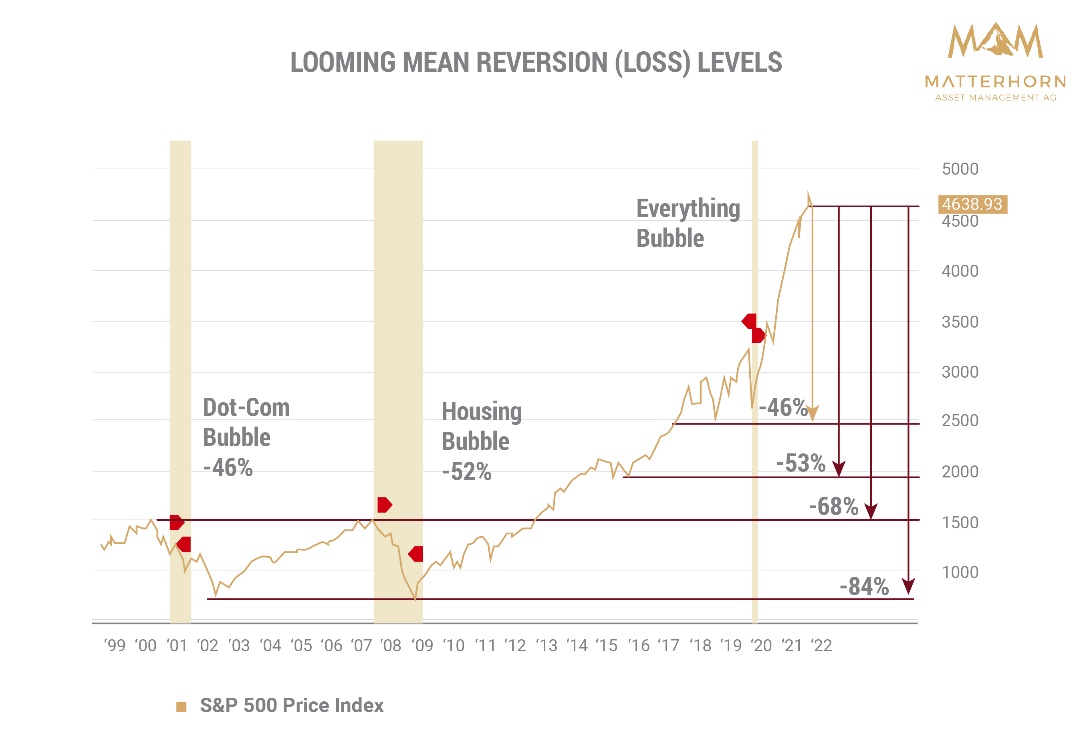

As the saying goes, what goes up must come down, and after over a decade of gravity-defying and artificially accommodated support from a QE-driven securities mega-bubble, the natural forces of “uh-oh” appear to be upon us.

That is, if expanding Fed balance sheets and artificially repressed interest rates gave us the drunken QE bubbles charted above, then it’s fairly algebraic to see that a tightening of the Fed’s balance sheet and a rising of rates will give us a QT market of pain (or hangover) at equally historic levels.

In case you want to know what that hangover looks like in terms of percentage losses in the stock market, here’s a picture of what mean-reversion (another natural but largely ignored market force) looks like:

Ignored Warning Signs from the Rates Market

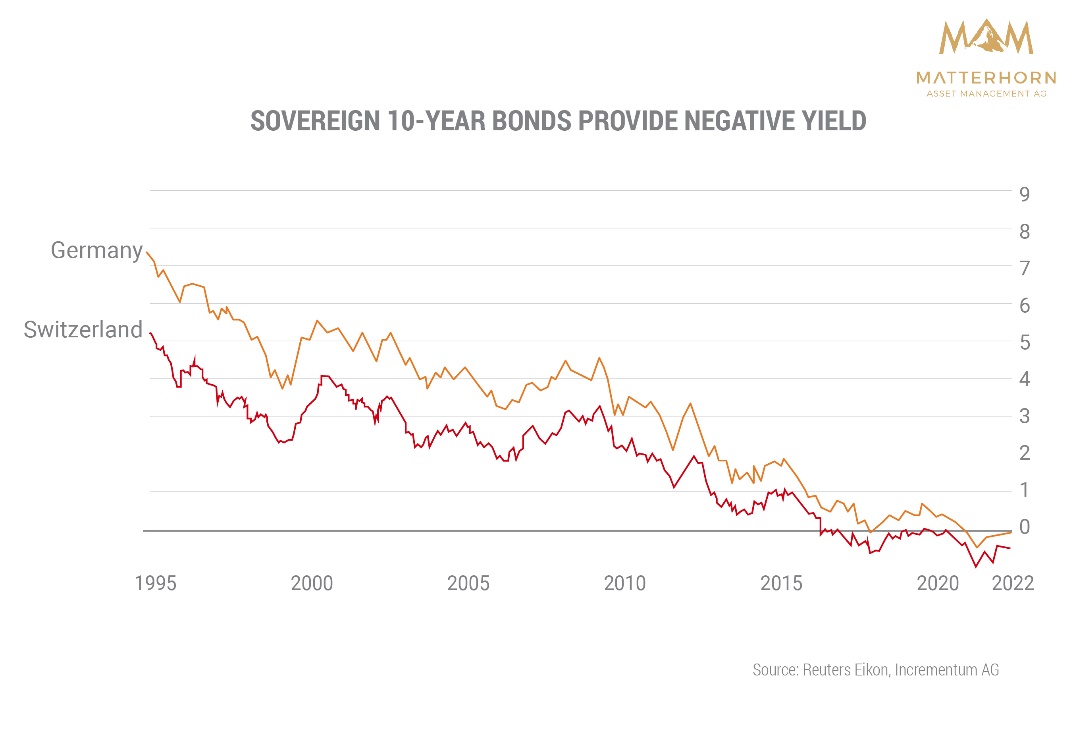

As indicated above, years and years of global central bank bond purchases have sent bond prices to the moon and hence bond yields (which move inversely to price) into the negative.

But what you may not have noticed is that all the chest-puffing taper talk and hawkish virtue-signaling of late has scared the heck out of that global bond market.

The number of grotesquely over-priced, over-supported, over-bought and hence negative yielding bonds dropped by more than half in the span of just one week.

Read that last sentence again.

It’s true. Global bonds have begun their slow, Titanic slide to the bottom:

This is a very, very, very telling and dangerous sign, for it simply means that bond yields are beginning their long-overdue and Lazarus-like climb from the depths.

Rising bond yields, we remind, means rising interest rates, and rising interest rates are to debt-soaked securities markets what rising shark fins are to surfers: Really bad news.

From Chest Puffing to Knee Hugging

Which brings us back to all the tough-talking, taper-talking, virtue-signaling, group-thinking experts from Morgan Stanley to Goldman, the White House to the Fed.

Namely, do any of you realize that your long over-due tough talk and Fed tapering is gonna have one helluva day of reconning in the stock and bond bubbles you alone created?

Will you be talking tough when markets, incomes, retirement accounts and public trust are reverting to record low means?

Expect a Classic Pivot or a Sham Solution

As Hemingway wrote, poverty starts slowly at first and then all at once. The same is true of cracking stock and bond bubbles.

When the taper’s tough talk slowly and then surely leads to a painful sell-off in inflated stocks and bonds, today’s so-called experts and hawks will become tomorrow’s double-speakers, engaging in a dovish, QE pivot and semantic two-step smoother than a politician under oath.

In short, the money printers will likely return at record speed, much like Japan is now currently doing with unlimited purchases of its otherwise unloved 10-year JGB’s (i.e., IOUs).

Naturally, the Fed and prompt-readers will blame any near-term pain on the convenient COVID crisis rather than years of pre-Covid drunk driving at the DC level. This too is to be expected.

If, however, the QT pain somehow does not result in yet another QE pivot (think Q1 of 2019 or QE1-QE4 of 2009-2014, or the unlimited QE of post March of 2020), the equally truth-challenged, history-blind and math-inept leadership will do what they already promised in the summer of 2020, namely: Announce a “Re-Set.”

We discussed the nature of this well-telegraphed IMF fantasy elsewhere, and recommend you re-read it.

In the end, their great plan is nothing more than solving old debt with more new debt monetized by more fiat currencies, only this time central bank digital currencies of CBDC.

Either way, it’s just more lipstick on a financial, debt-sick pig and either way investors need to be preparing for the kind of market volatility that most just wont and don’t see coming.

And that’s why we, and our portfolios, are here to prepare and help you.

Hi Matt –

A few questions and your thoughts:

1) Do we still hang onto PM already in portfolio and do we keep buying more? We already have 10% in that hard $ asset class.

2) Do you sense things are about to break and reset coming right behind it, or will our rich uncle be chicken littles, and after a 10-20% correction start the copier machines again? We will Not stone you if your prophecy-prognostications is wrong – just pease tell us what your gut is Telegraphing you these days.

3) Does our rich uncle still have lots of PM hidden away (perhaps in Cheyenne Mt: Vaults from Cold War days) to show The world and use to back any new CBDC initiatives?

5) When will US populations see rich uncles as the underlying problem and demand the E building be shut down for good?

Thanks,

Richie B

Hi Richie,

Assuming no stones my way, I’ll give you my best guess as to forecasting and my best advice regardless of the timing.

1. 10% in PM is fantastic–as long as its physical and not paper. Don’t worry about the price, don’t worry about the chatter–just hold on to it through the coming crazy–be it bull for a while longer, or bear. The Swiss typically hold 20% in physical gold–as currency insurance not speculative coo-coo. I like the way Swiss think (about gold at least 😉

2. I never ever, ever, ever thought the Fed would reach QE4, let alone the unlimited QE in 2020 or the level of printing since then, so it’s hard for me to say how much longer the Fed can keep this charade going. Whatever we want to think of the Fed, its powers, like that of a dirty cop, are hard to fight.. I see at least another 30% correction in a real taper, and any money printing that follows will have less and less effect–but again, don’t underestimate even a dirty cop or a desperate Fed. Their power is real, though not sustainable.

3. Yes.

4/5. As soon as more people are willing to challenge their faith in the comfortable structures they once believed in, but which have since lost all credibility. This requires looking at painful truths, and painful truths, like death and the sun, are very hard for most people to look straight in the eye.