Below we look at Tesla in the broader context of bubbles in general and tech growth stocks in particular.

Bubbles in General

Last week I shared a series of market charts that suggest U.S. stocks are well into bubble territory and heading toward a needle, or as my son would say: One big bug looking for a windshield.

Bubbles are nothing new, and predicting their expiration date, especially in a Fed-doped (aka “accommodated”) backdrop is a fool’s errand.

This, however, doesn’t mean it’s foolish to be prepared, nor is it foolish to call a duck a duck or a bubble a bubble.

Us realists (as opposed to just “bears”) are not alone. From Robert Shiller to Jeremy Grantham, the facts and conclusions are hard to ignore.

In fact, Grantham has publicly compared the current US stock bubble to the South Seas Bubble, the Crash of 29 and the dot.com mania.

I agree.

The Ponzi Phase of the Minsky Cycle

When valuations become silly and investors become blindly top-chasing and hope to sell to greater fools for higher prices tomorrow, we enter what Hyman Minsky called the “Ponzi phase” of his infamous Minsky Cycle—one that ends in disaster the moment easy money dries up.

By easy money, I’m referring to a number of forces, from: 1) money printed at the Fed, or 2) cheap money whose rates are repressed by the Fed to 3) dumb money chasing tops created by the Fed. (See the Fed pattern here?)

I’ve written about these forces (and Fed) for years, as these “Fed markets” have been over-valued for years.

As anyone who remembers prior bubbles, they can last longer than rational minds can imagine, and thus rather than predict expiration dates, I simply track the crazy and wait for the right market signals to get out or go short.

And as for my big short, more on that below…

And as for what’s easiest to track and signal the “Uh-Oh” moments, just follow the 3 forms of money above.

Once any one or all three of those forces (printed, cheap or dumb money) dries up, it’s party over.

The Real Bubble—Tech

Investor behavior, alongside easy money, are equally correlated to bubble growth and risk blind portfolios.

When investors see and chase something too good to be true, we can be confident that the Ponzi Phase discussed above is in full gear, and nowhere is this truer than in the current tech sector.

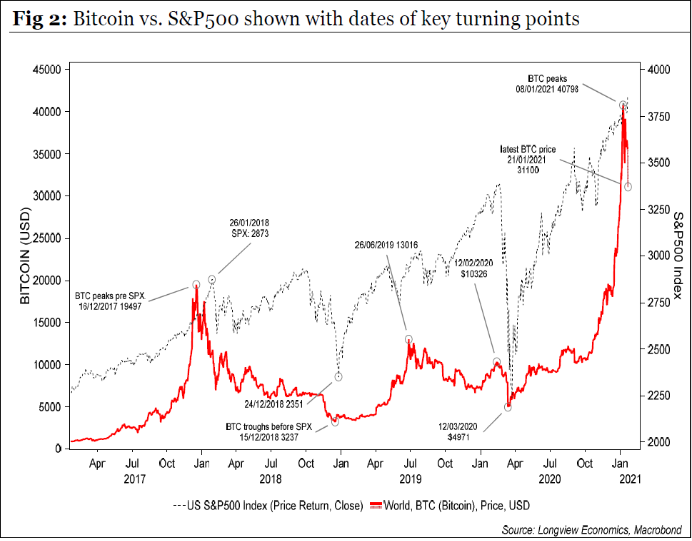

Bitcoin—New Money or a Panic/Euphoria Index?

BTC has gone ballistic in recent months, and tends to skyrocket whenever the S&P has a hiccup.

Many crypto-fanatics, of course, see BTC and other digital currencies as the “New Gold.”

I don’t. Not at all.

Although crypto’s are part of the brave new world of distrust in current fiat currencies and deserve pages rather than paragraphs to debate and consider, I ultimately see the crypto euphoria as less a sign of a new currency solution and more as a sign of a panic/euphoria index.

As greed replaces common sense, investors over-pay. Always have, always will.

I saw them do that with tech stocks like CISCO, Yahoo and Microsoft in the run up to the dot.com bubble of 2000 and with mortgage-backed securities in the run up to the 2008 disaster.

For crypto bulls, of course, I’m just in denial of the new magic of block-chain.

Perhaps this true. Truly—nothing would surprise me these days, and crypto’s like BTC can rise higher than nature (of which digital is no part) intended.

I’m in no position to predict the irrational. No one is.

But let’s look at the tech and growth world beyond just crypto’s to see more clearly at what crazy looks like, ok?

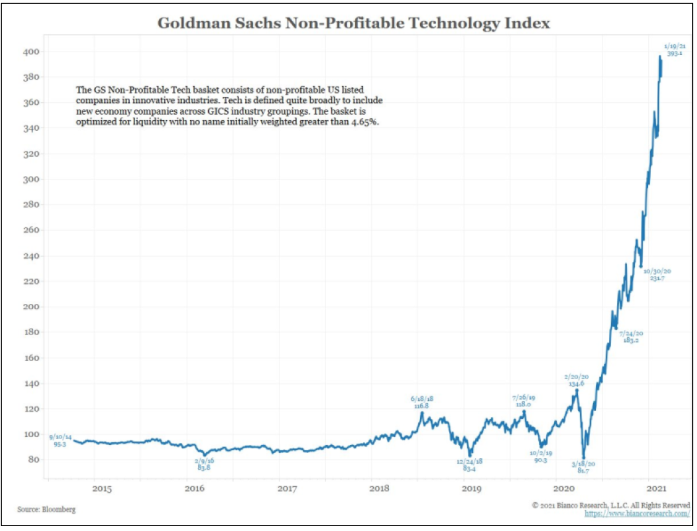

Technology & Growth Stocks in General—Pure Insanity

As I witnessed first hand in my youthful hedge-fund days as an over-paid lottery winner on the IPO-rich NASDAQ of the late 90’s, it’s never a safe sign when non-profitability is in vogue.

The Goldman Sachs IPO that paid for my lavish lifestyle in the Bubble of 2000 never made a dime of profits or earnings—it was just a big fat “growth projection” …

…which I sold for hundreds of dollars per share before it tanked to its inherent value of zero.

But oh, how history rhymes…

Today, that same Goldman Sachs, of which my beautiful and brilliant daughter is a crack analyst, is once again making gobs of money selling tech stocks which have yet to turn a penny of profit.

Hard to believe?

Naaaa. I’ve seen this movie before.

Still hard to believe?

Then have a look for yourself at the following chart of Goldman’s index of tech stocks that have no profits…

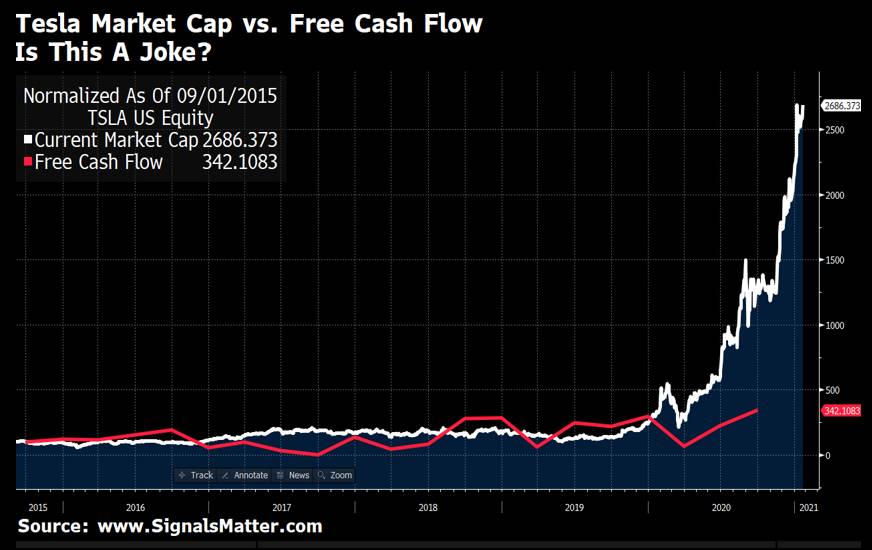

Tesla—My Patient Big Short

And then there’s Tesla…

Boy do I have a problem with Tesla — and it a problem with me.

Since Signals Matter opening market report in 2017, I’ve been mocking the great Elon Musk with great Piepenburg elan, as this report in May of 2017, or this report in April of 2018 or this more scathing report in August of 2018 made all too clear.

But so far, and perhaps even into the future, Elon has been enjoying the last laugh at my humiliated expense and I have been brutally humbled by Tesla’s meteoric stock rise, despite my clear disdain for the Musk hype.

I get that electric cars are the future. I get that technology is the future. I get that growth stocks have merit, and I get the green new vision for the world.

But I still don’t get Tesla’s valuation and I think it’s now priced beyond anything at all resembling sanity, let alone silly old things like free cash flow… (I will note that my son, when he was then 12 years-old, told my dad and I to buy Tesla at $17 per share. We, regrettably, ignored him…)

As of this writing, Tesla is the 6th largest company in the U.S., and the world’s largest auto manufacturer—IN TERMS OF MARKET CAP.

But in terms of actual car sales (or FCF…), it’s not even close to a global leader. It’s an over-priced, over-hyped bubble story for the history books.

Of course, the sell-side, as well as anyone whose made big bucks on Tesla, will roll their eyes at my beaten pride and misplaced resentments to visionaries like Elon.

They will remind us, and me in particular, that one must be forward looking and see the future growth rather than current car sales (or cash flow) to truly appreciate the genius and value of Tesla.

Fair enough.

Wall Street’s sell-side (who do in fact resemble car salesmen, so perhaps Tesla is right up their alley) are expecting earnings for Tesla five years out to boost the over-all earnings per share for the S&P in general and the consumer discretionary sector in particular (of which Tesla is now a part) to grow by greater than 80%.

Folks, that’s a 20-fold increase, driven by Tesla, over the next five years.

Hmmm.

This would mean that Tesla’s stock price will go commensurately much higher.

Hmmm.

I doubt it.

Of course, I may be dead wrong. I’ve been wrong before.

But I’m not buying this projection, nor this stock.

Again, I I’ve seen this movie before—and it plays out (and sells out) just before tech bubbles, like all bubbles, pop.

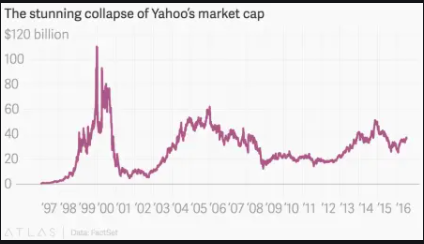

The Yahoo Factor

I remember when Yahoo made similar headlines back in 1999; I was a hedge fund PM in my 20’s and dreaming of becoming a Rockefeller.

Yahoo had the sell side projecting massive earnings growth for the next five years then as well. Like Tesla, Yahoo was the market. Yahoo was the next great mover. Yahoo was the future.

But then Yahoo did what just about every over-valued, over-hyped, over-sold tech growth stock does when the shine wears off: It tanked by greater than 60% in what seemed like minutes and its once immortal market cap, well…died.

Of course, Tesla is not Yahoo.

Tesla may prove that “this time is different” and soon its stock, like its cars, will literally fly to the moon on magical Elon dust.

Anything’s possible.

Shooting Unicorns

But like a veteran sniper, or an experienced deer hunter, I can be patient.

I still believe valuation matters.

I’ll be looking very carefully at the big-picture money flows (above) and the technical signals before me with my finger on the short trigger for Tesla.

Why?

Because I feel the best bet on this over-priced unicorn is to be against it.

And no, I don’t think Tesla will disappear.

And I don’t think Elon makes bad cars.

And I don’t think gas-guzzling Range Rovers are the future.

Like Yahoo, Tesla will live well beyond the next imploding bubble.

But like Yahoo (or Cisco, or Microsoft et al in the late 1990’s), I think Tesla today is simply this: GROTESQUELY OVERVALUED.

And thus my patient and long-awaited hunt for the perfect short on the perfect unicorn continues.

Tesla is in my gunsights, but for now, that itchy trigger finger will have to wait.