Fed Chairman Powell recently warned of “softening demand.”

Gee, thanks.

But what does softening demand really mean, and how can you be prepared?

Markets Tanking (Softening Demand?)

We’ve all been watching markets tank as fears of a now openly Hawkish Fed, and hence rising rates, increases.

As we’ve warned for years, neither the economy nor the markets can stomach rising rates, as the markets and the economy are driven by debt rather than productivity.

Thus, and quite simply, when the cost of debt rises (i.e., high interest rates), the debt -based system implodes.

Or more simply stated: Where the credit markets go, the world goes.

The Credit Markets: It’s All About Debt

Folks, let’s not kid ourselves. $300T+ in global debt, and $90T+ in combined household, corporate and public debt, is comically (tragically) unsustainable and unpayable.

And yet everything is tied to debt and easy credit, from the currency and rate markets to the stock and bond markets.

Even the money supply itself is tied to credit markets, as over 90% of that supply is driven by bank credit.

But now we face serious problems. Very serious problems.

Why?

The Debt is Drying Up

As recently reported, the Fed’s Quarterly Loan Officer survey confirms that credit is tightening.

The euphoric (i.e., record-breaking bubble days) days of cheap debt are at an end.

This will be a death knell to the US corporate bond market, 70% of which is composed of junk, levered loans and other high-yield zombies—i.e., the worst students in the class hitherto traded/priced as if PhD candidates.

Far more alarming, and unknown to most, is that US banks, levered by 10X, and European and Japanese banks, levered by 20X, are about to de-lever in a rising rate market—this means less easy credit.

This is serious for the USD as well as the credit markets, as the vast bulk of the dollar demand and credit demand came/comes from that sitting “weapon of mass destruction” otherwise known as the derivatives market, whose notional value in the OTC and COMEX exchanges is past 1 quadrillion, not the publicly reported 700T+ levels.

When the derivatives markets, which have been expanding like a cancer since 1985, begin to contract, dollar strength as well credit availability will create unimaginable ripple effects for the credit, equity and currency markets.

The Dollar—From High to Lows

Speaking of the USD, now deliberately pushed to un-natural DXY highs relative to the Yen (at 50-year lows), the British Pound Sterling (at 37-year lows) and the euro (at 20-year lows), its days of strength are numbered.

The trillions of USD-denominated debts owed by Emerging Market nations can simply not afford to pay back debts in a USD which keeps climbing.

After years of importing the US inflation from the Fed’s money printer, 3rd World economies are being pushed/forced to debase their currencies to pay off weaponized debt—which might explain why the current interest rate in Argentina is 69.5%.

This, of course, is not only insane, it is unsustainable.

More and more nations (Lebanon, Pakistan, Peru, Turkey etc.) are looking more toward multi-currency (i.e., non -USD) trade alliances with the East and not the West.

Thus, it’s more than just the BRICS who are turning away from the USD, it’s a whole list.

This slow but sure process of de-dollarization will undermine demand for the USD and trust in the US system, which I feel is now unavoidable after years of growing distrust.

When you combine these geopolitical shifts (all accelerated by the failure of the US sanctions) with the approaching pains in the derivatives market, the Dollar’s current strength is only that: current.

This will be a tailwind for physical gold, of course.

Once the DXY drops from 108, to 107 to below 106, the Dollar’s continued fall will be much like Hemingway’s description of poverty: Slow, then all at once.

Recession Facts

Of course, the US is already in a recession, and no nation in history has ever defeated a recession with a strong currency and high rates.

The Fed’s current policy to strengthen the dollar and raise rates into a recession is thus hawkish to say the least, and stupid to say the most. It won’t last.

But as we’ve written elsewhere, the Fed is stuck with no good options, and is only raising rates today so that they can cut them when markets continue to tank deeper and deeper.

Fed: Insulting the Working Class

Meanwhile, as Powell wandered Jackson Hole, he warned us to prepare for “softening demand,” which is a euphemism for crushing the working class via rising rates and long-term (rather than “transitory”) inflation ahead.

This rich.

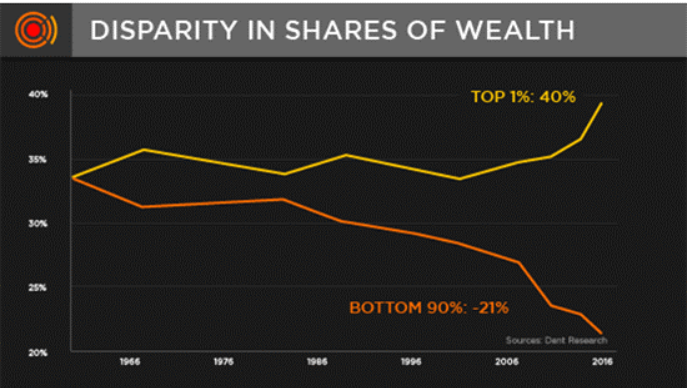

After being the sole tailwind for pushing equity markets up by hundreds of percentage points with mouse-click money since 2009, the Fed has made the top 10% (which owns 85% of the stock market wealth) extremely rich.

Now, by deliberately cranking rates higher, he’s about to make the middle class (bottom 90%) even poorer.

Wealth inequality in the US has NEVER been higher, and this never bodes well for the future of a nation.

In short, inflation pains and rising rates certainly hurt all Americans.

For the wealthy, they “pinch,” but for the working class, they cripple.

And as far as this crippling effect of “softening demand” goes, we can blame that squarely on the shoulders of such false idols like Greenspan, Bernanke, Yellen and Powell.

For years, they’ve been saying their mandate was to control inflation and manage employment.

But that employment is about to see hiring freezes, downsizing and lay-offs as debt-soaked enterprises with tanking confidence levels cut costs and jobs.

Again: That’s not “softening,” that’s crippling.

But as I’ve written in Rigged to Fail and Gold Matters, the Fed’s real mandate is providing liquidity to credit markets (and hence tailwinds for the equity markets), which benefit a minority, not a majority, of the population.

Perhaps this explains Andrew Jackson’s prescient warning that a central bank simply boils down to the “prostitution of our government for the benefit of the few at the expense of the many.”

Truer words were never spoken, and we are now seeing that in real time, and will see even more ahead in this surreal new normal of “softening demand.”

Why Signals Matter

We created SignalsMatter.com to help the many, not the few. After years of advising the wealthy, we designed our portfolio service to appeal to (and protect) the retail investor as well as the high-net-worth investor.

Unlike the Fed, we recognize that all income classes require protection, not just those the Fed was designed by and created for.

As we’ve seen (and warned), the markets are doing exactly what all grotesquely over-valued, artificially-engineered and liquidity-supported markets do when the liquidity dries up: They start to tank.

As we’ve also warned for years, the only sure manner to build wealth in the markets is not to lose wealth in the markets.

Looking ahead, we see massive risks, losses and wealth impairment.

Our key mission is risk management—the real kind, not the kind toted and superficially discussed in traditional risk parity portfolio products pushed by the RIA universe, which thrives in bull markets (who doesn’t?) yet then tank in bear markets, which advisors then blame on black-swan events rather than their own mistakes.

Our service and mission are to protect in all markets, especially those of “softening demand,” by following disciplined portfolio solutions hitherto available to only the top 1%.

In short: The rest of the 99% matter to us, even if they don’t to Powell.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.

Credit contraction by banks due to extreme leverage these banks have and the ripple effect of credit contraction on the derivatives market, zombie corporations, and GDP will be huge. And in order to avoid the crash, the central bank’s push for the debasement of currencies by printing will be hyperbolic towards the end as they are now gasping for air after almost 50 years of FIAT world & debt jubilee they enjoyed up until now. How long do you think, they will still be able to push the can down the road as they for sure will try until the last minute?

That’s the TRILLION dollar question. I never thought they’d make it this far, this long and this overtly absurd. The ice is already breaking as we speak, so I feel it could be a matter of months before a new excuse is rolled out to avert central bank blame for what is at root a central bank created mega debt cancer. Predicting is something I’ve stopped doing, as one can’t time madness. One can only be prepared, blunt and with eyes open rather than head in the sand.

So as we sit around and watch Rome burn…

Some losing all their fortunes and others cheering the Fed and thanking them for their service and kissing their…

When would the likely “Fed Pivot” occur?

Do we wait for the jobs that nobody wants either get forced filled by financially desperate debt slaves, or wait for these same companies to go bankrupt?

Or is the Fed waiting for a new low in Gold/Crypto markets and if so what might that be?

What is the TELL that the Fed is done and going to Pivot?

Excellent but very tough questions. The “tell”?

hmmm. Perhaps when the official unemployment passes 6.5% or when the 10Y yield passes 4%. Or when enough citizens realize the Fed is more in charge of the USA than the White House and Congress.

Or perhaps after the commercial and central banks sneak in enough physical gold at a repressed COMEX price to finally admit defeat as the USD dips below 106 on the DXY and the IMF, under the guise of “saving the world” (which they destroyed) offers a new Bretton Woods and a CBDC. In the mean time, Rome is burning and the markets wait for stimulus but ignore the slow death of the dollar’s inherent purchasing power as the media spends hours deciphering Prince Harry’s body language in London or ignoring Biden’s latest inability to speak a full sentence without embarrassing himself and the entire nation which needs a leader (left or right) not a weekend at Berny’s.