Below we discuss the traits of a market melt-up in the backdrop of a global pandemic and recession.

Sound crazy? Well, in this rigged market, anything is possible, including a market melt-up. Let’s see why.

Faker than a 42nd Street Rolex, and Bound to Break

I’ve made no secrets about how disgraceful I find the current disconnect between a tanking economy and a rising, central-bank supported stock market.

I’ve openly said as much recently here and here.

Nor have I been shy in telling you how a rigged stock market implodes. Fake Rolexes, like artificially supported markets, always break.

The two ticking time bombs beneath our currently rising markets are 1) a staggering debt bubble and 2) an inflationary/rising rate pin that will one day “pop” that bubble and send markets tanking.

As likely, the economy will simply continue to rot from the bottom up, a scenario whereby a recession leads to market implosion rather than a market implosion leading to a recession.

These forces and facts are undeniable. The market and economic future is bleak, yet hiding stocks still hide (and climb) behind the mask of artificial support.

But as I also said here, just because these painful endings are inevitable does not mean they are imminent.

In other words, the possibility of another (or continued) market melt-up is not off the table.

The Fed Giveth and the Fed Taketh Away—The Great Ironies of Faking It

The great irony behind this totally rigged market–a market so grotesquely distorted by central bank intervention and systemic risk–boils down to this:

The combined forces that will inevitably kill the markets are the very same forces sending them higher.

Or to borrow from another cliche: “Live by the sword, die by the sword.”

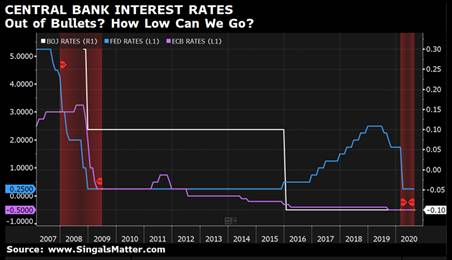

In short, more free debt (i.e. zero-bound interest rates) and unlimited QE (a powerful “sword” indeed) may be (and are) deadly steroids, but before they kill the market via overdose, there’s another intoxicated high in motion—one more “last hurrah,” one more yellow jersey before this Lance-Armstrong market disgraces itself.

In other words, it’s time to consider another market melt-up.

Really?

Yep. Really.

A Cynical Realist Speaks—A Market Melt-Up?

I can feel and see your eyes rolling.

“But Matt, you’ve been bashing these markets for months, for years. You even wrote a book entitled Rigged to Fail ?!

How can you be suggesting that these totally broken and destined-to-fail markets can go higher?”

Well, my point today has nothing to do with rotten fundamentals but everything to do with punch-drunk central banks, market history and investor behavior.

In a Fed market rather than a stock market, the bear-bull debate is effectively academic rather than helpful.

One simply has to track policy, not supply and demand, or rational price discovery to forecast near-term market trends.

In short: Where the Fed goes, the markets follow.

Sad, but oh so true.

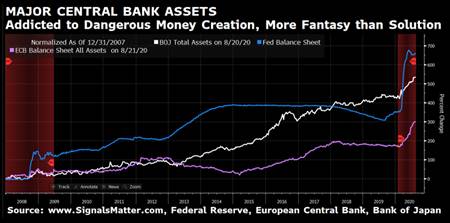

As for now, the Fed, as well as all the world’s major central banks, are printing fiat currencies—which is like a whole new keg of beer to a market rave party.

I’ve been equally blunt (and consistent) in reporting that when the Fed, however broken, addicted and desperate it may be, hands the markets a fat pitch or free-ride (albeit a steroid-soaked and dangerous ride), investors can’t ignore it.

For example, twice in 2019, I told investors to expect a risk-on rally despite a totally broken stock and bond market.

Why?

Simple—the Fed was telling us so. It was handing the Fed-“stimulus”-addicted markets the needle-chill of more “accommodation.”

In Q1 of 2019, for example, the Fed slashed rates—so I said risk-on! In Q3 and Q4, they started printing more money, and so again, I dropped my fly rod and shouted…risk on!

But risk-on doesn’t mean risk-be-damned, or that one should just take 100% exposure chasing a delirious top. (More on this below.)

Ironies Everywhere

For example, throughout 2019, I wrote of all the reasons we could expect a 2019 melt-up, and we sure saw one.

But note as a well that I warned equally of a melt-down, of which we saw only the first hints in Q1 of 2020 and in the September repo disaster of 2019.

COVID, alas, was the straw that broke the 2019 market bull’s back, a back which was already too weak to stomach a sniffle, let alone a viral pandemic.

But here’s the great rub and irony of 2020: COVID not only broke the 2019 bull’s back, it also gave it new life.

As I wrote in May, COVID first crushed the markets and then COVID saved the market. Indeed, the ironies do abound.

That is, while posturing as humanitarian saviors, DC and the Fed promised to rescue a real economy battered by a pandemic. Eh hmmmm.

But the bulk of the printed money and low-rate policies unleashed by the Fed to fight the global virus went into the markets, not the real economy.

This was a clever magic trick, of which the Fed and media have many.

After 2008, for example, no one would politically or publicly condone another open Wall Street bailout.

Luckily for Wall Street, they got one anyway—as it snuck in behind the curtain of an act of God followed by a less-than-holly act of Fed mercy—one bestowed almost exclusively upon the markets.

Regardless of what one thinks of the data, origins or policies surrounding COVID, the financial data coming from the repo markets and Fed-supported bond markets is clear—the unlimited QE, zero-rate pivot and open Fed Fraud that came in through the backdoor of the COVID crisis went predominantly to the benefit of Wall Street, not Main Street.

In short, the real economy is on its knees yet again as Wall Street parties on low rate debt and hence a debt-rollover moment of can-kicking the pain until, well—down the road.

This might explain why record-high retail bankruptcies, social unrest, dying cities and rising unemployment continue while markets break new highs.

Sickening? Yes.

Surprising? No.

As I’ve said more than once: The Fed serves the markets, not real people or the real economy they rely upon.

And as of today, the Fed has gone into total overdrive to keep these otherwise dead markets alive. (See the money printing and low rate evidence above…)

So, what can we expect?

Love it or hate, these broken markets still have some massive yet Fed-fowl winds beneath their tattered wings.

By no means is a market melt-up is unthinkable, despite the media’s clear aim to gain readership via headlines of CV-related data fear, which spends more time tracking infection rates than death rates. Think on that for a second…

As such, we can’t ignore the genuine possibility that this Frankenstein market can still roam uphill a bit longer with its arms outstretched before it eventually dies.

History Lessons

Market melt-ups follow patterns of euphoria and collective stupidity, not just money printers and low rates.

The melt-up we called in 2019 was no different, but it never got to run its full course toward a meltdown, as COVID changed the game plan and cycle of crazy.

Now, in the post-COVID outbreak setting of total Fed support and free debt, this final Euphoria (i.e. stupid) phase is getting a second wind.

Since 1980, for example, every 10% pullback has been followed by a market resurgence of at least 25% within one year and a median gain of 45% within 2 years; and 90% of that time, stocks are up rather than down.

The 2020 disaster was no different, as markets tanked in rapid fashion and then re-ignited even faster; this was because the Fed support was faster and deeper than any other time in history. Again: Steroids work.

History confirms that stocks often roar back when fear is replaced by fantasy (and Fed support).

Today we have tons of fear, tons of fantasy and even tons more Fed support. In short, the perfect setting for a final market melt-up.

I’ve seen melt-ups before, and they behave similarly. The Nikkei Index melt-up in Japan, for example, melted up from 5,000 to 40,000 before tanking.

Closer to home, the melt-up of the roaring ‘20s saw the Dow go from 100 to 400 before tanking.

France in the 1790s saw a similar boom and bust pattern, one I outlined here.

Later patterns were seen in Russian (2016) and Hong Kong markets as well as in sectors, as in tech (1999-2000), real estate (2006-2008) or even Bitcoin (February 2018).

In all of these cases, most of these market melt-up gains came in the final year before they melted down.

Last year, Tom and I warned of such a pending Melt-Down, and saw 2020 or 2021 as a possible time for this to play out.

Ironically, however, the COVID horror-show (black swan?) did not hasten this melt-down, it actually delayed it even further, as the monetary stimulus that followed COVID has been unprecedented and hence good for the credit and equity markets.

Again, steroids work.

During melt-ups, stocks can fall by 10% many, many times only to soar higher after each dip, climbing a wall of worry toward needle-peak valuations, creating more and more euphoria—and then…well, tanking like sinking battleships, straight to the bottom.

In the late 1990s, for example, I saw Cisco climb by 130%, Biogen by greater than 300%, as Tiffany’s gained greater than 200% and other names like Yahoo, Microsoft and others skyrocketed in one final surge—only to come crashing down and erase all their gains in the melt-down that followed.

We are not in melt-down territory yet, however.

The rapid speed and 50-day recovery data the Fed just handed Wall Street within the Trojan Horse of the COVID crisis (and “recovery policies”) suggests bigger gains as what clearly looks like a market melt-up is now in play.

Again: Steroids work. Fear works. Fantasy works. Markets will and can melt-up on the backs of such forces.

Adding more steroids to this witch’s brew of market melt-up forces is the fact that 2020 is also an election year.

Since 1950, every election year saw a double-digit rise in the markets, as election years are full of hope-selling and political promises. Remember: markets rise on fantasy…

Are Precious Metals Melting Up Too?

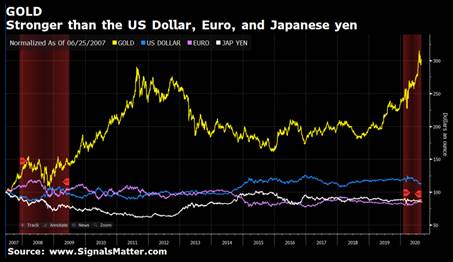

Those who track melt-ups often point to similar melt-up templates in commodities in general and gold in particular.

But gold, my dear readers, is altogether different, and what we are seeing today is not a melt-up in gold, but a far more sobering signal that global financial systems are nearing a breaking point.

In short, gold is not a “sexy trend;” it’s a warning sign.

If gold was just another melt-up asset, then ask yourselves how it continued to climb despite a macro environment otherwise totally against gold?

Traditionally, for example, gold tanks when 1) the dollar is strong, 2) inflation is low, 3) rates are low and markets are high. I wrote more on this here.

Yet despite each of these traditional gold headwinds in the last years, gold has nevertheless broken new resistance levels quarter after quarter.

Why?

Because gold is no longer about traditional markets (they died long ago), but about a growing realization that global currencies, grossly diluted by insane fiat money creation to artificially support otherwise dead risk assets, are themselves dying.

Don’t believe me? Just look at the relative strength of gold compared to the dollar, yen and euro. Still think gold is just a “barbaric relic” of the past? A melt-up asset?

Think again.

Gold is a 5000-year-old reminder of what is inherently wrong with this post-08, doped and upward melting market.

And if gold climbed in headwinds, just think how it will do in the inevitable tailwinds to come—namely rising rates, rising inflation, a falling dollar and a falling market?

As I’ve said so many times, gold is not a trend, it’s an antidote to (and insurance policy against) a broken currency system whose declining purchasing power (yen, euro, yuan, dollar, peso etc.) is no longer a debate but a fact.

Sure, gold prices, like any asset class, can rise and fall, but gold’s core role as a store of value (which fiat currencies are not) has never been more necessary and its future never brighter. Full stop.

How to Prepare Portfolios for a Possible Melt-Up?

So, if another market melt-up scenario is now in play, are we telling you to go all -in and ride the stock and bond wave to instant wealth?

Hardly.

Yes, we all know that history both rhymes and repeats itself, and the market melt-up template discussed above for risk assets is part of a confirmed pattern.

But this by no means suggests that investors should double down, go all-in and ride this latest wave as there are just too many ways it can drown you.

We’ve written scores of reports on portfolio construction, active management and the risks of taking a passive investment approach (i.e. buy, hold and pray) in both rising and falling markets.

Our subscribers have captured trends both up and down, yet never with a full allocation for the simple reason that we do not fully trust this Fed Market, but nor can we fight it.

Yes, many melt-up patterns are in play, and history is rhyming yet again, but the unique levels of systemic rot, Fed intervention, political risk, currency risk, bubble risk, social unrest and outright fraud masquerading as free-market capitalism today are too high to simply follow an historical melt-up template.

Instead of chasing trends or market-timing a top or bottom (no one can do this, btw), we prepare portfolios to minimize risk, and in doing so, eventually, see the greatest rewards.

Investors who can afford (because of their age, income or risk profile) to assume greater risk than others are perhaps willing to assume greater exposure in this final and potential market melt-up. We get this. Grab what you can.

At Signals Matter, however, we respect these trends but never fully ride them, as there are still more known and unknown risks than rewards inherent to this market monster, and we believe in buying at bottoms, not chasing nosebleed tops, however seductive they may otherwise seem.

There are other ways to make equivalent sums in markets like these, at a fraction of the risk and a sliver of the cost.

That’s what we do.

If you respect risk yet want to enjoy longer-term reward, then simply join us here and see how we beat the markets with far less risk of getting burned in melt-ups and melt-downs like these.

Best,

Matt & Tom

And yet in March when the fed told us they would support the market no matter what and I had my finger on the button waiting for you to give the call to go all in, I heard crickets. Lucky for me my wife was not following me with my newly purchased membership in March and asked me what I would normally do, I told her to buy things like Walmart, Berkshire, Microsoft, etc. Needless to say at this point her portfolio is putting mine to shame and I do not think I will catch up since I had her sell out of half her positions in August.

And lucky for all of us the market followed the Fed right on que, but our signals did not, and we still trust our signals more than luck or the Fed, even if it means missing some upside. It wasn’t luck that helped us avoid a 33% loss just weeks before, and making money is more about avoiding losses than capturing every dip, as some dips, in this new environment, don’t and won’t always stop dipping.

Brilliant, guys, absolutely brilliant.

And I particularly love this line: “one more “last hurrah,” one more yellow jersey before this Lance-Armstrong market disgraces itself.”

Excellent.

Your analysis of the unreal world in which we now live reminds me of one of my favorite Elwood P. Dowd quotes from the movie Harvey: “Well, I’ve wrestled with reality for 35 years, Doctor, and I’m happy to state I finally won out over it.”

Haha Carter, love the quote…Well, I’ve wrestled with the markets for 25 years, Carter, and I’m happy to state I finally can’t stop laughing at it.