The Fed has no good options left, which means investors need to be way ahead of the curve (ball) heading their way.

Last week, we discussed warning signs from the US bond market and the massive implications which tanking bonds have on broader economic and market forces.

U.S. Treasuries—Taking the Bond Market with It to the Floor

The record-breaking 30-year fall in US investment grade (IG) bonds we discussed is merely a consequence of equally tanking sovereign bonds.

Investors concerned about credit markets need to consider the history of crappy bonds and how they are repeatedly tossed around like hot potatoes until investors’ hands are permanently burned.

After the tech-wreck of 2000, for example, loads of crappy corporate bonds were replaced with the latest shiny toy out of Wall Street, namely crappy mortgage bonds.

After 2008 revealed just how toxic those mortgage-backed-bonds were, the last bonds remaining were Uncle Sam’s IOUs—the US Treasuries.

Unfortunately, no one really wanted/wants those either—so the Fed decided to buy them with debased dollars created out of thin air—et voila: A totally fake credit market was born.

But what we have seen as long-dated US Treasuries tank is just a slow yet consistent domino chain of dying bonds—from tech, to sub-prime to sovereign.

The recent sell-off in TLT (the ETF for long-dated USTs) confirms this.

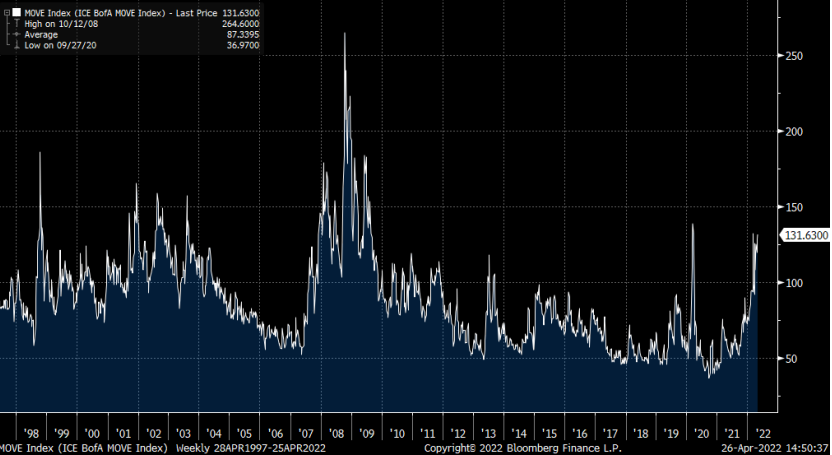

Now USTs are falling and hence their yields are rising. Volatility in USTs, as graphed below, is returning.

The problem is that UST’s (unlike dot.com or sub-prime bonds) are supposed to be “risk free sources of return” and hence far superior to say junky tech credits or subprime MBS (mortgage-backed-securities).

But when measured against inflation, USTs are now just return-free-risk.

Traditionally, as corporate bonds fall in price, investors could turn to sovereign USTs for safety. But today, in the new abnormal of central bank distortions, all those traditional ideas are gone.

Rather than serve as the bond of last resort, tanking USTs are now dragging IG bonds to the bottom.

As bonds of every stripe tank together, bond yields are spiking across the entire menu of available credits—which means the bond market is fatally sick and there’s no place to hide unless the Fed starts printing more debased money in the form Yield Curve Controls as we previously warned.

If such YCC becomes as inevitable as we predict, commodities, precious metals and industrials will benefit.

For now, rising rates/yields have given the USD a false perception of strength, and despite the hard fact that inflation is outpacing rates, the mis-perceived faith in the USD has sent precious metals temporarily downward.

Traditional Bond & Stock Portfolios Beware

As we’ve also warned numerous times, given that nothing is traditional anymore in these grossly over-indebted and artificially rigged/” accommodated” markets, traditional stock and bond portfolios are a big mistake.

As we recently saw in the sell-off of March 2020, traditional 60/40 stock bond portfolios are once again suffering big time.

As we consider the S&P along side the US bond market, we see two apples falling simultaneously.

Tech stocks, in particular, are taking a beating.

The recent sell-off in the S&P 500 (down year-over-year for the first time since March 2020) not only scares investors, it scares Uncle Sam.

After all, falling stocks means falling tax receipts in a country that has no steady income from anything other than a Fed-created stock bubble and a zombie bond bubble now crawling on its knees.

The Fed: No Good Options Left

So once again, the Fed has no good options.

Folks, if the Fed continues to tighten its monetary policies and hawkishly “taper” into a twin-deficit economy, markets will sink even faster—likely prompting an immediate dovish pivot by the Fed.

But then again, a dovish pivot just adds to the inflation fire burning all around us.

So, we repeat: The Fed is cornered. Its only choice is a tanking market (if it stays hawk-ish) or ripping inflation (if it pivots dovish).

Frankly, this is the worst macro environment we’ve ever seen in our careers. Period.

Falling Into Putin’s Trap?

Needless to say, the current geopolitical saber-rattling and weaponized sanctions are hardly offering any comfort to already deeply uncomfortable macro setting.

The trend toward rising energy costs and a commodity spike is only helping Putin as oil prices drive higher.

Such political and economic realities might convince the Fed to stay hawkish to “fight” these inflationary forces in the commodity market—which only means more disaster ahead for stocks and bonds.

Again: No good options left…

Speaking of Politics…

We know it’s never wise to delve into political discussions, but regardless of one’s left or right tendencies, I feel we can all agree that Biden is facing some embarrassing performance reporting.

A week ago, he was bragging about the 7.9 million jobs created since he took office.

What he forgot to tweet, however, is that in the same week the US GDP number for Q1 had dropped by a 1.4% annual rate.

Biden’s response?

He’s “not concerned.”

But WE are.

Recessions have a funny way of killing jobs, and what was gained under Biden’s boastful tweet can disappear in a matter of recessionary hours.

More importantly, signs of such a job-killing recession are everywhere, from declining GDP data to other tell-tale recession indicators like oil consumption-to-GDP ratios and whip-sawing USD strength.

The Ironies Abound

And speaking of the USD and its waning, post-sanction back-lash, it’s also worth noting that four European gas buyers have decided to use rubles to pay for the same.

The ironies just abound as European nations are asked by Biden to sanction Putin in day 1 of the Ukraine invasion, but by month two of the war are paying Putin for his energy in RUB.

But as we warned from the beginning of this tragic war, the West didn’t seem to see their own financial toes as they shot themselves in the foot.

As of now, Western leaders like Boris Johnson are also finding a foot in their own mouths as absurd war talk escalates in a nuclear era.

Such talk is pure madness, in our opinion, as no one wins when air-born radiation replaces bullets.

In any event, and regardless of one’s politics, the trend toward a multi-currency world is now in play and the USD’s role as a world reserve currency is slowly changing course.

The impact all of these changes will have on markets, currencies and economies is simply staggering, and places enormous priority on actively managing portfolios through a literal minefield of changing signals.

We are here to make this navigation safer.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.