Below we look at residential real estate. As the world tilts ever more into the current Twilight Zone of rising asset prices and tanking economies, many have been asking me about the housing markets.

The Big Questions as to Residential Real Estate Markets

In short, readers want to know if we are looking at another asset bubble in residential real estate in the same way we are seeing bubbles in risk assets like stocks and bonds?

The short answer is Yes. Absolutely yes.

But is the current residential real estate bubble as precarious as the nightmare we experienced in 2008?

The short answer is: Yes and No.

Ultimately, however, my bottom-line answer is also this: Be prepared for pain in the residential real estate markets.

Why?

Well, let’s just look at the numbers, the cycles and the data, ok?

Residential Real Estate Brokers Going for Broke

Like any profession based on commissions for income (whether selling cars, stocks, bonds, paintings or houses), brokers have no choice but to say “buy” at every opportunity.

Real estate brokers, of course, are no different.

I’ve poked some fun at real estate brokers elsewhere; they deal in face-shot business cards, flirty interactions and superficial small chat to sell real estate.

This is understandable.

What they don’t do, however, is deal in facts, candor or market knowledge. In short: Buyer beware.

Again, no blame. Residential real estate brokers make an often hard-living on commissions. They are therefore deliberately bullish on real estate and silent regarding broader facts, figures, prices and cycles that warn of risk.

The Last Residential Real Estate Bubble

In the run-up to the great housing bubble (and crisis) of 2008, for example, real estate and mortgage brokers collectively got “lose” not only with their “client-contact,” but also with their mortgage underwriting and smiley sales approaches.

Such broker behavior was made laughable in films like American Beauty and tragic in films like The Big Short. (Click Titles for excerpts).

Leading up to the 2008 crisis, for example, anyone who could fog a mirror could get a mortgage and buy a home.

This worked for a while. Commissions poured in, folks got new homes and brokers got new cars as demand for even more homes ensued.

This increased demand, led by lose mortgage and sales practices, led as well to increased home values. Homeowners saw their home valuations rising and felt “richer.”

The banks got excited too. They saw a chance to package all these mortgages into safe little asset-backed-securities called MBS, which I wrote about here.

All good, right?

Nope.

Slowly at First, Then All at Once

As we all know, many of those home buyers enjoying playful banter with their commission-based brokers couldn’t afford the houses and mortgages they were acquiring. They had bad credit and bad jobs.

Once those same buyers ran into a reality check, they had to let go of their homes, some voluntarily, some by law.

But the net result was the same: More homes hit the market.

Homes bought for the long-term were sold in the short-term. Suddenly banks found themselves foreclosing on homes which they had to quickly re-sell, often at discounts.

This new wave of listings, homes and quick sales sent home prices down, rather than up.

Those who still owned homes saw their valuations sink lower than the size of their mortgage. They were “underwater.”

Thus, they too began to sell their homes, further adding to the snowball effect of sell-offs and thus sending home prices and values to the floor.

Meanwhile, the MBS which traded all these mortgages on the public exchanges by the TBTF banks began to tank as well—slowly at first, then all at once—again, like Hemingway’s description of poverty.

The rest of course, is history.

By 2008, the once “un-poppable” residential housing bubble popped, as all bubbles do, and prices, valuations and dreams fell to the floor.

But the big question today is this: Are residential real estate prices, risks and bubbles in 2020 like those leading up to the 2008 crisis?

Another 2008 Moment Ahead?

Again, the answer is Yes and No.

Unlike the 2008 crisis, for example, today’s mortgage lending and credit providers, at least until recently, were far more careful in their underwriting.

In other words, post-2008 mortgages were no longer being handed out too easily and loosely to truly bad-credit buyers.

By improving credit quality, it was hoped that the post-2008 residential real estate markets could and would avoid another “credit crisis.”

Furthermore, Wall Street, having been burned by the MBS “weapon of mass destruction” otherwise known as the Collateralized Debt Obligation, or CDO, outlawed CDO’s to prevent another market implosion.

All good, right?

Well, as I like to say to my horse: Not so fast…

From Credit Crisis to Interest Rate Bubble

Sure, credit underwriting has improved dramatically since the pre-2008 debacle.

But face-shot brokers haven’t changed their commission-based ambitions, nor has getting a mortgage really gotten much harder since 2008.

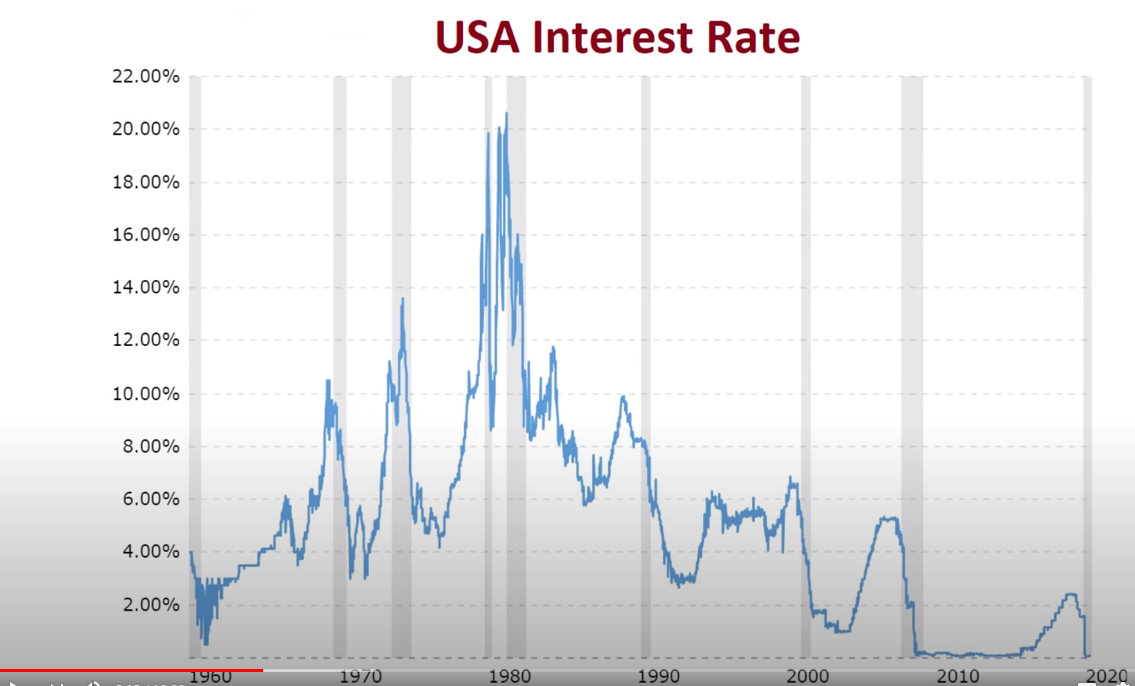

The main reason for this is that interest rates in 2009, as well as today in 2020, were stapled to zero, which as the graph below indicates, is a pretty rare occurrence.

The Fed, of course, is to blame, as they saw the need in 2009 and today to send rates to the basement of history in order to “stimulate” households, companies and even nations to take on more cheap debt and thus spend more to theoretically “boost the economy.”

But debt as a “stimulus tool” becomes a fatal tool when over-used, as I’ve shown in countless examples and reports.

Furthermore, with rates so low, most folks get no return or yield in their checking or savings accounts, so they tend to spend rather than save.

And with rates so low, and hence mortgage rates equally low, folks start spending on houses. As more houses are bought, the prices for houses rise in tow.

And that’s how a residential real estate bubble 2.0 is born.

Low Rates Distort Everything—A Nightmare in the Making

The average mortgage rate, for example, was once 8%. Today it’s around 3%.

Needless to say, this means even good-credit home buyers can buy nicer homes at lower rates which they might not otherwise have been able to afford at higher or even normal rates.

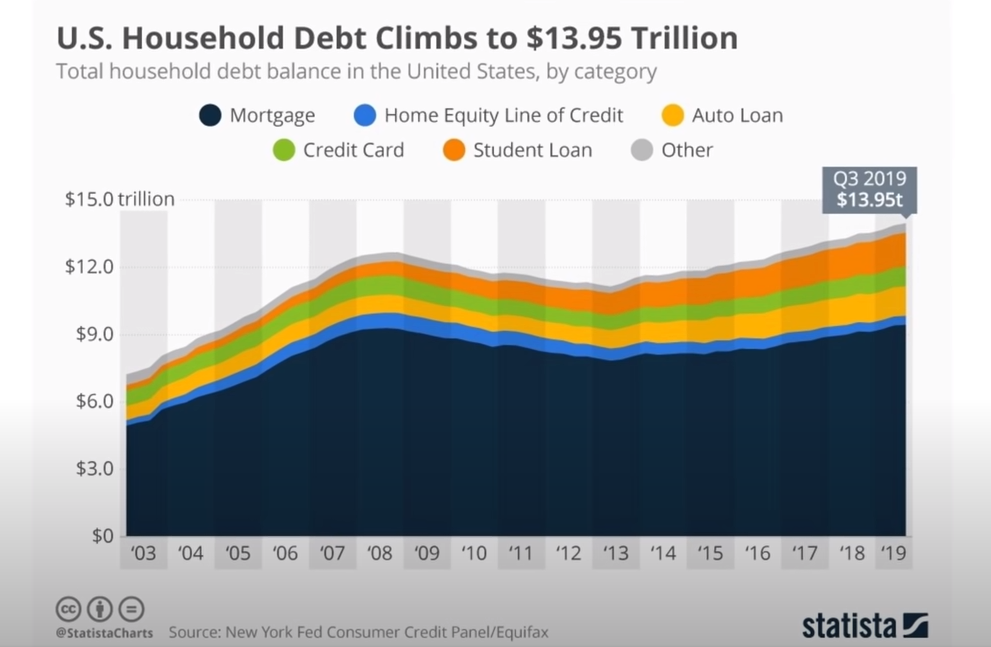

This also means that households, seduced by artificially low interest rates, are now in debt up to their ears. In fact, at $14 trillion, they are the most indebted they have ever been.

And therein lies the danger.

For debt is good when one can afford it. But debt is a nightmare when one cannot afford it, even someone with a far better credit score than those in 2006-2008.

In 2008, for example, we had bad-credit borrowers with toxic mortgages pushing up housing prices.

Post 2008, we have a different problem.

We have ridiculously low interest and mortgage rates pushing up housing prices by better-credit buyers who are over-spending on homes they shouldn’t otherwise own.

But here’s the rub: Despite better credit scores, those some buyers are now heading toward an economic “uh-oh moment” when and if the income is just no longer there to pay those mortgages.

It’s the Economy…

Despite rising real estate, stock, bond, and even art markets (all fed by Fed “accommodation”), the real economy, as we all know, is continually and slowly falling to its knees.

This is based on such stubborn facts as tanking GDP (i.e. national income) and rising unemployment.

The COVID disaster, of course, only accelerated the decline of an already declining economy.

And as expected, the post-2008 residential real estate bubble 2.0 began to burst right on que in early 2020 as even good-credit borrowers began defaulting on their mortgages.

Saved by Forbearances?

But then came the policy support from DC, the Cares Act, the printing of money, fiscal deficits to send checks to households, and, most importantly, DC-supported mortgage forbearance programs.

Desperate mortgage holders took immediate advantage of these forbearances, as the forbearance rate increased by 4X from 2% to 8% in the dark hours of early 2020.

This policy “solution,” however, was only a band-aide and hardly a sustainable answer to the volcanic rumblings beneath the current and highly dangerous residential real estate bubble.

As I argued in video-form here, and then again here, even if the Fed wants to artificially “support” markets (including real estate markets) via cheap debt, the next crash can come from the bottom up as more and more citizens stare down the barrel of a Main Street recession.

Just a Fine Line Between the Sublime and the Ridiculous

As Napoleon noted crawling from victory to defeat in the frozen march home from a burning Moscow, “it is only a fine line between the sublime and the ridiculous.”

For years, flirty-friendly real estate brokers and wide-eyed home buyers have been enjoying the “sublime” love-affair of low rates, easy commissions and homes which effectively sell themselves when rates are stapled to the floor.

But that fine line from the sublime to the ridiculous is merely one recessionary step away and comes to a disastrous end when the economy stalls, and hence jobs, incomes and mortgages can’t be covered.

That is, the sell-off spiral, which begins slowly at first and then all at once, kicks in as even good-credit homeowners can no longer make their mortgage payments.

Meanwhile on a clever Wall Street, the regulators who outlawed the toxic CDO’s of the 2008 Crisis, got back into the same racket by allowing something euphamisticaly called a BTO—or “Bespoke Tranche Opportunity.” They too, will begin to sell off as well.

As more homeowners and BTO securities are forced to sell, residential real estate inventories (i.e. supply) increase and hence housing prices decrease.

And as residential real estate prices fall, those in bigger mortgages go underwater, as their mortgage amount rises higher than their declining home values.

This leads, of course, to even more selling, and hence more housing price declines.

And that, alas, is how yet another residential real estate bubble pops.

Which brings us to the seminal question: Are we there yet?

Well, Yes and No.

When Will the Residential Housing Bubble Pop?

2021? 2022?

As always, I’ll disappoint you by telling the truth: I have no clue.

Why?

Because as in every bubble asset sustained by rock-bottom interest rate policies, Fed Fraud, monstrous debt levels, and fantasy, the sublime can continue long past rational levels so long as the debt which sustains it can be held at low rates and with employed debtors.

At some point, however, faith in Fed fantasy, fiat dollars and compressed rates ends when toxic inflation returns and jobs lost in 2020 do not.

As I always say–debt bubbles die when rates rise.

Housing bubbles die the same way. But they also can die when home owners lose their old income sources or income levels,which is wht we call recessions miserable.

The Clock on a Time Bomb

Looking at the residential real estate market is a lot like looking at a time bomb or the Frankenstein bond market:We see and hear the time bomb ticking loudly, but we just can’t read the face of the clock strapped to the dynamite of debt beneath it.

But one way or another, the bomb explodes.

The question is, are you prepared?

Residential Real Estate Advice?

Needless to say, those smiling and charming brokers won’t tell you much about the foregoing forces at play today for the simple reason that most of them don’t even know them.

They know commissions, wine lists and face shots.

As for me, I watch credit markets, economic data and employment cycles rather than crystal balls or real estate ads to measure and track markets, including residential real estate markets.

What I can say is this. If you are looking to buy a home today, you will be buying at an inflated top, not an opportune bottom, and that’s unwise in any asset class.

But if you are planning to get a low-rate mortgage, that’s your right—but I hope it’s at a fixed-rate and that you are confident of your individual circumstances and ability to pay it down the road.

Furthermore, if you’re buying a home for life, rather than a “flip,” the near-term price declines in a recession won’t mean as much over the long-term love of your family home.

Again, to each his/her own.

And for those of you with itchy trigger fingers and lots of cash on hand to buy residential real estate, be it high-end or low-end, for business or for personal use, my only suggestion is that you be patient enough to wait out this sublime phase and buy when the ridiculous phase arrives.

You won’t care about rising rates, as you won’t be using debt to buy.

More importantly, you’ll be buying real estate at a massive discount, where all the real wealth is made, regardless of the asset class.

And for those of you with second homes you neither want, use nor really can afford, selling at a top, before a panic, is the best time to do so—i.e. right now.

It’s your call. These are my views—and I promise: I make no commission on them.

Horse-crap…

As for me, all debt-driven bubbles labeled as “recoveries” or “miracles” are just horse-crap recoveries and dangerous bubbles.

Residential real estate markets are no different. For now, at least, the fun continues.

As shown at the end of my recent report here, I spend a lot of time around horses, but at least they are more honest about what they are dropping than these truth-challenged markets.

Look carefully where you walk.

Sincerely,

Matt & Tom