Still rigged to fail markets.

Back in July of 2019 we published a lengthy market report, Rigged to Fail, to put the global markets (and market forces) into sharp context for those who have been asking the big questions yet understandably lacked the background, reading list or advisors to give them straight talk and blunt context.

Such context was so critical to making sense of the financial, fiscal and market madness that we later published an entire book, of the same title, in February of 2020 which became an Amazon sensation:

As Tom and I now look back at all that has occurred in the years since, we were astounded at how sadly predictable and consistent the warnings we made then remain in play today, and thus we decided to re-release that critical market report yet again.

As you read this admittedly lengthy yet essential report, we think you’ll agree that the patterns we warned about then are playing out with eerie consistency in real time now, namely:

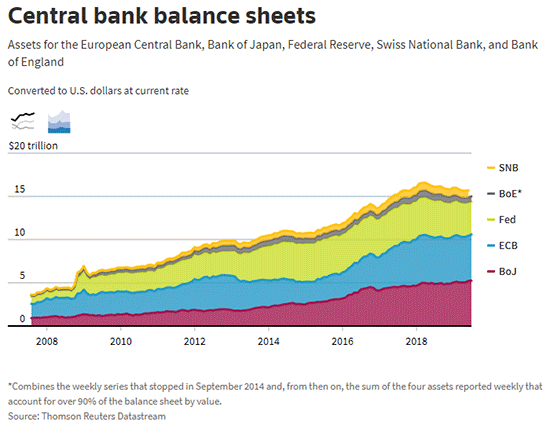

*That central banks would continue to print trillions more fiat currencies to artificially sustain truly Frankenstein stock and bond markets [since our July 2019 report, the global number has skyrocketed from $20T to +30T];

*That insane theories like MMT’s “unlimited money printing” without inflation would go from the fringes of desperate economic theory to mainstream policy;

*That inflation would continue to be misreported, as well as other lies masquerading as “data” would continue to flourish, i.e., lies as to such critical economic pulse-checks as employment and GDP, both of which have tanked rather than grown in the years since our first report—as forewarned;

*That faith in “tech” would send valuations in that sector to dangerous, nose-bleed highs in the coming years, as we’ve since seen play out with headline names like Tesla, Game Stop and Bitcoin;

*That the rigged system would continue to create increasing wealth disparity leading to increasing social unrest and distrust in policy makers, which is now a daily reality;

*That insider corruption (from financial lobbying in Congress to Wall-Street-First Treasury Secretaries) would continue a classic scenario of “insider”/pro-Wall Street foxes guarding the economic hen-house, now undeniable as Yellen moves from the Fed to the Treasury;

*That interest rates would go lower rather than higher, for the simple reason that the US is now so thoroughly soaked in public debt ($31T and counting) that low rates are inescapable. This has proven out as real yields on every US Treasury bill and bond are negative, a fact once thought unthinkable only 2 years ago;

*That more market volatility would come, such as the crash in Q1 2020, followed by more can-kicking and fantasy “QE recoveries” (as seen in Q2 2020) in which staggering debt problems are solved by more debt (2020 saw deficits triple and money printing go to the moon);

*That such inevitable and desperate money printing would continuingly debase the USD and other global currencies at rapid speed, setting the global markets up for an inevitable and pathetic “re-set” from the global banks.

Again, everything we said about this “everything bubble” just under 2 years ago is now playing out in real time with undeniable foresight.

We saw this not because we are gifted market timers (no one is) or market psychics, but simply because we understand debt cycles, market cycles and the easily predictable patterns of staggering political economic ignorance (blue and red) and the perennial risk-pushing fantasy of Wall Street’s sell-side, which we know all too well.

Thus, for those still trying to make sense of the noise and confusion in these admittedly senseless times and markets, we ask you to revisit the warnings as well as patterns set forth below so that you can replace confusion and anxiety with blunt perspective and thus sound preparation for what’s ahead.

Again, it’s a lengthy read—grab a coffee (or a stiff drink) and take your time.

What’s ahead is simple, a system that is already failing, and rigged to fail far more so.

Rigged to Fail Market—What YOU Can Do in This New Abnormal

July 24, 2019

Bonds, Central Banks, Macro Thoughts, Stocks

Below we list a number of fact-confirmed reasons why this market, currently enjoying a bull-run based on central bank support, is ultimately and historically a rigged to fail market.

American investors have never experienced such a profitable run…

The bull market in stocks, now in its 11th year, is officially the longest on record. Some shareholders have doubled their money since 2009.

Meanwhile, the rest of Main Street America is drowning in debt.

That’s why we’re getting this message out to as many people as possible right now.

Because while the losses could start at any moment (as you’ll see today) or even be postponed for years (DC is capable of pushing deficits and money printing to the limits of reason), you don’t have to go through another “08 Moment” – not when you can get and stay prepared.

But first, it’s important to understand all seven ways this market is – without a doubt – a rigged-to-fail market.

- Rigged to Fail Market: Investors Addicted to Stimulus

The easiest way to introduce obvious signs of a rigged-to-fail market is to simply trace the events that brought us into – and then allegedly helped us to “recover” from – the Great Financial Crisis of 2008.

The rapid resolution of the 2008 crisis, which was unleashed by the very banks that the U.S. taxpayers and government later bailed out, was an obvious sign of a system that values banks, the ultra-wealthy, and grossly over-stimulated markets more than economic reality and Main Street fairness.

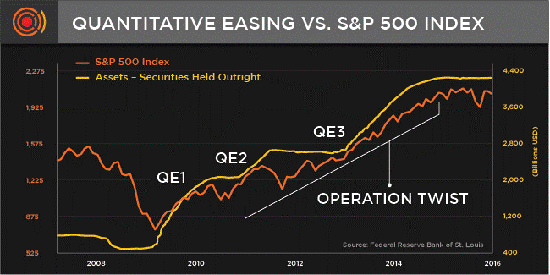

In 2008 and 2009, for example, we saw how the “temporary emergency measure” of QE1 (money printing) and ZIRP (zero interest-rate policy) slowly morphed into years of QE1-4, Operation Twist, and a permanent low-rate “keg party” for Wall Street.

In short, what began as a temporary measure became a chronic, decades-plus addiction; one intentionally rigged to provide cheap money for historically unprecedented debt levels created to support the exploits of a “stimulus”-addicted Wall Street.

The direct correlation between the market’s rise and this artificial “stimulus” (i.e., addiction) is now undeniable.

With this rigged “stimulus” comes all the attendant symptoms and behaviors of “addiction:” insider support, lies, delusions, desperation, and ultimately, death by slow overdose.

Following the 2008 crisis, the Fed was literally the artificial buyer of greater than 70% of the U.S. Treasury and mortgage-backed bond market. Folks, that’s not a real bond market, but a Fed market…

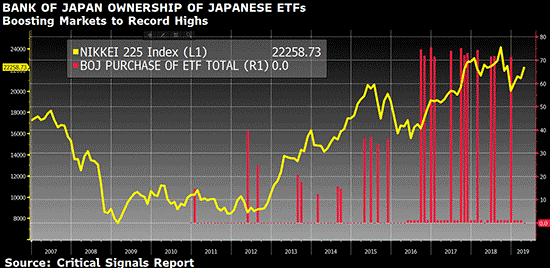

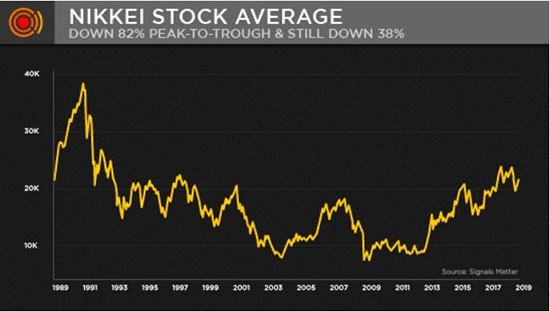

In Japan, its QE/ZIRP drug-pushing central bank still owns over 50% of its entire sovereign bond market and has become the personal lender and shareholder to over a stunning 70% of the country’s publicly traded stocks following record ETF purchases and is now the majority shareholder in over 40% of its listed companies.

No wonder the Nikkei is up by 150% since November 2012.

Folks, these are not stock markets, but rather “central bank markets.”

Between 1998 and today, the central banks of the WORLD have collectively printed over $21 trillion to scoop up their own (and otherwise unwanted) sovereign and corporate debts.

That’s $21 trillion with a “T.”

Of this $21 trillion, $15 trillion is split equally by JUST three Central Banks – the U.S. Fed, the European Central Bank, and the Bank of Japan – $15 trillion!

By loading up on central bank debt to rig their respective stock markets, the Fed, ECB, and BOJ have rigged the central banking system to fail.

And the addiction does not stop there.

As anyone familiar with college frat parties knows, one binge follows another, and the decisions made while wearing beer goggles are rarely intelligent…

People do silly things, like ignore common sense and go further and further out on the risk branch to get yield (in junkier bonds) or return (in grossly over-valued/high PE stocks).

But as long as rich uncles, like Uncle Fed, are paying the market’s bar tab (with printed money) or putting it on a national credit card (of suppressed rates), the party (as well as the drunken behavior) continues well past the 2:00 a.m. cutoff.

The Fed’s QE and ZIRP policies/addictions are no different, and they have binged way past the 2010 “emergency measure” deadline – morphing into a full-on debt addiction.

Since 2009, the perverse, 10-plus-year extension of “Fed stimulus” (i.e., free-market beer) caused markets to become fully dependent upon cheap debt and free money.

This rigged “keg party” has lasted so long that companies, governments, and individuals went into the largest debt and spending binge in the history of U.S. markets – $72 trillion!

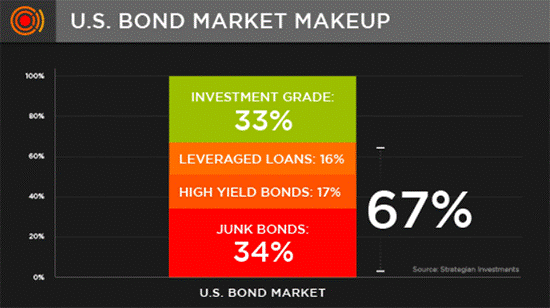

Today, over 60% of our entire corporate bond market is rated as junk, high-yield, or levered loans – the very D- students of the credit class – and yet no one notices, because everyone is enjoying the party. Again, beer goggles…

For those of you holding large amounts of “safe” corporate bonds in your standard pie chart portfolio, we’d highly suggest you rethink just how “safe” they really are.

Whenever this debt party ends, many of these debt-drunk bonds will be dead on arrival.

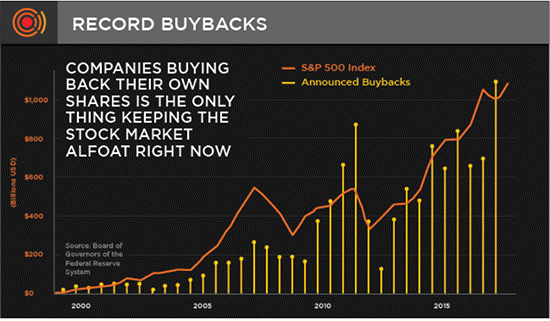

Such addictive low rates not only encouraged massive corporate debt levels, but equally massive stock buyback levels (>$5 trillion since 2008), all deliberately rigged to send DUI markets way past normal valuation multiples or the principles of sane (i.e., sober) risk management.

Instead, such a rigged, low-rate environment has allowed over 15% of U.S. companies to exist as otherwise dead broke “zombie companies” – i.e., companies that survive only by taking on just enough new debt to pay interest (rather than principal) on existing debt to stay alive.

Such debt rollover schemes/scams are of obvious benefit to company board members, yet they exist to the extreme detriment/risk of their long-term shareholders (i.e., YOU) once this debt can no longer be paid.

But as Richard Russel famously said, the market – and companies like these – won’t go down until it has sucked everyone in.

We are not there yet, but getting closer…

By the way, we’ve done the math, and if one were to take away the rigged influence of stock buybacks (which many claim should be outlawed) from 2010 to today, the S&P would be 20% lower than it is now.

Next, let’s look deeper at the “insider support” that helped make this rigged to fail market– and debt addiction – possible…

2. Rigged to Fail Market: Wall Street in Bed with Washington

It’s important to know that the very gang of insiders (Paulson, Geithner, Summers, Bernanke, etc.) who helped design and then trade this rigged-to-fail market system has done so to their own advantage.

The very bankers who caused the 2008 crisis became the foxes guarding the hen-house of their own ill-gotten financial “recovery.”

Alas, since 2008, everything has changed into a centralized, pro-Wall Street market that rises every year while the real economy and wages on Main Street stagnate.

For example, let’s keep in mind that the Secretary of the Treasury in 2008 who authored the “bailout” was himself a former (and highly controversial) Goldman CEO who helped convince Congress and the White House that the only way to save America was to save the TBTF (too big to fail) banks like Goldman Sachs.

Real shocker there, eh?

And as for the heroic bank “regulators” that D.C. subsequently put in place to “monitor” those foxy banks, they were themselves just bankers (i.e., insiders), with a vested interest in keeping banks and the risk-on markets they serve a priority over the real U.S. economy.

But if you are hoping that our Congress has their eyes on protecting you from these insider priorities with an objective eye, it’s worth pointing out that for every member of the U.S. Congress, there are five financial lobbyists attached to them.

Now ask yourself this: Can such a rigged to fail market system of financial “influence” over lending and budget regulations possibly lead to fair and objective financial stewardship from D.C.? The obvious answer is… nope.

Sadly, one must consider the evidence that our Congressional and regulatory process is largely rigged in favor of a singular and powerful class of influence-buying Wall Street and bank executives (and the bought-and-paid-for legislators who support their high-risk survival).

Henry Ford once observed that if Americans actually knew how banks operated, there would be a revolution in the streets. Unfortunately, very few understand how banks create money out of nothing and then lend it at interest (via the fractional-reserve system of the private, TBTF banks and the QE system of the central bank).

As former Morgan Stanley, Dresdner Bank, IMF, and World Bank veterans, however, we at Signals Matter know all too well how the sausage is made…

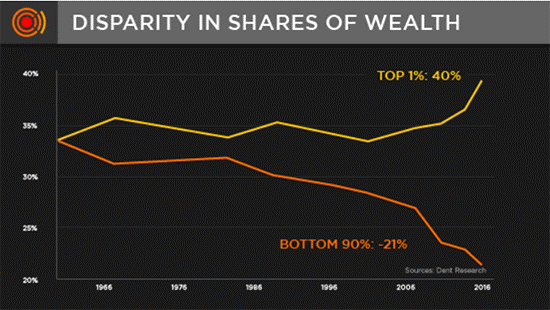

But worst of all, if we just focus on facts and math, rather than rants or partisan bias, we quickly discover that as markets, Wall Street, and the top 10% reap the benefits of this entirely rigged “bailout,” the U.S. middle class has been sold out.

Today, we have historically unprecedented wealth disparity in America. 52% of American children live in welfare-assisted homes, and 40% of U.S. households can’t afford a $400 emergency without having to sell something.

According to the U.S. Social Security Administration, 50% of all U.S. workers made less than $30,500 last year. Over seven million Americans are defaulting on car loans; there’s greater than $164 billion in student loan defaults; and with 480 million credit cards in circulation, the average American carries three credit cards to juggle over $1 trillion in credit card debt.

How could things be this lopsided?

The answer is both sad and simple. By the time the markets began their “recovery” in 2009, 80% of the nation’s stock market wealth was in the hands of just the top 10% of the country’s wealthiest families.

By 2016, this percentage climbed to 86% of all stocks. In short, the vast majority of 401(k), hard-working America was not reaping the rewards of the post-’08 melt-up.

Instead, they were still licking their wounds from the 2008 disaster unleashed by the top 1% of American wealth – the very banking class that is rigging the current melt-up and best prepared to hedge against the inevitable meltdown to follow…

Needless to say, the wealthiest Americans could not only stomach the risks better, but were also better advised and thus able to ride the obvious (and record-breaking) melt-up handed to them by the Fed.

According to a Gallup survey, 45% of Americans had no money in the post-’08 markets, and of those that did, 43% were in passive index funds tracking the market with no advice as to risk management, key sector growth, or the importance of active management.

Sadly, these “buy-and-hold” retail investors were, and will be again, the ones who suffer the greatest losses when markets fail.

Again, this is because the financial system is a rigged system that favors one segment – rather than all segments – of the real economy.

Of course, the key to sustaining such a debt-spiked and rigged securities market today is to ensure that interest rates never get so high that those grotesquely rising corporate debts (today’s new “subprime”) become otherwise unpayable.

That’s the next way the markets are rigged…

3. Rigged to Fail Market: Interest Rates Determine Everything

Indeed, record-breaking debt levels, which push stocks to nosebleed highs today, are so massive that any genuine or natural bump in interest rates would immediately kill the markets and the economy.

Such unnatural repression of rates (allegedly needed to hit a fictional “target inflation”) is thus a further and obvious sign of a rigged market.

In a fair, just, and natural market backdrop, for example, investors would be aware of these risks and thus be able to monitor and trade them by tracking equally fair and accurately reported levels of inflation.

But in a rigged system, such reporting is intentionally distorted to keep the rigged fantasy of low inflation (and by extension low rates) going, as low rates are the key to keeping a massive debt bubble from popping.

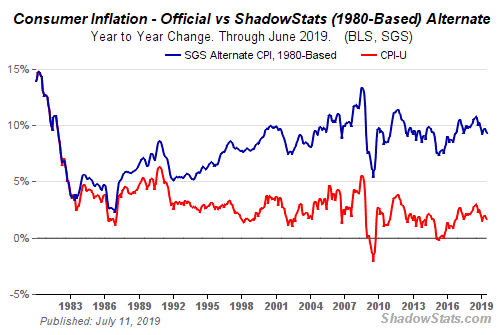

Toward this end, the math makes it objectively clear that we are being lied to about real inflation (much closer to 10% than 2%) so that the Fed can artificially suppress rates to keep debt-soaked markets rising rather than naturally allowing bond markets and true supply and demand forces to set the rates – and thus the rules – of a fair and sustainable system.

To rig inflation reporting, the U.S. government periodically shifts its reporting methodology, as it did in 1980 and again in 1990, to artificially depress the number.

Consumer inflation is triple to quadruple today’s reported number using original methodologies.

Here’s what inflation really looks like (top line), using 1980s based measurements vs how it’s being “reported” to you (bottom line)…

Courtesy of ShadowStats.com

If honest inflation was accurately reported, rates would be naturally higher and we would already be in the mother of all market disasters – right now.

But again, lies keep this rigged game not only going, but at all-time highs.

But markets, like anything supported by lies, are hardly safe: The truth eventually gets the last word.

Today, instead of natural market-driven rates (and hence market-driven valuations and risk decisions), we now have entirely unnatural, central bank-manipulated (i.e., rigged) interest rates.

The Fed, for example, knows that interest rates need to reach at least 4-5% in order for it to have rates high enough to meaningfully reduce in the next recession – but at this dangerous stage in the rigged game, if the Fed tries to raise rates in the very debt bubble of its own creation, the markets panic and turn fatal.

The Fed has literally rigged itself into a corner. The ironies do abound.

And as we all saw in December of 2018, when the Fed tried to nudge rates up by even a quarter of one percent, the debt-addicted markets nearly died and immediately sought an unnatural “new life” from the Fed.

In this rigged to fail market scenario of complicity with Wall Street, the Fed in Q1 famously paused further rate hikes to give new breath to this otherwise dying, but now Frankenstein-like, market.

And now, despite “Fed-Speak” that says all is “reasonably good” for the U.S., we are looking at rates going further down – a desperate emergency measure masquerading as “support.”

This is a dangerous game, and it’s ultimately rigged to fail.

In a normal, fair, and accurate market, such market downturns like we saw in Q4 of 2018 are to be expected, even welcomed, as they naturally dilute the “alcohol content” of otherwise over-valued/drunk markets and allow sober investors to consider risk management rather than drunken speculation.

But in totally debt-driven, low-rate, and rigged markets, such drawdowns are artificially revived via central bank rate manipulation that sends markets toward unsustainable highs that only buy time and rising markets at the expense of far greater pain (and crashing prices) down the road.

But, folks, all you need to know now is this: By lying about inflation and hence artificially suppressing/pausing interest rates, the Fed and D.C. have shown us that the markets are rigged rather than “recovered.”

Again, we literally trade in a Frankenstein market, and such monsters bode danger ahead.

The trouble is, everything is masked in lies…

4. Rigged to Fail Market: The Real Statistics are Buried in Lies

As to such lies, nothing reveals a rigged to fail market system more clearly than the intentional distortion of facts. Sadly, we are seeing record-high examples of deliberate myth creation from the agencies and institutions along the D.C./New York City corridor.

Given today’s record-high corporate, sovereign, and household debt, the market rigging Fed and its masters on Wall Street are quite aware that the stakes and dangers have never been higher.

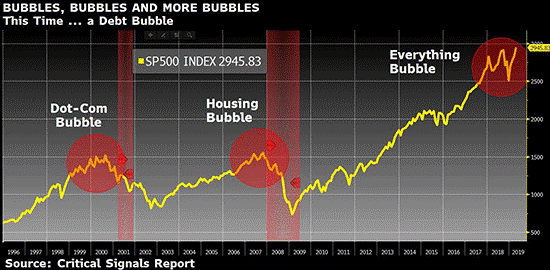

That is, today we are no longer in just a tech bubble (like 2000) or a real estate bubble (like 2008) but rather an “everything bubble.”

In other words, everything (stocks, bonds, real estate, private equity deals, tech, retail…) is at stake today, which means D.C. and Wall Street will desperately seek to do whatever it takes to prevent an equally record-breaking and historic catastrophe as markets and asset classes reach record peaks founded upon the sandy foundation of unsustainable debt.

Unfortunately, such sandy foundations ensure that the very markets upon which they are built are equally rigged to fail.

But for now, one of the easiest ways to keep rigged markets alive despite such realities is to intentionally influence a false perception of strength through the intentional delivery of bullish hype.

The better word for this hype, however, is blatant dishonesty -you know, lies.

That’s why the Fed and Bureau of Labor Statistics (BLS) have deliberately lied to us for years about “roaring GDP growth” and “contained inflation.”

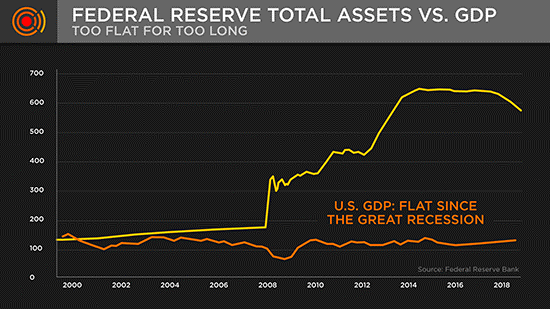

But with markets skyrocketing on debt, our actual GDP since the 2008 crisis has only annualized at a pathetic rate of 2%.

Thus, we have debt (and hence markets) skyrocketing, while GDP flatlines – a classic sign of a rigged to fail market.

And as for inflation lies, again, we all know that costs (inflation) are rising in education, energy, health care, and housing. Just walk out your door and open your wallet: The proof is everywhere.

In order to get around this open lie, however, the BLS simply ignores/under-weighs these data points. Equally dishonest are the clever ways the SEC allows public companies to exploit ex-items accounting tricks to make their profits and earnings reports look far better than GAAP reality – effectively and legally allowing companies to use clever bookkeeping schemes to bypass overhead costs to “cook” their adjusted profits and earnings statements.

Such ex-items schemes are essentially the equivalent to a lemonade stand where the beverage sales are reported but not the cost of the lemons.

Again, this is an SEC-sanctioned earnings scam totally unknown by most, yet totally rigged by the Street.

Yet perhaps the most brazen yet open lie that we’ve been sold for years is our “record low” U3 and U6 unemployment figures. Like the other myths coming out of the BLS, the unemployment lie is largely one of omissions.

That is, when calculating the number of unemployed, the BLS measures it as a percentage of a clever sample pool known as the “civilian labor force.” What they omit telling you, however, is that this “civilian labor force” does not include the tens of millions of Americans who’ve totally given up looking for work.

In essence, D.C. thus measures the “low” number of unemployed workers with the same distortive conclusions as if measuring the number of short people in America, but using the NBA as the sample pool. It really is this crazy, this rigged.

Taken individually as well as together, these extraordinary lies as to GDP, inflation, earnings, and unemployment can be proven mathematically, empirically, and apolitically.

They are clear indications of a rigged rather than transparent market.

A less direct form of market rigging comes from the actual nature by which the majority of wealth advisors provide consensus-driven (safety in numbers) market advice.

5. Rigged to Fail Market: Today’s “Advisory System” is Totally Rigged – and Not in Your Favor

For generations, wealth advisors, banks, and other financial advisory shops have traditionally argued that the best way to make money is to diversify your assets within a pie-chart portfolio of stocks and bonds.

These portfolios take about five minutes to construct by any first-year bank or advisory employee…

Advisors today almost uniformly recommend that you essentially stay “all in” and “at all times” to ride out highs and lows by simply “buying and holding” such cookie-cutter portfolios.

They say (and even believe) this is because history confirms that such an approach is the best way to compound returns and avoid “market timing” mistakes.

But in the current market backdrop of rigged highs and artificially sustained debt risks, such traditional thinking will get you slaughtered, like bringing a traditional muzzle-loading musket of 1776 to the D-Day landing at Normandy.

In short, what worked yesterday won’t work tomorrow. Here’s the truth behind this rigged game…

- Advisors are paid a percentage of what you have invested in markets – thus it’s in their own best interest to keep you nearly permanently invested all the time. Needless to say, Wall Street loves this, too.

- The government also wants you to be all in the markets all the time because the government makes money on capital gains taxes provided by a stock market filled with permanent buyers and hence longer highs.

- IRAs and 401(k)s are equally rigged to keep you in the markets all the time, regardless of dangerous market conditions. Early withdrawals before retirement age are thus heavily penalized.

The smart money, however, knows that since 2008, the game is more rigged than ever. A historical bubble is forming, and all bubbles eventually pop.

The smart money (including most insiders of this “rigged game”) therefore avoids bubbles, go deeper into cash at hyped market tops, and then buy at signaled market bottoms.

That is why those in the top 10% who can afford the high-end advisors at places like UBS, Morgan Stanley, and Bank of America are currently going to cash allocations of 25% or greater even as markets break all-time highs.

Unfortunately, today’s “advisory system” for the rest of America is rigged to criticize such “active portfolio management” or cash positions. Instead, they seduce average investors to chase tops rather than patiently manage risk by exiting dangerous peaks before returning later to buy at market bottoms.

That is, most experts will tell average retail investors that markets are impossible to time and that the number of days responsible for the bulk of your gains as well as losses in any given ten-year period is so few that you can’t predict them and thus you just need to “stay in” all the time with proper diversification.

They’ll also tell you that “all markets eventually recover,” so just wait out the pain.

To some extent, we agree.

No one can time a market, even a rigged to fail market. No one knows precisely when it could turn. Halloween? Christmas? This year? Next year? Impossible to say.

But while no one can predict the precise time of the first raindrop of a rigged to fail market storm, most smart folks can predict the rain is coming by simply looking at the color of the clouds.

When market clouds (indicators) turn stormy, you don’t need to be a meteorologist to know it’s time for an umbrella. And sure, all markets do recover eventually.

But ask the Japanese what happened to them in 1989. Like us, their equally obvious (yet ignored) rigged to fail market was thriving for years on happy debt – and then they tanked, big time – by over 80%. A classic rigged to fail market that failed big time.

And guess what, it’s now 30 years later and their market has yet to recover…

When our rigged-to fail market tanks next, how many of you can afford to wait 30+ years to “recover” your losses? Please, please, please do not make the traditional assumption that riding out storms is historically confirmed to work, or that markets will quickly recoup your losses.

As Japan’s example reminds us, some debt binges and market parties are simply too decadent, too extreme, and too absurd – and thus can’t be solved with a central bank aspirin the morning after.

If you lose 50%, 60%, or even more in the next crash to hit the U.S. markets, one driven by historically unprecedented debt (falsely described as “stimulus,” “support,” or “accommodation”), you will not see it (or your losses) come back in one or two years…

Instead of the V-shaped “recovery” we saw in 2009 (driven by astronomical money printing and debt), the next L-shaped recession to hit the U.S. will last much, much longer, because even our arrogant Fed can’t just print money to infinity and outlaw recessions – despite every effort to do so in the last 11 disturbing years of “keg party” markets.

Riding out the storm in a “set it and forget it” portfolio of inflated and highly correlated (and rotten) bonds and equally inflated stocks will not save you.

The pain ahead can last for decades, not years. But, and of course, the folks at the Fed, Wall Street, and the advisory shop down the block will likely tell you not to worry.

To them, history, debt, math, and even candor just don’t apply…

6. Rigged to Fail Market: Caution, Realism, and Common Sense are Ignored

Given that both stock and bond markets in the U.S. are now at historically unprecedented bubble levels, the risks have never been higher for both the markets and the otherwise ignored real economy.

And given such desperate (yet glossed-over) conditions, D.C. and Wall Street are increasingly forced to seek odd and blatantly desperate measures that are otherwise cloaked as “recovery plans” or “central bank-supported stimulus.”

In fact, such “recoveries” or “stimulus solutions” are merely further evidence of totally rigged measures to keep equally rigged markets alive on hype well past points of natural and realistic sustainability.

For now, however, the party rages on. It’s fun. We’re riding part of this free-beer high ourselves. We know that the Fed will continue to suppress or even lower interest rates to “buy more time” and thus try to solve grotesque debt problems by, alas… encouraging more debt.

If that offends you, then you ought to trust your common sense…

The most extreme example of such rigged support is the growing popularity of insane ideas like Modern Monetary Theory (MMT), by which D.C. and Wall Street are theoretically prepping to print trillions more dollars and effectively double current debt levels without, as they “promise,” causing any inflationary harm.

This is pure, desperate fantasy.

But in rigged markets, fantasy is often disguised as policy and is given reassuring titles like “stimulus,” “easing,” or “accommodation.”

Moreover, fantasy works – even for a long time. Until it doesn’t.

And if more money printing doesn’t fly, then the Fed will certainly consider lowering rates into negative territory (like Europe and Japan), an equally desperate (and futile) measure that does buy time but is absolutely useless when it comes to solving systemic economic cancers like our current debt levels.

Today, there’s even increased talk of a potential “miracle solution” or great big debt “reset” by which the government passes measures to forgive large swaths of U.S. debt. If this sounds too good to be true, that’s because it is.

But in a rigged game and rigged to fail market, no one in public office (or from a bank being interviewed on TV) will admit to this or speak the plain truth.

But we will.

Folks, a debt-forgiveness “jubilee” may seem like a simple solution, but what happens to markets, pension funds, banks, insurance companies, and countless other institutions that hold those magically forgiven debts as investments?

They tank, that’s what. And so will your portfolio, savings, and faith in fairytales.

There’s also plenty of hype now about how blockchain, artificial intelligence, and the Internet of Everything are about to be the next mega “revolutions” for markets, possibly sending the Dow to 50,000 or more.

We certainly agree that tech is the future, but it’s not a future that just goes straight up. It is essential to remember that mega-tech stocks like Microsoft, Cisco, and others can (and did) lose 50% or more in a market crash (think 2000-2003) despite being leaders in an otherwise revolutionary tech sector melt-up.

In short, even if you rightly believe that the future of technology will result in extreme stock price increases, don’t believe the rigged hype that such moves don’t come without dramatic volatility and price decreases along the way.

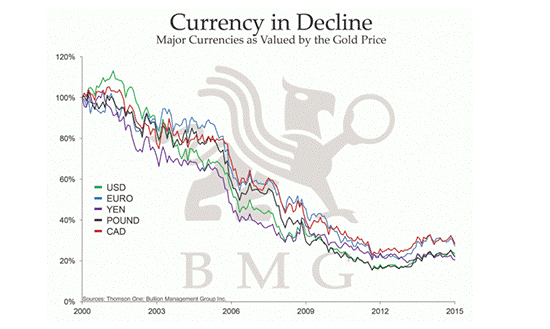

Already, the staggering levels of debt and money creation around the globe have objectively destroyed the purchasing power of the major global currencies when measured against traditional stores of value like gold.

Just imagine what further “stimulus” would do to the already crippled purchasing power of your currency.

But again, in a rigged game desperate to keep investors fully invested in all conditions and at all times, such caution, facts, and common sense are deliberately ignored. Instead, hype and evidence-suppression are king.

7. Rigged to Fail Market: A Debt Crisis Can NEVER Be Solved by More Debt

As per all the data above, it’s clear that today’s market is indeed a rigged to fail market.

Throughout the history of U.S. markets, from 1929 to today, every debt binge rigged by desperate, over-extended monetary policies (FDR in the ’30s, the post-Nixon ’70s, the dot.com late ’90s of Greenspan, and the sub-prime fiasco of the Bernanke 2000s) always ends in failure.

The most that the central bank and its Wall Street cronies can do now is seek to postpone this failure.

But in doing so, they only make the conditions worse down the road.

To help this sink in, think of an even more extreme example like the French revolution…

In 1790, France was the strongest economy in the world, but it had a debt problem…

Solution? Easy. Print a gob of money and throw a low-rate debt party.

Result? Fun for a while, followed by total collapse and over 40,000 folks losing their heads…

But, and of course, 2019 America is not the same thing as 1790 France… Unlike the French of 1790, the U.S. currently has the extra help of having its Petro-Dollar also serve as the world’s reserve currency.

This gives us significantly more power to buy significantly more time as the best patient in the global ICU of debt-sick markets.

But despite the relative strength of our currency and place in history, this relative strength – which we are tracking daily – only delays (but does not prevent) a massive market selloff.

That is, throughout the history of markets, from first-century Rome to today, a debt crisis can never be solved by more debt. Never. Not ever. Period.

Since the days of Nero, there have been 54 recorded examples of countries attempting to solve one debt crisis via the creation of a new debt bubble.

And in each of those 54 cases, the net result was a massive economic disaster.

Folks, that’s 54 examples, and 54 failures. Do you really think “this time is different”? The Fed wants you to think so. They are relying on your faith/ignorance. But now, you know better…

In the end, such rigged and desperate measures to enrich one class and/or industry can merely buy time, not offer a permanent solution. These very measures are historically rigged to fail.

But just because we live in a period of dangerously rigged markets doesn’t mean that informed investors can’t prevail in such otherwise sad conditions.

Signals Matter, and the portfolio solutions we’ve designed, were created for precisely this reason: To prepare and protect all investors, not just the fancy lads…