Below, we dig deep into how we build our all weather portfolio at Signals Matter. This matters a lot, and as we began penning this report just hours before market openings this early Monday morning, the Dow was down over 800 points in overnight trading, plunging on fears that the Coronavirus is spreading, as investors jump toward safe haven assets.

Just 15 minutes into the opening bell, however, our all weather portfolio was already up .82% as the Dow was down -2.67%. In short, having an all weather portfolio is just plain smart. Below we prove this.

Portfolios are not for fun…they’re intended to keep you safe.

To this point, we go deep behind the curtain to explain how we build an all weather portfolio that works at Signals Matter. This all weather portfolio is your friend in good times, and equally so in these increasingly uncertain and virally concerning times.

Also, let us remind you that we have made our recent book, Rigged to Fail, now a Top-10 New Release on Amazon, yours for FREE until 5:00 PM on Thursday, February 27.

That’s right. During this exclusive period, the eBook version of Rigged to Fail is available at zero cost—just click and read. You’ll be glad you did.

OK, now for What’s Happening Now this new week and what you need to know to backcheck investment portfolios.

Let’s discuss.

Is the Coronavirus the Next Disease X?

For years, the World Health Organization (WHO) has been cautioning that a mysterious ‘Disease X’ could spark an international contagion by quickly morphing from something at first mild into something more sinister and deadly.

The Coronavirus (or Covid-19) could qualify, for its onset has been similarly described – “frequently mild, but occasionally turns deadly in the second week.”

Marion Koopmans, head of viroscience at Erasmus University Medical Center in Rotterdam, and a member of the WHO’s emergency committee, wrote this troubling message last Wednesday:

“Whether it will be contained or not, this outbreak (of Covid-19) is rapidly becoming the first true pandemic challenge that fits the Disease X category.”

What’s Happening Now is a Wake-Up Call

Markets are waking up to the notion that Covid-19 could move from being a Gray Swan to being a Black Swan as Market Risks Rise.

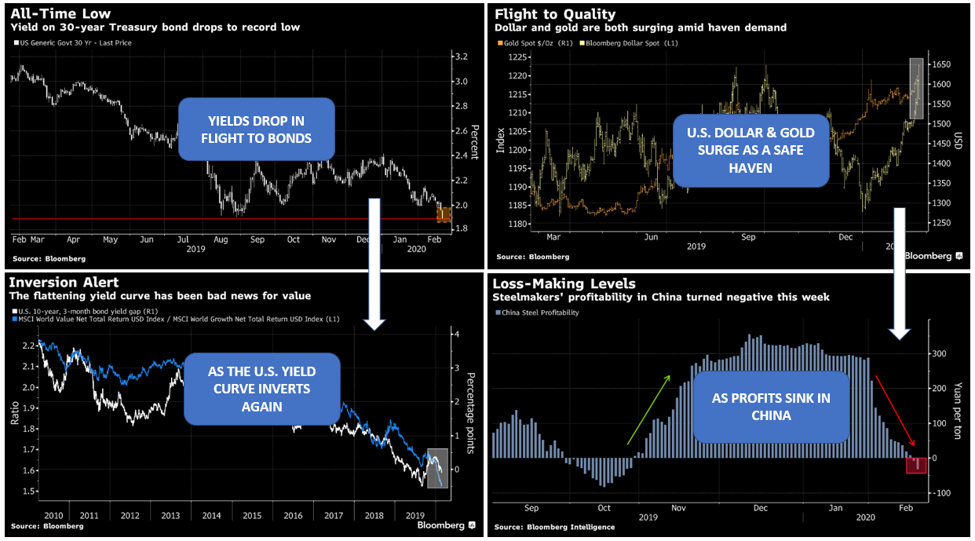

The charts below tell an unfolding tale of financial market impact, from falling yields to inverting yield curves as investors seek safety in bonds, gold and the U.S dollar in the backdrop of sinking Chinese profits.

Portfolio Impact

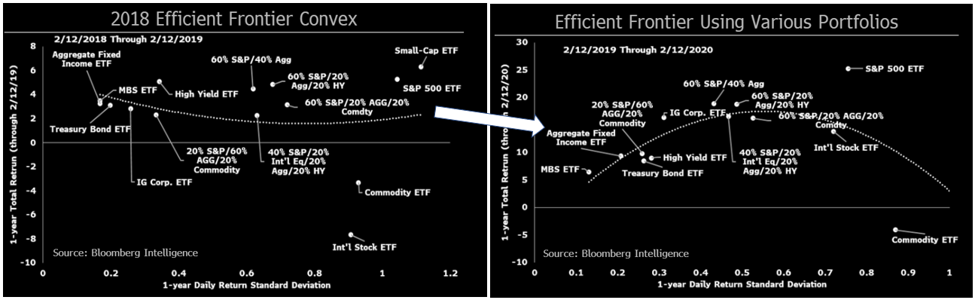

As market dynamics change and risks rise, investment portfolios will be impacted. In the chart below, we show just how different portfolio allocations have become from 2018 to today, as trends, volatility and correlations have shifted.

As trends and conditions change, investors should be actively changing their portfolio line up as well.

That is, informed investors, such as those we serve at SignalsMatter.com, see the wisdom of moving from passive to active investing.

Instead of the traditional 60/40 stock/bond portfolio, they are building an All-Weather Portfolio and moving beyond traditional return methodologies toward approaches that adjust and measure your return against the current risk levels.

Sadly, too many investors take a traditionally-passive approach to investing. They believe that recessions come, recessions go, and markets always bounce back. “My bond allocation will save me,” is something we hear over and over again.

But as we’ve expressed elsewhere and at greater length, traditional investing approaches won’t save you in the post-2008 Twilight Zone of Fed-distorted markets.

Our worry here is that history does repeat itself. Too many investors are willing to fail traditionally, that is, with traditionally-allocated portfolios.

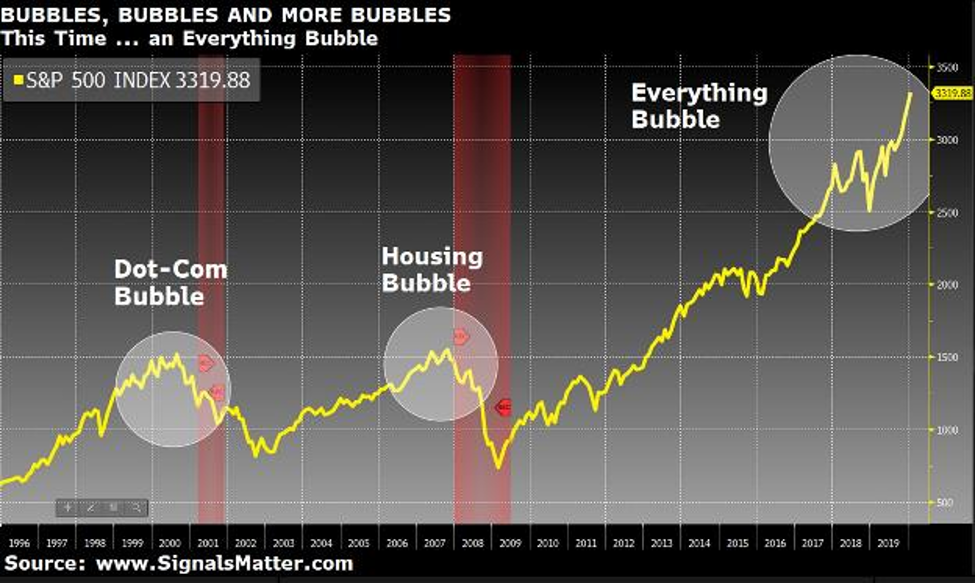

They failed traditionally in the dot.com bubble in 2000; they failed traditionally in the sub-prime bubble in 2008.

And more signs suggest further traditional failures for those that fail to act on this question – Is the U.S. Already in Economic Depression?

Our Simple Solutions

In our industry-leading all weather portfolio service, we provide Subscribers with precisely the needed and active all weather portfolio solutions in our All-Weather Portfolio Service which is miles ahead of traditional portfolio management in terms of both performance and risk management.

It’s described as an “all-weather” portfolio because it’s geared to profit in all market conditions and based upon returns handicapped for risk.

In this special report, we are taking specific efforts to make complex portfolio construction simple so that you can understand the complexity behind our simplicity in building your all weather portfolio.

Here We Go

Let’s start by introducing a fictitious investor named Joe, pictured below.

Joe is walking a tightrope. Joe’s been reading our reports and getting more informed. Thus, Joe knows now that he (and his portfolio) may already be heading over a cliff despite record high market peaks.

But Joe’s hanging on, walking that thinning line between fear of a fall and fear of missing out. He’s making a ton of money in the market melt-up we already called, but he’s also getting wise to the market meltdown we are tracking with equal conviction.

That’s the abyss below Joe’s tightrope, but he trusts the data and ideas we’ve shared and wants to do just what this slide suggests—namely, balance risk and reward by building resilience in a new, all weather portfolio.

To make it across a tightrope, with his portfolio intact, Joe needs to understand basic elements of portfolio construction, how to build all weather portfolio allocations, and how to contain risk and volatility and actively capture upside regardless of market direction, up, down or sideways.

First—The Important Questions

Joe’s been asking some seminal questions. What’s really in my portfolio now? What’s my plan? Should I be back-checking my financial adviser? Should I become a more active investor, replace my adviser? Am I truly diversified or are all of my investments highly correlated? Am I using the appropriate benchmark?

Joe knows how to monitor his return, but not how handicap that return for risk, a critical metric.

So, if you have a little bit of Joe inside you, bear down. Read every sentence that follows. Study every chart and save this report for future reference. Better yet, take a further step. Download our FREE Investment Primer or simply Contact Us.

Either way, here we go.

The Signals Matter All Weather Portfolio

Let’ start off with a few conceptual points.

First and foremost, to ride out any storm, Joe needs to build an all weather portfolio – a portfolio that adapts to changing market conditions, that is able to profit in good times and bad, like we are seeing this morning…

This requires that Joe change his mindset away from traditional investing in a current backdrop that is anything but traditional.

Constructing an all weather portfolio is as much an art as it is a science…which is why we call it an artful science. It requires active portfolio management; picking the right benchmark to measure success and adopting an absolute return approach to investing.

Here’s what all that means.

Active portfolio managers actively adopt different solutions for different weather conditions and that’s what Joe needs to do.

He needs to manage to What’s Working Now, and to do so actively, and not just across stocks and bonds, but across stocks, bonds, currencies, commodities and other diversifying strategies.

Joe also needs to learn that constructing an actively-managed portfolio also requires picking the right benchmark.

Traditional investors like Joe tend to benchmark their portfolio’s performance against that of S&P 500 Index…that’s called a relative return benchmark.

We think that’s the wrong benchmark.

If you’re a traditional, passive investor looking for a better relative return benchmark than the S&P 500 Index, you would be a whole lot better off basing and measuring your returns upon the percentage return you need from your portfolio to make ends meet rather just beating the S&P.

After all, once this market reverts to its mean and is down by 50% or more, will you be satisfied just because your traditional portfolio “beat” the S&P and was only down 40%?

It’s crazy, but when the S&P 500 stumbles badly and your broker calls with the “good news” that you are beating a tanking benchmark (the S&P 500 Index) by simply losing less, I bet you’ll be scratching your head.

You see, portfolios designed to track the S&P are no longer very sexy when that S&P inevitably tanks…

Absolute return investors—i.e. informed investors– know this. They invest for the long-term and for all conditions, not just the seductive bull runs.

They don’t give a hoot about the S&P 500 Index. Their game is to make money in any equity market cycle, up or down. And when the S&P tanks, they won’t care, because they are not bench-marked to a rigged market.

Absolute return (as opposed to relative return to the S&P) simply measures the gain or loss on an investment portfolio as a percentage of invested capital. Full stop. No “relative” benchmarks, just one question: Are you up or are you down?

In short, informed, absolute return investors simply and effectively deploy different strategies in different market conditions in order to produce a positive return regardless of the direction and the fluctuations of capital markets and the S&P 500 Index.

In this way, informed, active, and absolute-return portfolio managers do not build traditional stock and bond portfolios. No way. Those only work when things are rosy, not when things turn ugly. And things will turn ugly.

With interest rates this low, they know that rates will eventually rise and when they do, they also know that their bond allocation will sink, as well as their stocks.

They know that corporations have doubled their debt since 2008, at Fed-induced low rates, and that those same companies have allocated some 70% of that debt to buyback their own shares rather than save for a rainy day.

During the good times like the last decade (!), those companies also borrow money (and issue risky bonds) to pay higher dividends and thus artificially pump their stock prices to unsustainable and rigged highs.

Of course, all that “affordable” debt during the good times is going to become “unaffordable” as rates rise in the bad times, which means the bonds and stocks of those debt-goosed-up companies sink like rocks together in the same ocean of Fed “stimulated” debt.

Think about it, stocks and bonds went up together as the Fed pinned interest rates to the floor. Why wouldn’t they go down together when rates rise? That would be a rude, double-whammy for traditional investors like Joe.

But remember, Joe is becoming an informed investor. He’s got a better plan for his portfolio.

Getting Smarter–The All Weather Portfolio Apporach

On this subject of portfolios, we (and Joe) have a lot of respect for Chris Cole over at Artemis Capital Management.

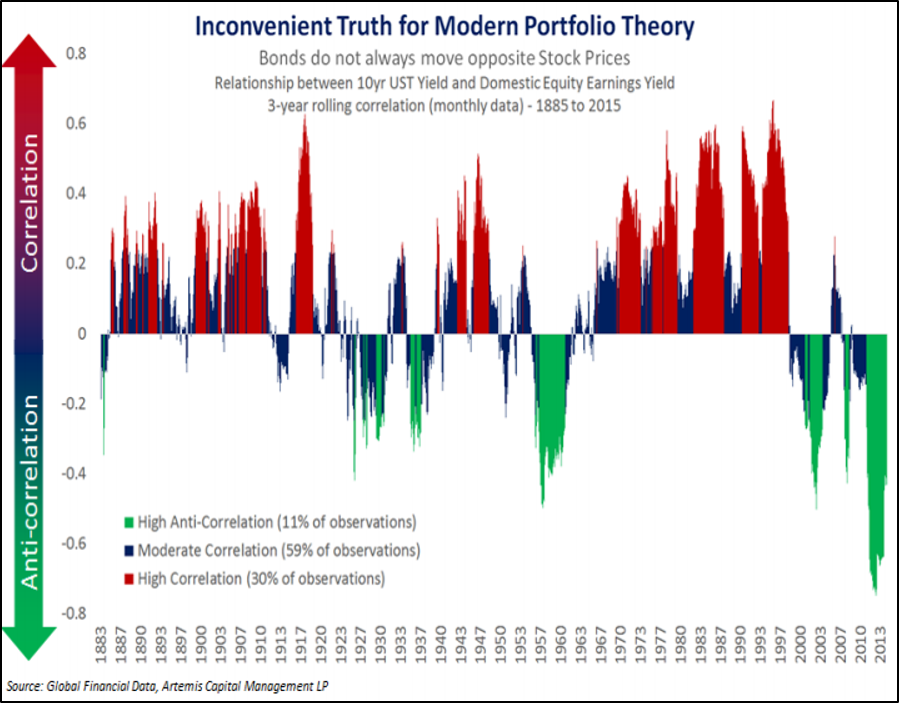

Chris has tracked the correlation of stocks and bonds over decades. For those of you like Joe who once believed that shifting from stocks to the “safety” of bonds will save you when something like a Coronavirus pandemic breaks out or the Fed runs out of free market beer, take a look at the inconvenient truth below.

You see, bonds do not always move opposite to stocks, which means they are not necessarily a “safe haven” asset class when stocks fall, despite what most traditional portfolio allocation models would have you (wrongly) believe.

In fact, once we start to see bonds and stocks falling together, that’s when we’ll know that this entire rigged, debt-driven sham of a Fed-created bull market is near the end of its artificial and record-breaking cycle of just bubble-insanity.

Not insane? Just look once more at the current bubble compared to the last two market bubble disasters and see for yourself:

Now look at how bonds are not always acting as “safe havens” despite the consensus-thinking pamphlets of your traditional wealth advisers…

According to Chris, the truth about the longer historical relationship between stocks and bonds is scary. Between 1883 and 2015 stocks and bonds spent more time moving in tandem (30% of the time) than they spent moving “safely” opposite one another (11% of the time).

It’s only during the last two decades of falling rates, accommodative monetary policy, and globalization that we have seen an extraordinary period of anti-correlation emerge between stocks and bonds unmatched by any other regime in history.

Not only are stocks and bonds positively correlated most of the time, there is a precedent for multi-year periods whereby both have declined at the same time.

This notion is critically important. So, take heed. Bonds, especially in a bond bubble, are not necessarily “safe havens”—especially the corporate bonds.

Ok, so let’s take this data and build an all weather portfolio for Joe. We’ll call it Joe’s Portfolio, for that’s what it is – an all weather portfolio custom-made for investors like Joe that are walking a tightrope.

Building Joe’s All Weather Portfolio

Now that we understand the approach, let’s solve for the solution – an actively-managed, absolute-return, all-weather portfolio of non-correlated assets.

Cash First

First, Joe needs to assess the current market risks and decide upon his cash allocation.

Smartly, Joe has honed up on our Storm Tracker and knows that, with a 35% probability of recession ahead, 35% of his all weather portfolio should be allocated to cash or, say, Treasury Bills to enable some income and buffer his portfolio against risk, while also having dry powder to re-invest when assets reach their lows rather that highs.

Next, the Remainder Allocations in the All Weather Portfolio

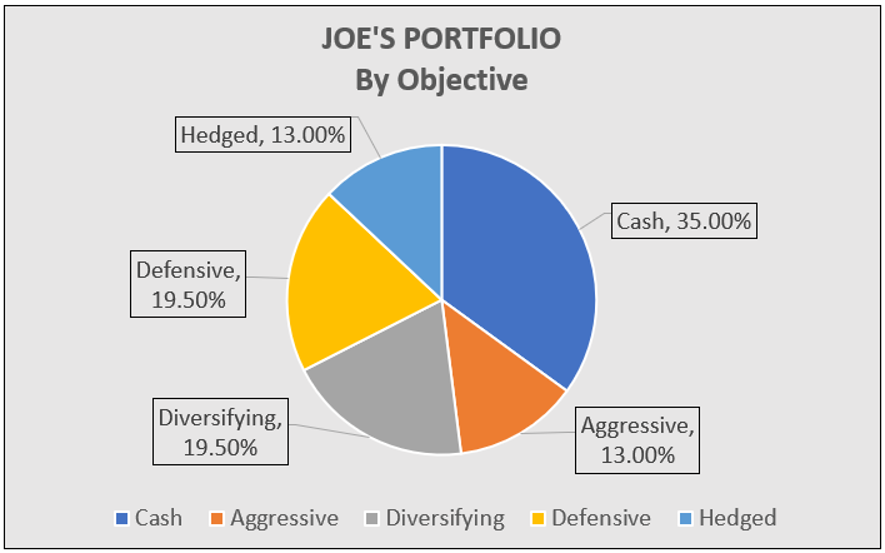

And as for his remainder allocations, Joe has wisely decided to diversify by taking yet another tactical step – allocating by objective rather than by asset class.

Objective-based investing assures you the diversity you seek so that you can generate an absolute return (i.e. make money) in all market conditions. That’s what we call the All-Weather Portfolio.

Here are Joe’s picks, by objective:

Joe’s All Weather Portfolio is allocated 35% to cash; 13% to aggressive picks (high-tech, info technology); 19.5% to diversifying picks (construction, mortgage & real-estate; 19.5% to defensive picks (utilities, convertible & corporate bonds); and 13% to hedged solutions (precious metals & selective short equity positions).

Joe’s Performance: More Pleasure than Pain

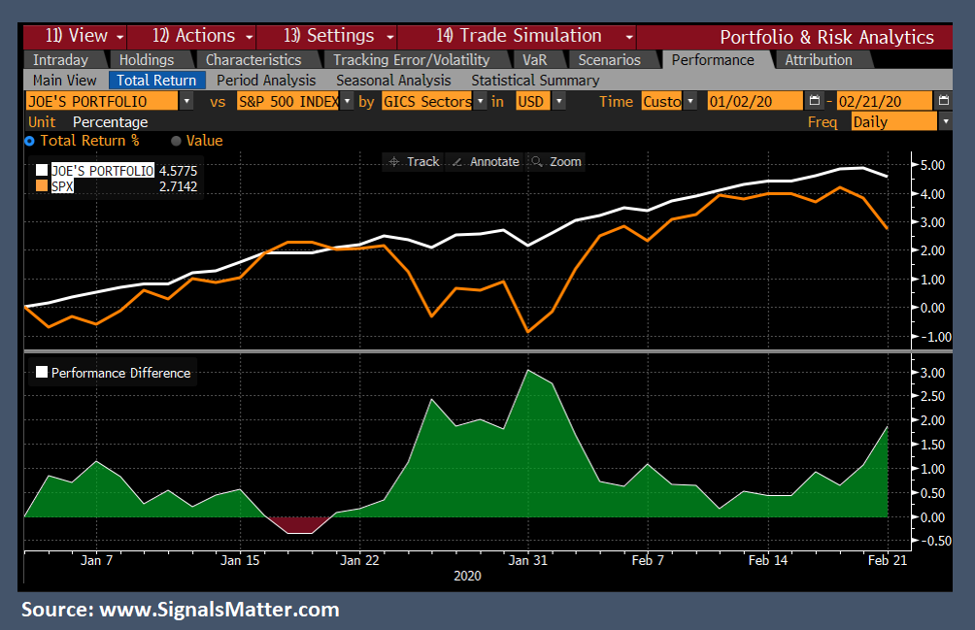

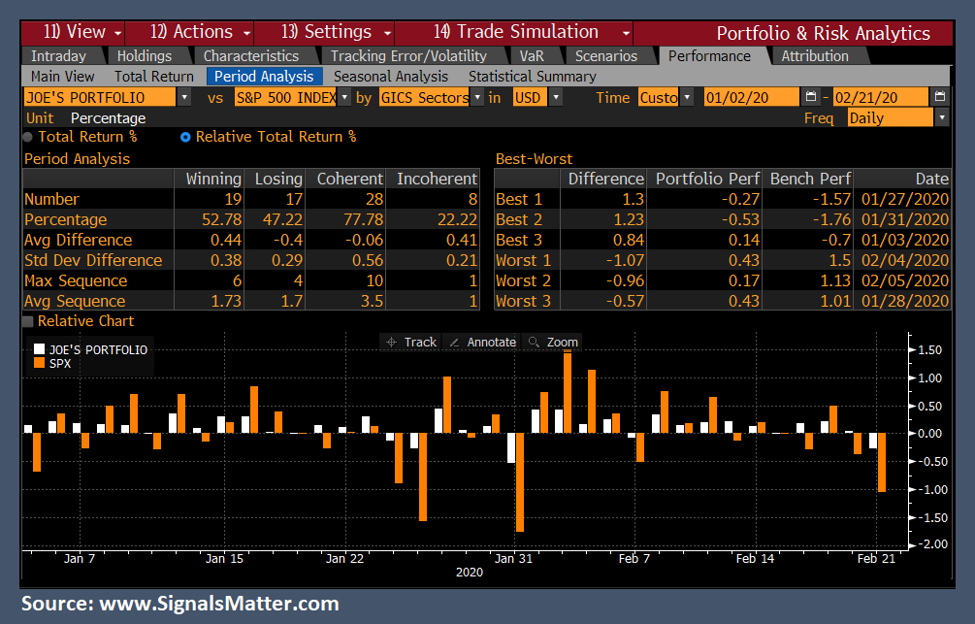

As to Joe’s performance, check it out below.

From the first of this year, 2020, Joe’s Portfolio is pretty much up and to the right, generating a 4.48% return (pleasure) with only 3.25% overall volatility (pain) and with even less downside volatility of just 2.59%.

It’s the downside volatility that really matters.

Joe’s portfolio generated a rate-of-return (pleasure) that exceeded the downside volatility (pain) by a factor of 1.73x (times).

Pretty good. In short, far more pleasure than pain. We simply divided 4.48% by 2.59%.

Now let’s introduce that dreaded relative-return benchmark – the S&P 500 Index used by traditional portfolio approaches…

Just to be sure we know what we’re talking about, Joe wanted to check out his all weather portfolio compared to the S&P 500, which he had been doing for so many years, charted below.

The S&P 500 Index (in orange) generated a gain over the period of 2.71% (i.e. pleasure) with overall volatility (up and down) of 11.25% (i.e. pain) and a downside volatility of 8.60% (i.e. real pain), for a ratio of pleasure to pain of just 0.31x—i.e. near equal amounts of pain and pleasure. No fun.

Sure, Joe’s equity curve and the S&P 500 start and end pretty much at the same place. BUT…the pain (i.e. stomach-churning volatility) Joe would have endured had he concentrated his portfolio in a traditional 60/40 pie chart of mostly stocks was huge by comparison.

In short, by taking a more active, uncorrelated and risk-buffered approach to his all weather portfolio, Joe made the same (and often more) money as the traditional approach, but with a lot less sleepless nights and stomach-churning price swings.

And that’s with a 35% cash allocation! Which means, on a risk-adjusted basis, which is what really matters, Joe’s All Weather Portfolio beat the S&P 500 Index by 558% (1.73x divided by 0.31x).

Furthermore, Joe’s new approach to active portfolio construction works all the time, whereas the traditional approach of pie chart stock and bond allocations tends to get slaughtered in bear markets—a fact no one seems to remember these days, as it almost feels like the Fed has outlawed bear markets.

Hopefully, you don’t actually believe that…

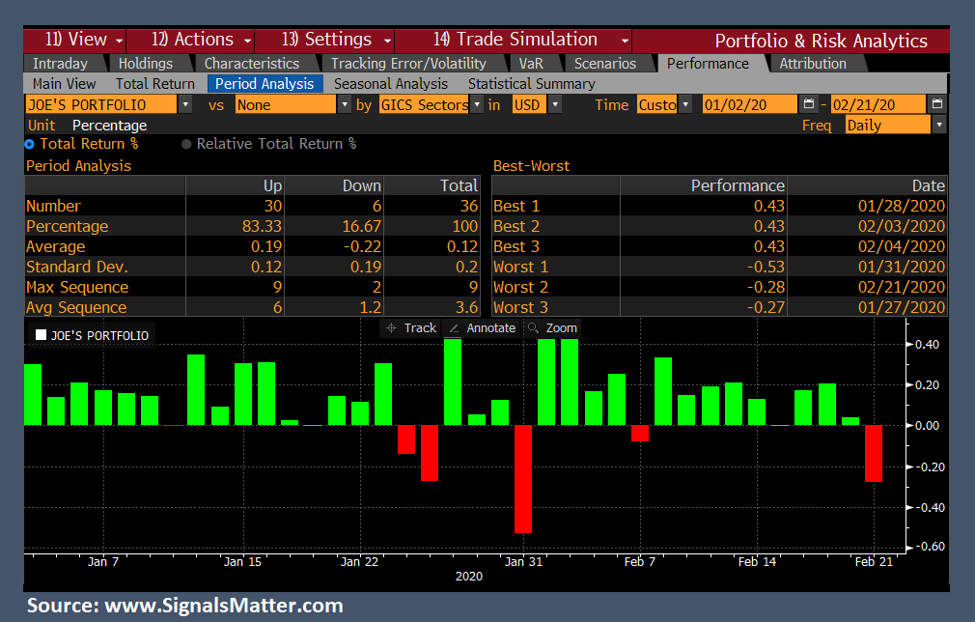

You can see what we’re talking about in the table below, which exhibits the volatility (up and down) for Joe’s new, active Portfolio.

Just to nail this, in the chart below, we compare the overall volatility (pain) of Joe’s new active Portfolio (white) with that of the S&P (tan) over the same period.

See how Joe missed all that S&P Jinjiang (i.e. pain)? Pretty cool. And pretty safe.

Here’s the bottom line for Joe’s All Weather Portfolio…

Joe (with a 35% allocation to cash) beat the S&P 500 by over 5 times on a risk-adjusted basis.

And Surprise…Surprise We Do All of Joe’s Hard Work for Him…

Joe’s All Weather Portfolio is in fact “Your Portfolio” posted in recent weeks on the Subscriber side of SignalsMatter.com.

And yes, we’ve just walked you through how we built it.

You have a choice now.

If you’d like access to “Joe’s portfolio”, Subscribe here and make it your own by simply clicking the icon on the subscriber side that says Your Portfolio, where you’ll see easy to follow allocations and performance updates of our all weather portfolio suggestions for Joe.

Pretty simple. Pretty cool. And just so you know, Joe’s portfolio has been updated from that shown above…because the risks are rising.

Our New Book amplifies on these kinds of solutions for the coming storm ahead which, again, we are making free to you for the next few days.

Simply go to Rigged to Fail at Amazon.com and download our new book, for FREE in digital form NOW through 5pm, Thursday, February 27th.

Rigged to Fail is also available in paperback. Once you understand the risks ahead, we know we’ll see you as a SUBSCRIBER at SignalsMatter.com.

And if we may ask…when you download or purchase Rigged to Fail, help us help millions of other unsuspecting investors, as we have you, by spreading the word as well as the chance to share this book for free.

Hope This Helps

Hopefully, the foregoing analysis behind our All Weather Portfolio service makes common as well as financial sense to you.

As always, stay informed and thus, stay safe.

Sincerely,

Matt & Tom

Love your efforts to help us not get slaughtered in our Retirement accounts. My wife are Canadians and I look after our our retirement investments( around CAD$1,000,000) and have about 15% in some gold ETFs (i.e. CGXF & HEP and royalties FNV & WPM) We also have about 10% in physical gold/silver. Our investments are split 65% $CAD -35%$U.S.

Our $U.S.component used to give us currency stability BUT the $U.S. has been dropping like a stone against our currency lately and seems doomed to continue that path( $1 U.S. was worth CAD$1.45 in March 2020…now $1.26). I am thinking that I should lessen $U.S exposure so I am uncertain that I could utilize your strategies by becoming a member….given that your strategies seem to be exclusively $U.S.sourced.Some of your strategies may also run afoul of our CRA regulations as well.

Cliff, all valid points. Maybe reach out to Tom at Info@signalsmatter.com regarding these important issues–he might have some insights to help you with securities in your country.