Below we tackle the inflation question square in the jaw, examining the various inflationary tailwinds and headwinds currently at play and the immense importance of (as well as implications behind) the great inflation debate.

From the same, informed investors can draw their own inflation conclusions based upon facts and hence prepare accordingly.

In the end, however, my take is clear: The Fed’s “inflation policy” just sucker-punched Main Street yet again while handing Wall Street another keg of centralized “rate support.”

Bond Bubble Meets Inflationary Needle?

In my recent 2020 Summer Markets Video Report, I highlighted the two most critical issues facing future market direction and risk, namely: 1) the unsustainably debt-soaked bond bubble and 2) the inflationary “needle” that will eventually pop that bubble.

On Tuesday, I then looked more directly at the first issue, i.e. the nature of US corporate debt and broken bonds.

In today’s report, I’ll tackle the second issue in more detail—namely the great inflation question.

Why Inflation Matters

As discussed so many times, the engine that drives this totally surreal stock market “rise” in the backdrop of a totally broken economy boils down to one word: DEBT.

I’ve shown how grotesque US debt levels are here, here, here and elsewhere. This debt reality is not a subject for debate, but rather a cold reality. Full stop.

Given that debt is the critical engine behind our so-called “surge” and “recovery,” if that engine dies, so too does the market “Ferrari.”

The key force that would destroy a debt-based engine is if the cost of that debt were to rise, making the payment of debts painful at first and then ultimately impossible later.

By extension then, if inflation were to return (or be honestly reported…), interest rates would then rise, the cost of debt would become unbearable, bonds would sink, defaults would rise and companies on the stock market would see earnings tank to make painful debt re-payments.

Alas, we would then see a perfect storm in which stocks and bonds fall together, all driven by a breakdown in the rate-supported bond market.

In short: Inflation matters. If it returns, the debt engine driving the market Ferrari stalls. Party over.

The Fed, naturally, knows this and are scurrying like mad to control it.

But can they? And for how long?

Is inflation returning?

The answer is yes.

But let’s dig deeper to flesh this critical inflation issue out and keep you as informed and prepared as possible, for there are so many forces at play to both spur and counter-act inflation in the near-term.

As importantly, the Fed has a few clever tricks up its sleeve to keep Wall Street happy as Main Street continues to fall to its knees.

The Great Inflation Debate

First, it’s important to understand that inflation is ALREADY here; it has simply been falsely and deliberately mis-reported by the Bureau of Labor Statistics and the Fed for years.

Don’t believe me, just click HERE and see for yourself.

The US is basically at 8-10% inflation as we speak; it’s just that the Fed would not be honest with you with its 2% reporting and almost comical quest for “target inflation.”

Yellen and Powell deserve Academy Awards for acting concerned about inflation.

I know—seems like a tinfoil hat statement, but it’s nevertheless true—as well as sad. Today, open lies rather than facts help keep this Frankenstein market alive.

Nevertheless, and despite such sober facts, the financial world remains harshly divided on the topic of inflation.

Some, like the mad scientists (i.e. Frankenstein-makers) behind Modern Monetary Theory, would have you believe that inflation is now as extinct as a Brontosaurus.

But even for those with a more sober acceptance of rising inflation (which always follows rising money supply), many argue that the issue is not important, as the COVID crisis (real or exaggerated) demands that humanitarian issues take precedence over financial concerns.

In short, if we need to print more money and take on trillions more in fiscal and monetary policy excess, so be it—the times demand extreme measures. Inflation (as well as free markets or free anything) be damned. That’s one view…

Others argue that COVID will cause budgets to rise, markets to fall and deflation (rather than inflation) to increase, with no inflation on the radar at all. That’s another view…

This inflation vs deflation debate is one I’ve examined in more detail here.

For now, of course, the deflation camp seems to have the data to confirm its case—deflation certainly seems like the current norm, no?

But just because we have reported deflation yesterday and today, does that mean we must have it tomorrow as well?

Such logic suggests that if it was sunny on Monday, it has to be sunny on Tuesday. Surfers also know that if there’s a great swell one day, the next day can be flat.

Unfortunately, market and inflation patterns, like weather and wave patterns, are not fixed…

COVID, of course, is a big wave, and has caused a massive rise in money printing as well as fiscal (i.e. deficit) spending. This means the velocity of money is creeping into the real world to deal with real world issues.

Velocity of money, by the way, is a tailwind for inflation.

Despite COVID emergency measures (i.e. fiscal and monetary policy largesse), governments and central banks are confronting enormous pressures to ease up on the money/liquidity spigot, as pandemic relief efforts, already worth some $20 trillion according to Bank of America, are going to lead to a spike in prices—i.e. inflation.

As Main Street Americans see their wages stagnate, fall or vanish (at 10% reported unemployment), the cost of their bills, expenses and consumer goods will be rising—which, well…is not good.

That’s what we call stagflation—rising prices in a tanking economy.

Is Inflation Coming?

Indeed, inflation is no fun at all. But will it come? And if so, when? That is the big question.

Charles Goodhart –- an honest (and 83-year-old) scholar at the London School of Economics, has seen a few inflation cycles in his lifetime and is not shy about his views.

He is now openly warning that what happens to inflation after the pandemic “will affect macroeconomic theory and teaching, perhaps forever.”

For now, however, the deflation vs inflation debate remains strong.

Many countries, for example, saw deflationary drops in prices early in the COVID crisis. Recently, however, those same zip codes have seen a gradual (and inflationary) rise in prices.

Thus, and again, what will it be? Deflation or inflation? And for how long?

Let’s consider the key inflation tailwinds as well as their counter arguments.

Inflation Tailwind 1—Money Supply

As Milton Friedman reminds: Inflation is always and everywhere a monetary phenomenon. In short: As money supply rises, inflation follows.

Given the trillions in printed currencies around the globe since 2009 in general and this COVID year in particular, where’s the inflation?

Across the globe, the money supply has grown at record breaking rates, and not just within the tight and allegedly “leak-proof” banking circles, but now directly to consumers and companies.

As I argued recently, when central bank money “leaks” out of the central-bank/private bank loop, inflation increases, and as such, interest rates thereafter.

That, again, rising rates are typically very bad for bonds and bond issuers on the stock market.

Below, however, we’ll see how the Fed will try to protect its spoiled rotten bond nephews on Wall Street by “controlling rates” despite targeting higher inflation. Hmmmm.

For now, this leaking money can to lead to inflation, but one has to track what is called the “velocity” of that money—namely, not just the creation of that money but its actual use and circulation.

I’ve argued here that many of those printed dollars, for example, are tangled up/absorbed by the immensely complex repo and Euro Dollar markets, thereby slowing the velocity of these otherwise massive amounts of printed/levered dollars.

Such factors, in turn, slow down inflationary risks, at least for the near term.

In the U.S., the “velocity” of money (i.e. the frequency by which it actually changes hands) actually declined during the 2008 financial crisis and has yet to “speed up” as the current (and unprecedented velocity lows) below confirm.

A key question today, then, is what, when and how will that “velocity” of money pick up?

Inflation Tailwind 2: Spending Spree

Unlike the 2008 crisis, however, the current COVID policy reaction of monetary and fiscal spending has been deeper and faster, a fact which could drive prices (and hence inflation) higher and faster.

Of course, markets supported by central bank money now “recover” in a matter of months rather than years—as the Fed creates “asset price” inflation via monetary policy—i.e. unlimited money printing.

But fiscal stimulus, unlike monetary stimulus, goes directly into people’s bank accounts rather than the stock market, where rather than saved, that hand-out money is immediately spent, as most Americans are, well…tapped out.

This spending of government aid/money should increase “velocity” and hence creeping inflation.

On the flip-side, however, there is current evidence that many folks are scared, which means they are saving more than they are spending. For now, this can mean less rather than more velocity, and hence less rather than more inflation…

Inflation Tailwind 3—Drunk Central Banks

The Fed and other central banks are now committed to binge on more printed dollars which would normally lead to inflation. The Fed, of course, knows this too.

The great genius (wink) Powell, for example, is already prepping the media, the masses and the markets for “allowing” more “average inflation” above its “targeted” 2% range.

Unlike Volker, who was a hero facing too much inflation, Powell, the anti-hero is wrestling with fudged inflation, and is going to spur rather than contain our bogus CPI inflation metric and far more bogus bond market.

Of course, spurring more inflation is supposed to be a scary thing for the markets, because rates rise with inflation, and as discussed, rising rates are a shark fin for debt-soaked companies.

But the Fed, at least for now, wants to have its cake and eat it too.

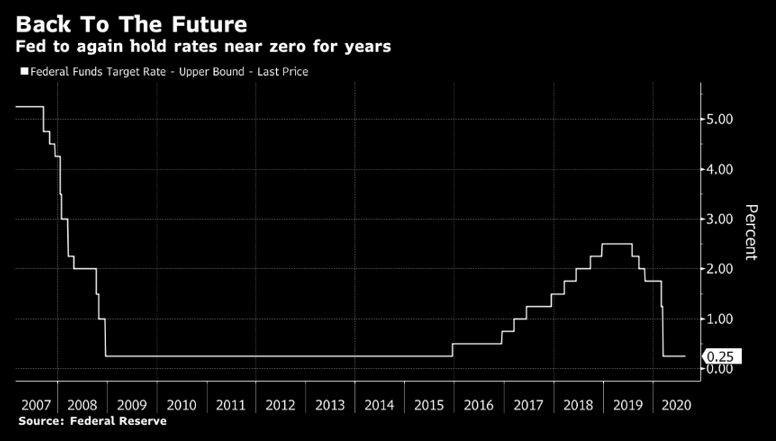

That is, it will “allow” for inflation yet force rates artificially at or near zero for at least 5 years of more of “forward guided” rate suppression.

In short: Powell is virtually announcing a new strategy today from Jackson Hole which will be more “tolerant” when prices rise (i.e. “allow” inflation), yet simultaneously refrain from lifting interest rates.

This, however, is hubris of the tallest order, as well as one big middle finger to every-day Americans (see below).

The Fed literally thinks it can control inflation with the same stupid logic of a sailor thinking he can control the ocean.

That is, this policy assumes the Fed has absolute control over interest rates. Officially, for example, the Fed can set short-term rates.

But folks, despite such “control,” the Fed has no power (at least for now) over longer-term rates, which are decided by the bond market (and supply and demand), not Powell et al.

As we saw in September of 2019, when repo market rates surged to 10% in a day, the Fed’s “control” over rates is tenuous at best, and getting weaker (and more desperate) by the day.

That said, I suppose the Fed could simply print trillions more dollars and buy every long-term Treasury bond, thereby forcing yields and rates to the floor—but folks, that level of yield curve control and hence rate control, would be require a lot of fiat money resulting in the crushing of currency purchasing power.

For now, however, rates in the US and around the world are indeed at the basement levels of history, so the artificial rate compression scam (and hence bond bubble), at least for now, seems to be working….

But as I also warned here, when rates are artificially compressed for too long, an explosive “spring” reaction of rising rates is only a matter of time not theory.

In short, the central banks are playing a dangerous and arrogant game of yield control roulette.

The Fed Gut-Punch to Main Street

Far more importantly, however, is the fact that Powell’s “allowance” for inflation puts a boot square in the groin of every day Americans, who will have to suffer through a rise in prices (on everything from education to healthcare or groceries and car repair) at the very same time the economy itself is nosediving.

This combination of inflation (rising prices) and a stagnate economy is stagflation, and Powell just gave it the green light.

In this scenario, of course, Wall Street rather than Main Street, emerges once again as the clear winner, as broken companies on the stock market get to enjoy more low rate debt rollovers while regular Joes on Main Street eat a stagflation sandwich.

Absolutely no surprise there. As I’ve said since day 1 at Signals Matter, the Fed serves a Wall Street mistress, not the Main Street economy.

Inflation Tailwind 4—Supply Shocks

As we learned in school, when supply tanks, prices rise. Hence inflation.

Trade war and COVID disruptions to supply chains are continuing to push prices higher. China is already experiencing food inflation.

This problem, exacerbated by trade tensions and viral finger pointing, can easily spread to the US and EU, as more companies leave Asia for their own shores (it’s about fricking time), but causing costs and prices to rise at home—which, again, is inflationary.

For years, greedy US companies have been benefiting from cheap Asian labor costs to sweeten margins and executive salaries. This was a major tailwind for lower prices and hence deflation.

But the trend now is slowly from low prices (i.e. deflation) to higher costs and prices (i.e. inflation).

And yet there’s always a flip-side…

In the US and around the world, for example, factories are more idle than ever, as COVID policies crush demand and work-place safety and shut down measures crush production.

Simply put, many facilities are just not being used.

As such, demand too is falling, and as demand falls, so do prices, which is a deflationary rather than inflationary force.

Summing It Up—Inflation or Not?

So, there we have it: money supply rising, velocity of money gyrating, government spending and money printing off the charts of history, consumers spending and consumers saving, and finally Fed double speak and trickery colliding with supply shocks and idle production.

From this gigantic and confusing pell-mell of inflationary headwinds and tailwinds, what can we expect? Inflation or not?

My stance is clear. Inflation is already here, yet hidden behind fudged reporting and Fed double-speak.

Furthermore, the double-speaking Fed is now forward guiding more inflation ahead (under their magical “control,” of course) which will sting an already broke Main Street facing lower or no wages yet higher consumer good costs.

And as for the Fed’s concern for that Main Street? Well, history confirms they have no concern at all.

Instead, Powell and Co have their eyes on one thing: keeping interest rates artificially repressed to allow an historical and grotesque corporate and national bond bubble to defy the levels of sanity and rise to levels of pure absurdity.

How long can this debt bubble last under central bank support before inflation gets the last dark laugh over central bank yield curve control?

I have no clue.

Instead, all we can do today are track the signals that lead toward eventual inflationary implosion, namely: bond yields, velocity metrics, spending and saving trends and the real rather than reported sensation of inflation in our daily and financial lives.

For now, the money printing continues, zero rates are in play and the dollar in your pocket weakens by the second in purchasing power and credibility.

Informed investors are prepared with our portfolio solutions and precious metal convictions to both embrace and navigate what comes ahead, however (and in whatever form) inflation arrives, for one simple reason: We manage risk not headlines. We track data rather than Powell speak.

If this makes sense to you, join us here.

Sincerely, Matt & Tom