Below we give a sober analysis of the bull and bear case for gold as well as shed needed light on the current Bitcoin mania, Bitcoin debate and possible Bitcoin trap.

I’ve written a lot about gold over the years, and my convictions are no secret. I’ve also written at length about Bitcoin, and my envy is equally no secret.

Although not here to mock Bitcoin or those who love it, I am here to splash some cold water on the face of those who compare Bitcoin to gold, or even worse, of those who feel gold’s reign is past.

Toward this end, I am equally not averse to considering and examining the bear cases for gold, as informed investors deserve balance not bias.

There are gold headwinds worth considering, especially for those who don’t invest in gold for the long-term and are thus easily spooked by near-term price headlines and moves.

As someone who sees gold as longer-term fire insurance for global currencies already burning to the ground, such price volatility matters very little to me, as the longer-term wealth preservation role of gold remains not only without equal in history, but without doubt in my mind.

That said, let’s look at the big picture, including the headwinds and tailwinds, and draw our own conclusions with a little help from my own.

The History of the Gold & Silver Dance—A Bearish Sign for Gold?

In the 50 years since Nixon removed (i.e. welched on) the U.S. gold standard, an interesting dance between the price of gold and silver has been in play, the choreography of which resembles a kind of patterned waltz.

Silver typically lags gold momentum, then surges ahead, followed by both metals declining in price, sometimes for years at a time.

Beginning in August of 1971, for example, gold skyrocketed 350% from $40 to $180 once.

Thereafter, silver began its delayed move as the gold rally stalled by the end of 1974 for a period of four years until 1978.

In a period of only 90 days, silver rose by 120%, and the gold-silver ratio went from 47 in late 1973 to 19 by early 1974.

By the end of 1978, gold was again rising and the gold-silver ratio rose back to 40 as silver lagged.

Then, once again, silver jumped on the faster horse and advanced by 800% in less than a single year, hitting $50 per ounce by the first weeks of 1980.

At that point, investors feared that such a silver spike foreshadowed a shared decline in both gold and silver, which is precisely what happened next, as both gold and silver entered a twenty-year bear market of respective 70% and 95% price declines.

Ouch.

Later, in 2010, silver once again began to rise past its prior $50 highs, foreshadowing yet another joint price decline in both metals after peaking in 2011.

Thereafter, and as per the prior “dance,” both metals once again entered yet another bear market phase lasting five years, with gold bottoming by 45% by Q4 of 2015. Silver bottomed even more, and by 2016, the gold-silver price ratio hit 65.

By 2019 the ratio steepened as silver prices continued to fall and gold made its rise just as COVID began to make the headlines, sending silver even further down to $12 by March of 2020 and the gold-silver ratio to an extraordinary 123.

Then, as most investors know, silver began its familiar catch-up rally, doubling in price and sending the gold-silver ratio down from 123 to 70.

So, what does this mean today for gold and silver?

As per above, we saw silver’s catch-up rallies in 1973, 1979 and 2010 as a sign of bear market warnings for both metals.

Does this mean another bear market for these two assets tomorrow?

Other Bear-Scares for Gold & Silver—Declining Central Bank Demand

Precious metal bears will also note that central banks have slowed their gold purchasing.

In 2020, central banks bought a record 660 tonnes of gold, ending a ten-year binge of over 5000 tonnes collectively.

But that buying has slowed, as has the gold price surge of 2020—for now.

Furthermore, the gold sold by central banks has not been re-purchased with similar gusto.

Russia’s central bank, for example, recently announced a suspension of additional gold purchases—due more to the cash-crunch it’s suffering from tanking oil prices and COVID pains than a loss of longer-term faith in the metal.

Turkey, which was a big gold buyer in early 2020, is equally likely to curb buying as their financial conditions deteriorate.

And as for China, having surpassed India as the world’s largest gold buyer in the last two decades, it is now evidencing less demand, as the premiums (as high as $15) it has traditionally charged above the global gold price have been declining rather than increasing, and are in fact now trading at $50 discounts.

The Bitcoin Buzz and Gold Price Declines

Needless to say, Bitcoin has also been taking headlines, as well as market share, away from the gold market and gold “buzz” as well.

Over $2B in outflows from gold ETF’s alongside $7B of in-flows into Bitcoin can’t be ignored, as digital currency bulls equate blockchain to the “new gold.”

Designed as a digital cash system, Bitcoin’s original and noble vision as an electronic wallet was soon usurped by its use on the Silk Road, an online mecca for illegal drug sales.

Such shady uses are less discussed today as BTC makes greater inroads into the main stream consciousness.

That said, BTC is not alone, nor even supreme, as a payment tool.

Over the last decade, payment tools like Cash App, Zelle, Apple Cash and Venmo have emerged allowing transfers to take place in seconds for reasonable fees.

BTC fees are around $10 per transaction, but almost no one is buying BTC for such transactions, as other tools are superior.

The simple truth is Bitcoin holders are getting rich by just watching its value rise in their Coinbase wallets, not because they believe BTC is (or will be) good for grocery or car purchases.

For BTC holders, the only thing on their minds and e-wallets other than instant wealth has been the cost of electricity needed to mine more of these magical coins as concerns rise about straining, or even killing, the electronic grid where coins are “mined.”

Bitcoin Beware

But what really is Bitcoin? Is it an online cash system? A truly safe, un-seizable “digital gold” that will protect holders from debased fiat currencies and the inevitable rise of inflation?

In short, will BTC send gold into the history books and gold prices to the basement?

And when placed in the broader context of the gold-silver dance described above, as well as declining central bank purchasing of gold, is gold in trouble?

The short answer is no.

Gold’s Bull Market Has Only Just Begun

Why?

Although it’s normal to expect a correction phase within a larger bull market for both silver and gold, the price retracements of late signal a buy opportunity for precious metal investors, not grounds for a bearish panic—unless you’re a gold trader blind to technical buy/sell signals.

The broader bull market in gold today is much different than the bull market of 1971 to 1974, or 2000-2011, which saw very little interest/demand from western buyers.

Demand going forward will in fact be driven more by western than eastern buyers, though current investors can’t ignore declining demand from China, Russia or India going forward.

That said, the gold-silver dance described above will be very different going forward as both assets rally in synch rather than one step up, two steps back.

Most importantly, the world in which gold and silver trade today is infinitely different than the world it rose and fell in during the post Nixon era and the cycles described above.

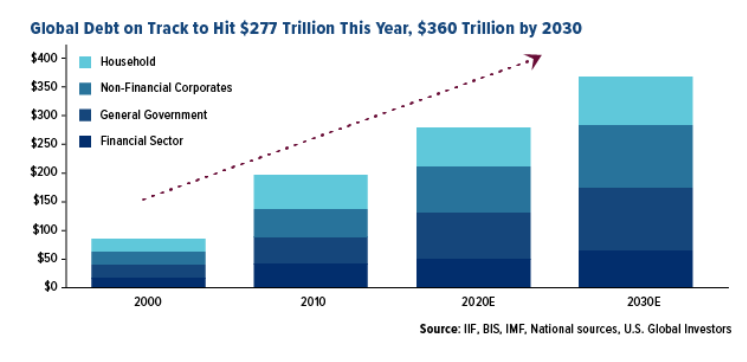

Unlike prior bull and bear cycles, the global economy today, unlike say 1973, 1979 or 2010, is flat-out broke, with global debt at $280T and global GDP 1/3 of that horrific number.

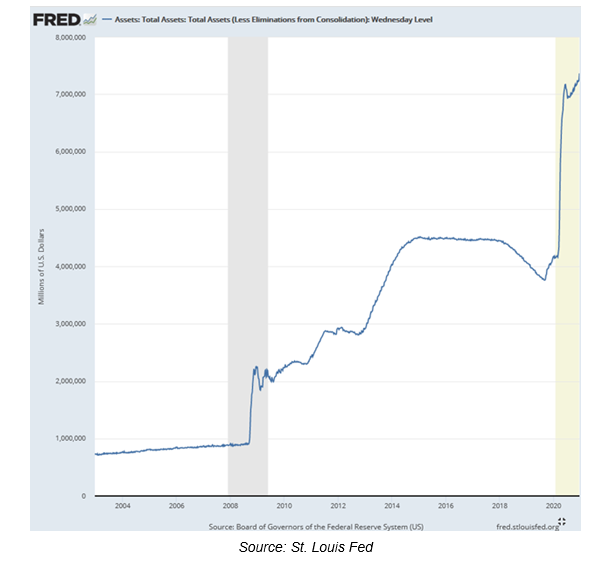

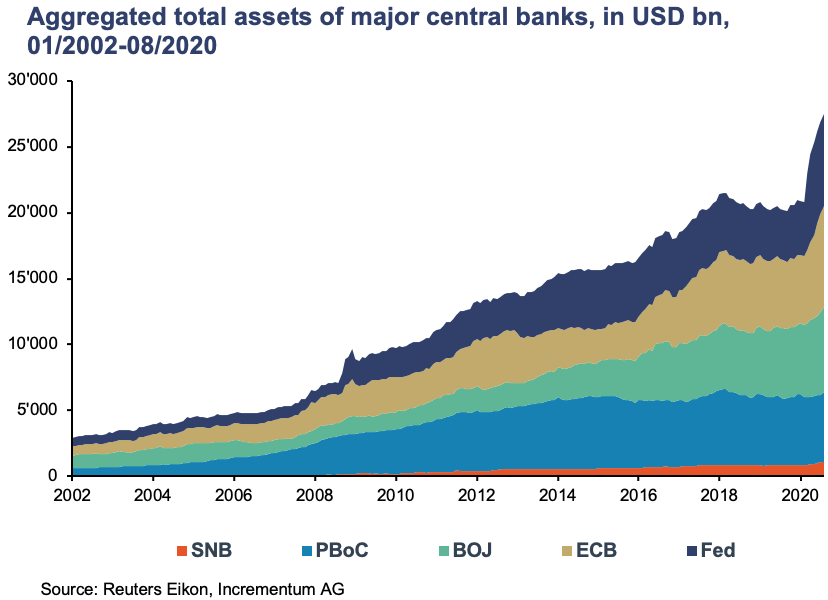

With this much debt off our bow, the only way to pay for it has been with printed dollars, yen and euros. Lots and lots of them. Just look at the Fed’s recent printing spree…

Central bank balance sheets (i.e. the levels of unfathomable amounts of printed currencies) are unlike anything seen before in the history of capital markets.

At greater than $28T and counting, the level of fiat (i.e. fake) money has never been this high, which means the amounts of increasingly worthless paper money has never been this grotesquely inflated nor the purchasing power behind them so profoundly debased.

Of course, this also means that the need for a genuine real store of value, i.e. gold, to legitimize now openly discredited fiat currencies has never been greater.

Never. Not ever.

But is Bitcoin the answer to this fiat currency disaster?

Nope.

Bitcoin Is Not the New Gold

Bitcoin, as a store of value so necessary to the inevitable and eventual recalibration (or re-setting) of the current debt and currency markets, is simply not the answer.

That is, Bitcoin may be many things, but it is not a currency stabilizer.

As an instrument of speculation, of course, Bitcoin is (for now) an absolute dream asset, with far, far, far greater speculative and price power punch than gold.

The 5X annual price moves, the 10% daily gains (and losses) and the overnight millionaires made by Bitcoin are beyond compare, even to the speculative success recently enjoyed by gold. Nor is BTC a mere “tulip mania”–as tulips don’t have blockchain DNA..

But therein lies the key point. BTC’s radical moves are more a sign of mania than just the “new normal” in alt currencies.

Although gold can and will see price surges (and losses), the kind of surges made by BTC are far too volatile, up or down, to be considered as a credible store of value.

In short, Bitcoin will not be the Fed’s next balance sheet asset nor the IMF’s next SDR/currency solution.

The extreme price fluctuations in Bitcoin invalidate its claims as a store of value. Full stop.

As to being un-seizable, Bitcoin in fact, is quite the opposite. There have been many instances of government confiscation of this digital asset from illicit enterprises.

Furthermore, and unknown to most, Bitcoin’s source code (and the complex inclusion of a “segregated witness” modification by Bitcoin miners) means that Bitcoin is no longer a digital cash system to be used as medium of exchange by other massive platforms, like…say Amazon.

Instead, Bitcoin is now being seen and held as the new gold—a fixed-supply asset to serve as an alternative to fiat currencies.

Hmmmm.

But how will Bitcoin serve a global population buying and selling goods by the second when it can only handle about 350,000 transaction per day?

Again, and whatever your or my opinion of the banking “elite”—BTC is not going to be the new currency, but merely the new tool of a massive mania making many investors undeniably wealthy—for now.

Bitcoin Manipulation-the Tether Effect

Of course, like any new toy in the markets, room for abuse and fraud is equally possible, if not likely.

There is growing evidence, rather than mere theory, for example, that Bitcoin’s astronomical rise has been artificially manipulated through one or more stablecoins, including Tether (USDT).

Without getting too complex, Tether was a coin allegedly promising a one-to-one USD backing.

There is concern, as well as growing evidence, that USDT agents were minting Tether coins out of thin air (much like the Fed creates dollars out of thin air), and then using those magically created USDT coins to buy Bitcoin on exchanges like Bitfinex.

In short, this suggests BTC price manipulation on steroids—and quite possibly a bubble of epic as well as fraudulent proportion.

In fact, this would make Bitcoin more than just a mania bubble—but something far worse: An artificial asset driven by artificial demand from other artificial coins. A veritable castle in the sky, of which the digital world will see many more.

In other words, digital currencies are hardly beyond massive levels of risk as well as manipulation—and hence destruction.

All Roads Lead Back to Gold…

Of course, gold finds its stability and source from the periodic table of the elements, science and the real world, not a software miner, hacker or digital trader in a dark basement.

BTC generates no cash flows, has no industrial or consumer use other than as something to sell to someone else, who may be the next greater fool rather than millionaire.

Just saying: Be careful.

When the world one day faces the facts that fiat currencies need a chaperone rather than just another fiat imposter to control open currency debasement and distortions, some re-pegging to gold is not only necessary, but inevitable.

Anything less would be a charade, and all of us, of course, are growing tired of financial charades.

For each of the foregoing reasons, gold is entering a new era as well as a new bull market, though not one free of price volatility or even manipulation.

Last Friday, for example, last Friday’s 1.4 million oz. sell order of gold in a single illiquid market trade was additional evidence of the open secret on Wall Street that gold prices can and will be manipulated by bullion banks dumping gold in massive volumes to tank its price in order to cover prior short exposures.

Overall, however, natural commodities, like natural market forces, get the last and final laugh over artificial markets, artificial currencies and artificial gold like Bitcoin.

For those therefore looking to truly hedge against these un-natural and distortive forces, as well as the inflation to come and the dollars to sink, gold will protect you Bitcoin simply won’t—in the long run.

For now, of course, BTC is making many rich, and I applaud them 😉

Good writen, but with one ” mistake” . Can someone explain what or who are bulion banks? Name of thi banks? I read everything and you are damn right. Congrats for free readings. Thx

Hi, the major bullion banks include JP Morgan, Goldman Sachs, Citi, Morgan Stanley, Merrill Lynch–i.e. the one’s taxpayers bailed out in 2008-09…Also included are RBC, UBS, BNS and RBC.

Simply, investment banks. Thx for answer.